-

Data showed that the latest upgrade could tank BNB Chain’s revenue.

Broader trader sentiment was positive, suggesting that BNB’s price can retest $600.

As a seasoned crypto investor with experience in analyzing blockchain projects and their underlying metrics, I am keeping a close eye on BNB Chain’s latest upgrade and its potential impact on revenue and price.

On June 20th, BNB Chain, the decentralized blockchain platform, announced a significant update. As per the announcement, using BEP 336, users will experience a reduction of up to 90% in transaction fees while utilizing the network.

The revelation is equivalent to Ethereum‘s Denver update, leading to a reduction in transaction fees. Notably, BNB Chain acknowledged being influenced by EIP4844 without contradiction. Regarding this influence, they clarified:

“BEP 336 brings down transaction costs on the Binance Smart Chain (BSC) network substantially, as it dispenses with the requirement for long-term storage of specific data types.”

Will this affect revenue?

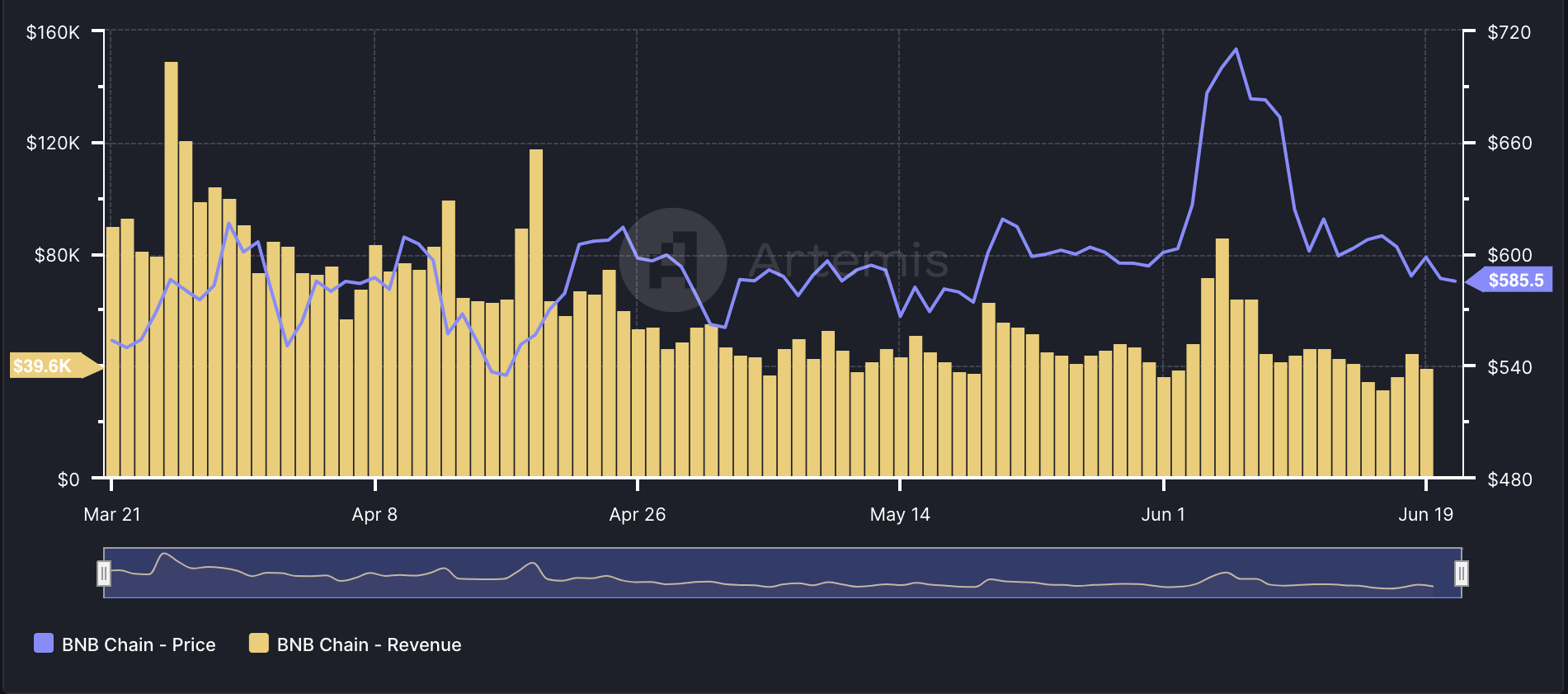

It’s worth noting that the progress of this project may impact BNB Chain’s earnings. Based on current data from Artemis, the revenue of the project has dropped since the 19th, as observed by AMBCrypto.

