- BNB’s breakout from the falling wedge pointed to a potential rally toward $800.

- On-chain activity and derivatives data reinforced bullish sentiment despite slowing development contributions.

As an analyst with over two decades of experience in the financial markets, I have seen my fair share of bullish and bearish trends. The recent breakout by Binance Coin [BNB] from its falling wedge has certainly piqued my interest.

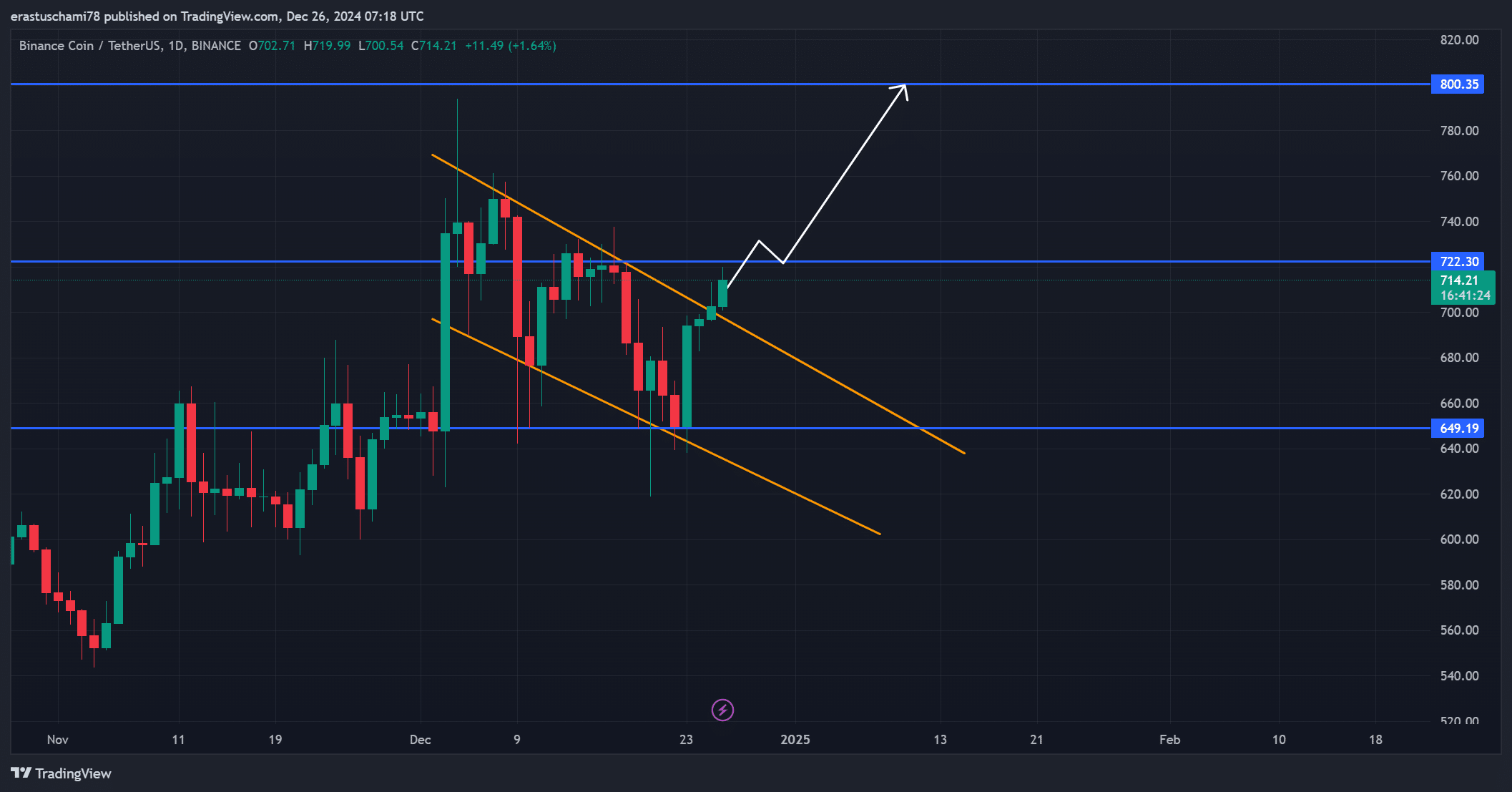

Notably, Binance Coin (BNB) has broken through its downward trending wedge formation, which is usually a bullish indicator. Currently, BNB is being exchanged at $712.51, representing a 1.24% rise in value compared to the previous day.

Having been a trader for over two decades, I can tell you that breakthroughs like this one often serve as catalysts for renewed optimism among traders. With the next critical resistance level at $722 looming ahead, if we manage to sustain our push beyond it, it could pave the way for an ambitious climb toward $800. My experience has taught me that such milestones can bring about substantial gains and make for exciting trading opportunities. However, I always remind myself that every trade comes with its own set of risks, and it’s crucial to stay informed and disciplined throughout the journey.

Yet, with market circumstances continuing to fluctuate significantly, doubts are surfacing regarding whether BNB can sustain its current pace.

BNB price movement hints at bullish potential

The performance of BNB is noteworthy, as it’s bouncing back effectively following its consolidation period. The surge out of the descending triangle has sparked optimism among traders, suggesting a potential prolongation of a bullish trend.

surpassing $722 not only verifies the current trend, but might also spark more purchasing enthusiasm, potentially pushing the value up to $800.

If BNB fails to stay above $722, there’s a possibility it could return to the $649 support level. The upcoming trading periods are crucial as they will help us understand if the current upward trend can continue.

