-

BlackRock’s Bitcoin ETF (IBIT) faced fluctuating inflows; Ethereum ETF (ETHA) performed better.

BlackRock’s whitepaper highlighted Bitcoin’s exceptional performance over the past decade but acknowledged its high risks.

As a seasoned analyst with years of experience navigating the volatile waters of the financial markets, I find myself increasingly intrigued by BlackRock’s recent moves in the crypto space. The contrast between their Bitcoin (IBIT) and Ethereum (ETHA) ETF performances is particularly fascinating.

Over the past few days, the flow of investments into BlackRock’s Bitcoin ETF (IBIT) has seen ups and downs. The latest information, provided on September 18th, indicates that there were no fresh investments made in the ETF.

Conversely, Farside Investors reported an influx of approximately $4.9 million into BlackRock’s Ethereum ETF (ETHA) over the same timeframe.

Blackrock’s ETF performance analyzed

In contrast to the fluctuations over a shorter period, the Invesco Blockchain Technology & Cryptocurrencies ETF (IBIT) has garnered a whopping $20.92 billion in total investments since its launch. This figure surpasses the accumulated inflows of all Bitcoin ETFs put together, which amount to $17.45 billion.

In contrast, ETHA has gathered approximately $1.03 billion in total investments since its debut, while the Ethereum ETF market has faced a combined outflow of about $9.8 million.

The data indicates that the temporary decrease in inflows for IBIT might be just a short-term variation, implying possible enhancements ahead.

