- The weekly time frame for Binance showed a key level to close above for a rally.

- The liquidation heatmap and profitability on BUSD signaled bullish momentum.

As a seasoned analyst with over two decades of trading experience under my belt, I have witnessed countless market cycles and have learned to read trends like the back of my hand. The current chart setup for Binance Coin (BNB) is nothing short of intriguing.

The weekly graph for Binance Coin (BNB) demonstrated robust upward thrust as it neared a significant resistance point.

BNB soared past multiple resistance levels and, settling in near the $662 mark at press time.

Experts suggest that surpassing this particular level might trigger a potential rise heading towards $1630, which is considered a significant goal based on psychological factors.

Since early 2024, Binance Coin (BNB) has been showing a strong upward trend by consistently hitting higher bottoms, suggesting a potential continuation of this growth.

The recent volume spike further validated the strong buying interest at current price levels, suggesting a firm support base around $529.88.

With this backing and the rising pattern it’s in, BNB seems poised for further growth. Closing the week above $662 might signal a bullish outlook, possibly initiating a significant price surge in its history.

Making this move could have significant consequences, representing a critical point in the journey of Binance Coin within the dynamic landscape of the cryptocurrency industry.

BNB’s RSI and MACD flipping bullish

On the 4-hour chart, there was an uptick in Binance Coin (BNB) as the Relative Strength Index (RSI) surpassed its downward trajectory, suggesting a resurgence of bullish energy.

Additionally, the Moving Average Convergence Divergence (MACD) is now indicating a surge in buying activity, which suggests a positive trend.

If BNB manages to end its weekly trading above the crucial $662 mark, it could potentially set sights on a significantly increased goal of approximately $1630.

The substantial increase in this potential area highlights a vigorous revival and increasing trust among traders in the resilience of the BNB market.

