- BitTorrent was a top daily gainer on 21st August, up +20%.

- However, the rally hit a Q3 supply zone; can bulls push forward?

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent surge of BitTorrent [BTT]. On August 21st, BTT was the top daily gainer, marking a +20% rally that outperformed even Bitcoin. However, this bullish momentum has hit a snag at the Q3 supply zone, a familiar barrier I’ve seen many times before in my journey through the crypto jungle.

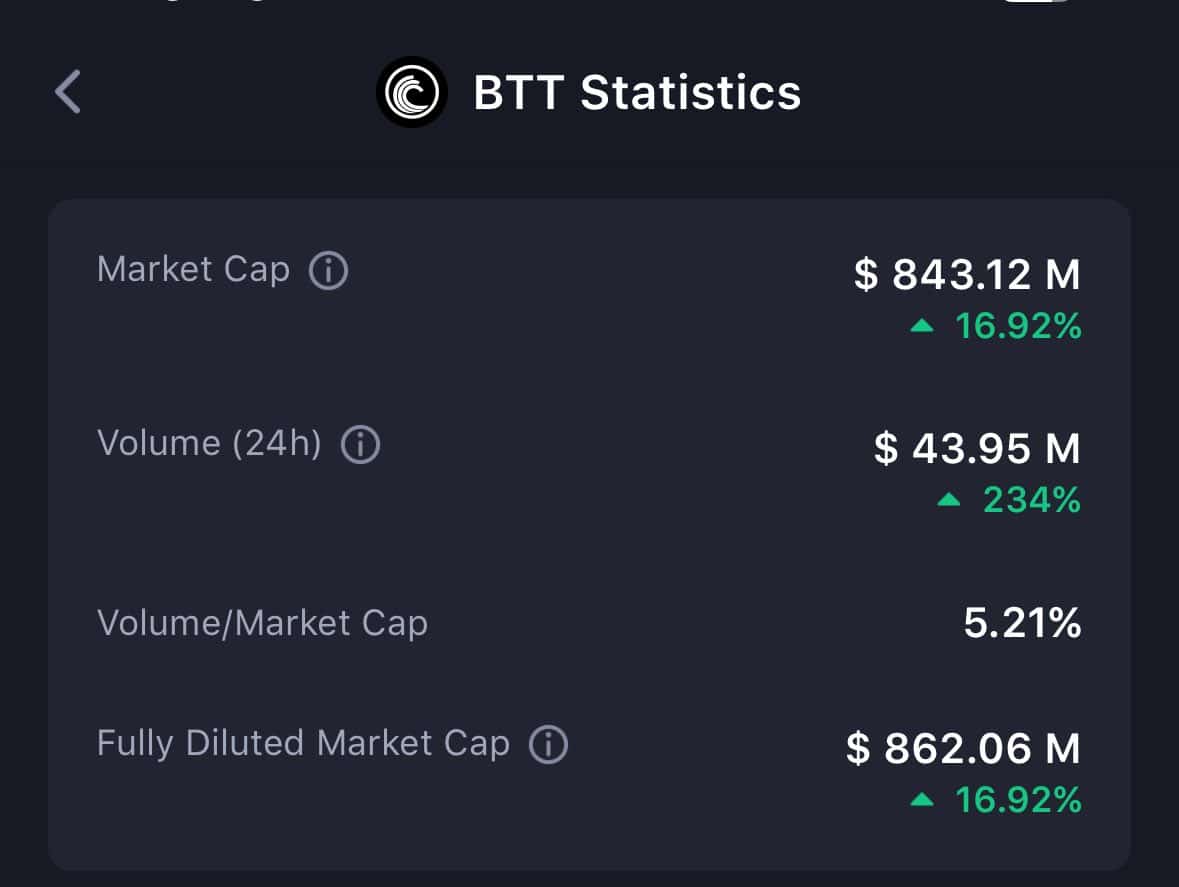

On August 21st, as reported by CoinMarketCap, BitTorrent Token (BTT) – which boosts the functionalities of the file-sharing system, BitTorrent protocol – was the leading token in terms of daily gains.

Its daily trading volume was up +230% while its price exploded +20% on daily charts.