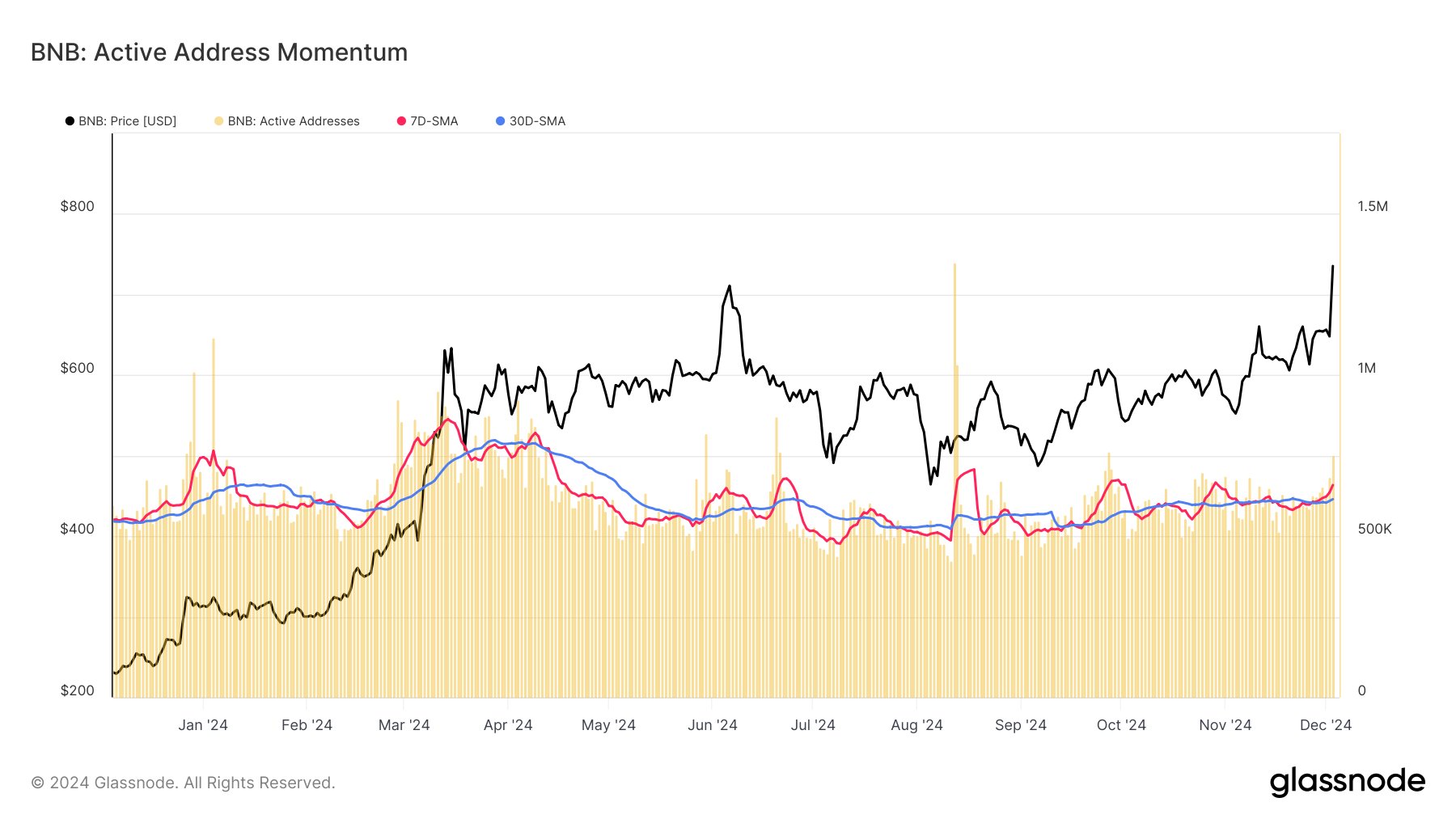

Growing on-chain activity supports optimism

As a researcher observing the BNB Chain, I’ve noticed a significant surge in the number of active addresses, now standing at approximately 751,000. This undeniably suggests heightened network involvement and engagement.

The crossing point of short-term and long-term moving averages indicates a buildup of investor enthusiasm towards BNB, suggesting it’s on an upward trend.

As someone who has spent years in the industry, I have learned that increased activity is often a sign of growth and improvement. Not only does it suggest a potential enhancement in the underlying strengths of the business, but it also indicates a growing user base. This expansion of users can come from various sources, such as word-of-mouth referrals, targeted marketing