- June saw all Bitcoin ETFs noting significant outflows, led by Grayscale Bitcoin Trust with $559 million

- BlackRock’s Global Allocation Fund disclosed ownership of 43,000 IBIT shares

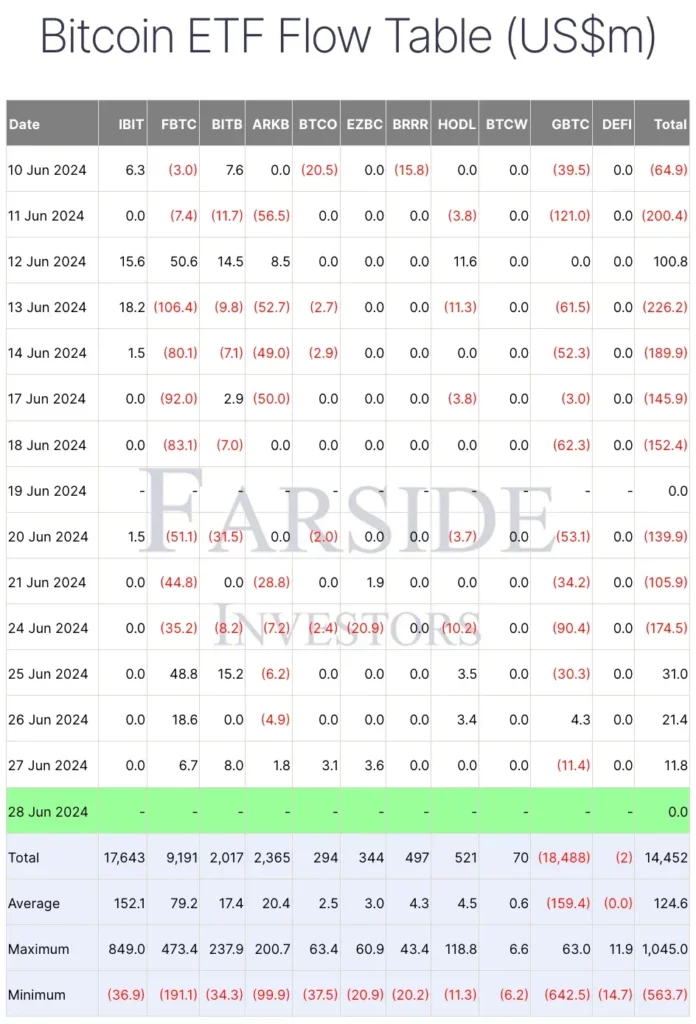

As a seasoned crypto investor with a keen interest in the Bitcoin and Ethereum ETF market, I find the recent developments quite intriguing. The consistent outflows from Bitcoin ETFs, especially Grayscale Bitcoin Trust (GBTC), have been a cause for concern. With nearly $559 million in outflows since 10 June, it’s clear that institutional investors are taking a cautious stance on BTC.

As a researcher studying the cryptocurrency market, I’ve noticed an interesting development: we’re approaching the final approval stage for Ethereum [ETH] ETFs on July 4th. However, recent data from CNF reveals that Bitcoin [BTC] ETFs have experienced substantial outflows throughout the month.

Bitcoin ETFs underperform

According to Farside Investors’ data, this trend held true for the majority of Bitcoin ETFs in June. As of now, Grayscale Bitcoin Trust (GBTC) has seen the largest outflows among them, with approximately $559 million being withdrawn since the 10th of June.

On June 27th, among all Bitcoin Exchange-Traded Funds (ETFs), GBTC was the only one that experienced outflows to the tune of $11.4 million, whereas the others reported inflows or no change with zero net inflows or outflows.

BlackRock’s surprising move

Despite experiencing volatility in the Bitcoin spot ETF market following its approval, it’s noteworthy that as of now, iShares Bitcoin Trust (IBIT) by BlackRock is the only one without any outflows since June 10th.

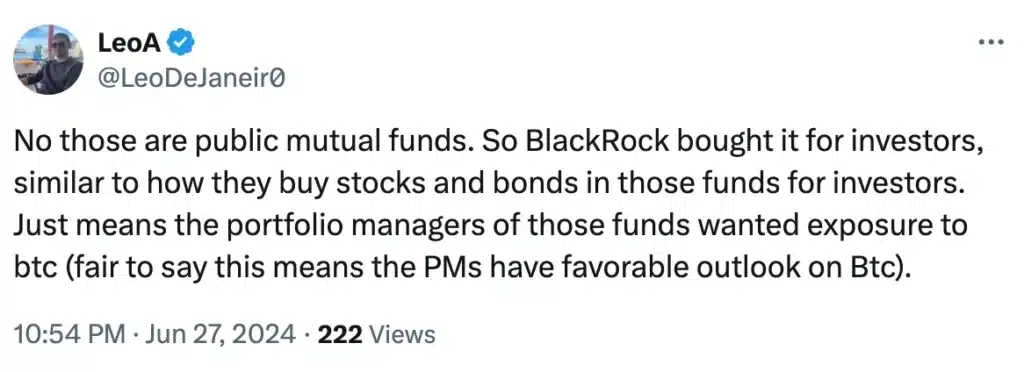

As a researcher studying investment trends, I was taken aback by a recent disclosure in an SEC filing: BlackRock’s Global Allocation Fund has acquired approximately 43,000 shares of IBM’s stock, IBMIT, marking the third internal fund under BlackRock’s management to invest in Bitcoin (BTC) through this particular investment.

The same was first highlighted by a blockchain analysis firm – MacroScope. Its tweet claimed,

Today, BlackRock’s Global Allocation Fund revealed in a Securities and Exchange Commission (SEC) filing that it held 43,000 shares of the iShares Bitcoin Trust as of the end of April.

Further expanding on the same, the firm added,

Two disclosures from BlackRock were made on May 28th, revealing their investment in Bitcoin through the Strategic Global Bond Fund and the Strategic Income Opportuneities Portfolio. (See my tweets from that day.)

Other ETFs in the pipeline

On Thursdays, VanEck filed for regulatory approval to introduce the “VanEck Solana Trust” as the US’s initial attempt to launch a Solana (SOL) spot Exchange-Traded Fund (ETF).

As an analyst, I can’t help but notice the excitement in the crypto community regarding the upcoming launch of a Spot Ethereum ETF. This anticipation is further fueled by recent updates from companies like VanEck. So, it comes as quite a surprise when industry giant BlackRock announces its entry into this space. The market reaction to this news has been significant, creating waves throughout the crypto sphere.

Reiterating the same, an X user – Bam – said,

“Is this indicating that they personally hold Bitcoins, not just for their clients? Isn’t this newsworthy?”

Worth pointing out, however, that some also came out to defend BlackRock. One of them claimed,

Impact on Bitcoin’s price

Following the recent developments, Bitcoin experienced a gentle increase of 0.35%, reaching a value of $61,401 during the time of this report.

Despite this, Bitcoin had a hard time advancing beyond its bullish territory based on the charts, as evidenced by the Relative Strength Index (RSI) staying significantly below the neutral threshold.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-29 02:15