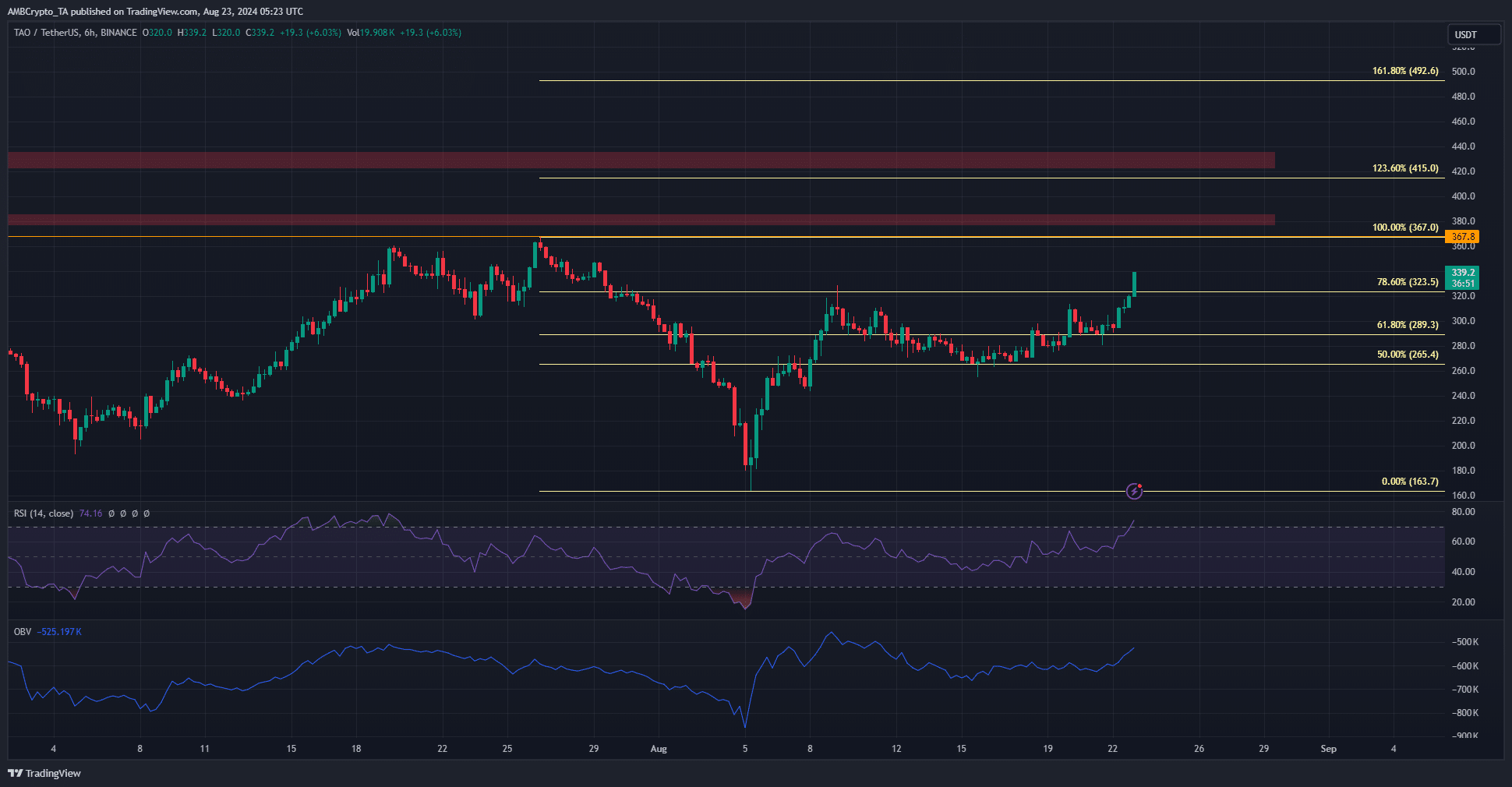

- Bittensor has recorded large gains in recent days, pushing past a key Fib level.

- The $360-$380 zone that was significant in June could be pivotal once more.

As a seasoned crypto investor with a knack for spotting trends, I must say that Bittensor’s [TAO] recent surge past key resistance levels has me quite intrigued. Having navigated through multiple bull and bear markets, I can attest to the fact that such price actions often precede significant gains.

Over the past few days, Bittensor [TAO] has experienced a significant surge of approximately 21%, climbing from its low on August 21st at $280.5. This substantial price hike transpired as Bitcoin [BTC] hovered around the resistance zone of $60k without showing any clear direction.

Based on my years of trading experience and careful analysis of market trends, I believe that the price action is strongly suggesting a potential move towards $380. However, the question remains whether the bulls have enough strength to continue pushing the upward trajectory. My personal approach would be to closely monitor the market and look for key indicators that could confirm or contradict this prediction. It’s crucial to remember that past performance is not always a guarantee of future results, but it can provide valuable insights when making informed decisions in the stock market.

TAO bursts past key resistance

Throughout August, the$323 served as a strong resistance. The bears flipped it in late July, and it was retested during the price bounce after the 5th of August. This retest was a failure and TAO was forced back to $265.

