Ah, dear reader, it appears that two rather large transactions of Ethereum have been spirited away from the esteemed institution known as FalconX. Our sleuthing friend over at Lookonchain has made the connection, and it seems BitMine, that cheeky little ETH treasury company, is at the heart of the matter.

BitMine’s Ethereal Acquisition: 48,049 Ethereum from FalconX!

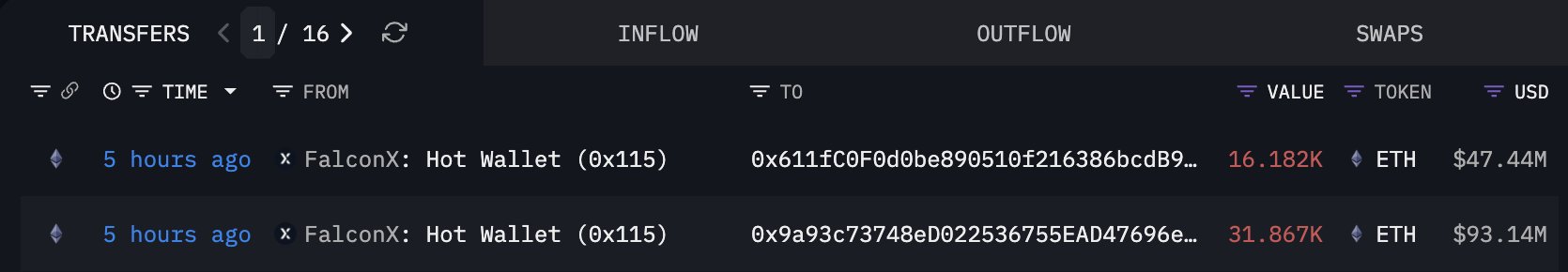

In a recent post on X-where all the cool kids hang out-Lookonchain has revealed that BitMine has scooped up a whopping 48,049 ETH from a rather hot wallet associated with FalconX, the digital treasure trove for institutional trading. It’s a bit like finding a forgotten fiver in your old coat pocket, only much, much larger.

The coins were transferred in two separate transactions, much like a well-orchestrated ballet. The grander of the two waltzed in with 31,867 ETH while the smaller, yet still quite impressive, pirouetted in with 16,182 ETH. Altogether, these tokens amounted to around $140.58 million-enough to make any cryptocurrency enthusiast weak at the knees! 💰

Now, just as our dear Ethereum took a nosedive below the $3,000 mark-seemingly more dramatic than a soap opera cliffhanger-it looks as though BitMine might have decided to buy the dip. A bit like picking up last season’s fashion at a fraction of the price, if you will.

Once upon a time, BitMine was solely focused on Bitcoin mining. However, under the dashing leadership of chairman Tom Lee, it has gallantly transitioned into an Ethereum treasury vehicle since June of this year. They’ve been piling up the cryptocurrency faster than a squirrel in autumn! 🌰

On Monday, BitMine announced in a press release that their holdings have skyrocketed to 3,967,210 ETH. While they haven’t officially confirmed this latest shopping spree, should they do so, it would push their total reserves past the illustrious 4 million ETH milestone. Quite the feather in their cap, wouldn’t you agree?

The ambitious firm has set its sights on acquiring 5% of the total circulating supply of Ethereum. Currently, with about 3.3% of the stash safely tucked away in their wallets, they still have a bit of a trek ahead. But fear not, they’ve made some rather impressive strides already!

With a treasure trove valued over $11 billion, BitMine proudly holds the title of the second-largest corporate cryptocurrency holder in the world, just trailing behind Strategy. Unlike Michael Saylor’s firm, however, this Ethereum enthusiast finds itself in the red at present. But chin up! If those blockchain transactions indeed reflect purchases, it signals that BitMine remains steadfast in their quest for more. 🏴☠️

