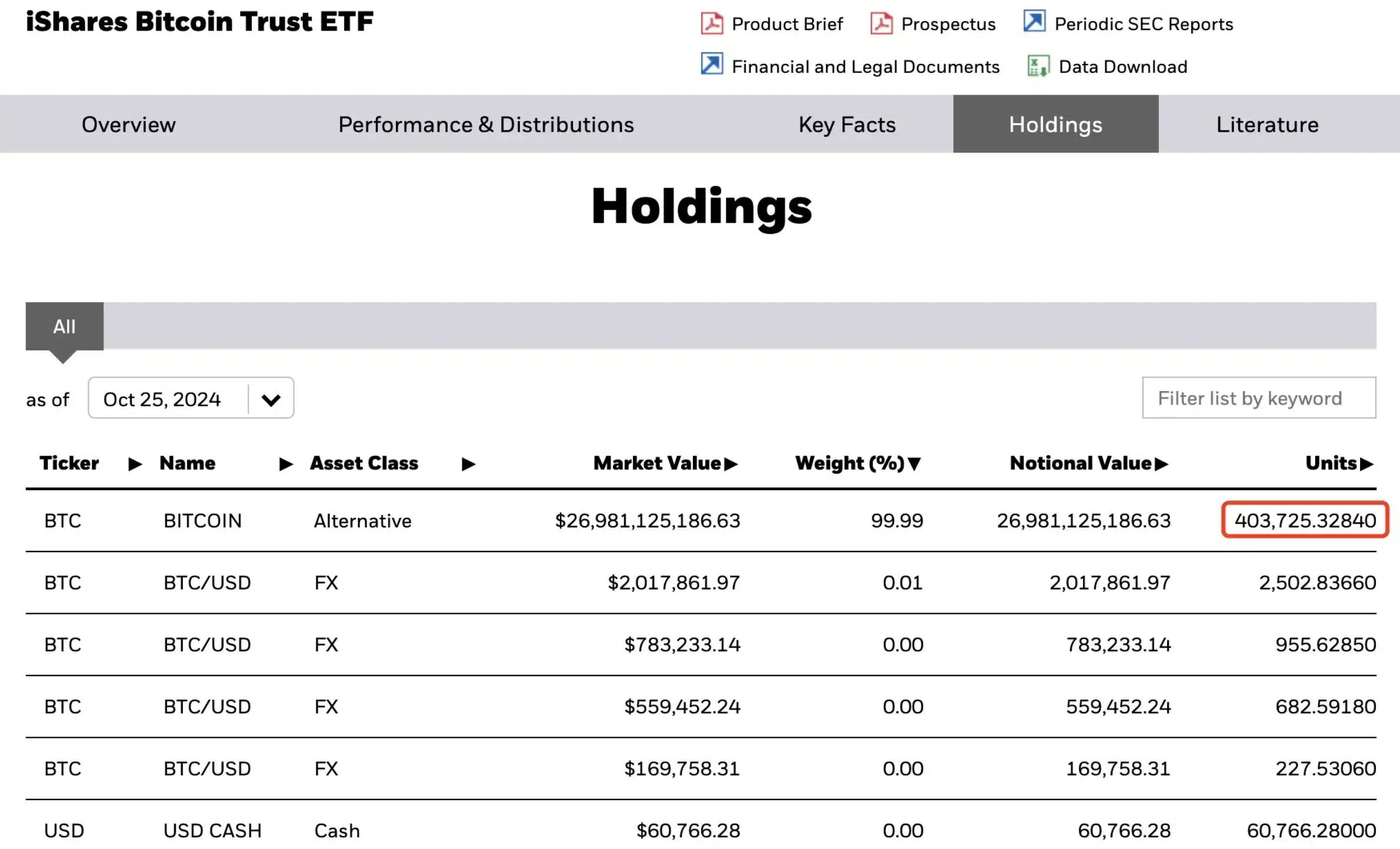

- BlackRock’s Bitcoin holdings exceed 400,000 BTC, valued at $26.98 billion.

- BlackRock’s Bitcoin ETF sees consistent inflows, surpassing $23 billion in total value.

As a seasoned crypto investor with over a decade of experience in this volatile yet exciting market, I find the recent developments surrounding BlackRock’s Bitcoin accumulation nothing short of intriguing. The fact that they now hold over 400,000 BTC, worth a staggering $26.98 billion, is a testament to the growing mainstream acceptance of digital assets.

As talk builds about Bitcoin ETFs potentially surpassing Satoshi Nakamoto’s holdings, BlackRock has made a substantial stride in its Bitcoin amassment process.

Blackrock’s Bitcoin accumulation

As per the latest report from Lookonchain, it’s been revealed that the leading asset manager currently has control over around 400,000 Bitcoins. This significant amount is currently estimated to be worth a staggering 26.98 billion dollars.

