- Well, it seems our dear Exec has a hunch that BTC might just leapfrog over $110k if the stars align in the macro cosmos.

- But hold your horses! The short-term sentiment is as cautious as a cat in a room full of rocking chairs, while the valuation models are playing a game of mixed signals.

Now, gather ’round, folks! Bitcoin [BTC] has taken a tumble, shedding a hefty 12% of its value over the past week. It’s now lounging at a new low of $74k on this fine Monday, all thanks to those pesky Trump tariff troubles and a sprinkle of macro uncertainty. That’s a staggering 30% drop from its all-time high (ATH) of $109.5k. Ain’t that a kick in the pants?

But fear not! Quinn Thompson, the sage of crypto hedge fund Lekker Capital, believes that BTC could very well be on the path to a new ATH in 2025. He’s got a track record, folks! He said,

“Me: Calls Trump win early 2024. Calls BTC 100k in summer 2024. Calls BTC correction to low 80Ks since late December 2024…BTC > 110k in 2025.”

He also mentioned that the macro narrative could take a turn for the better, with tax cuts and deregulation on the horizon. Sounds like a recipe for a good ol’ fashioned rally!

Short-term fears persist

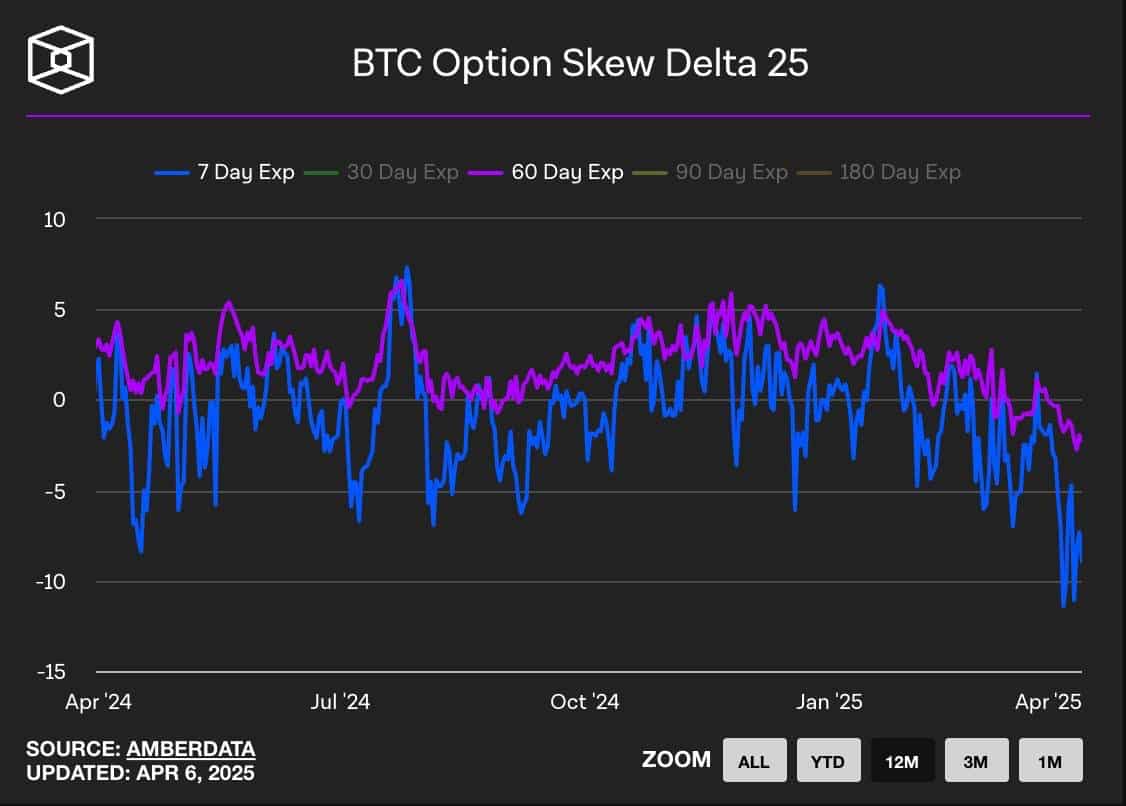

Now, despite the rosy mid-term outlook, traders are as cautious as a squirrel crossing a busy road. Kelly Greer of Crucible Capital pointed out that Options are hedging against downside risks like a bear in hibernation, as evidenced by the premium for puts (those bearish bets). She quipped,

“Protection is the most in demand that it’s been in 12 months across maturities, most pronounced in 1 week. Gamma is peak negative – will exacerbate volatility.”

