Bitcoin ETFs fell off their high horse for what felt like the financial equivalent of a sneeze, then came stampeding back with $422 million in net inflows—because obviously, panic is just a phase, like midlife crises and TikTok dance trends. Meanwhile, Ether ETFs, determined not to let their older, shinier sibling have all the fun, limped in with a totally respectable $6.49 million. Bravo, team 🚀.

BlackRock’s Bitcoin ETF Swallows $422 Million Like a Third Sandwich

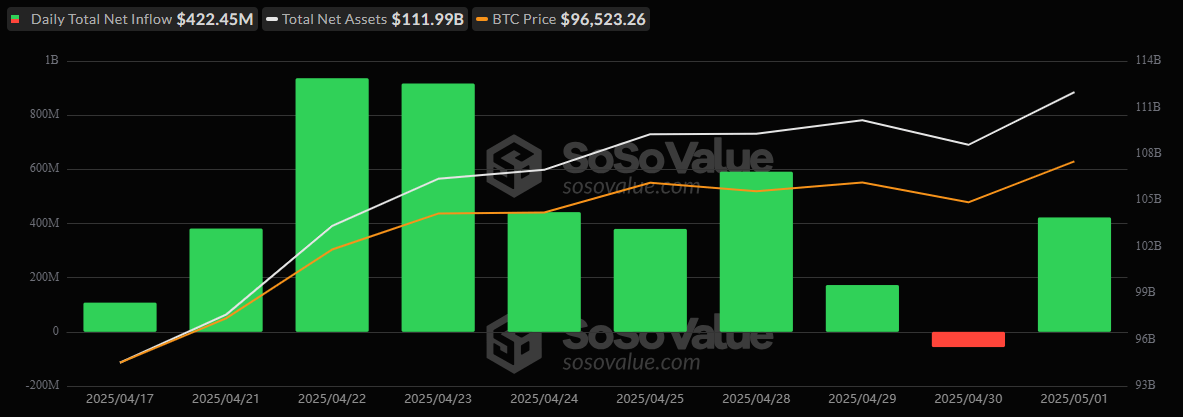

One would think investors would have learned by now: if you sell on Wednesday, the universe will mock you on Thursday by making bitcoin ETFs bounce back with the force of a toddler hopped up on Pixy Stix. On May 1, these things surged back, netting $422.45 million. (That’s more than the GDP of several Pacific islands, and arguably just as stable.)

Who led this charge? Why, BlackRock’s IBIT, like a financially gifted Roomba, vacuumed up $351.38 million—over 80% of the cash inflow. It’s almost rude at this point. The parade continued: Grayscale’s BTC and Bitwise’s BITB got to play too, picking up $41.92 million and $38.39 million each. Not enough to buy Twitter, but you could at least get a swing at Tumblr.

Fidelity’s FBTC put $29.52 million into the basket, Vaneck’s HODL found $21.86 million under the ETF couch, and Grayscale’s GBTC coughed up $16.01 million. Even Invesco’s BTCO, like your cousin at Thanksgiving, showed up at the last minute with $10.61 million and no explanation. Not everyone was feeling generous, though: Ark 21shares’ ARKB saw $87.23 million skedaddle out the door—presumably pursuing a career in AI.

Trading volume hit $3.52 billion, because making absolutely pointless numbers go up is America’s favorite game show. Net assets also managed to get themselves back over $110 billion, landing at $111.99 billion—for those keeping score at home, that’s a number big enough to buy you several of the world’s less successful soccer teams.

As for ether ETFs (a.k.a. bitcoin’s quieter crochet-obsessed cousin), they scraped together $6.49 million in net inflows. Grayscale’s ETH lassoed $11.98 million, and Fidelity’s FETH picked up $6.47 million. Grayscale’s ETHE, obviously having better places to be, lost $11.96 million. Total trading volume was $240.71 million—enough to keep several crypto podcasters gainfully employed for another quarter—and total net assets climbed to $6.39 billion.

So yes, the momentum’s back, the ETFs are backfilling their emotional voids with other people’s money, and we’ll all pretend, for one shining day, that nothing bad could ever happen again. 💸

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-05-02 15:27