Well, I’ll be hornswoggled! 🤠 In the past week, these here tokenized U.S. Treasury bonds done puffed up by a whopping $450 million, and Blackrock’s BUIDL, bless its heart, grabbed 67.33% of that there increase. Seems like everyone’s fixin’ to get a piece of that digital pie!

Tokenized Treasuries Jump $450 million

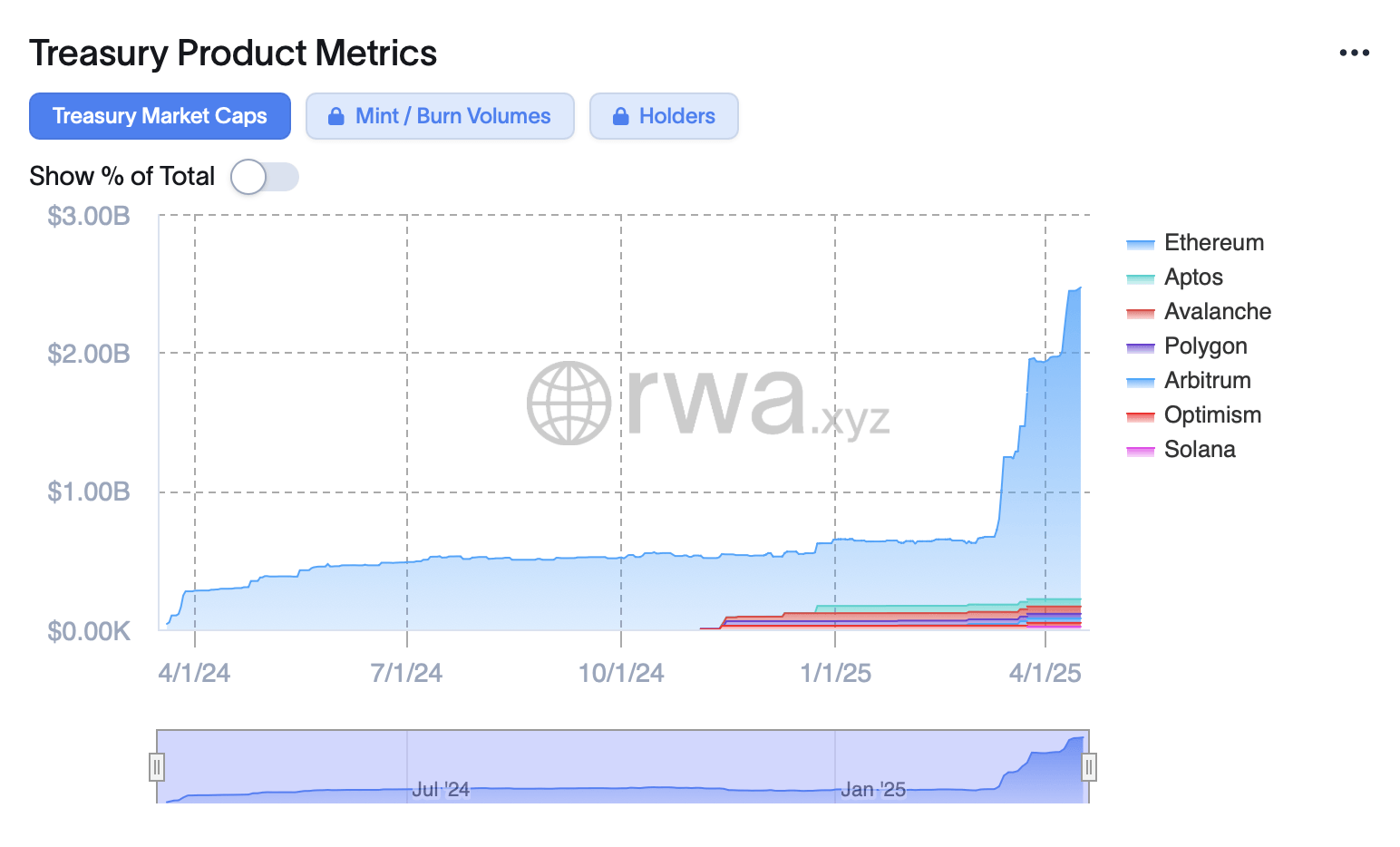

Now, in the year of our Lord 2025, these tokenized Treasury bonds have been growin’ faster than a weed in a manure pile. It’s all thanks to them big-shot institutional fellas throwin’ money around – especially that Blackrock contraption they call the USD Institutional Digital Liquidity Fund (BUIDL). Why, just in seven days, the whole shebang went from $5.49 billion to $5.94 billion. They’re practically swimmin’ in money! 💰 Just a measly $60 million shy of $6 billion. Good gravy!

Now, accordin’ to them Rwa.xyz fellas, BUIDL is still the biggest fish in the pond, sittin’ pretty at $2.469 billion, up $303 million from the week before. Next up is Franklin Templeton’s Onchain U.S. Government Money Fund, or BENJI as they call it, holdin’ a respectable $702 million. Though, truth be told, BENJI done lost $4 million. Poor fella! Ondo’s USDY fund, on the other hand, just kinda sat there, movin’ from $586 million to $585.9 million. Not exactly settin’ the world on fire, is it? 🔥

And Hashnote’s USYC? Well, it slipped again, from $557 million to $524 million. Meanwhile, USTB, OUSG, JTRSY, TBILL, and USTBL all made a few pennies. But the main thing is, this here tokenized Treasury bond business has been shootin’ up like a rocket since 2023, and they’re sayin’ it’ll hit $1 trillion by 2028. That’s a lot of zeroes! 💸

Now, the real advantage of these tokenized Treasuries is that they settle quicker than a greased piglet at a county fair, thanks to that there blockchain contraption. Cuts tradin’ time from days to minutes, and keeps things a bit safer. So far this year, the market’s up by 48.13%. It seems these here institutions are gettin’ mighty fond of these newfangled digital thingamajigs. 🤔

If this here efficiency and liquidity keeps up, then tradin’ government bonds on the blockchain might just change the whole game, and bring in even more money this year. And wouldn’t you know it, BUIDL has even snuck into the dollar-pegged token arena, sittin’ at sixth place, accordin’ to them Defillama folks. It’s a dog-eat-dog world, ain’t it? 🤪

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-04-17 21:57