efforts, or even organic growth due to positive reviews and experiences shared by existing users. In my experience, these signs of increased activity are exciting indicators that the business is moving in the right direction and reaching more people. It’s a testament to the hard work and dedication of the team, as well as the value we provide to our customers.

Maintaining high levels of on-chain activity is crucial for future price increases. Keeping an eye on the steady increase in active addresses will be important to watch in the upcoming weeks.

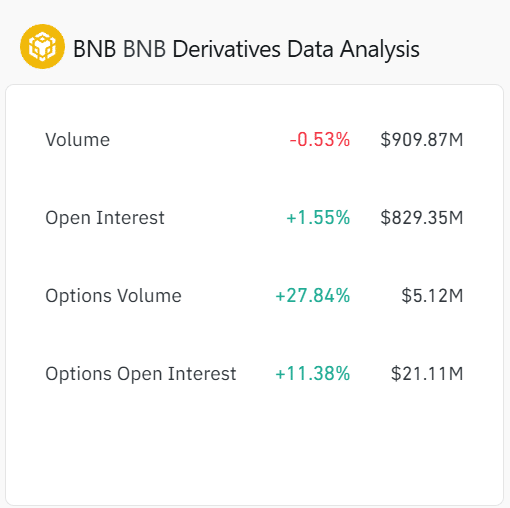

BNB derivatives data adds to the bullish sentiment

The increase in open interest for BNB’s derivatives, now at $829.35 million (up by 1.55%), suggests that traders are becoming more optimistic and actively engaging in the market.

