- BitTorrent saw a high volume of trading during the recent 35% price move.

- The growing speculative interest and high buying volume meant that more gains were likely.

As a seasoned analyst with over two decades of experience in the crypto market, I find myself intrigued by BitTorrent’s [BTT] recent price action. The 35% surge in just four days was a clear sign of growing interest and speculation, which often indicates more gains to come.

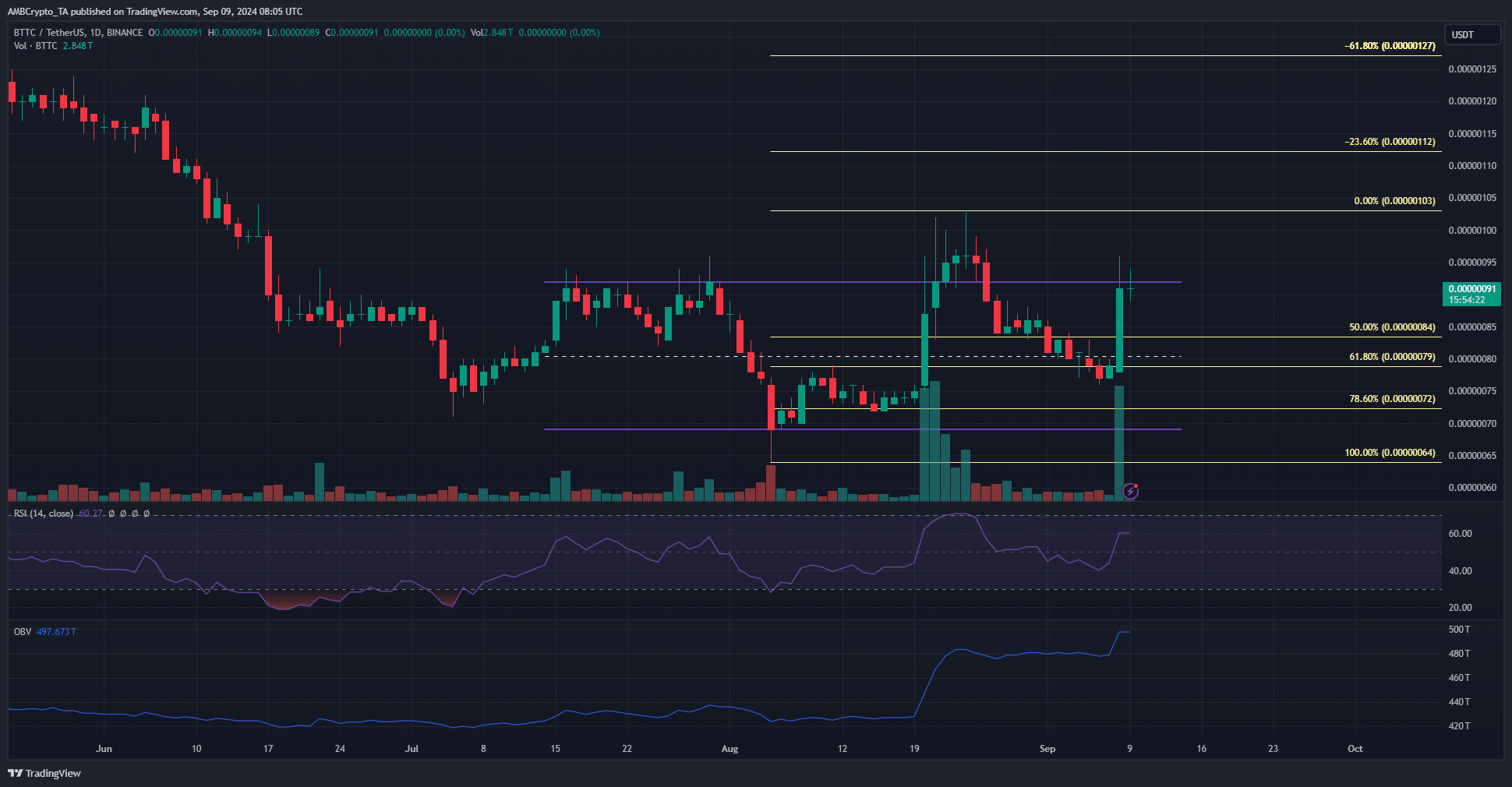

BitTorrent’s price graph began to climb upwards at the start of August, eventually breaking through a defined range. However, after that, it pulled back and once again fell within the established range. Despite this dip, the overall positive sentiment for BTT remains robust.

Strong trading activity boosted investors’ optimism for an imminent price increase. Key Fibonacci levels indicated potential future milestones, making a rising Bitcoin (BTC) beneficial to BitTorrent as well.

The selling volume shed light on market sentiment

On August 20th, BTT experienced an increase in trading volume that propelled it above its mid-level resistance. Two days after, it surpassed this range, resulting in a 35.5% surge over the subsequent four days of bullish market activity.

Following that point, I’ve noticed a test of the 61.8% retracement level. Quite intriguing, as the trading activity during this decline was minimal. Prior to my current analysis, there was another price surge towards the range top.

Once more, the OBV jumped up, indicating that the bulls had regained control over the market. Additionally, the Daily Relative Strength Index (RSI) confirmed this strength, as it read at 60, signifying robust momentum.

The extensions at $0.00000112 and higher would be the next targets.

