-

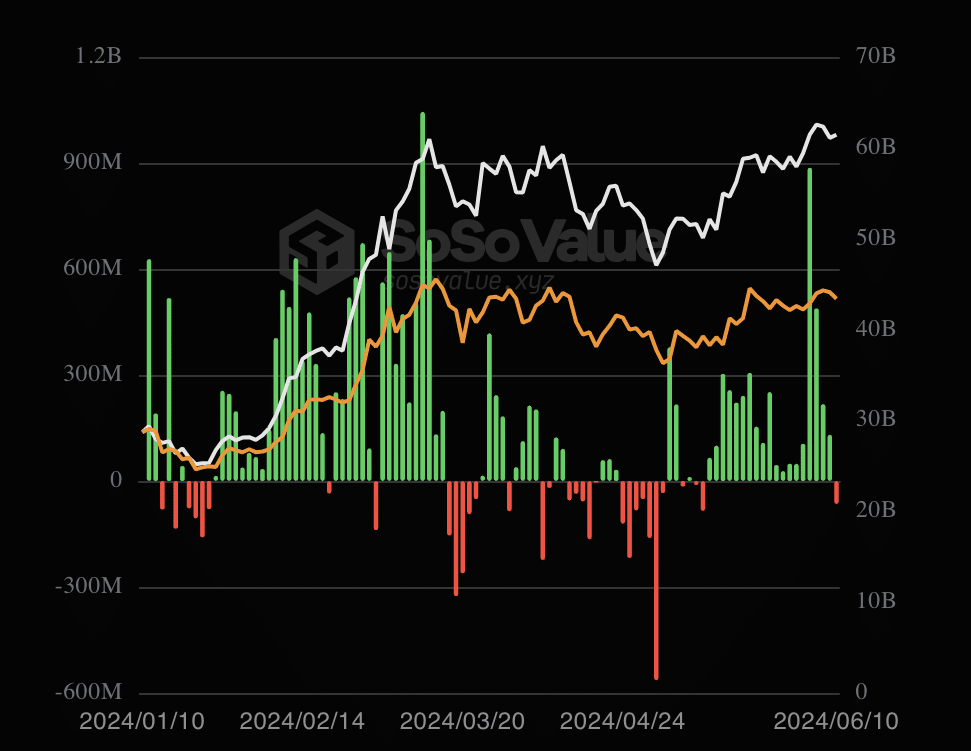

Though earlier inflows were worth billions, the ETF registered a net outflow on the 10th of June.

Long-term holders were cashing out, suggesting a further decline for BTC.

As an experienced financial analyst, I’ve closely monitored the Bitcoin Exchange-Traded Funds (ETFs) market for quite some time now. The recent developments have been intriguing, with Bitcoin ETFs registering a net outflow on June 10th after consecutive days of inflows worth billions of dollars. This trend has been driven mainly by institutional investors such as BlackRock.

Bitcoin [BTC] ETFs have experienced 19 straight days of investment influx following a prolonged phase of outflows. The recent inflow, primarily driven by BlackRock’s Bitcoin ETF, amounts to nearly $3 billion over the past few weeks.

On June 10th, I observed inflows of $6.34 million into BlackRock’s crypto investments and $7.59 million into Bitwise’s IBIT. Yet, the situation appeared to shift as Grayscale’s GBTC experienced an outflow of significant magnitude, amounting to $39.53 million.

Due to GBTC’s (Grayscale Bitcoin Trust) large redemption volume, more Bitcoin left the trust than entered it. For those unfamiliar, a Bitcoin ETF (Exchange-Traded Fund) and Bitcoin, the cryptocurrency, are not one and the same.

The outflows are taking the top spot

With Bitcoin ETFs, you don’t actually need to possess Bitcoin. Rather, your investment gains or losses are linked to the value of Bitcoin, affecting the ETF’s Net Asset Value.

During the initial three months of the year 2024, specifically in Q1, various assets, with BlackRock Bitcoin ETF taking the lead, experienced significant inflows worth billions of dollars on certain days. Consequently, Bitcoin’s price reached a new peak and set a fresh all-time high in March.

As an analyst, I’ve observed that the inflow of funds towards Bitcoin took a pause, resulting in its value dipping under $60,000 momentarily. However, the recent surge of interest and investment has mitigated the correction, allowing Bitcoin to recover some ground.