Currently, the token has experienced a surge of more than 20%, outperforming other assets in the market, even Bitcoin itself. Yet, it reached a crucial resistance level during Q3 at approximately $0.00000095. The question remains: will this rally persist?

BitTorrent price hits Q3 supply zone

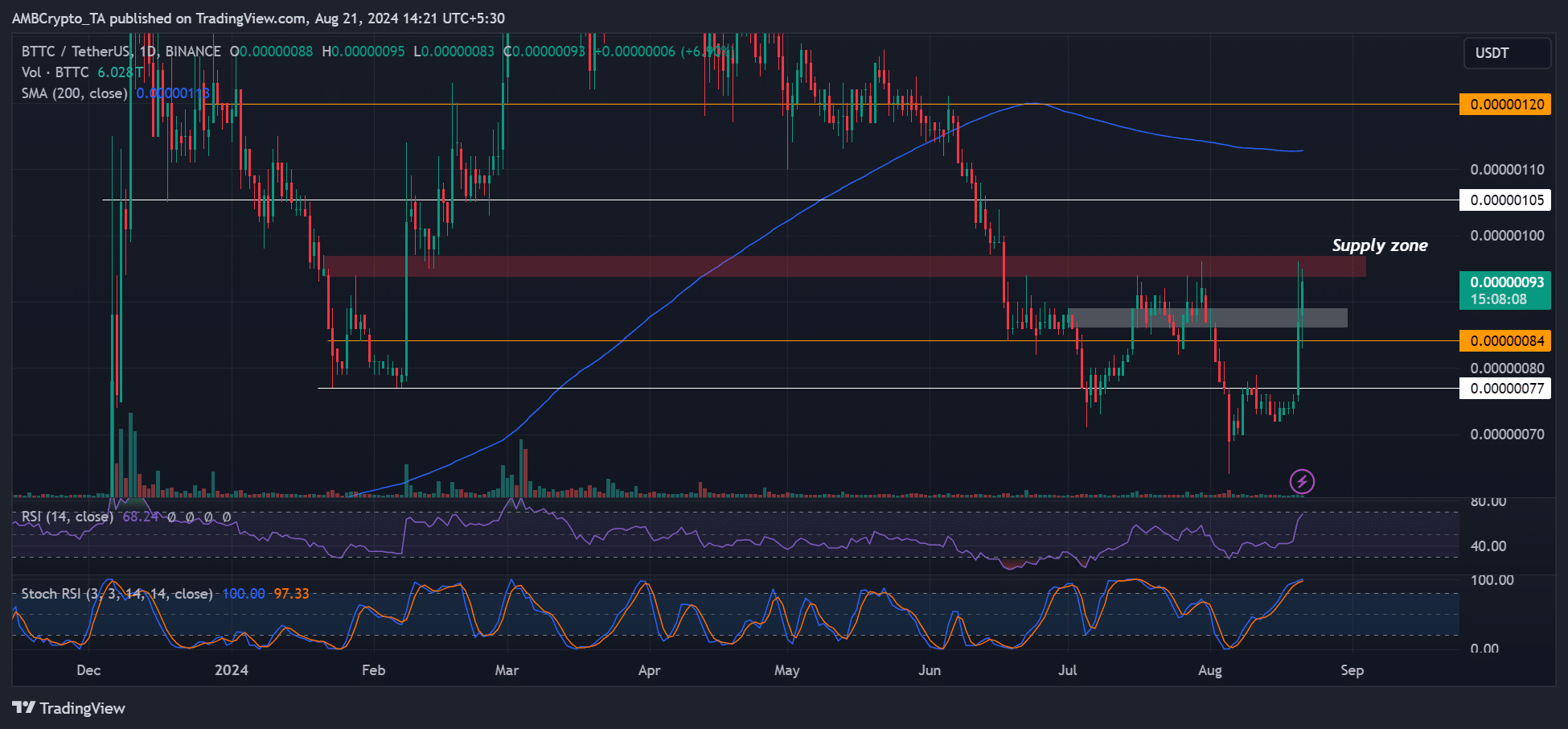

In early August, the price of BTT plummeted to its lowest point for the year, surpassing the previous record of $0.00000077 set in February.

