- BNB has been testing the $599.9 resistance but faces the risk of a double top formation.

- Momentum indicators suggest a potential breakout above $600.

As a seasoned crypto investor with scars from the 2017 bull run and the subsequent bear market, I find myself intrigued by Binance Coin’s [BNB] current position. The $599.9 resistance is a formidable hurdle indeed, one that has tested my patience on more than one occasion. However, I can’t help but feel a sense of optimism this time around.

At the moment of reporting, Binance Coin (BNB) demonstrated strength as it neared a significant point, currently exchanging hands at approximately $597.2, experiencing a minimal drop of 0.08%.

The primary question for traders and investors is whether BNB can decisively break through the $600 resistance and ignite a stronger rally.

Shall we take a look at the present trend, crucial resistance points, and speed indicators to decide if a surge might occur?

BNB current price structure: Are we heading higher?

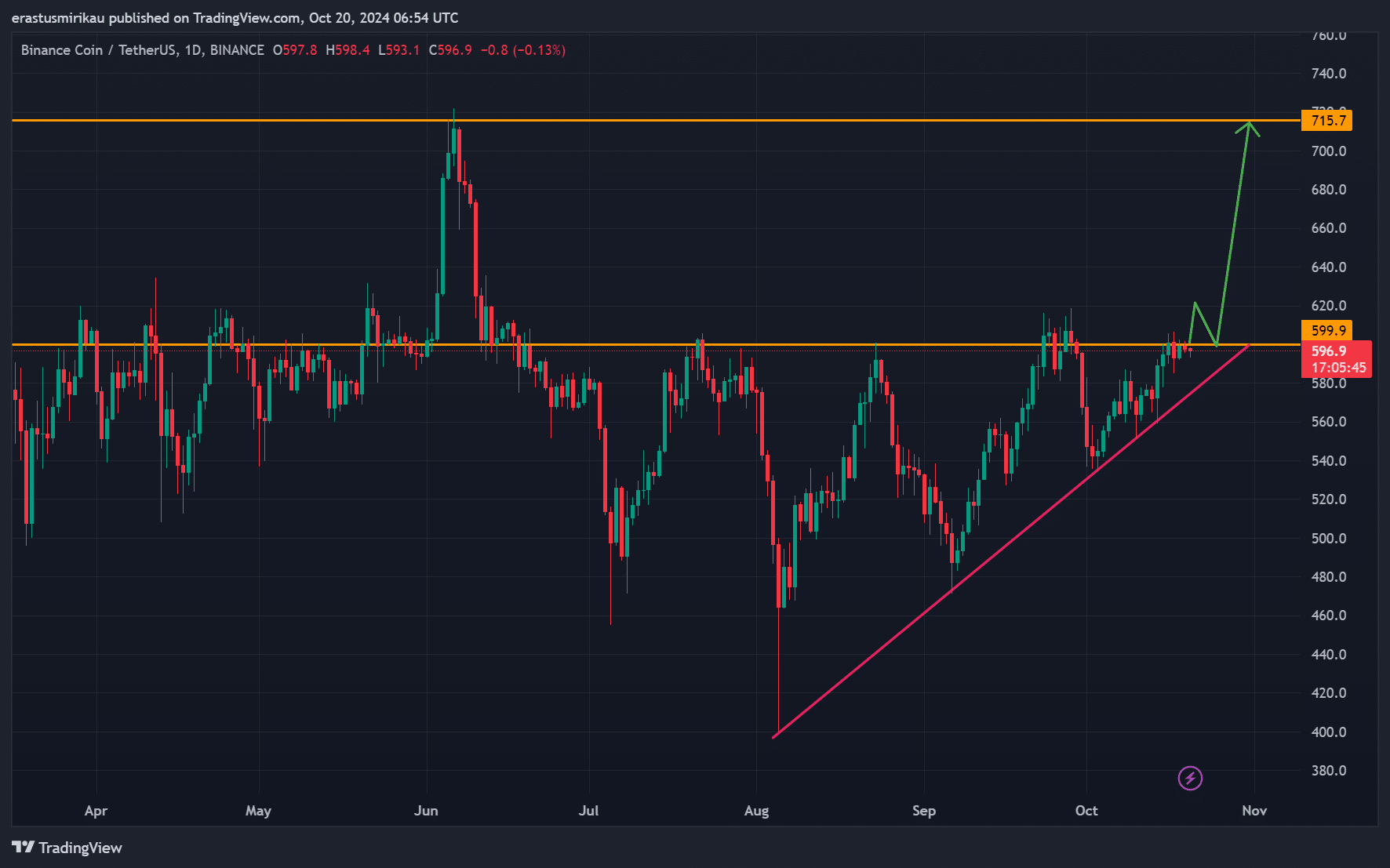

Over the past few weeks, Binance Coin (BNB) has been oscillating within a specific price range, with trades occurring between approximately $560 and $600. This pattern mirrors an ongoing uptrend from August’s low near $500, signifying growing demand as investors buy more.

