Ah, Ethereum, that mercurial creature of the digital realm—now shimmying into a tempestuous tango after a fortnight of insatiable buying fervor! Rising like a phoenix (or perhaps just a well-cooked soufflé) above the lofty heights of $3,800, our dear ETH now finds itself caught in the clutches of resistance. Fear not, for the bulls have donned their armor, valiantly defending the crucial lower demand enclaves against marauding bears! What a spectacle! 🎭

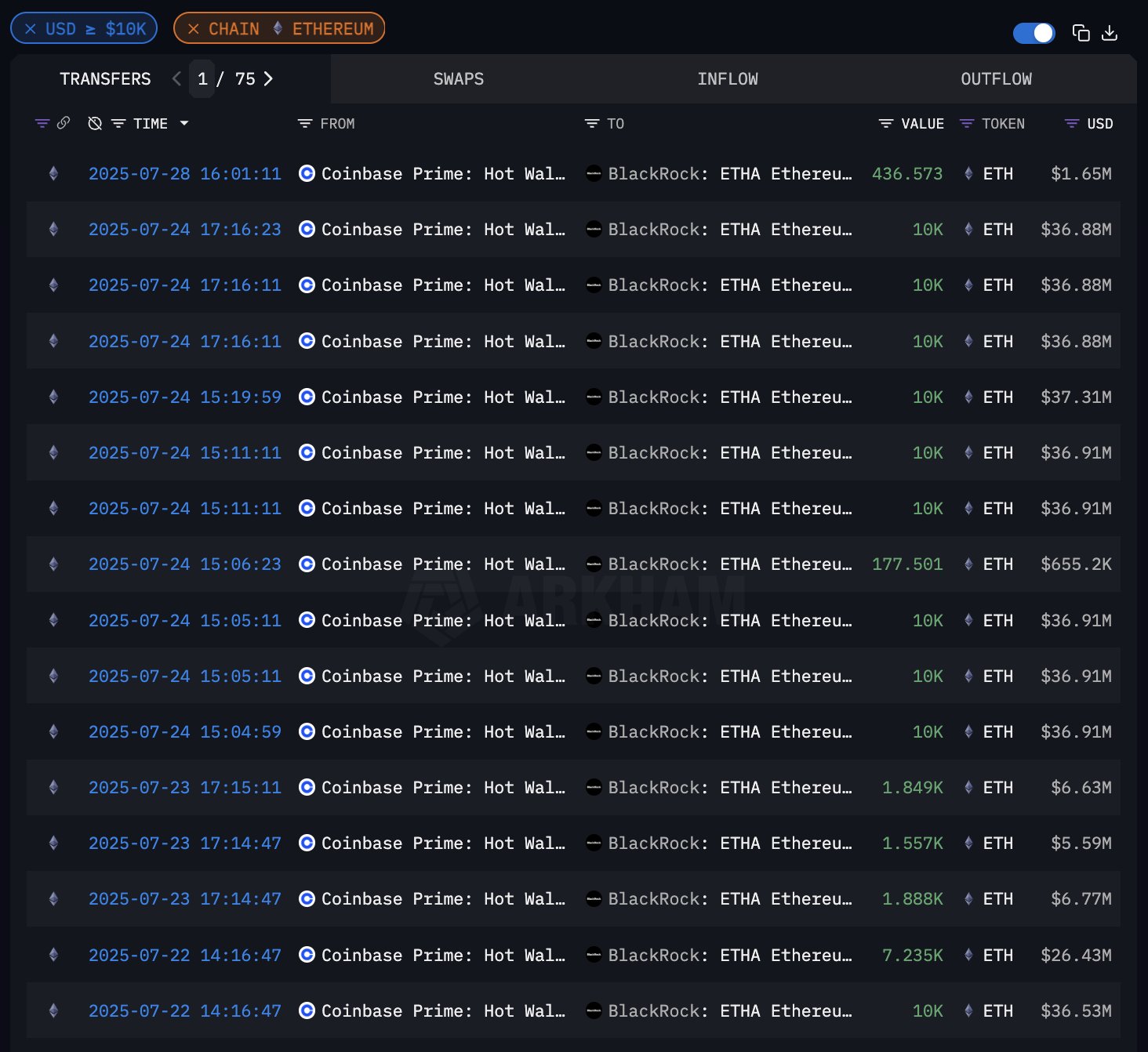

And speaking of spectacles, run and fetch your magnifying glasses, dear reader! Fresh tidings from the oracle of Arkham reveal that the behemoth known as BlackRock has galloped forth, hoarding over four times the Ethereum than its pedestrian sibling, Bitcoin, just last week. Oh, what a twist of fate for our beloved Ethereum—a veritable turning point! Could it be that the titans of traditional finance are finally placing their bets on the ebullient dance of Ethereum? Very well, then! 🤑

As Bitcoin lounges comfortably near its historical peaks with an air of nonchalance, Ethereum finds itself at a proverbial crossroads. Will it continue its upward journey, gracefully narrowing the distance, or will this stumbling block above $3,800 mark the onset of a calamitous tumble? One cannot help but speculate! 📈🤷♂️

BlackRock’s Bold Ethereum Strategy: An Institutional Ballet

Our keen sleuths at Arkham have unearthed a rather stunning revelation about institutional investment in the whimsical world of cryptocurrencies: BlackRock, that illustrious titan of finance, has splurged a staggering $1.2 billion on the Ethereum, while daintily tossing a mere $267 million toward Bitcoin. Behold this titanic 4.5x chasm—it’s a true spectacle of monetary mayhem! To many a spectator, this is the quintessence of institutional embrace for Ethereum—plenty of greenbacks flooding into the veils of ETH, tearing apart conventional market norms! 💰🎉

Yet, dear audience, this grand production did not materialize overnight! Nay, the seeds of institutional affection were sown back when our dear ETH languished near the dismally low $1,380 in April. Ah! A delightful cast of characters—legal clarity, tantalizing ETF whispers, and Ethereum’s blossoming role as the belle of the financial ball—have orchestrated this wave of accumulation from the old guard. And BlackRock, it seems, is merely the marquee arrival at this cryptic carnival! 🎪

