- BLAST kicked off with a positive price movement after launch.

- The network TVL has continued to decline.

As a researcher with experience in the crypto market, I find the recent launch of Blast crypto quite intriguing. The initial price movement following its airdrop was positive, with a significant increase in value that attracted a high level of trader interest and market activity. However, the Total Value Locked (TVL) on the network has been declining since before the airdrop launch.

As a crypto investor, I’ve been keeping a close eye on the new kid on the block, Blast. The airdrop launch was nothing short of impressive, with the asset’s value seeing a notable surge. However, despite the initial buzz and heightened activity, the total value locked (TVL) on Blast’s network has taken a downturn.

Blast crypto launches

On June 26th, the formal representative of X, previously known as Twitter, unveiled the distribution of the Blast cryptocurrency through an airdrop. As stated in the declaration, eligible recipients will have a month-long period, ending in July, to secure their allocated airdrop.

As a researcher studying the rollout of the Ethereum [ETH] layer-2 scaling network developed by Blur’s team, I’ve discovered that each user will initially receive 17 billion BLAST tokens collectively. These tokens are an integral part of this network associated with the incentivized Non-Fungible Token (NFT) marketplace established by Blur.

Blast crypto in the last 24 hours

After its debut, Blast crypto has experienced a significant surge in engagement based on CoinMarketCap’s statistics. The token began with a price point roughly around $0.20, but by the close of its first day, its value had risen to approximately $0.025.

As a crypto investor, I observed an initial uptick in value, reaching roughly $0.029 at the onset of this trading session. However, it subsequently leveled off and has remained relatively stable around $0.026.

In the last 24 hours, Blast’s market value has significantly increased by over 20%, amounting to approximately $441 million. Furthermore, the company has experienced substantial trading activity with a volume of around $674 million.

The new crypto asset has sparked significant curiosity and trading action among investors, indicating a high level of market engagement.

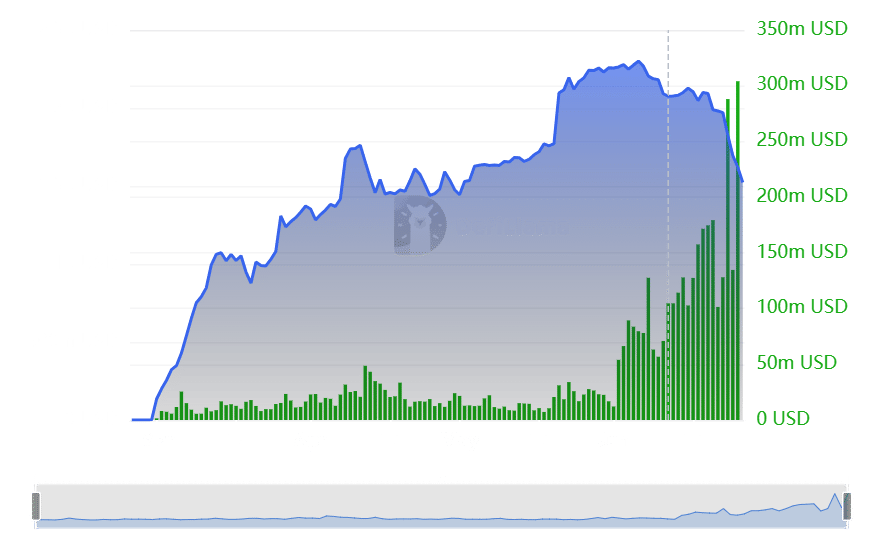

Blast’s volume spikes

On DeFi Llama’s assessment of the Blast crypto network, there was a noticeable surge in trading activity on the 26th of June. This uptick in transactional data aligns with the initiation of their airdrop distribution.

The trading volume exceeded $304 million for the first time ever in the history of the Layer 2 network, shattering the previous record set on June 24th, with a volume of approximately $288 million.

In spite of the significant increase in trading activity, the cumulative value of assets locked within the network has been decreasing since approximately the 23rd of June. This decline persisted even with the added excitement from the airdrop event.

At first, on June 23rd, the total value locked (TVL) amounted to more than $1.9 billion. Later on, this figure has dropped down to around $1.54 billion.

As a crypto investor observing the market, I’ve noticed that the recent decrease in Total Value Locked (TVL) indicates that the initial launch of this project sparked significant trading activity. However, it seems that this surge has yet to result in a lasting increase in the value locked within the network. At present, the network hasn’t fully retained the value generated from the launch.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-27 21:11