After that point, the bullish trend made a comeback, pushing prices higher once more. On this occasion, they managed to surpass the 78.6% Fibonacci retracement line, which was calculated based on the decline from mid-July to early August.

The Overbought Volume (OBV) was steadily rising, suggesting increasing market demand. Additionally, the Daily Relative Strength Index (RSI) indicated robust momentum, as it surpassed 70. This suggested that Bittensor prices could soon touch $367 and possibly rise even further.

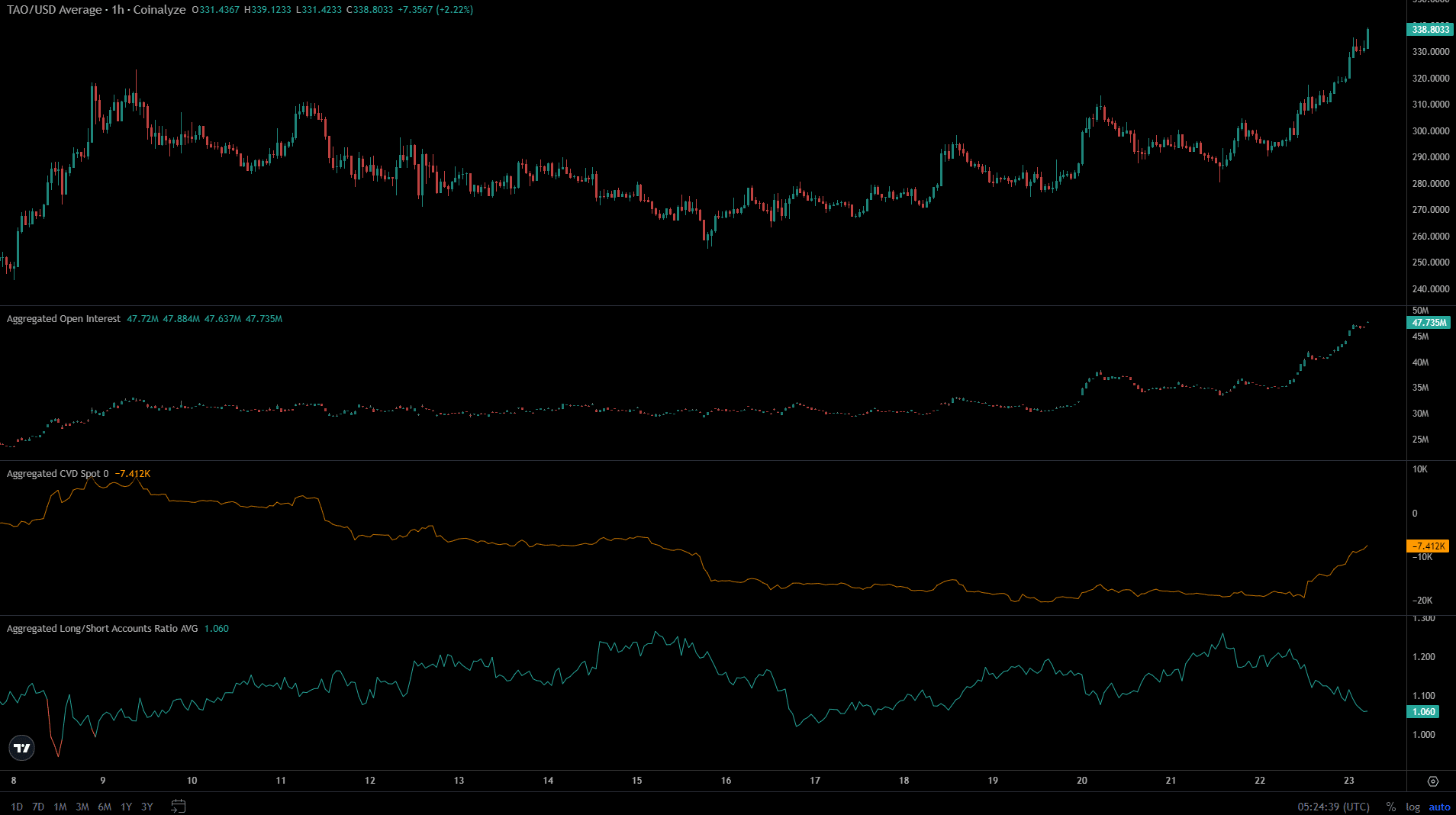

The lower timeframe data was hugely encouraging

Over the past two days, the Open Interest has surpassed $12 million, coinciding with rising prices. This surge suggests robust bullish speculation. Simultaneously, the spot Contract Value (CVD) climbed higher as well, signaling an uptick in demand for immediate transactions.

Read Bittensor’s [TAO] Price Prediction 2024-25

The balance between long and short positions in the market leaned more towards buying (long), indicating a slight bearish attitude. However, this was a positive sign since it suggested that the imbalanced long/short ratio was starting to level out, even as prices continued to climb.

A reset like this might propel TAO further upward since traders are closing their long positions (to secure profits), but it’s unlikely to significantly dampen the overall optimistic outlook.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2024-08-23 16:07