Ah, Bitcoin, that elusive creature of the night! It has slipped beneath the sacred support of $108,000, like a cat burglar in the dark, gathering liquidity below the $107,000 level this fine Thursday. The grand holders of this digital gold seem less than impressed by the sweet nothings whispered by regulators and the enthusiastic proclamations from U.S. Vice President JD Vance and Senator Cynthia Lummis. Analysts, with their crystal balls, warn that BTC might just sweep the liquidity under the $100,000 milestone this week or perhaps over the weekend. What a thrilling prospect! 🎢

Table of Contents

Bitcoin bulls are slowing down, what’s next

Our dear Bitcoin maximalists and permabulls are showing signs of fatigue, like marathon runners who forgot to hydrate. Strategy’s purchases have been declining in volume, and between May 19 and May 25, they managed to acquire a mere 4,020 BTC at a staggering $40.61 billion, courtesy of “Common ATM, STRK ATM, and STRF ATM.” Quite the shopping spree, wouldn’t you say? 🛒

Barron’s, in its infinite wisdom, reported a correlation between Strategy’s Bitcoin purchases and BTC price. Some analysts argue that these large acquisitions have positively influenced BTC, while TD Cowen, the skeptic, examined six months of price action and concluded that “MicroStrategy’s purchases represented only a fraction of total Bitcoin trading volume, with a median average weekly result of 3.3%.” So, in layman’s terms, not much to write home about! 📉

News of Wall Street giants adding Bitcoin to their treasuries may have lifted spirits among traders, but alas, there’s no clear evidence of any meaningful impact. This week, traders remain largely unmoved by both promises and purchases, like a cat indifferent to a laser pointer. 🐱

Institutional capital flow into U.S.-based spot Bitcoin ETFs is also on the decline, while large whales and long-term BTC holders are cashing in their chips. 🎰