Blackrock on Bitcoin’s role

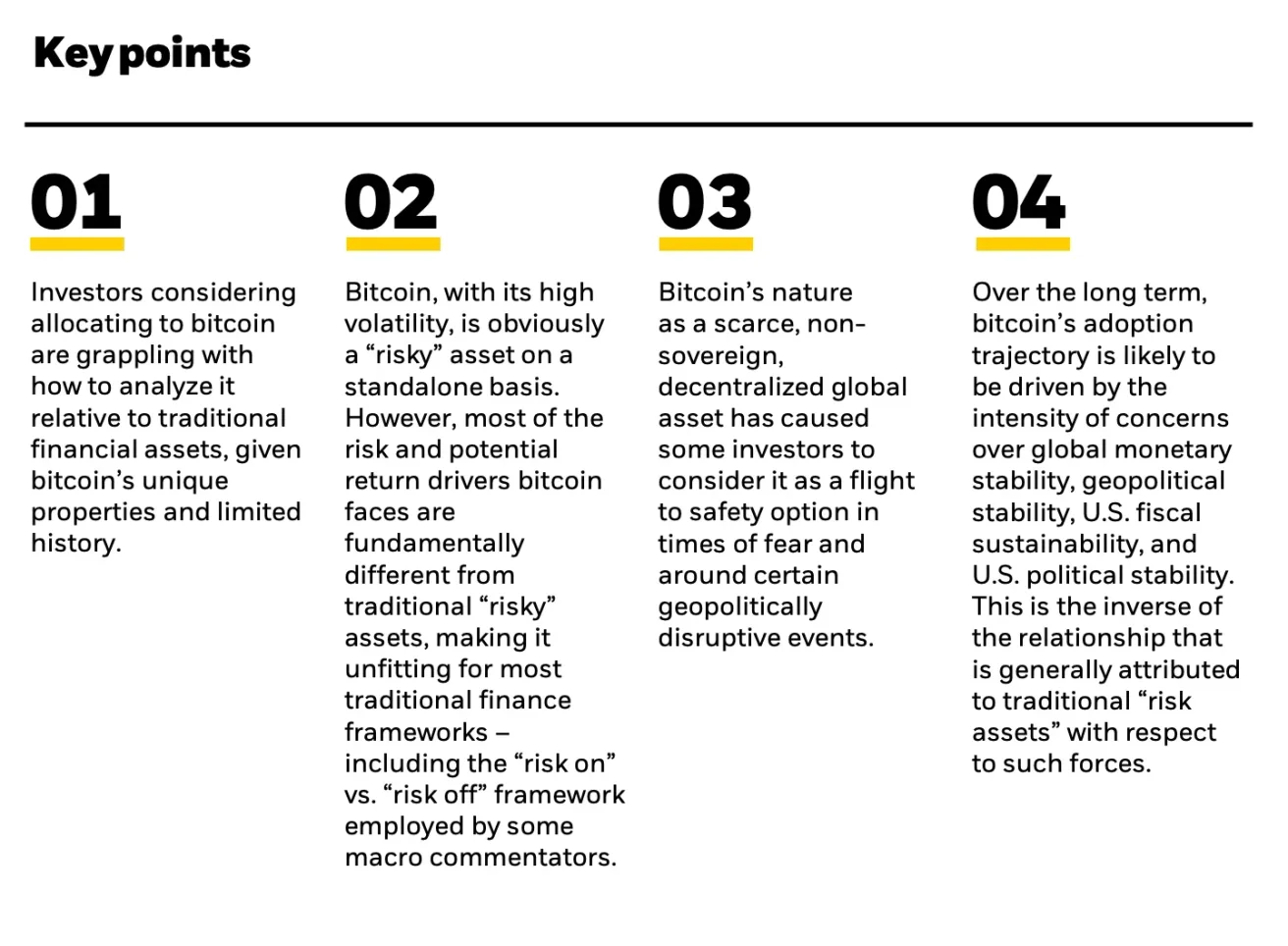

As an analyst, I’m excited to share that BlackRock, known for its impressive track record in launches, has recently released a detailed whitepaper on Bitcoin. This nine-page document explores Bitcoin’s unique position within the major asset classes.

This research underscores Bitcoin’s distinct role as a “differentiator” compared to conventional investments, particularly U.S. stocks and USD yields. It points out that the correlation between Bitcoin and these traditional assets tends to be brief or unstable.

Based on BlackRock’s perspective, the unusual traits of Bitcoin can offer benefits as well as hurdles for investors who are more familiar with examining conventional investment types.