During this timeframe, the Assets Under Management (AUM) of BlackRock’s Bitcoin ETF surpassed $20 billion. AUM signifies the total value of the investments that a fund manages. This figure is influenced by funds flowing in or out of the fund and the performance of the underlying assets.

With the surge in Bitcoins being sold off lately, its value could potentially drop. The current price is $67,539 – a 2.63% decrease from the previous day’s price.

Will BTC slip below $67,000?

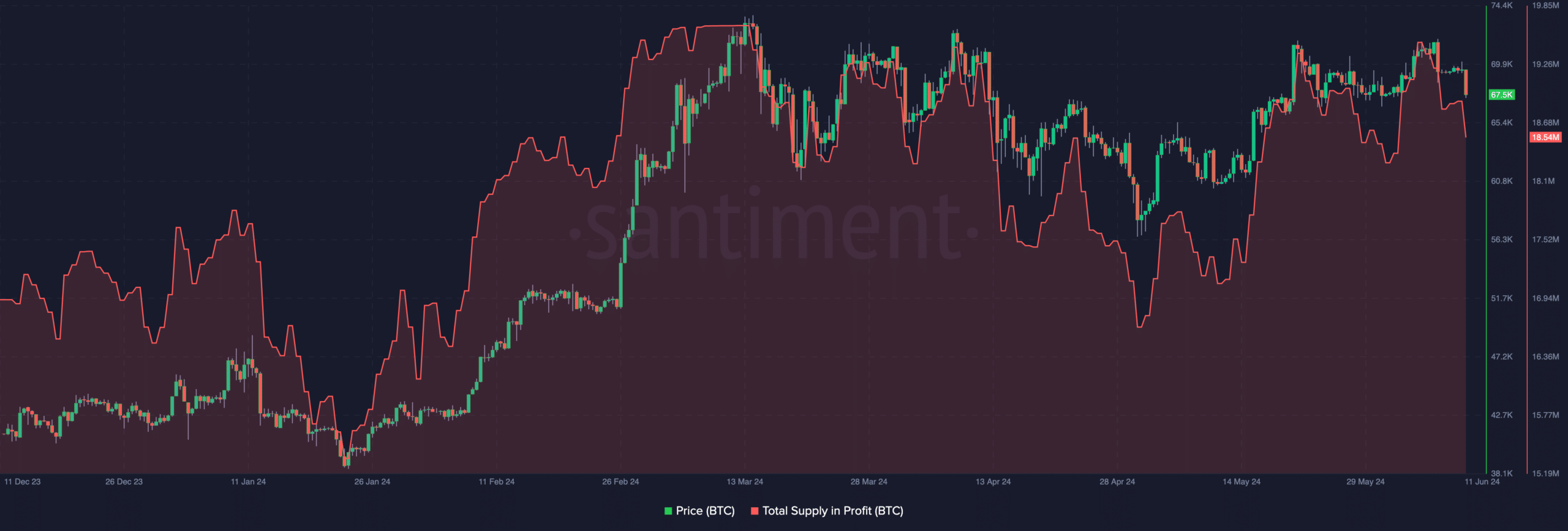

Due to recent developments, the amount of Bitcoin in circulation with a profitable price difference has decreased from 19.64 million to 18.54 million based on the data provided by Santiment.

As a researcher studying the Bitcoin market, I’ve observed that a decrease in Bitcoin price may lead to a shrinking supply of coins held at a profit. Nevertheless, this reduced profitable supply presents an opportunity for investors and traders to potentially acquire Bitcoin at lower costs.

As a crypto investor, if I notice a buy signal emerging, I’d be optimistic about Bitcoin’s short-term price recovery. This bullish sign might push the value of BTC back up toward the $70,000 mark. However, if selling pressure remains persistent in the market, the price of Bitcoin could dip down to around $65,000 instead.