Moreover, The volume of trades for these options increased significantly by 27.84%, amounting to $5.12 million. This suggests a surge in investor activity and anticipation regarding potential changes in the asset’s value.

As a researcher, I noticed a subtle dip in total trading volume by approximately 0.53%. This indicates that some traders may have adopted a more reserved approach, possibly due to market uncertainties.

Consequently, even though derivative data seems to back up a bullish outlook, it emphasizes the importance of ongoing investor involvement to validate this trend.

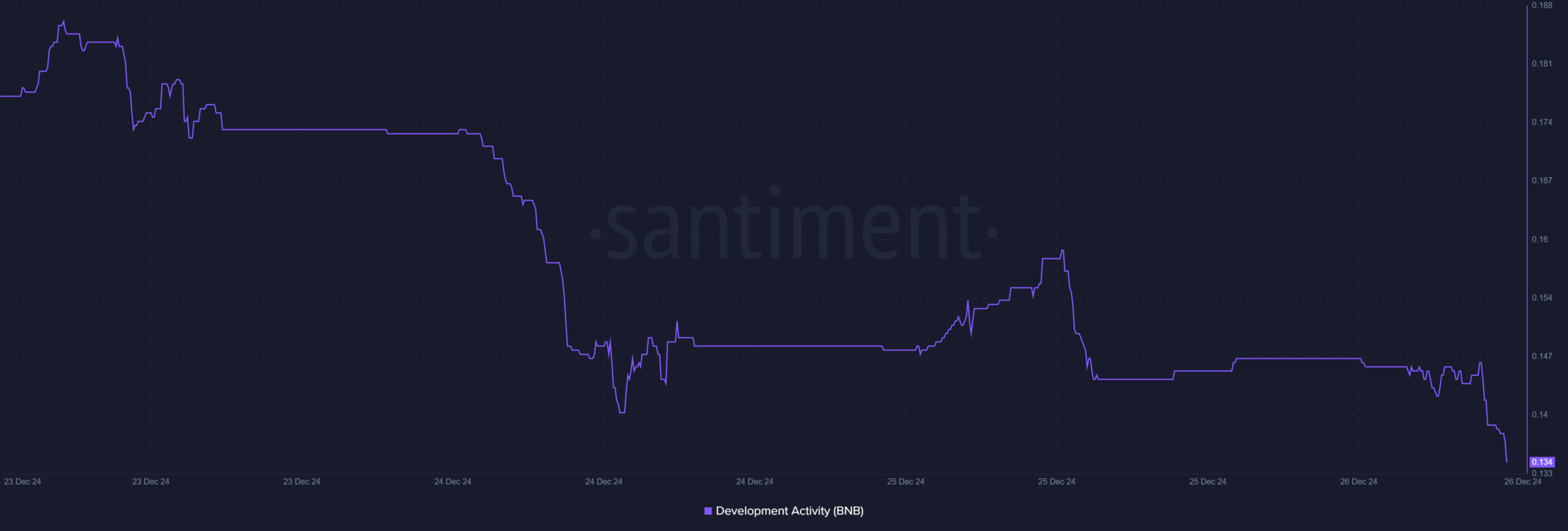

Development activity remains subdued

Although the prices of BNB are rising, there’s been a decrease in its development activity. The activity score has dipped to 0.134, indicating fewer contributions from developers. If this trend persists, it could potentially hinder innovation within the network.

While immediate price fluctuations might not significantly respond to development activities, sustained investor trust could potentially necessitate active participation from developers in the long run.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Breaking out of its descending triangle (or falling wedge pattern) by BNB suggests a robust bullish trend. If it surpasses the price level of approximately $722 and continues to show increased on-chain activity, this bullish momentum might push the price up towards around $800.

As a researcher, I recognize that maintaining these key performance indicators is crucial for continued progress. If we fail to do so, our advancements might plateau, and the next level of resistance could become pivotal.

Read More

- Masters Toronto 2025: Everything You Need to Know

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-12-26 21:44