- Bitcoin traders, those cautious creatures, are tiptoeing as the FOMC uncertainty looms like a dark cloud.

- With a 9% January gain, can Trump’s policies ignite a fresh spark in the BTC bonfire?

Ah, January, that dreary month when Bitcoin [BTC] typically slumbers in its cryptic cocoon. Yet, lo and behold, 2025 has decided to be the rebellious teenager, flaunting a 9% gain. But wait! A record drop in Open Interest and those pesky negative CME premiums are whispering sweet nothings of caution to traders, who are now trimming their BTC exposure like a gardener pruning a wilting rose.

🛑 Trump Tariffs vs. Euro: The Fight of the Decade?

Discover how the EUR/USD pair could react to unprecedented pressure!

View Urgent ForecastWith the U.S. economy playing the role of the fickle diva, one must ponder: is this mere caution, or the prelude to a grander metamorphosis?

What’s happening in the U.S.?

Ah, the U.S. investors, the watchful hawks of the financial skies! The Coinbase Premium Index (CPI) has been sulking in the red for a week, mirroring BTC’s descent from a lofty $104K to a more pedestrian $102K. How poetic!

As de-risking continues, with over $3 billion in Futures positions closed faster than a magician’s disappearing act, buying pressure remains as tepid as a lukewarm cup of tea.

With the FOMC meeting looming like a suspenseful cliffhanger, traders are retreating from high-risk leverage trades, keeping any major surge in open positions off the table – for now, at least.

Inflation appears to be under control, and Trump is waving his magic wand for lower oil prices, but it’s the execution of these policies that has the market in a state of suspended animation. Until clarity arrives, traders are playing the waiting game, popcorn in hand.

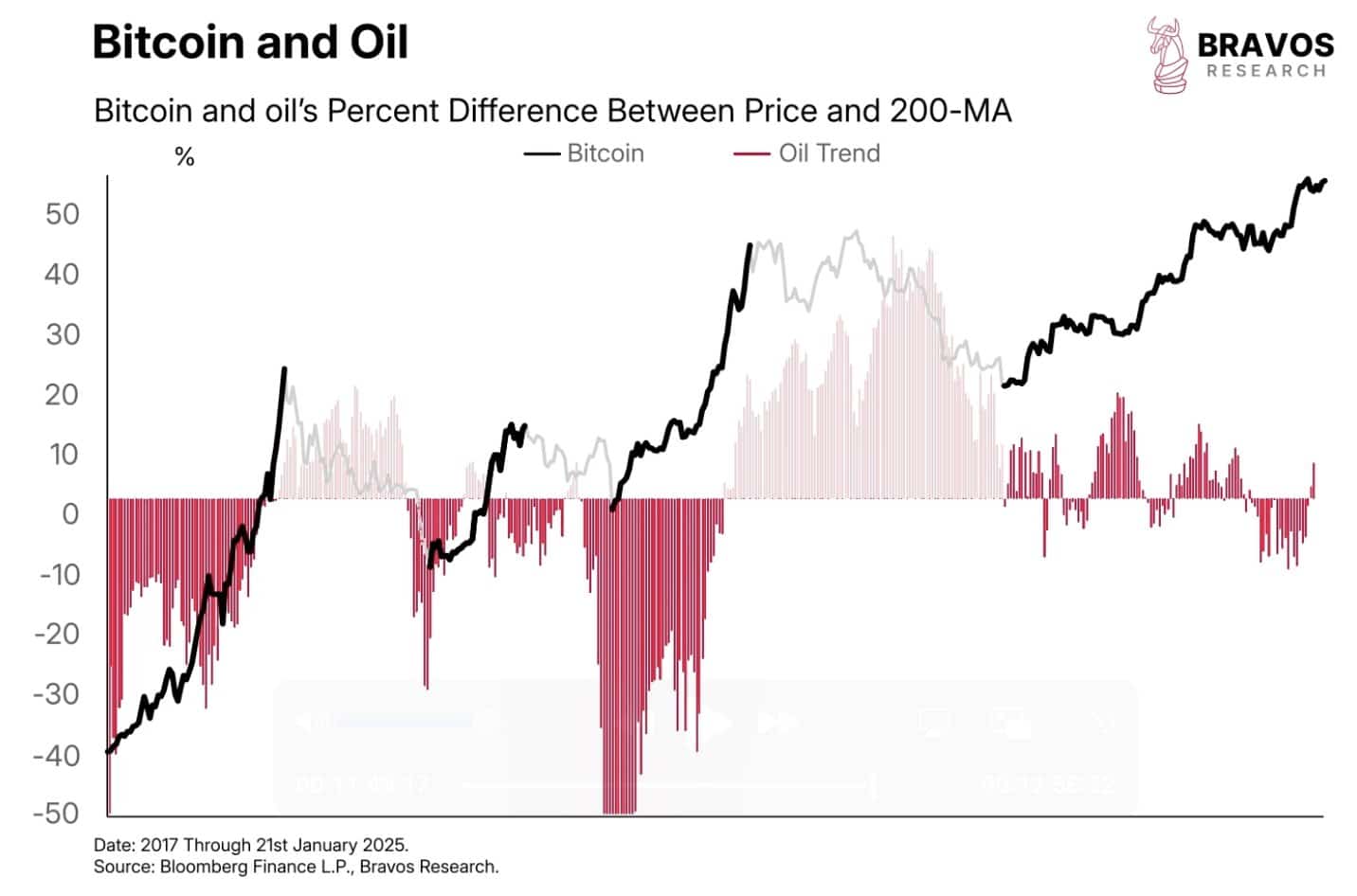

Bitcoin has a penchant for performing well when oil prices take a tumble. If oil helps cool inflation, the Fed may just cut rates. Keep your eyes peeled—it could be the plot twist we didn’t see coming!

Bitcoin in January

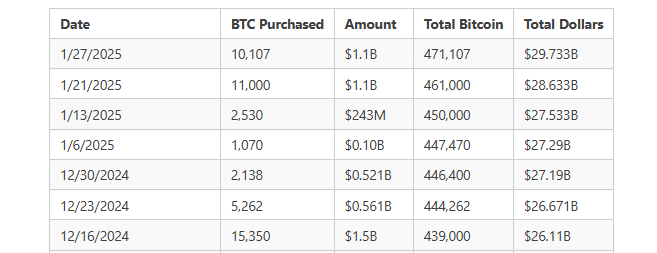

Between Trump’s inauguration, MicroStrategy’s relentless Bitcoin accumulation, and a 10-month high in ETF volume, Bitcoin strutted its stuff with a solid 9% jump in January. Bravo!

These key players are setting the stage for a potential market shift. If bullish expectations falter, the $87K–$90K range could emerge as a strong support zone, with major players likely swooping in to scoop up BTC like kids in a candy store.

It’s a scene reminiscent of December’s price drop, when BTC plummeted from $106K to $89K in a mere fortnight after inflation ticked up a mere 0.2%. Oh, the drama!

During that tumultuous period, MicroStrategy made three colossal Bitcoin purchases, each worth over a billion dollars, doubling down on their Bitcoin bet like a gambler at a high-stakes poker table.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

So, while the market is treading cautiously, a Bitcoin ‘crash’ seems as likely as a cat learning to swim.

If anything, a major shock could come if the Fed defies expectations – but with Trump pushing for lower rates, the market seems poised to weather any potential storm, bringing much-needed relief in 2025. Cheers to that!

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2025-01-30 03:07