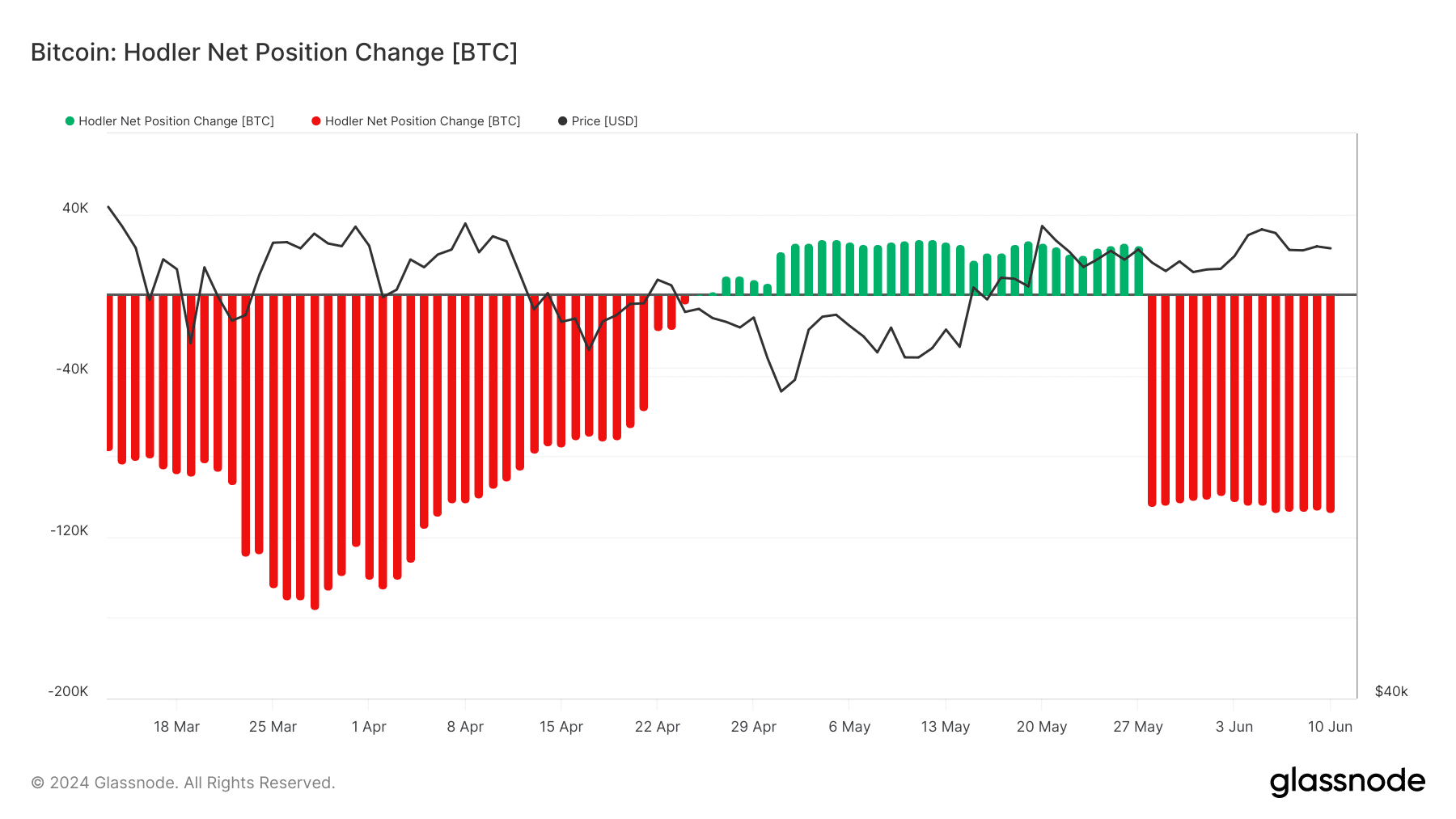

In addition to examining the BlackRock Bitcoin ETF and the mentioned indicator, AMBCrypto also focused on another significant measure. This measure is referred to as the Hodler Net Position Change.

A favorable interpretation of this metric indicates that long-term investors are amassing more Bitcoins. Conversely, an unfavorable reading suggests an uptick in Bitcoin being taken off the market.

Is your portfolio green? Check the Bitcoin Profit Calculator

Based on Glassnode’s data, the change in Bitcoin’s Holder Net Position was a decrease of 107.211 BTC. This finding indicates that Bitcoin holders have recently sold off some of their coins, likely realizing profits.

In simpler terms, the cost of Bitcoin might drop instead of bouncing back. But this pessimistic outlook could change if substantial buying occurs.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-06-12 04:07