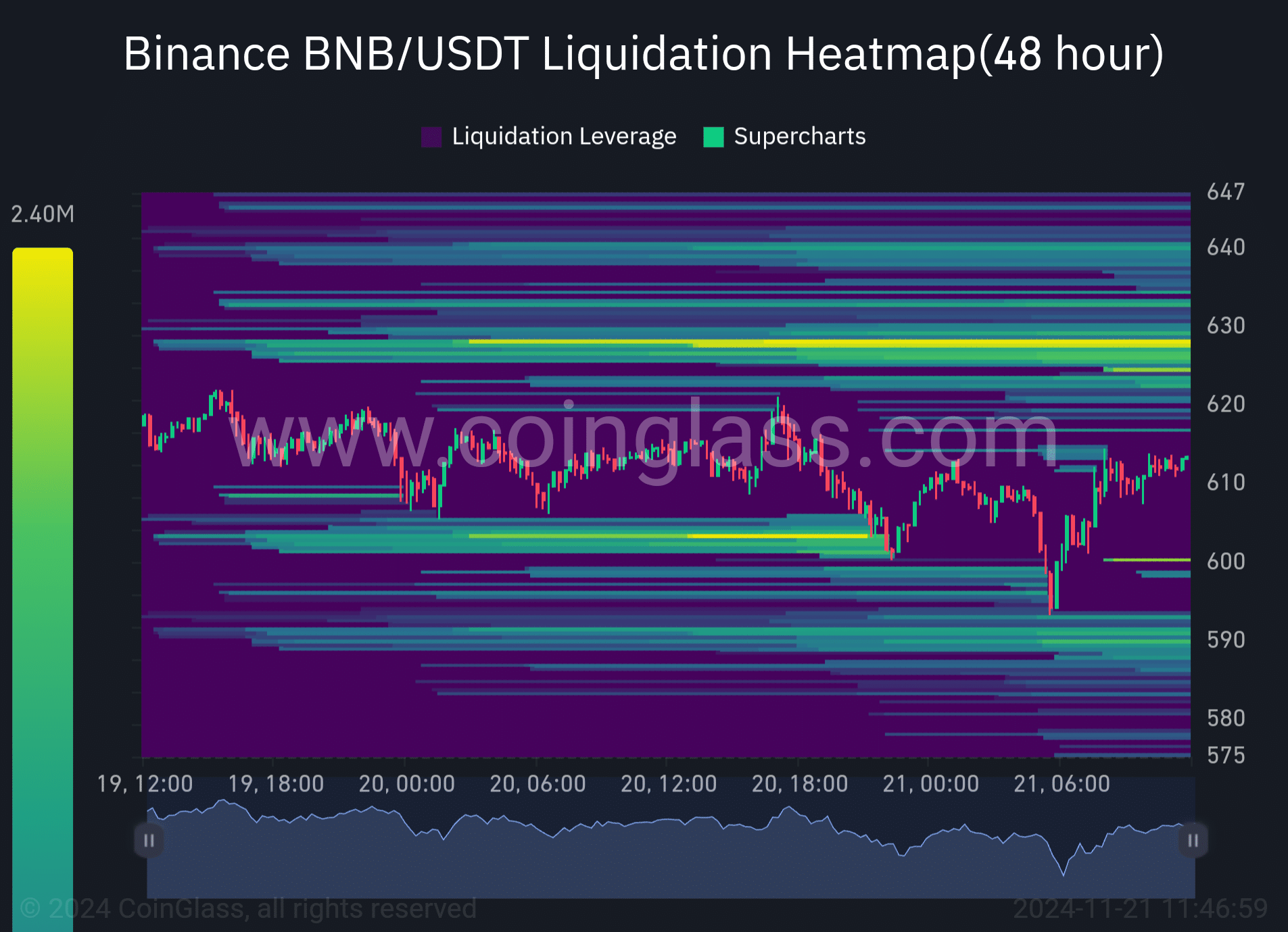

Liquidation heatmap and BUSD profitability

The liquidation chart for BNB/USDT highlighted an essential range, approximately $600 to $647, suggesting possible turning points where the market might change direction.

If Binance Coin (BNB) continues to hold its value above the $662 mark over the coming days, we could potentially witness another strong surge that may push its price upwards towards a potential goal of around $1630.

The heatmap showed considerable liquidation levels at lower prices, suggesting strong support near the $600 mark.

Keep a close eye on liquidation levels, since traders are eagerly awaiting potential changes that might spark additional growth in the price of Binance Coin (BNB).

This action suggests growing market curiosity and the possibility that the worth of BNB could rise significantly if crucial resistance levels are surpassed.

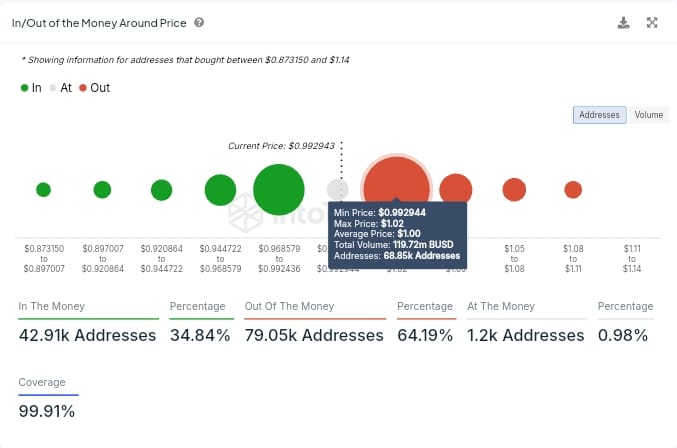

Furthermore, it was observed from on-chain analysis of Binance USD that a total of 42,910 wallets had profits, which equates to approximately 34.84% of all holders.

Approximately two-thirds (64.19%) of all address holders, numbering approximately 79,050 addresses, ended up not receiving the value they expected due to the price of the asset being lower than their purchase price.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Approximately 68,850 BUSD buyers primarily made their purchases within the price range of $1.00 – $1.02.

If BNB finishes its weekly trading above the $662 point, it could signal a potential shift in direction, possibly leading to a path towards the $1630 level on the weekly chart.

Read More

2024-11-21 23:36