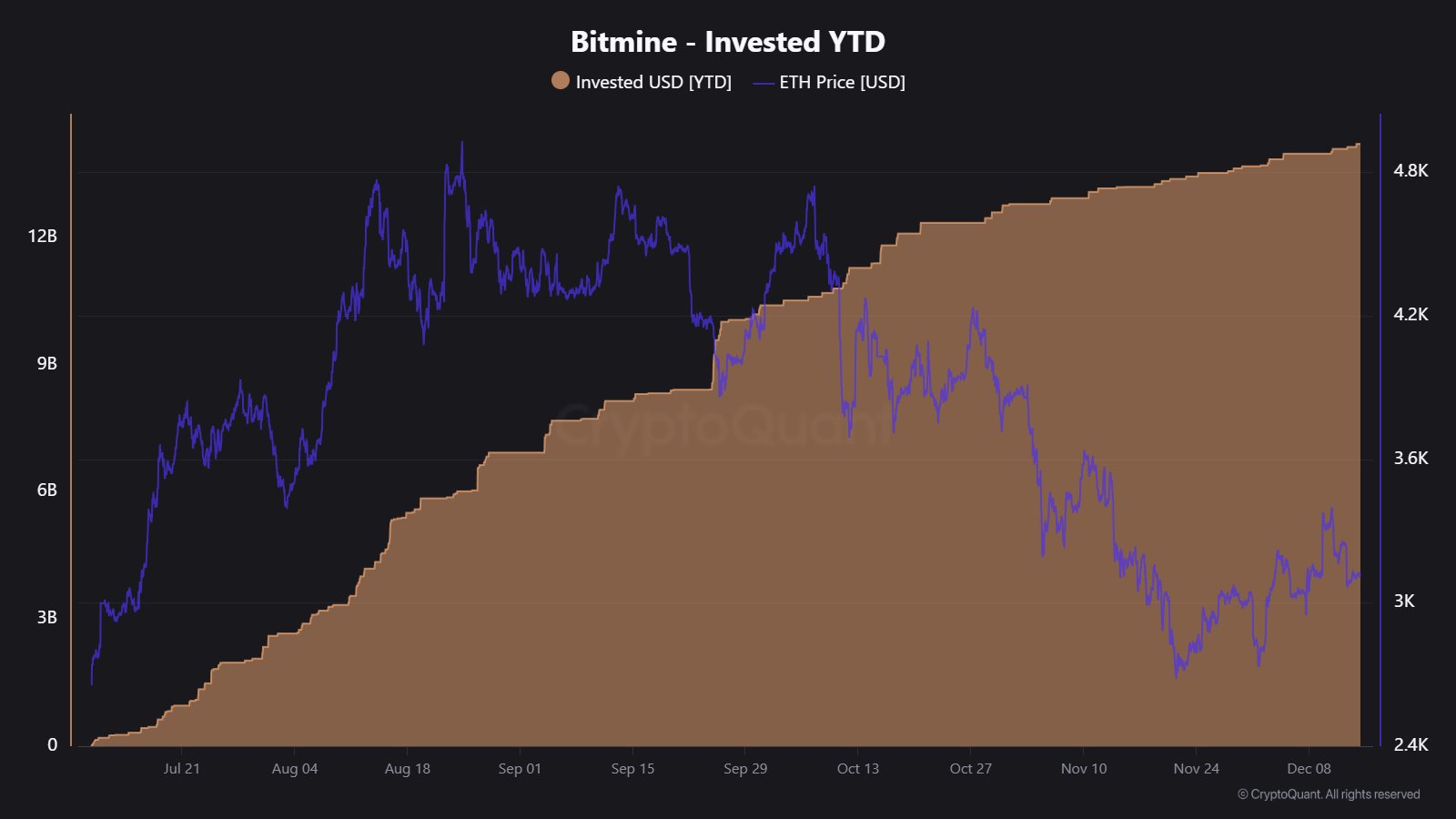

CryptoQuant’s very own analyst Maartunn has shared some insights on X about the capricious nature of Ethereum’s price since BitMine began its buying bonanza. The charts tell a riveting tale-ETH saw some sprightly growth during the initial buying frenzy.

Yet, despite the persistent purchasing spirit from BitMine, the asset’s price decided to take a little snooze, first flatlining before taking a tumble downwards. “Big buys ≠ sustained momentum,” quipped the analyst, and one cannot help but admire the wisdom in those words.

ETH Price Update

Last week, Ethereum made a valiant recovery to $3,400, but alas, it has once again succumbed to bearish tendencies and has slipped back to a rather modest $2,930 level. Oh, the cruel twists of fate in the cryptocurrency realm!

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Gold Rate Forecast

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Controller Settings for ARC Raiders

- Best Werewolf Movies (October 2025)

- Goat 2 Release Date Estimate, News & Updates

2025-12-18 09:15