Bitcoin’s journey so far

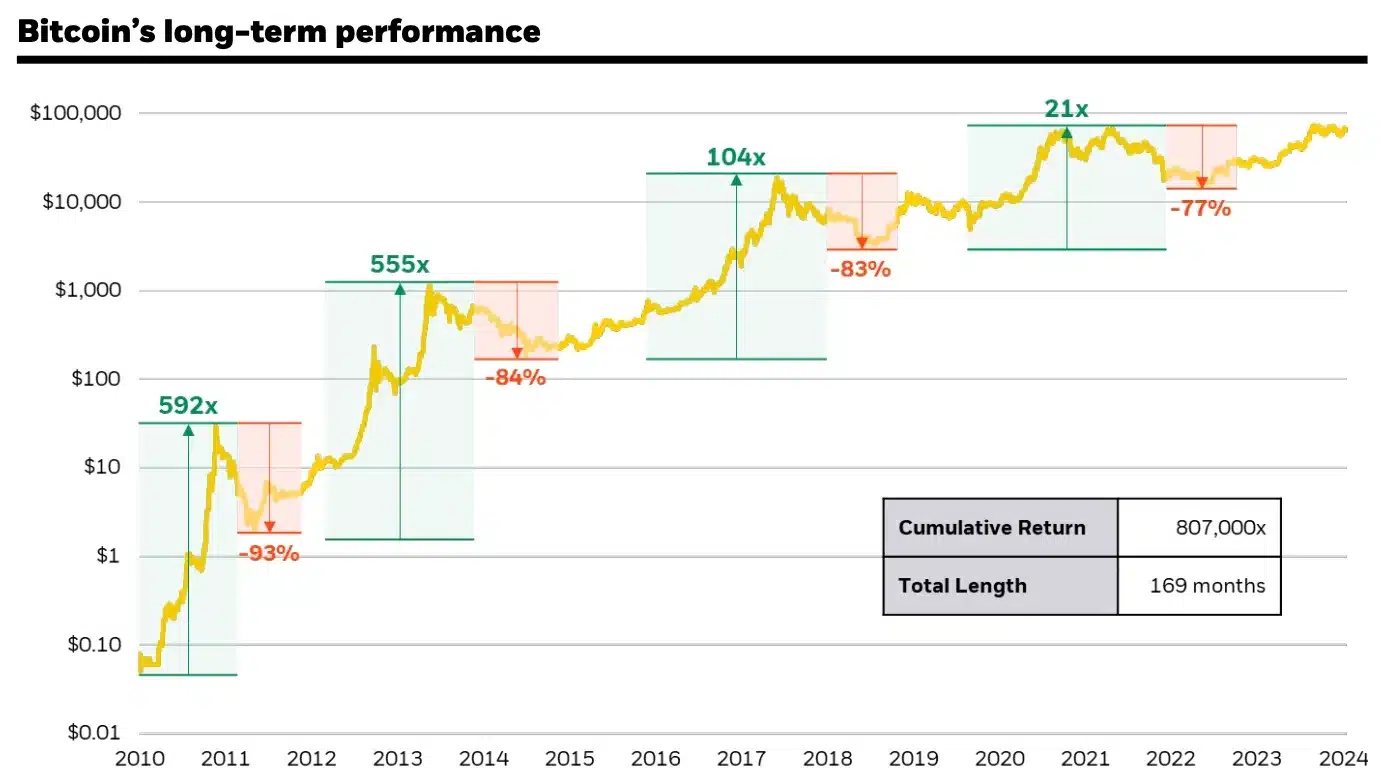

The whitepaper offers a comprehensive examination of how Bitcoin reached a market capitalization of one trillion dollars, highlighting its outstanding growth during the last ten years.

In seven out of the last ten years, Bitcoin surpassed other significant investment assets, consistently yielding a remarkable yearly return of more than 100%.

Despite Bitcoin being the weakest performer in three out of those years, characterized by four substantial declines surpassing 50%, this exceptional expansion took place.

The fluctuations in Bitcoin’s value are increasingly showing signs of it being more widely accepted as a potential worldwide substitute for traditional money.

