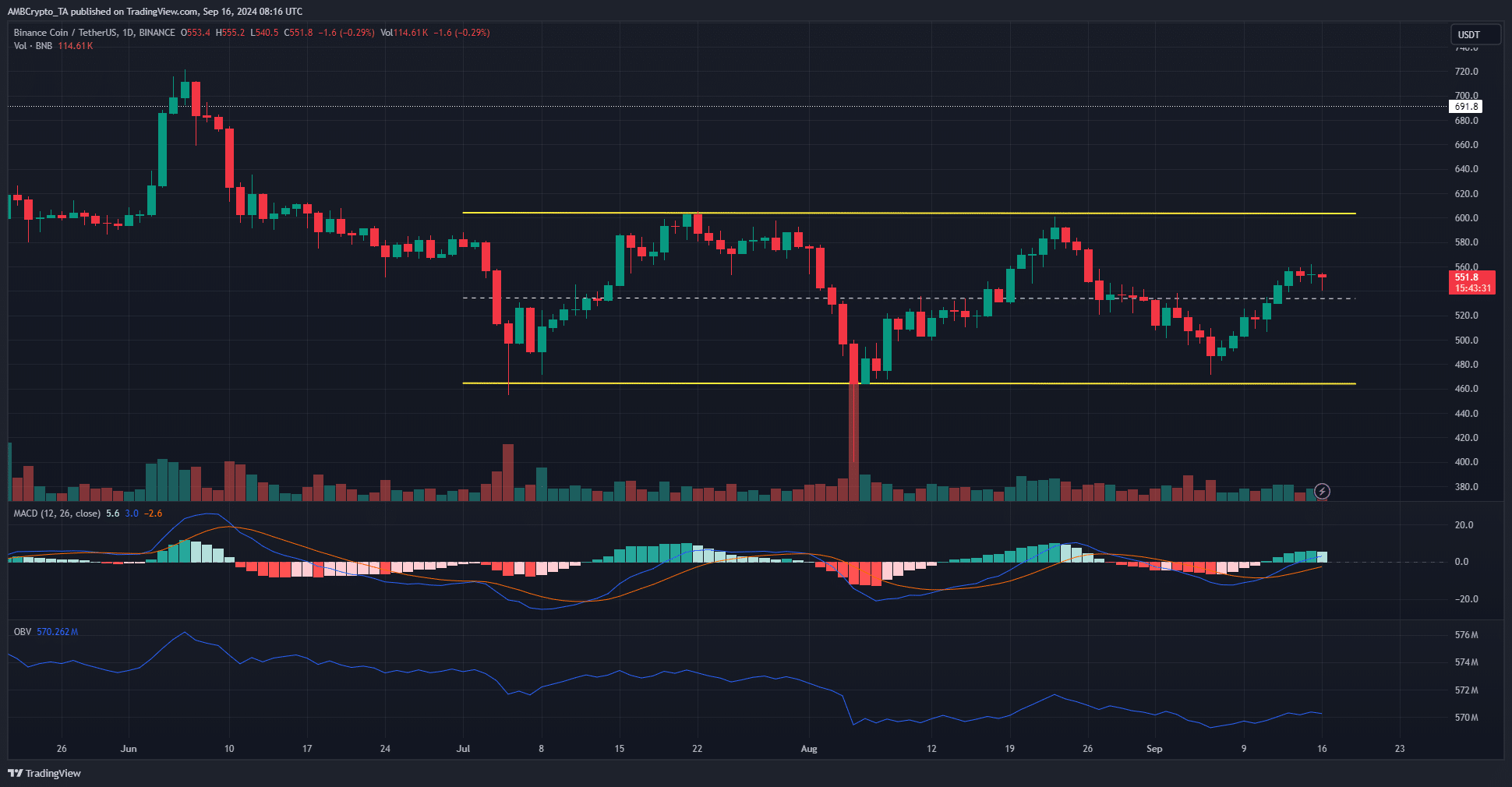

- The momentum on the daily chart was about to shift bullishly.

- The short-term speculators’ sentiment was bearish.

As a seasoned crypto investor with battle scars from numerous market cycles, I find myself cautiously optimistic about Binance Coin [BNB]. The daily chart is showing signs of a potential bullish shift, but it’s not yet time to pop the champagne corks.

In simpler terms, after a dip to around $471 in early September, investors holding Binance Coin [BNB] aimed for a price surge toward the upper limit of $604 within the current trading range. This ambition was driven by their determined defense of the support level at the recent low points.

Based on the analysis of various technical indicators, we’re seeing somewhat conflicting messages, but there’s a possibility for some positive movements in the near future. However, the buying pressure hasn’t been consistently strong enough to predict an imminent breakout just yet.

The psychological $550 was in a bullish grasp

On shorter timeframes like the 4-hour chart, there was a clear advantage for buyers. In late August, the market range dipped down to around $464, and it almost revisited this level in early September. However, since then, BNB has experienced an uptrend that has pushed its price past the resistance at $535, which sits in the middle of its current range.

