- TAO showed no signs of recovery as it traded near a critical support level historically linked to price rallies.

- Multiple technical and market indicators aligned, signaling a strong likelihood of further declines.

As a seasoned crypto investor with a penchant for spotting trends and navigating market turbulence, I find myself standing at the precipice of uncertainty regarding Bittensor’s TAO. Having witnessed its rollercoaster ride over the past few months, I can’t help but feel a sense of déjà vu as it approaches a critical support level yet again.

In simpler terms, it seems that the Bittensor [TAO] token hasn’t done as well as expected over various periods. Specifically, on a monthly basis, we’ve seen a decrease of about 14.22%.

During today’s trading session at the specified hour, TAO faced further losses, starting off with a significant drop of approximately 5.05%, which underscores its persistent downward trajectory.

Previously, AMBCrypto pointed out that TAO was treading cautiously. Currently, it seems like the ongoing price drop is due to a wider market instability, potentially exposing the asset to a more significant decline.

Can TAO hold its ground at key support?

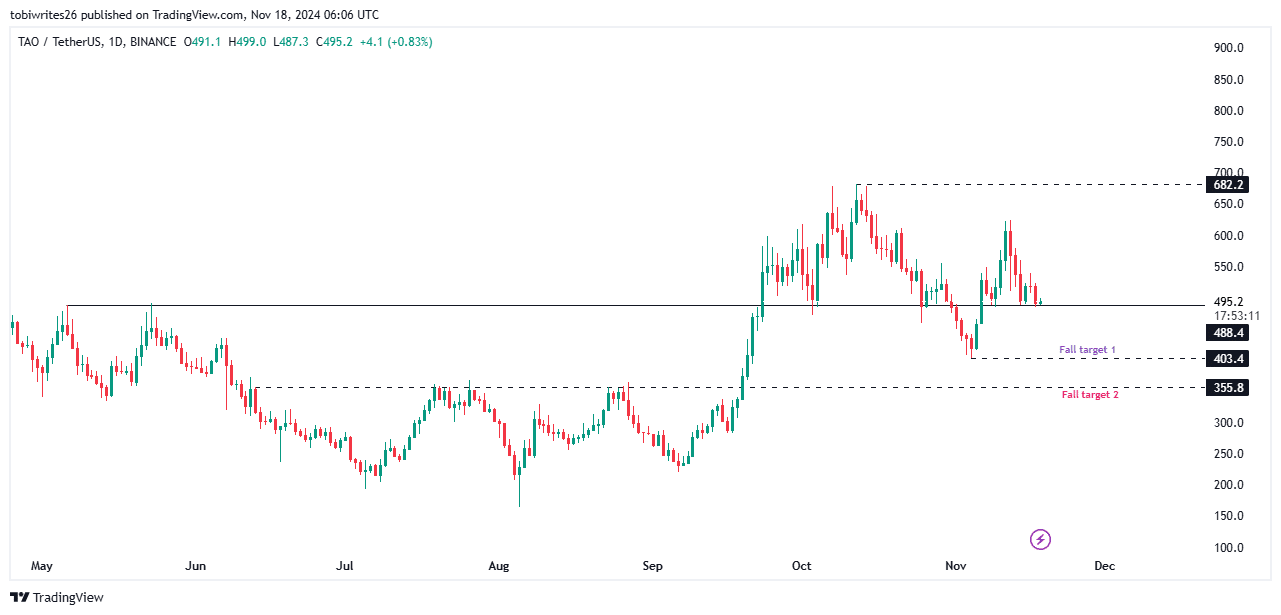

At the moment, I’m closely watching TAO’s price action, as it’s hovering around a crucial support point of $488.4. Historically, this area has been known to spark substantial price shifts in the opposite direction.

Twice before, this level played the role of a takeoff point for rallies, and investors are keenly observing as TAO attempts to pass through this support level for the third time.

Should past patterns persist, there’s potential for TAO to surge toward $682.2. Yet, if it can’t maintain that level, it might pave the way for additional drops.

The potential initial levels for price decreases are around $403.4. If the selling activity increases significantly, there could be a further decline to approximately $355.8.

To predict TAO’s future actions, AMBCrypto delved deeper by examining supplementary data points. They emphasized crucial elements likely to shape the direction of this asset.