Nevertheless, BNB has encountered multiple refusals near the $599.9 mark. Yet, there’s increasing enthusiasm suggesting that BNB might surpass this significant barrier, which could lead to an upward trend towards the $715.7 level reached in June if successful.

Key resistance and support levels to watch

The $599.9 level remains the critical resistance, acting as a strong barrier to further upward momentum. Should BNB break through this level with a strong close above $600, a surge toward $715.7 could follow.

Alternatively, for the moment, the $560 level continues to act as a buffer if the price drops. If $560 cannot be maintained, it might result in a more significant drop towards the $500 region.

One potential bearish signal to consider is the double top formation around the $599.9 resistance. This pattern could indicate a trend reversal, and if BNB fails to break higher, it might trigger a corrective move.

But if the price breaks out powerfully above $600, that would contradict this pattern, paving the way for a possible bullish surge instead.

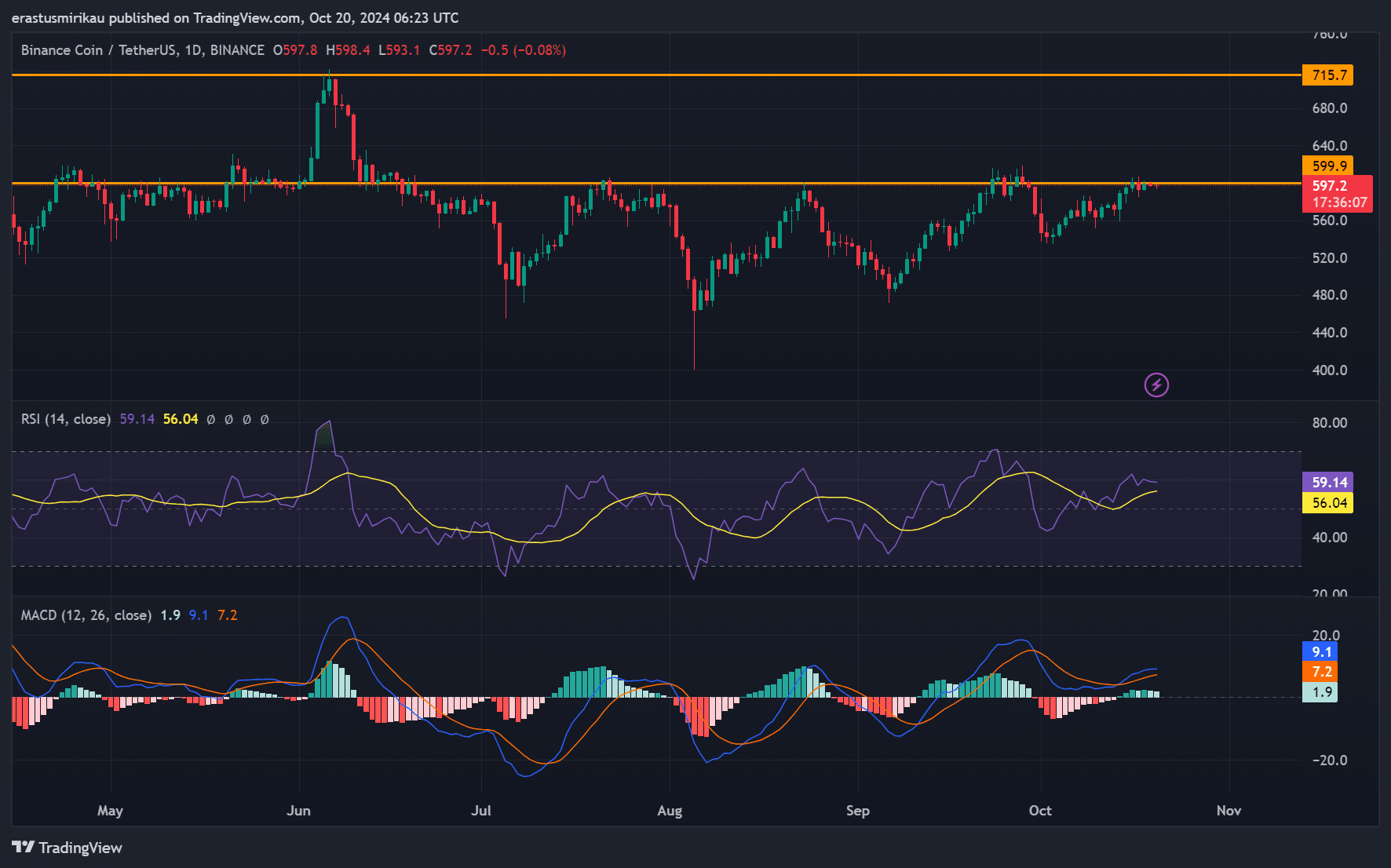

BNB technical indicators: RSI and MACD in focus

At the moment, the Relative Strength Index (RSI) stands at 56, suggesting a balance between positive and negative momentum, potentially allowing for more growth in the future.