On the daily graph, there was a bullish crossing of the Moving Average Convergence Divergence (MACD), indicating that the growing upwards movement had become stronger. Additionally, the MACD was almost ready to surpass the zero line, suggesting it might indicate a possible change in trend direction.

Despite the OBV failing to surpass previous local peaks and with reduced trading activity, the likelihood of a significant BNB surge seemed minimal. Nevertheless, it might gradually approach the range high of $604.

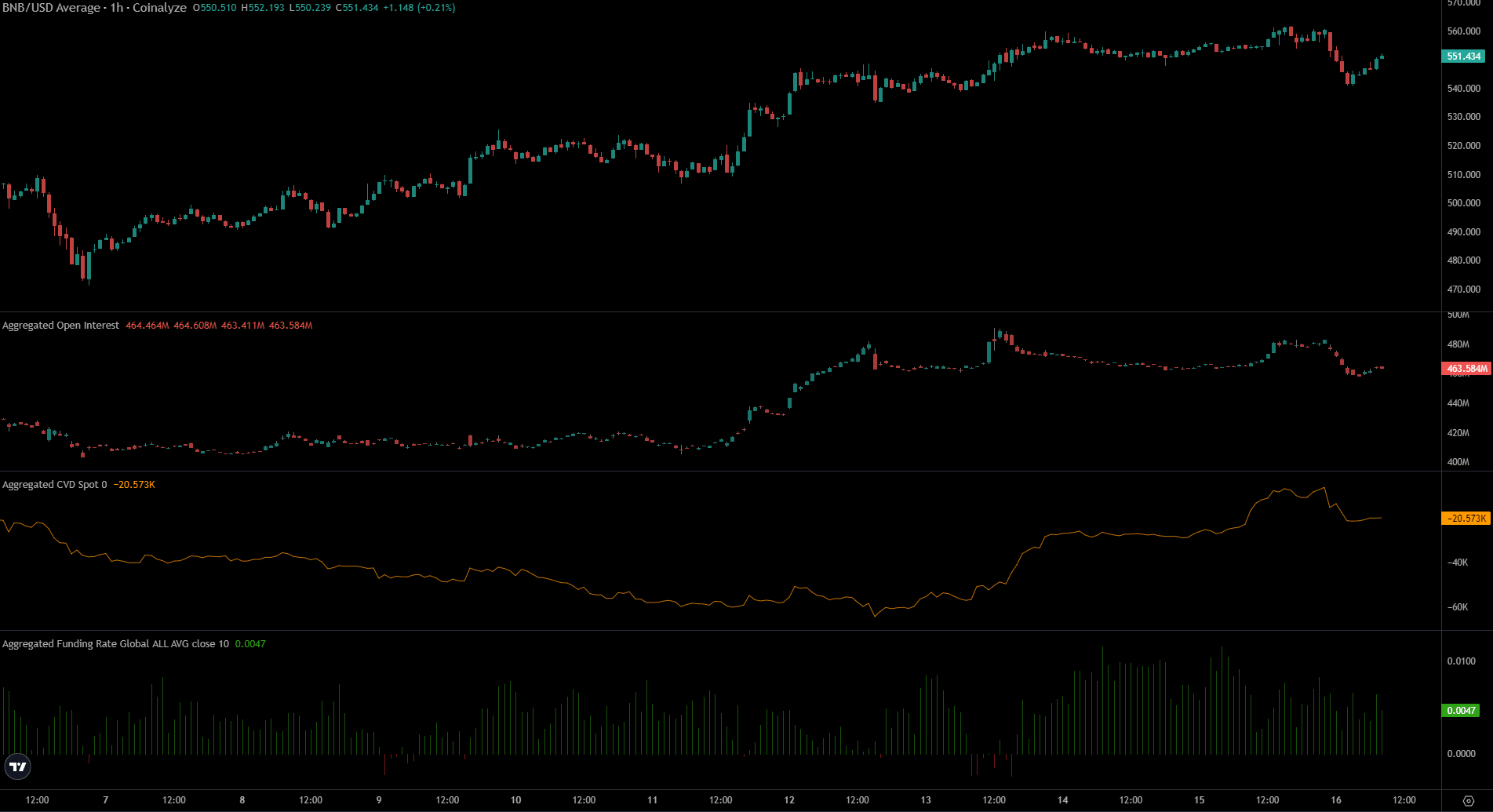

Futures showed bullish sentiment was transitory

Starting from September 12th, the funding rate has predominantly been positive. Additionally, Open Interest saw a slight uptick on both the 11th and 12th, but has remained steady since then. Over this period, the price has fluctuated between approximately $540 and $560.

Read Binance Coin’s [BNB] Price Prediction 2024-25

Last week’s optimistic feelings have diminished and been replaced by doubt. The decrease in Open Interest recently indicates a temporary pessimism. Moreover, the price of the spot Contract for Value Delivered (CVD) has risen substantially in the past few days, suggesting that demand is high.

Despite the uncertain signals, both the rise in Cardiovascular Disease (CVD) and the regaining of the mid-level resistance were promising indications suggesting a potential approach towards the peak of the range.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-16 18:15