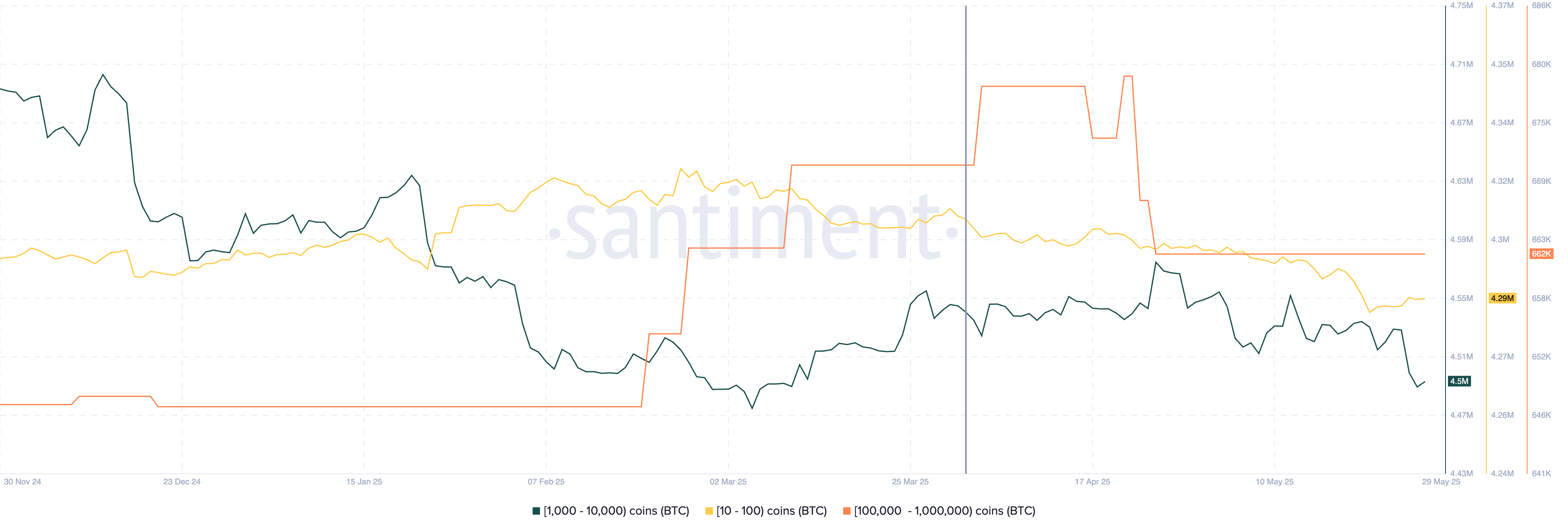

Since April 1, three key segments of Bitcoin holders have shown similar behavior. Addresses holding 10–100 BTC, 1,000–10,000 BTC, and 100,000–1 million BTC have all reduced their holdings, likely cashing out gains from the April to May rally. It seems everyone is in a hurry to take profits! 💰

Santiment data shows a steep decline in holdings of these three cohorts. 📊

If this profit-taking continues, it could increase selling pressure across exchanges and push BTC lower in the long term. Buckle up, folks! 🚀