A hedge against U.S. dollar weakness

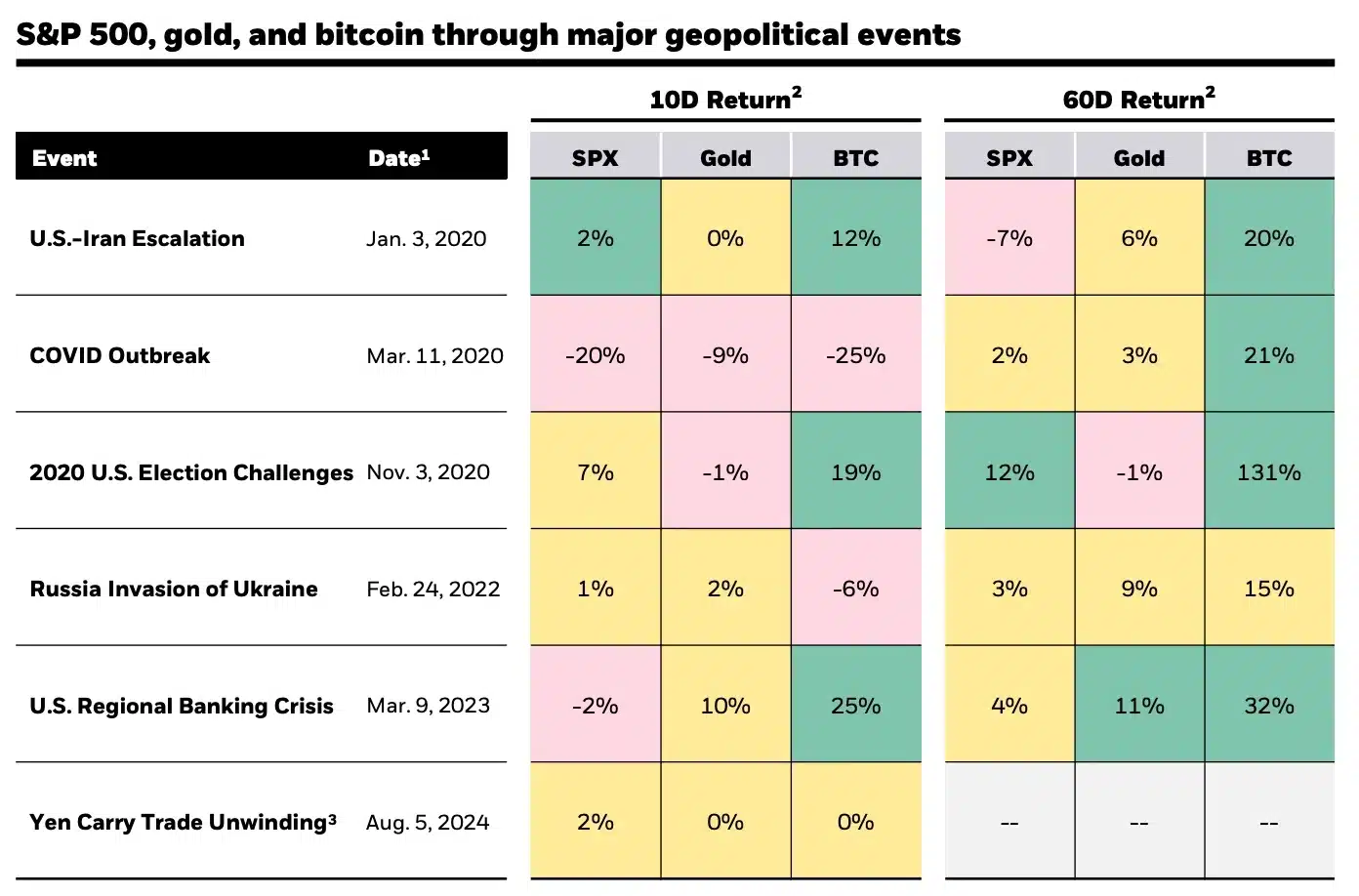

The paper also emphasizes BTC’s perceived insulation from global macroeconomic factors, suggesting that, for some investors, it has emerged as a “flight to safety” during times of geopolitical uncertainty.

Moreover, BlackRock suggests that Bitcoin provides a protective measure against potential weakening of the U.S. dollar, which might stem from the expanding federal deficit.

In the whitepaper, it highlights the differences between Bitcoin and U.S. stocks, particularly focusing on Bitcoin’s 24/7 trading availability and swift cash settlement that boosts its liquidity even during turbulent market conditions.

Instead of conventional stocks which trade only within specific hours, Bitcoin functions continuously, 24/7. This makes it especially advantageous in times of market strain, particularly on weekends when traditional markets are not operating.

In times of financial turmoil, I find myself drawn to the unique trait that makes Bitcoin an extremely liquid investment option. Compared to traditional assets that can become harder to access during uncertain times, Bitcoin stands out as a clear choice for me.

Bitcoin, a risk-on asset — Why?

That being said, the whitepaper concluded that Bitcoin remains a high-risk asset, and noted:

Although past assessments don’t dispute this, it’s important to remember that Bitcoin remains a high-risk investment on its own. It’s characterized by significant volatility and is exposed to various threats such as regulatory hurdles, questions about future acceptance, and an environment that’s yet to reach full maturity.

This means that BTC’s risks are distinct from those of traditional investment assets.

Unlike many other types of investments, the behavior and associated risks of Bitcoin do not fit neatly into traditional “risk-on/risk-off” classifications, where “risk-on” refers to investing in perceived higher-risk assets for potentially higher returns, and “risk-off” signifies avoiding riskier investments in favor of safer options.

In summary, due to its distinct features, Bitcoin (BTC) presents a unique situation, suggesting that conventional risk evaluation methods might not adequately account for its intricacies.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-09-19 18:16