Currently, the MACD was showing a positive crossover (bullish sign), since it was positioned above the signal line at the moment of inquiry.

Consequently, it appears that the indicated trends suggest an increase in positive momentum, which could potentially lead to a significant surge or breakthrough.

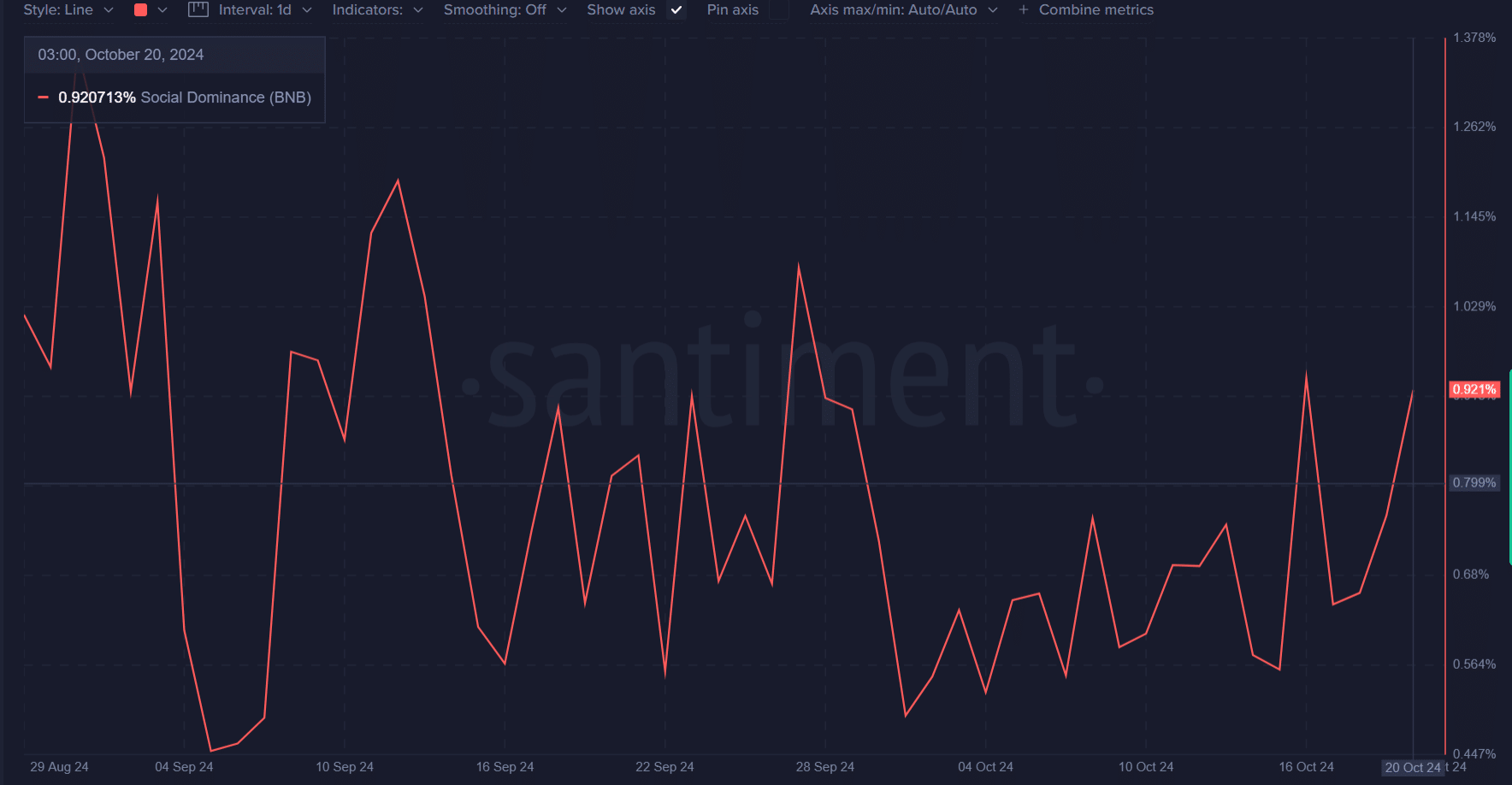

BNB’s Social Dominance: A bullish sign?

At the current moment, BNB’s Social Dominance was climbing, standing at 0.92%. This growing interest might lead to an increase in purchasing activity.

Traditionally, a greater level of Social Dominance has been associated with more significant fluctuations in prices and larger shifts in their trends.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Is a breakout imminent?

Right now, Binance Coin (BNB) stands at a crucial juncture. Although the $599.9 ceiling continues to pose a significant challenge, optimistic technical signs and growing public enthusiasm indicate that a surge beyond this level might soon occur.

Should BNB manage to break through the $600 mark, it’s probable that the price could rise towards approximately $715.7. Consequently, traders are advised to pay close attention to the market trends in the forthcoming days for any clear indications of a significant shift.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-20 19:04