- BlackRock’s IBIT spot Bitcoin ETF saw record inflows, marking strong investor interest.

- Bitcoin ETF’s demand hinted at the asset surpassing Satoshi Nakamoto’s holdings, signaling institutional confidence.

As a seasoned researcher with over two decades of experience in the financial markets, I find myself intrigued by the rapid growth and evolution of Bitcoin Exchange-Traded Funds (ETFs). The recent inflows into BlackRock’s IBIT have been nothing short of remarkable, setting new records and hinting at a growing institutional confidence in this digital asset.

Ever since their introduction, Bitcoin [BTC] Exchange-Traded Funds (ETFs) have generated a significant amount of attention and curiosity. However, the level of achievement has differed significantly among the different providers.

Since its debut on January 11th, BlackRock’s IBIT has experienced inflows exceeding $25 billion, but in contrast, Grayscale’s GBTC has registered a notable $20 billion in withdrawals or outflows.

Blackrock’s Bitcoin ETF breaks record

On a significant note, the largest single-day influx into BlackRock’s Bitcoin Spot ETF (IBIT) has been observed since January.

According to information from Farside Investors, it was discovered on the 30th of October that IBIT managed to secure an impressive $875 million during a crypto market surge. This figure surpasses its previous highest inflow of $849 million, which was achieved on March 12th.

Over the past thirteen days, IBIT has consistently seen an increase in investments, totaling approximately $4.08 billion during this timeframe.

Conversely, Ethereum ETFs encountered hurdles; they saw minimal inflow of just $4.4 million on that specific day, while BlackRock’s ETHA witnessed no fresh investment during the same time frame.

How did Bitcoin ETFs help Bitcoin?

Traders are discussing the possibility of a massive $1 billion investment approaching soon, which could indicate increasing faith among investors in BlackRock’s Bitcoin ETF, as interest from investors is steadily increasing.

At the same time, Bitcoin reached a significant peak of $72,247.96, showing a robust 7.3% growth over the past week.

As reported by CoinMarketCap’s recent data, Bitcoin experienced a slight decrease of 0.17% in its value over the last day.

Lately, there’s been a surge in investments into Bitcoin via Bitcoin ETFs by both institutional and individual investors. This trend indicates growing trust and desire for Bitcoin within the market.

This pattern suggests a promising future for Bitcoin. Many believe that ongoing investments might strengthen the bullish trend, potentially causing the price to continue rising.

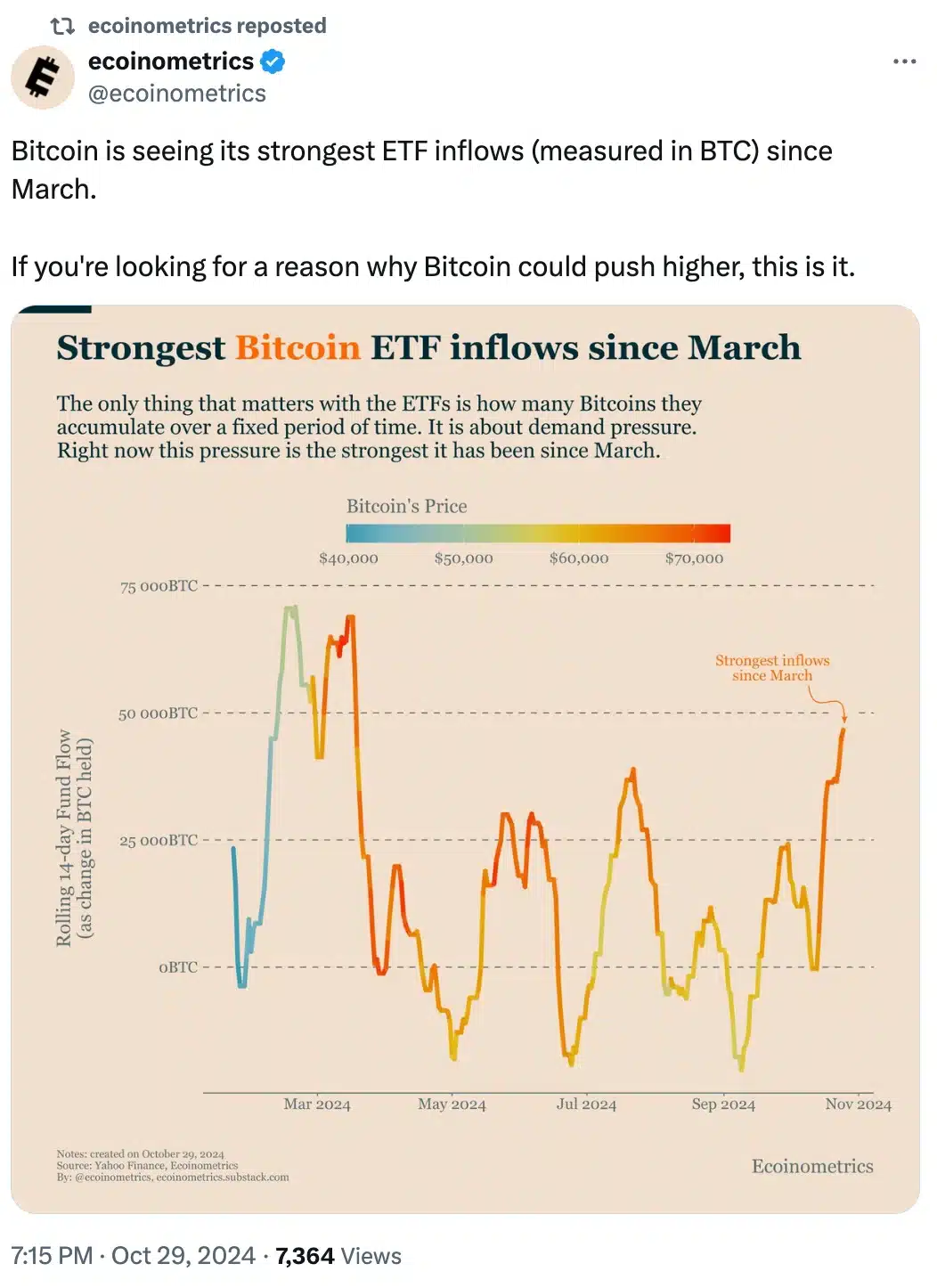

Remarking on the same, ecoinometrics noted,

Will Blackrock’s Bitcoin ETF surpass Satoshi’s holdings?

As influxes continue to rise, there’s a mounting belief among investors that the amount of Bitcoin held by U.S. spot exchange-traded funds (ETFs) might surpass the original Bitcoin reserves attributed to Satoshi Nakamoto.

Eric Balchunas, a senior analyst at Bloomberg for ETFs, pointed out that the substantial increase in ETF investments could be a key factor boosting Bitcoin’s appeal among institutional investors.

With an increasing number of investors pouring money into these funds, the distribution of Bitcoin ownership may undergo a substantial shift. The holdings in these Exchange-Traded Funds (ETFs) could potentially exceed the amount held by the enigmatic creator of Bitcoin.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-31 13:44