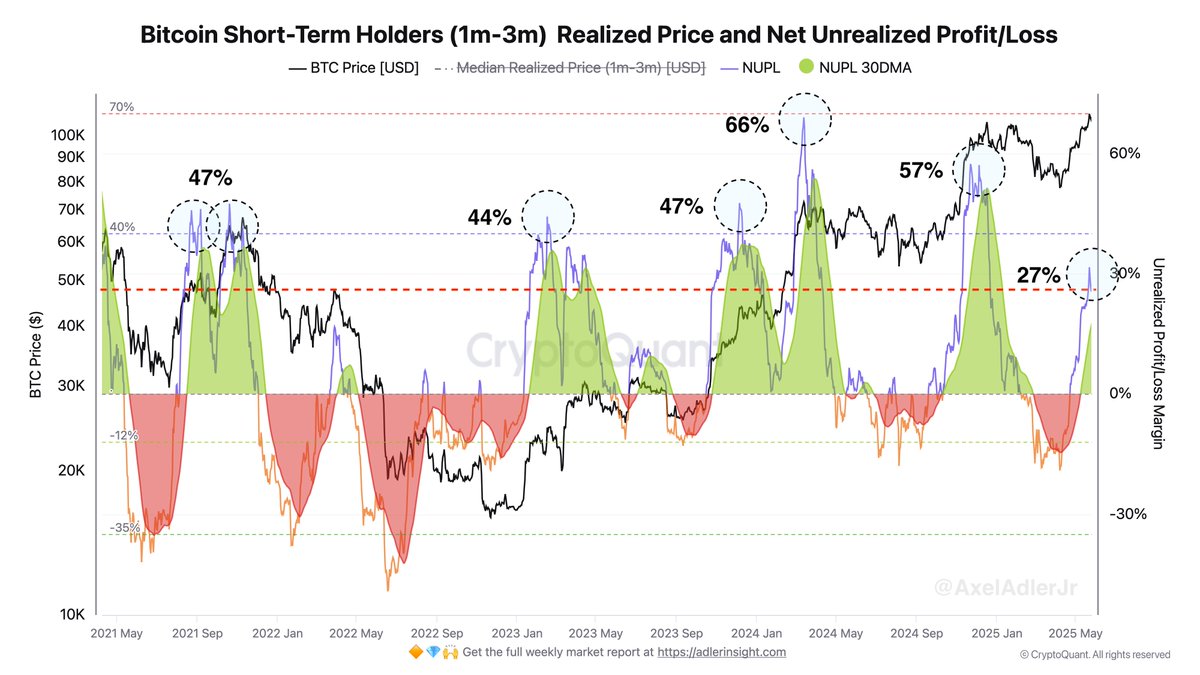

Ah, the world of Bitcoin! A place where numbers dance like they’ve had one too many espressos. Historically, when our dear metric crosses the 40% threshold, it’s like a neon sign flashing “SELL NOW!” to short-term holders, often leading to a delightful downward spiral in prices. Who doesn’t love a good rollercoaster ride? 🎢

Now, our friend Adler has crunched some numbers and suggests that at the current growth rate of about 0.818 percentage points per day (because who doesn’t love a good percentage?), we could hit that magical 40% mark in roughly 16 days. Mark your calendars, folks! June 11, 2025, is the day we all hold our breath and hope for the best.

If this trend continues, Adler predicts that Bitcoin could skyrocket to a jaw-dropping $162,000 by the time those short-term holders start thinking about cashing in. But let’s be real, this prediction is as reliable as a weather forecast in April—full of surprises and potential black swan events (or, you know, a tweet from a certain president). 🦢💬

Historically, Bitcoin has had a knack for dramatic pullbacks at similar NUPL peaks—47%, 44%, 66%, 47%, and 57% over the past four years. Each time, short-term holders have been left clutching their wallets, wondering where it all went wrong. Traders are watching this rise like hawks, fully aware of its potential to send prices tumbling faster than you can say “HODL.” 🦅💸

As of now, the NUPL for short-term holders sits at a cozy 27%. The historical profit-taking threshold? A neat 40%. That means we need a 13 percentage point boost. At our current growth rate of 0.818 percentage points per day, we’re looking at about 16 days to reach that threshold. So, June 11, 2025, could be a day of reckoning—or a day of celebration. Adler’s crystal ball suggests Bitcoin might just hit that $162,000 mark. Fingers crossed! 🤞💵

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- The Battle Royale That Started It All Has Never Been More Profitable

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

2025-05-27 03:30