The Skew Delta 25 indicator is like a crystal ball, tracking the demand for puts or calls (those bullish bets) over days, weeks, or months. It paints a picture of traders’ future expectations and market sentiment. Negative readings? Heavy demand for puts (a sign of doom). Positive values? A glimmer of bullish hope!

According to Amberdata’s Greg Magadini, the puts premium suggests that short-sellers might just be the ones laughing all the way to the bank in the short term. He remarked,

“Short-dated options have seen even more puts premium…I think opportunity favors crypto shorts (the laggard theory) as opposed to longs right now (the safe haven theory).”

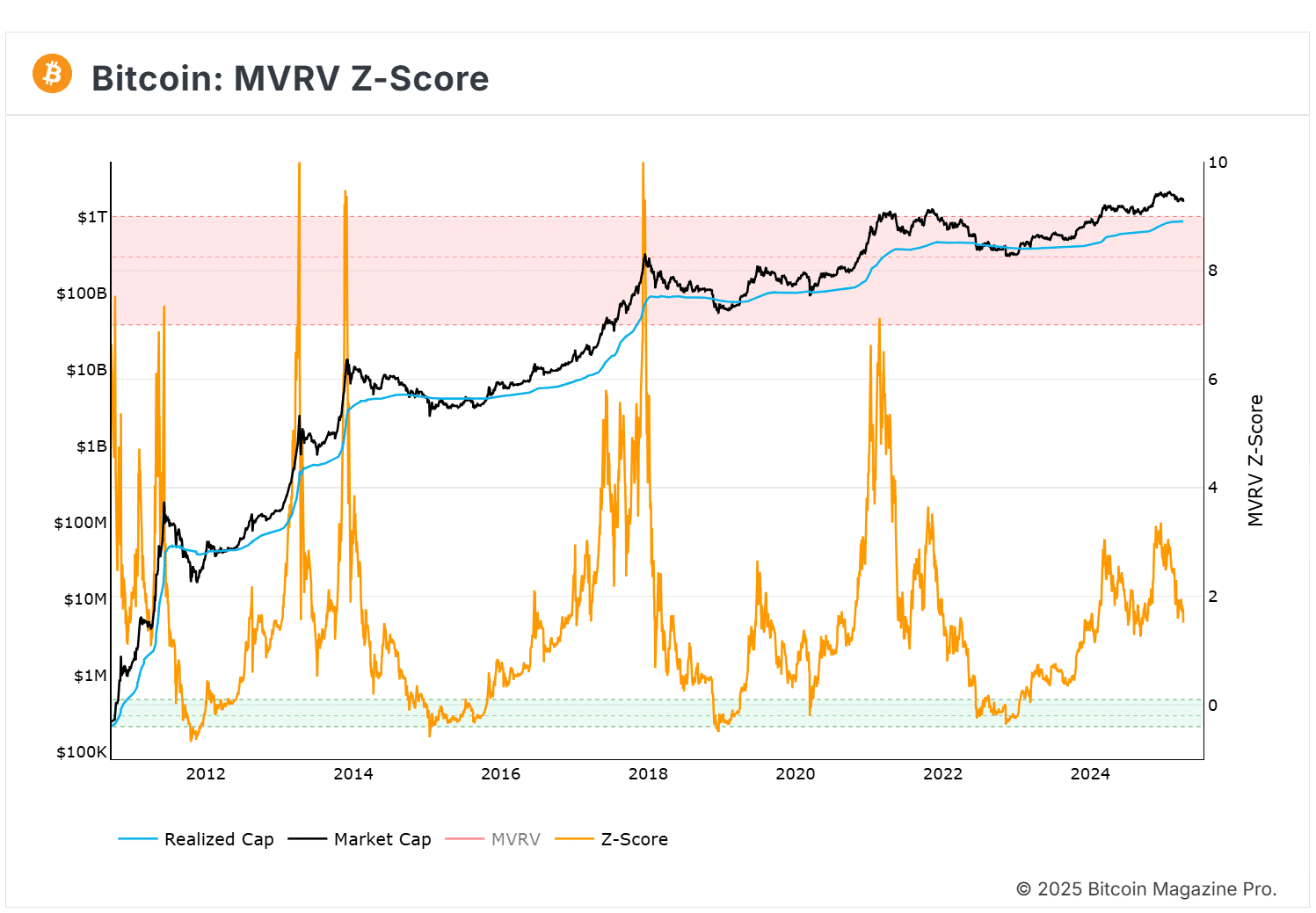

From a valuation standpoint, BTC’s status is as mixed as a fruit salad. The slow capital inflows, according to the realized cap, hint that the king coin might be tiptoeing into bear market territory. But wait! On another valuation model – the MVRV-Z score – BTC hit a local top. It seems to be cooling off towards levels seen last September. In plain English, Bitcoin might just be a bargain at its current price!

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-04-07 15:07