Bearish sentiment takes hold of TAO

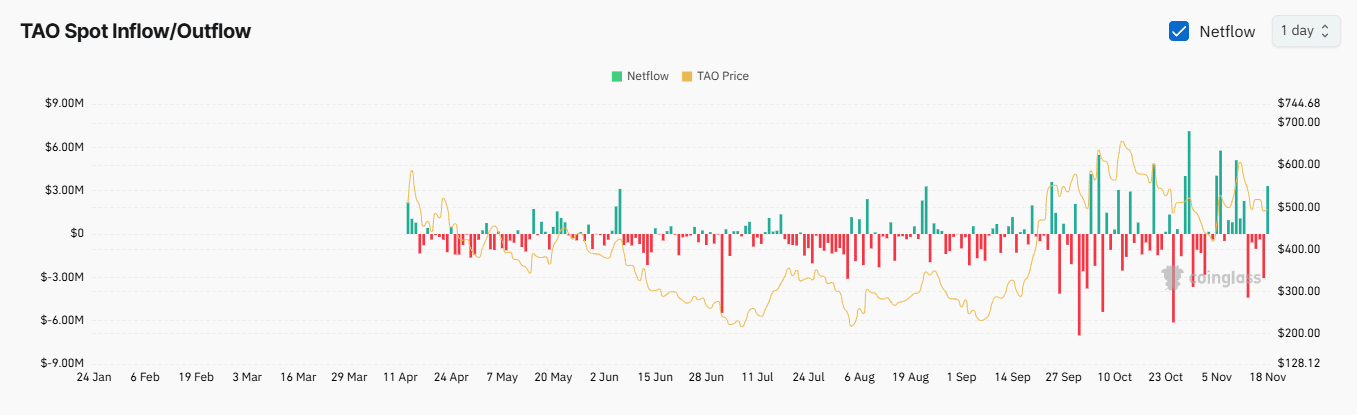

Based on AMBCrypto’s analysis utilizing Coinglass data, the general opinion about TAO in the market has become more negative (bearish).

Over the last day, the flow of tokens on TAO’s Exchange NetFlow has shifted, showing that more tokens are being transferred into exchanges rather than taken out.

In simpler terms, a high NetFlow often indicates that traders might be preparing to sell their assets, such as TAO in this case. As I write this, approximately $3.90 million of TAO has been placed for potential selling.

Furthermore, there was a substantial closure of long positions in the market, amounting to approximately $295,620, while short positions saw minimal closures worth only about $9,590.

The imbalance indicates that traders who were speculating on an uptrend had to exit their positions, as the bearish pressure became stronger.

The analysis showed that the Long-to-Short ratio was approximately 0.9084, suggesting that traders were predominantly betting against TAO’s growth and favoring its downturn, which mirrored a rising sense of doubt among market participants.

Indicators align with on-chain data

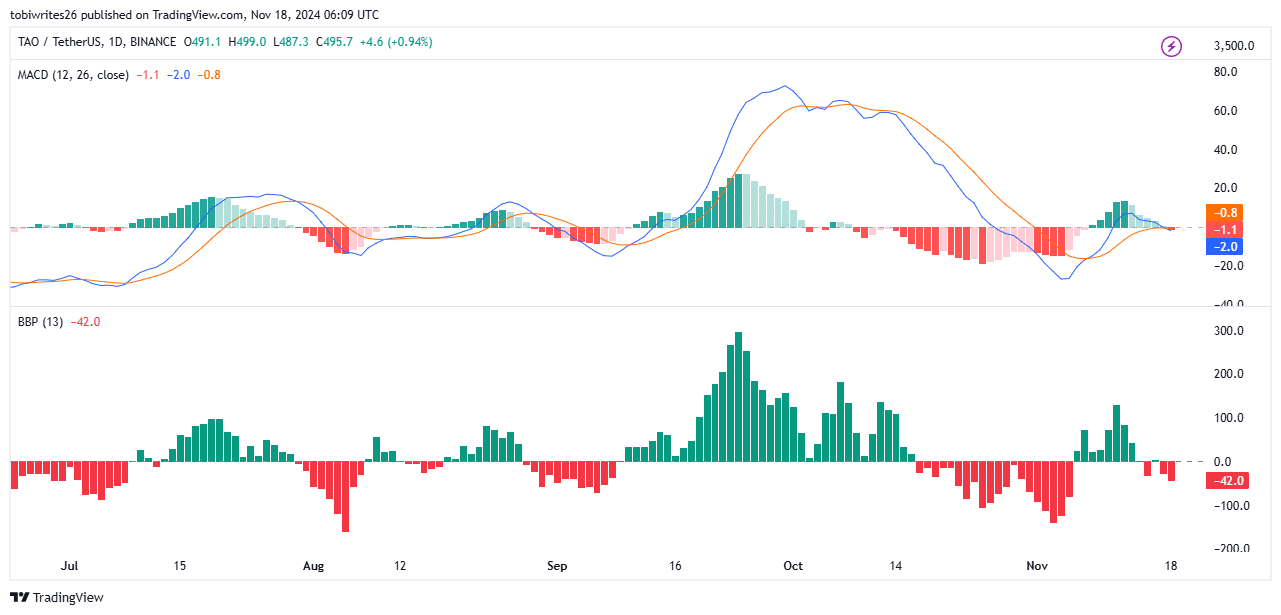

The technical analysis shows a bearish trend for TAO as the Moving Average Convergence Divergence (MACD) and Bull Bear Power suggest a dominant force of buyers in the market, indicating that sellers are in control.

In simpler terms, the graph shows a “death cross” formation where the blue line (MACD) dips beneath the orange line (signal line). This pattern is typically followed by a decrease in momentum, strengthening the overall downtrend.

Additionally, the Bull Bear Power indicator provided additional support for the predominance of Bittensor’s bearish market.

Read Bittensor’s [TAO] Price Prediction 2024–2025

As a crypto investor, I noticed the increasing sea of red bars on my indicator, signaling that sellers are dominating the market right now. This has strengthened the overall negative vibe, making me more cautious about my investments.

Given these technical indicators, the general market outlook stayed pessimistic, implying a higher chance of continued drops for TAO.

Read More

2024-11-19 01:44