In just the last fortnight, BlackRock has bolstered its Bitcoin holdings by purchasing an additional 34,085 BTC, which equates to approximately $2.3 billion. This recent purchase underscores BlackRock’s growing influence in the cryptocurrency market, as it consistently increases its Bitcoin investments.

Conversely, BlackRock’s Bitcoin ETF, known as IBIT, has experienced significant expansion, reaching over $23 billion, as reported by Farside Investors. It’s worth mentioning that IBIT has been experiencing a continuous influx of funds since the 14th of October.

From the 14th through the 25th of October, IBIT observed inflows approaching $400 million on certain days, demonstrating robust investor interest and faith in BlackRock’s Bitcoin strategy. This highlights BlackRock’s strategic stance towards Bitcoin as its use becomes more widespread.

Community reaction and impact on Bitcoin

Seeing this the crypto community has responded with optimism.

Currently, according to CoinMarketCap’s most recent data, Bitcoin is being traded at approximately $67,773.35. Over the last day, its value has increased by more than 1%.

As an analyst, I observed that the Relative Strength Index (RSI) surpassed the neutral level, indicating a shift in favor of bullish dynamics, suggesting that the bullish momentum is gaining strength over the bearish forces.

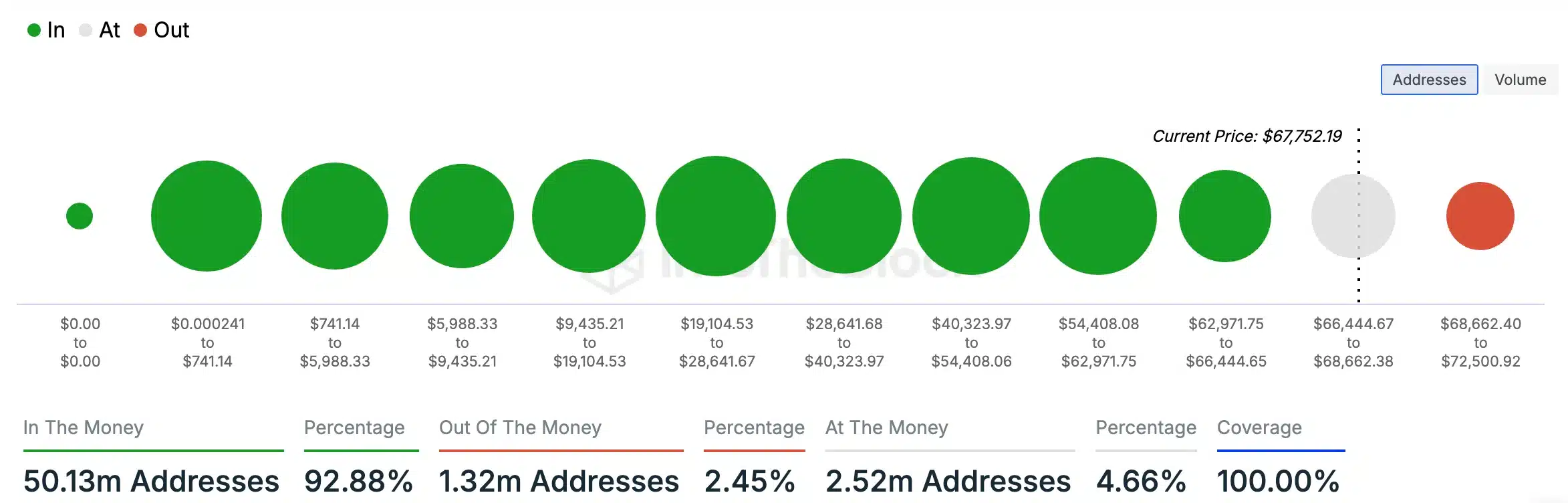

As a researcher, delving into the future trajectory of Bitcoin, I’ve uncovered some insightful data from IntoTheBlock’s analysis, as reported by AMBCrypto. It appears that an overwhelming majority, approximately 92.88%, of Bitcoin holders are currently in profit, meaning their current holdings exceed their initial investment cost – a strong indication of overall optimism and faith in the digital currency’s potential.

Currently, about 97.55% of investors are “in the money,” indicating strong market optimism and possibly implying more price increases to come.

Is this the start of the “Bitcoin war”?

As a researcher exploring the dynamic landscape of cryptocurrencies, I can’t help but ponder about potential future disputes often referred to as “Bitcoin Wars.” Some analysts suggest that influential entities such as BlackRock might contemplate forking the initial Bitcoin blockchain and advocating their own variant as the authentic one.

Although it might appear far-fetched at present, the swift amassing of Bitcoin by BlackRock has sparked worries regarding their escalating control and impact on the digital currency market.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

On the contrary, they aren’t the only ones investing in Bitcoin – significant entities like MicroStrategy, under the leadership of Michael Saylor, as well as Tesla, Binance, and SpaceX, are all accumulating Bitcoin gradually too.

Consequently, it’s uncertain if MicroStrategy and other institutions can rival BlackRock’s current position of power.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-10-28 14:16