-

BlacRock’s IBIT logs net zero inflows for two days straight as total outflows compound.

Bitwise exec claims BTC price could hit $250K by the 2028 halving cycle.

As a researcher with a background in financial markets and experience following Bitcoin closely, I find the recent developments in BlackRock’s Bitcoin ETF (IBIT) inflows concerning but not necessarily indicative of a larger trend. The two consecutive days of zero net inflows and the significant outflows earlier in April are indeed worth noting, but it is essential to remember that these are just a snapshot of the broader market dynamics.

As an analyst, I’ve noticed an intriguing development regarding BlackRock’s Bitcoin spot ETF (IBIT). After a consistent run of daily inflows since mid-January, there have been no new additions to the fund over the past two days.

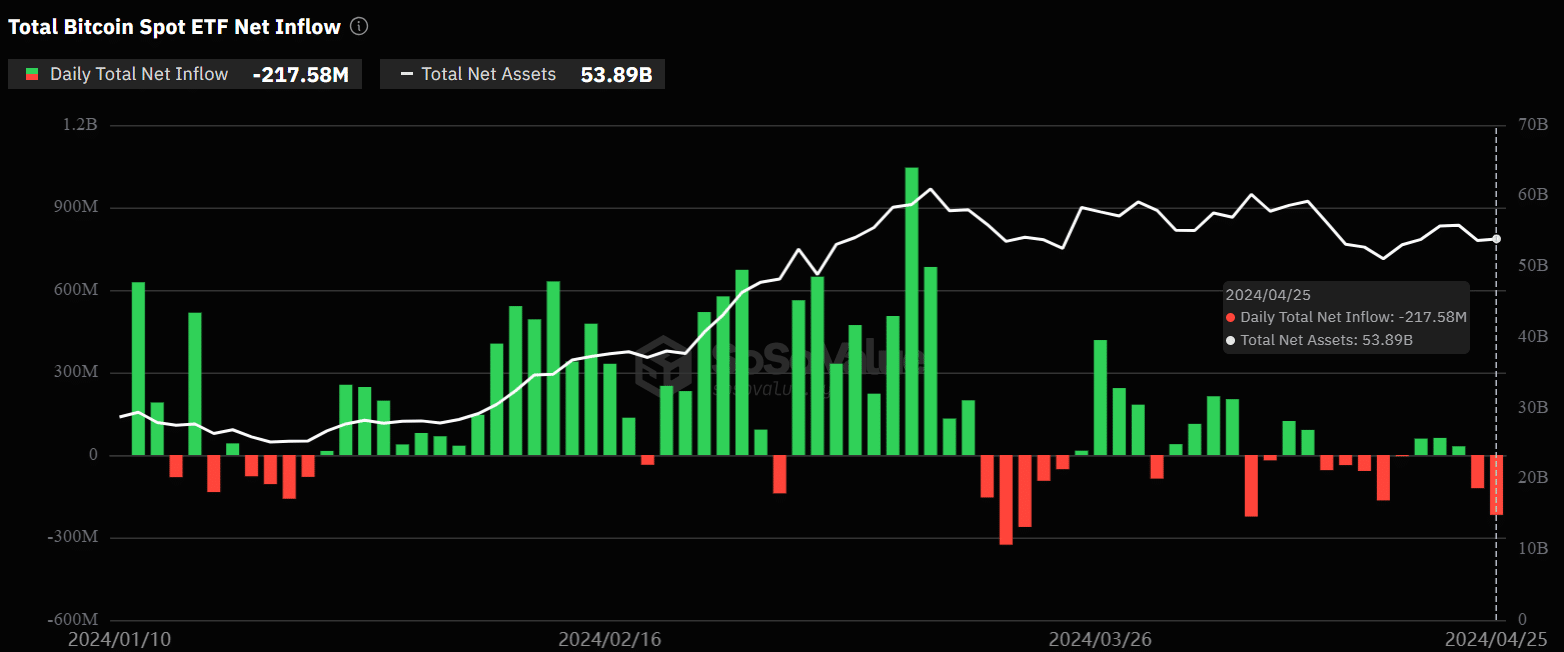

I’ve observed that during the 24th and 25th of April, the running totals showed negative cumulative flows for SoSo Value data. The net outflow during this period reached a substantial amount of $338.2 million.