As the crypto cosmos ignites in a dazzling display of enthusiasm, Ethereum appears poised to ascend further into the heavens! Yet, hold your applause, for not all is as rosy as it seems. ETH now grapples with the behemoth of resistance looming ominously around $3,800, and whispers of uncertainty echo through the air. Would it be too much to ask of this rally to maintain its momentum without taking a breath? Alas, the fear of a swift correction dances narrowly around the bend! 🚧😬

ETH’s Reluctant Encounter with Resistance Following a Whirlwind Gala

Indeed, Ethereum has waltzed with unparalleled flourish over recent moons, pirouetting from the pits of sub-$2,000 to a dazzling price of $3,782.61! The weekly scroll reveals a triumphant break from the $2,852.16 barrier—now we’re approaching the crucial guardian at $3,860.80. An audacious leap reaching $3,941.86 was thwarted—oh, the drama! Could it be that our exuberant friend is feeling a tad weary after such vigorous pirouettes? 🎭💃

Volumes have swelled in this dazzling breakout, affirming the fervor of buyers in the constraints of the cosmos. The 50, 100, and 200-week SMAs—all snugly nestled around $2,700 to $2,850—now serve as the pillars of support, a safety net for our beleaguered ETH. As long as our intrepid ETH remains above the $2,850 threshold, the prospects remain bright! 🌞

However, this current pause under $3,860 radiates indecision like a deer caught in the headlights. A harmonious close above this threshold could unfurl the door to possibilities leading toward a fantastic $4,200 to $4,400. Yet, dear traders, beware—the specter of rejection looms menacingly, and a tumble below $3,500 could shriek a cacophony of profit-taking woes! 😱💔

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Goat 2 Release Date Estimate, News & Updates

- Best Thanos Comics (September 2025)

- Best Controller Settings for ARC Raiders

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

2025-07-30 14:44