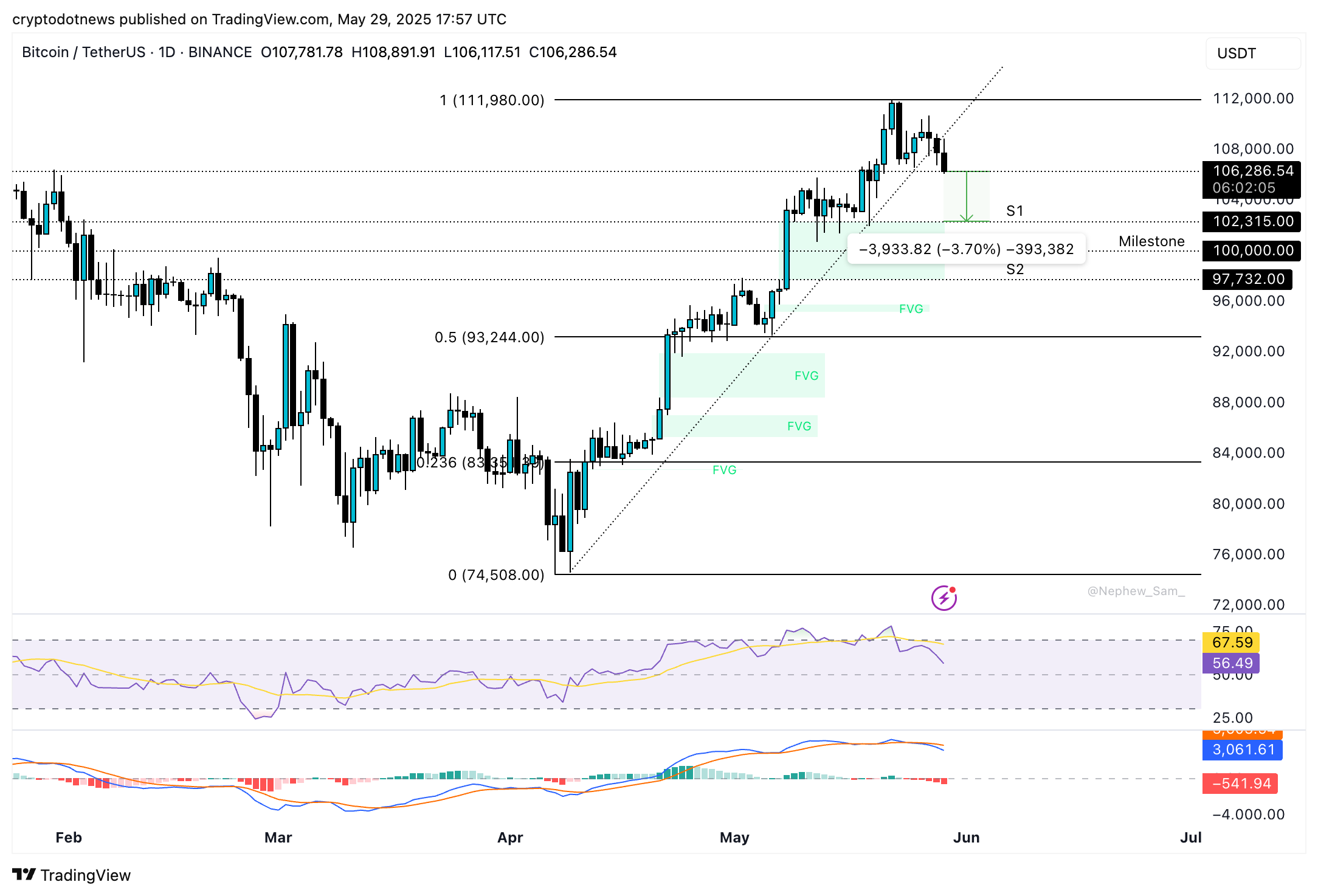

Bitcoin price forecast

Currently, Bitcoin is trading under the $108,000 support level, at $106,286 at the time of this literary endeavor. On the daily timeframe, technical indicators support a bearish outlook. The RSI is trending downward at 56, while the MACD is printing red histogram bars below the neutral line—both signs of weakening momentum. Not the best news for our dear BTC! 😬

BTC could collect liquidity at support levels S1 and S2, marking the upper and lower boundaries of the FVG on the daily chart, located at $102,315 and $97,732, respectively. A retest of the $100,000 psychological milestone remains a likely scenario. Will it be a triumphant return or a sad farewell? 🤔

Bitcoin is currently less than 4% away from its S1 support. Once the FVG is filled, a recovery may begin, as this zone is marked as a bullish FVG on the BTC/USDT daily chart. Fingers crossed! 🤞

“We’ve observed accelerating volume and capital inflows into narrative-driven tokens in sectors like AI (e.g., FET, RNDR), real-world assets (e.g., ONDO, LINK), and Layer 2 (e.g., ARB, OP). If BTC faces resistance in the 110k–115k range and ETH breaks through the critical $2800–$3000 level, we could see a segmented capital rotation favoring high-narrative, high-liquidity altcoins, rather than a traditional full-blown altcoin season.”

Altcoin season, typically defined as a period when 75% of the top 50 altcoins outperform Bitcoin, appears either delayed or segmented this cycle. Experts support a theory of focused rotation into specific narratives instead of broad altcoin outperformance. It’s like a party where only a few get to dance! 💃

Expert commentary

Ruslan Lienkha, Chief of Markets at YouHodler, told Crypto.news in a written note that recent activity suggests a correction rather than a full reversal. A classic case of “not all that glitters is gold!”

Lienkha noted that Bitcoin has spent most of 2025 trading between $90,000 and $110,000, a key consolidation zone saturated with market orders. This suggests strong interest and potential support. He believes another leg up is likely, with BTC potentially rallying to a new all-time high after more range-bound trading. Hope springs eternal! 🌱

James Toledano, Chief Operating Officer at Unity Wallet, said,

“Bitcoin’s rally to a new all-time high of almost $112,000 has already priced in bullish catalysts like institutional inflows and geopolitical uncertainty. As liquidity tightens ahead of key economic data, traders are likely adopting a wait-and-see approach. I see it as a stabilization and not a stall, reflecting a classic consolidation phase after strong gains earlier in the month. With open interest still high and funding rates relatively neutral, this sideways movement suggests a temporary breather rather than a trend reversal.”

Toledano is in agreement with Lienkha on a temporary breather and a return to the all-time high as Bitcoin consolidates in a key support zone. It’s a waiting game! ⏳

Bitunix analysts also commented on macroeconomic factors influencing Bitcoin price. They noted that the latest Federal Reserve minutes signal a “dove in hawk” stance, with the policy direction still unclear. The analysts stated in a separate note:

“BTC as a high volatility asset is the first to bear the brunt of uncertainty. Technically, we need to pay attention to the support zone of $107,700-$106,500. If it breaks down, it may be down to $105,000, and the upper pressure of $110,800-$112,000. We recommend to wait and see before a breakthrough.”

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2025-05-29 22:57