Nevertheless, the significant surge on August 20th caused a reversal of BTT’s earlier August losses. However, the price touched its Q3 high and supply area at 0.00000095 USD (highlighted in red). Will the bulls manage to drive prices higher for additional gains?

According to the readings from the chart indicators, the supply zone might present difficulties. The Stochastic RSI (Relative Strength Index), which often signals price changes when in the oversold zone, is currently within that range.

Collectively, the indicators revealed high buying pressure, but a trend reversal was also likely.

If so, selling at the supply zone could push BTT towards $0.00000084.

Instead, BTT might aim for an additional 8% or 16%, should the token continue its rise and reach the potential highs at $0.000001 or the 200-day Simple Moving Average, respectively.

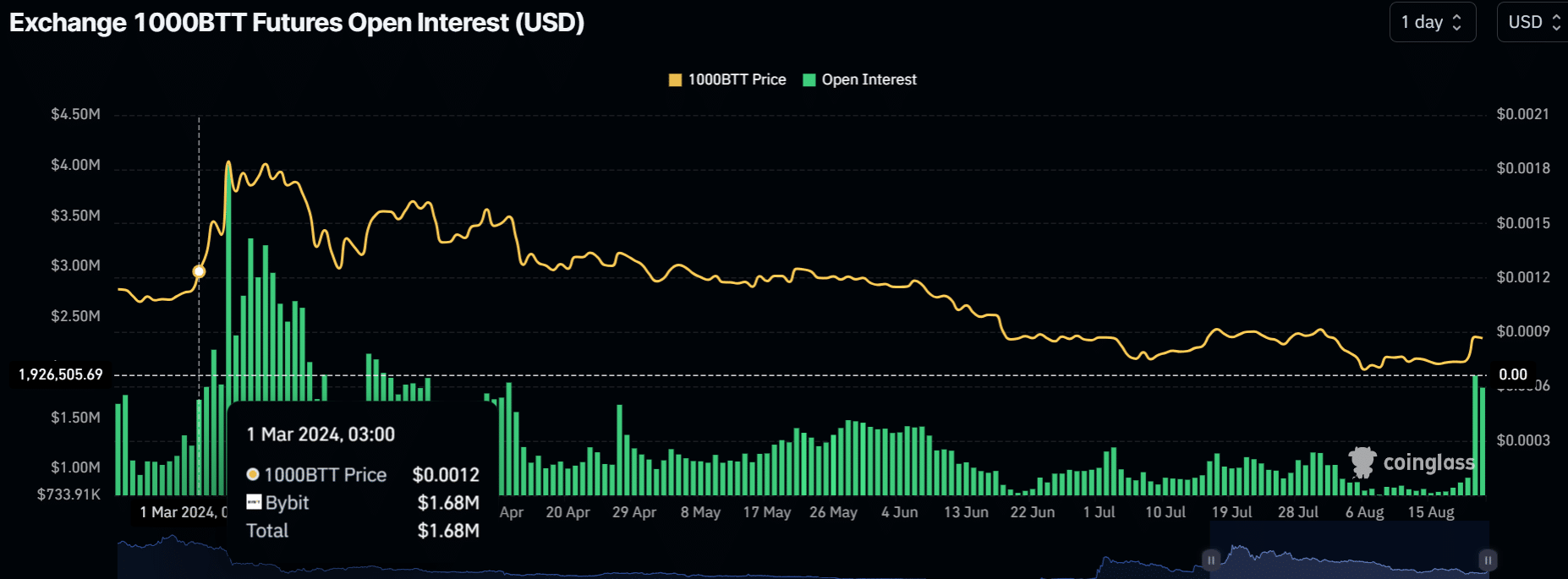

BTT’s interest surge to early 2024 levels

The amount of funds pouring into the derivatives market for BTT significantly increased, as indicated by Open Interest (OI) figures reaching approximately $1.5 million. This is a level not seen since March when BTT reached its highest point of $0.0000022 for the year, suggesting strong optimism in the futures market.

