In a dazzling display of fiscal flair, BUIDL paid over $10 million in dividends just last month, confirming that money indeed enjoys a good party. 🎉💰

BUIDL Has Amassed a Whopping $43.4M in Dividends Since Its Start—And Still Counting!

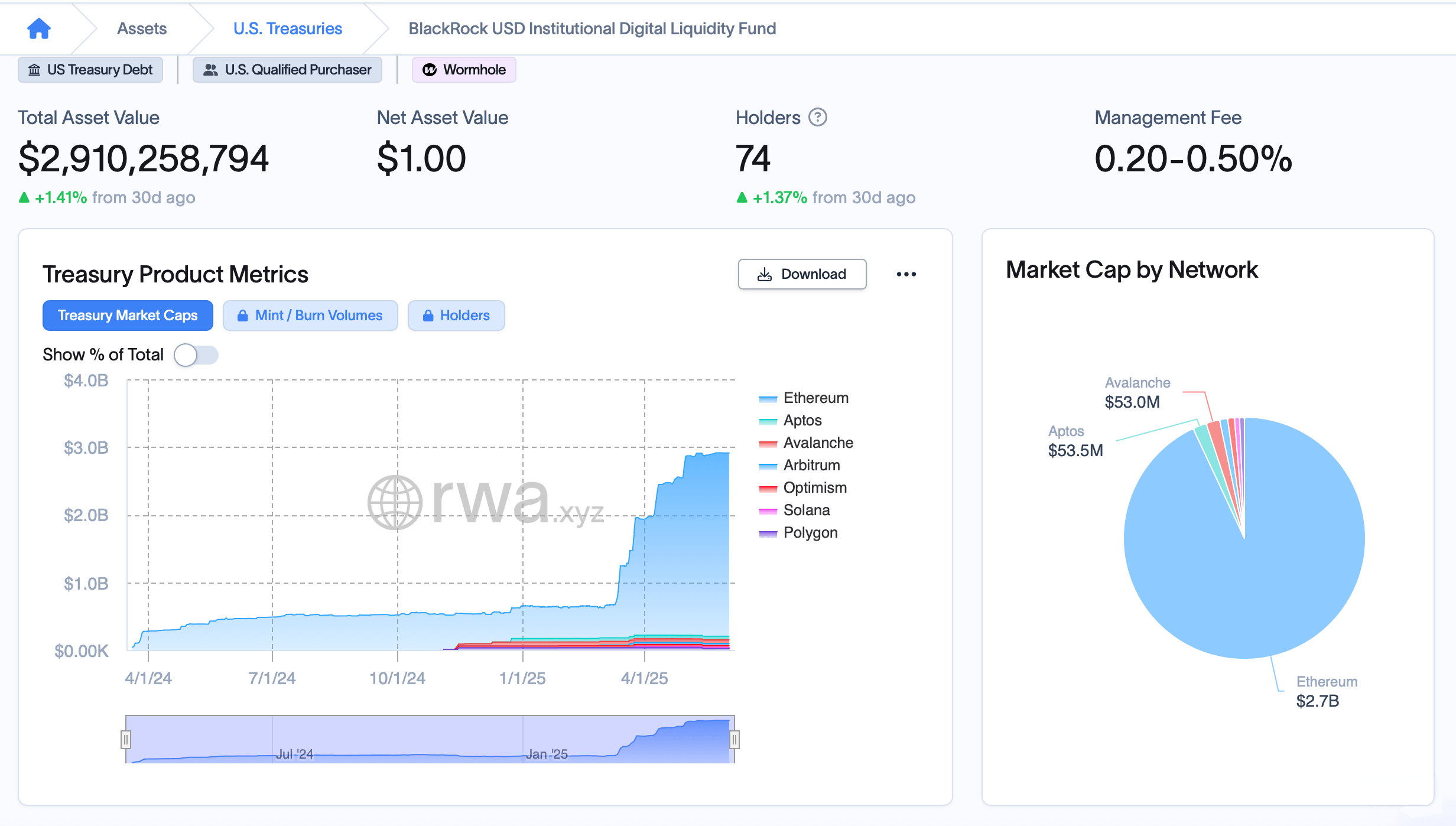

Allow me to introduce BUIDL, the enfant terrible of asset management: the Blackrock USD Institutional Digital Liquidity Fund. This marvel, born from a passionate romance between blockchain and Wall Street—thanks to Securitize—brings your tired old money market assets onto the grand stage of public blockchains. U.S. Treasury bills, cash, repurchase agreements—all tokenized, so you can trade it with the ease of a click. Because, apparently, paper is so last century. 📜❌

The fund doesn’t just issue tokens for fun; it has a clever whitelist to keep things above board—regulatory compliance, you see—and trots around multiple blockchains including Ethereum, Solana, Polygon, Avalanche, Arbitrum, Optimism, and Aptos. Investors—those brave souls—get daily interest, turning each morning into a minor miracle of yield. ☀️✨

Now, let’s talk dividends—those lovely, sticky notes from the universe reminding you that money makes money. In May alone, they handed out a staggering $10 million+—a tidy feat for a tokenized treasury fund—and Ethereum gobbled up almost $9.37 million of it, proving once again that it’s the currency of choice if you enjoy being king of the hill. 👑💵

Other blockchains joined the applause: Aptos chipped in $187,734, Avalanche added $185,708, Polygon $104,889, Arbitrum $102,000, Optimism $85,339, and Solana—the social darling—$70,593. It’s clear Ethereum’s the star, but the ensemble cast is growing fonder of the limelight. Securitize handles all this tokenization jujitsu—keeping things compliant, onboarding investors, and managing whitelists, because nobody likes a rebel, even in crypto. 🤹♂️🔐

Investors are a discerning lot—qualified and ready—or at least they think they are, with minimums of $5 million for individuals and $25 million for institutions. Whitelist? KYC? AML? Just a few hurdles before you can sit by the pool and enjoy digital dividends. Assets are guarded by the likes of Anchorage, Bitgo, Coinbase, and Fireblocks. BNY Mellon? They’re just watching from the wings, probably sipping tea and clapping politely. ☕🎩

Since its debut, BUIDL has lavished investors with more than $43.4 million in dividends—proof that the market appreciates a good thing when it tokenizes it. And with a valuation approaching $3 billion, BUIDL isn’t just playing; it’s leading the dance of institutional-grade, onchain yield products. 💃💸

Of course, it’s not alone in the ring—Franklin Templeton’s BENJI, Superstate’s USTB, Ondo’s USDY and OUSG, Circle’s USYC—all vying for a piece of the pie, because in crypto, even the giants like to share the spotlight. And so, the circus continues—smaller acts and bigger performers, all under the glittering tent of tokenization. 🎪✨

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-06-04 16:03