Bitcoin ETF inflows

Market observers have been startled by this development, with some now directing their attention towards next week’s anticipated debut of the Hong Kong ETF and prospective involvement of institutions such as Morgan Stanley.

But a pseudonymous market analyst, Kamikaze Fiat, has downplayed such prospects, noting that,

As a researcher studying the cryptocurrency market, I have observed that approximately $12.5 billion in investments flowed into Bitcoin Exchange-Traded Funds (ETFs) during the period when Bitcoin’s price increased from $44,000 to $73,000. This influx of funds likely contributed significantly to this price surge. However, it is essential to note that we cannot ignore the potential impact of native flows, which are investments directly into the cryptocurrency market, on Bitcoin’s price movement during this time.

I have my doubts about Morgan Stanley’s ability to attract such a large number of new Bitcoin buyers. As for the Hong Kong Bitcoin ETFs, it seems optimistic to assume they will see more than 200 million dollars in inflows during their first month. In my opinion, these expectations border on unrealistic hope.

Will the decline in BTC ETF inflows reverse?

US spot BTC ETF flows have recorded a massive decline in Q2.

In the first quarter, the largest amounts of money flowed into the market in February, totaling $6 billion. The next highest inflow was in March, which added $4.6 billion. The market took in $1.5 billion worth of investments in January as it adjusted to new offerings.

As a researcher studying the trends in ETF investments, I’ve observed that during the second quarter, the total inflow into Bitcoin ETFs up to April 24th was $170 million. However, this does not necessarily imply that the demand for these ETFs has waned. It is essential to consider various factors influencing investor behavior and market dynamics before drawing such conclusions.

Matt Hougan, the Bitwise CIO, holds a different perspective. In his recent communication to financial investors, he expressed his belief that there is still room for additional inflows into the market within the upcoming months.

Supporting his claims, part of the Hougan’s statement read,

In simpler terms, the use of US-listed Bitcoin ETFs is only beginning to gain traction. A significant factor contributing to this is that these ETFs have yet to be widely offered at large financial institutions such as Morgan Stanley and Merrill Lynch. Furthermore, institutions are still in the process of conducting thorough research and evaluation, which could lead to a surge in demand over the long term.

Further, Bitwise Experts projected an additional demand may originate from central banks prior to the 2028 Bitcoin halving. They underscored this point.

“In my opinion, people will begin purchasing Bitcoin prior to the next halving event. Similar to gold, Bitcoin functions as non-debt money – an asset that cannot be created through borrowing and thereby increasing its supply. Moreover, unlike sovereign bonds, Bitcoin cannot be confiscated by foreign governments.”

As a Bitcoin analyst, I would interpret Hougan’s prediction in a widely adopted market scenario as follows: By the time of the next Bitcoin halving event in 2028, I anticipate that the price could surpass $250,000 per coin.

How will crypto react to next week’s US Treasury move?

As an analyst, I’d interpret Arthur Hayes’ perspective in the following way: In the coming week, I anticipate a bullish market trend for BitMEX and Maelstrom based on my belief that the US Treasury’s planned $1.4 trillion liquidity injection could significantly influence the markets with positive momentum.

During the upcoming Q2 2024 refunding announcement by the US Treasury, Hayes pointed out three potential situations:

As a researcher studying the potential impacts of the following three scenarios on financial markets, I would like to share my perspective. If any of these situations unfolds – variable liquidity injections – I anticipate a notable rally in stocks and an essential re-acceleration of the cryptocurrency bull market.

The US Treasury makes quarterly announcements regarding refunding, which is a component of their debt management policy adjustments. These announcements often prompt significant responses in financial markets.

It will be interesting to see how the next announcement affects Bitcoin into the summer.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-04-26 14:16