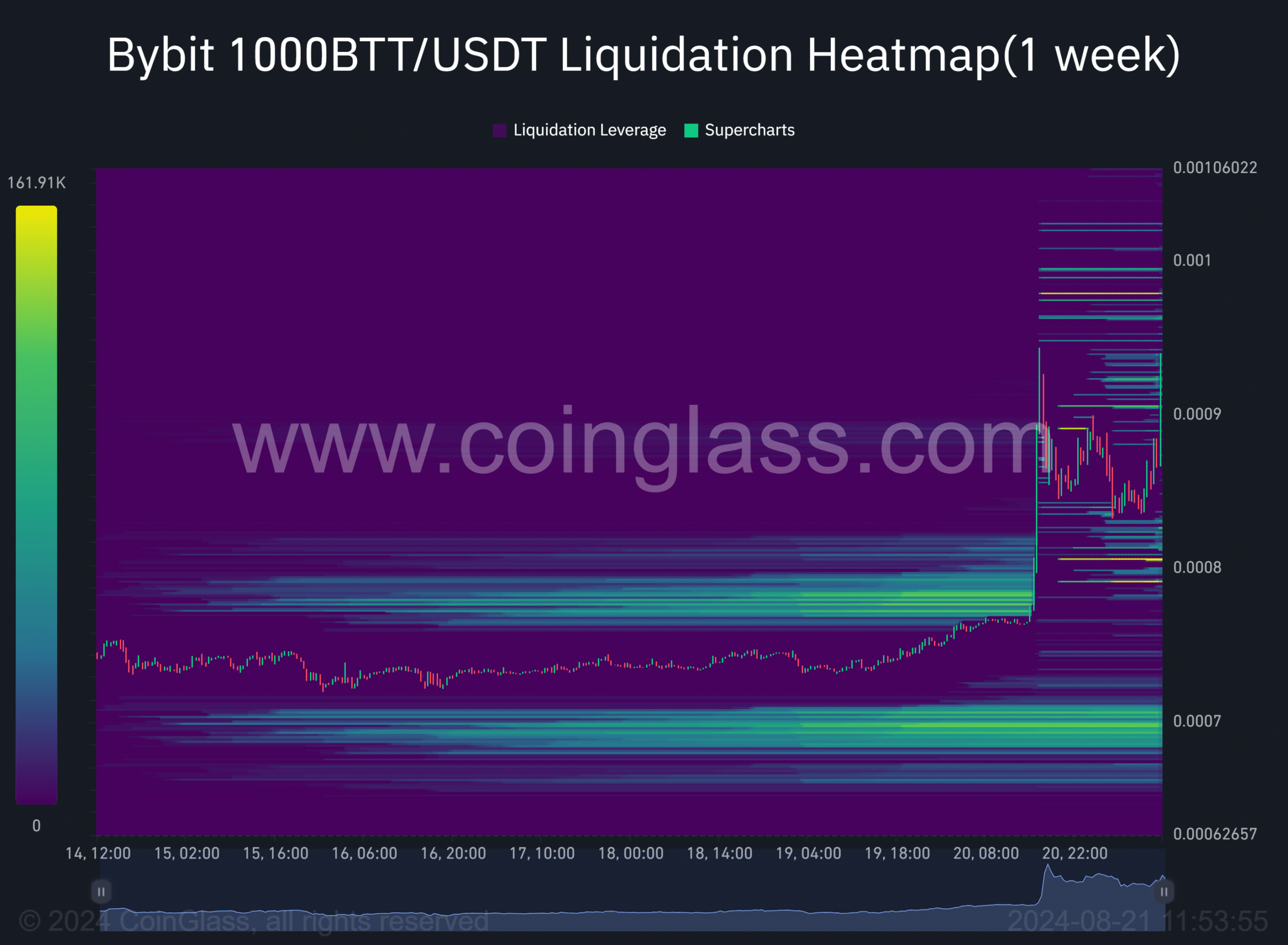

According to the liquidation heatmap that marks significant price fluctuations, the $0.00000097 served as a pivotal level indicating potential price increases.

Read BitTorrent [BTT] Price Prediction 2024-2025

At the lower end of market activity, the level of $0.0000008 held significant importance. This figure aligns with the area where sellers were active, also acting as a point of potential buyer support according to the price graphs.

In essence, it’s possible that the value of BTT may drop beneath the Q3 supply area, given that the general market sentiment stays negative.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-21 22:15