The social media sentiment needs to turn around

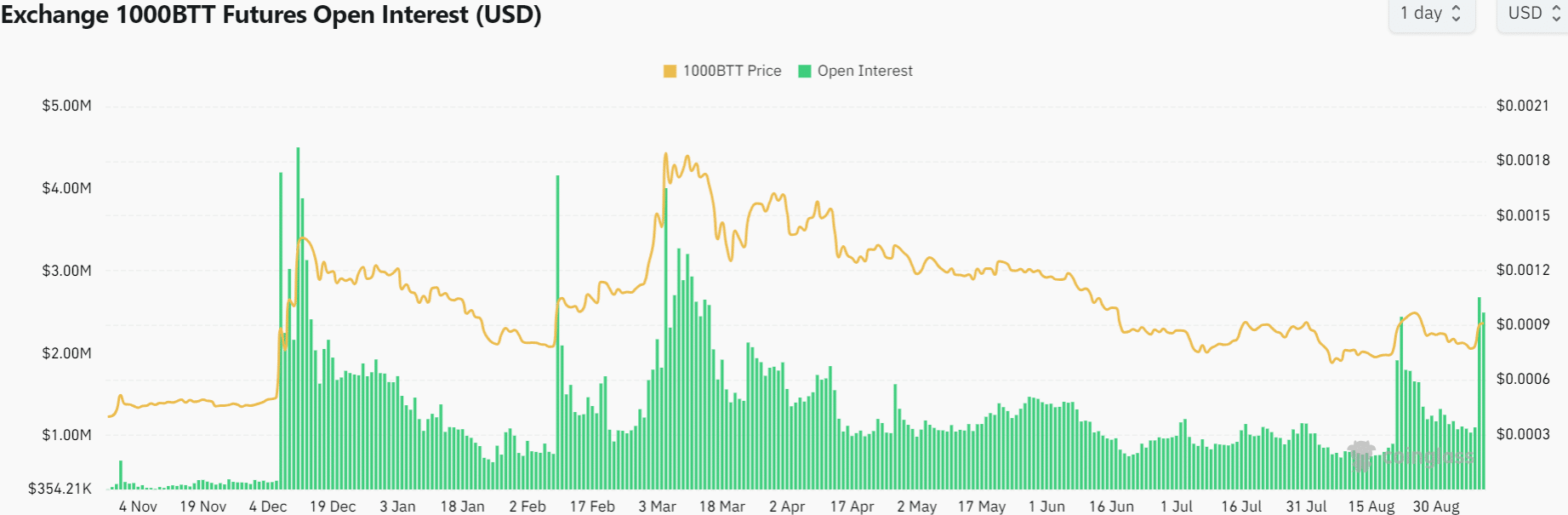

Over the last week, there’s been a positive outlook or optimism in speculative trading sectors, particularly with BitTorrent tokens. This bullishness is reflected in the significant price increases these tokens have experienced. Notably, this optimistic trend can be observed through the sudden increase in Open Interest that occurred during the rapid rise in token prices.

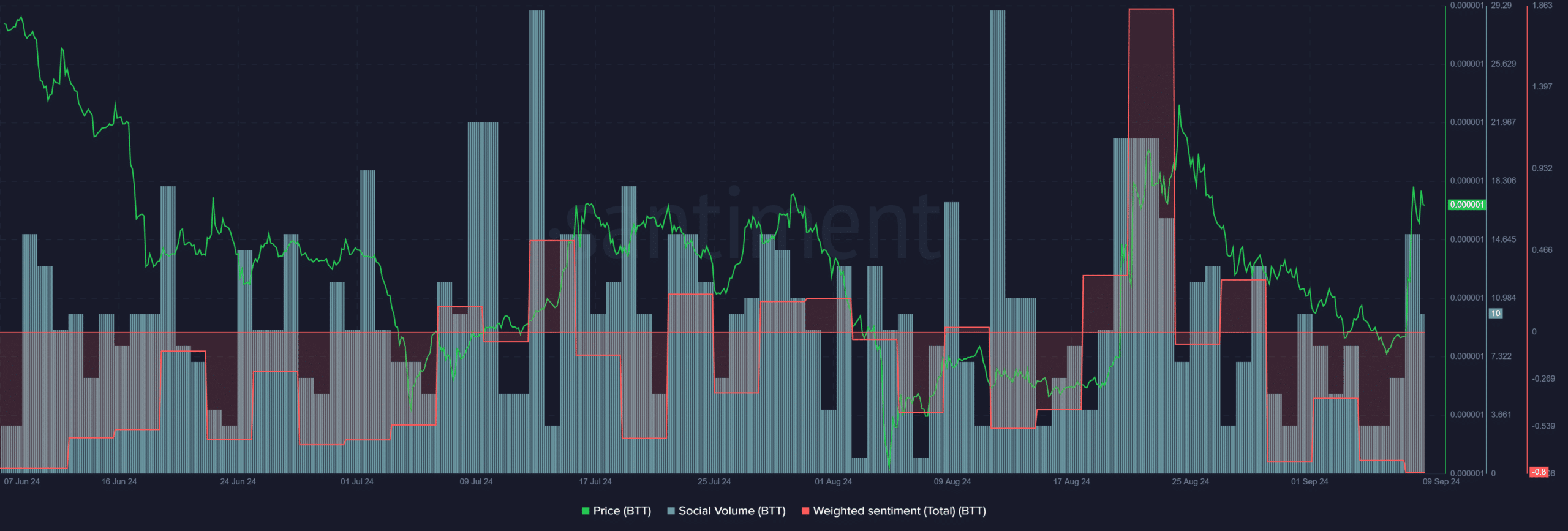

In more straightforward terms, it seems that social media interactions have been predominantly negative in the past few days, according to the analysis by Santiment, which indicates a decline in sentiment during the price drop.

Realistic or not, here’s BTT’s market cap in BTC’s terms

Because we’re looking at a 3-day average, it might take a couple of days for the latest price surge’s positive impact to show up on the indicator. Meanwhile, there has been a rise in social activity as well.

Overall, the trading volume and the recent breakout encouraged more gains.

Read More

2024-09-10 01:11