Significantly, transaction fees make up a substantial portion of our income. Consequently, decreasing them any further might result in additional losses. Furthermore, the price of BNB is another variable that could be affected by this development.

At the moment of publication, the price of BNB was $585.37, marking a significant drop from its previous record high.

As an analyst, I’ve observed that a decrease in transaction fees on the Binance Smart Chain (BNB) network could potentially lead to heightened demand for the BNB cryptocurrency. Consequently, if this trend continues, the price of BNB might have a chance to revisit its all-time high of $720.67 once more.

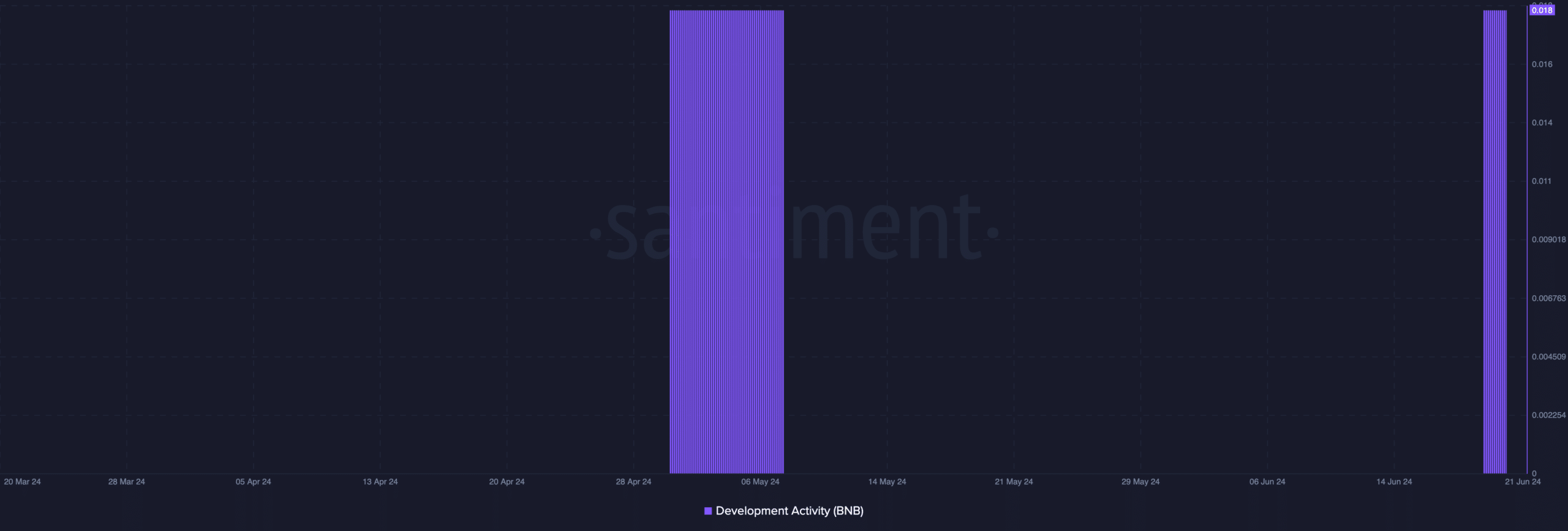

Despite this, evaluating current network events is crucial. At present, AMBCrypto has examined developmental activity as a point of reference.

Development improves while traders plan to take advantage

As a crypto investor closely following a particular project, I keep an eye on development activity as an essential indicator of its health and progress. This metric signifies the amount of work being carried out in the public GitHub repositories, with an increase implying that developers are actively committing new codes to bring forth innovative features and improvements.

Based on the data from Santiment, I’ve observed that BNB‘s development activity reached its peak level since May 6th. Consequently, this surge in development activity suggests a heightened commitment to enhancing the network rather than a decrease.

The implication was that developers became more committed to the project. In terms of investment, this increase in price might be a positive sign for the cryptocurrency. Additionally, consider examining the Funding Rate as another significant metric.

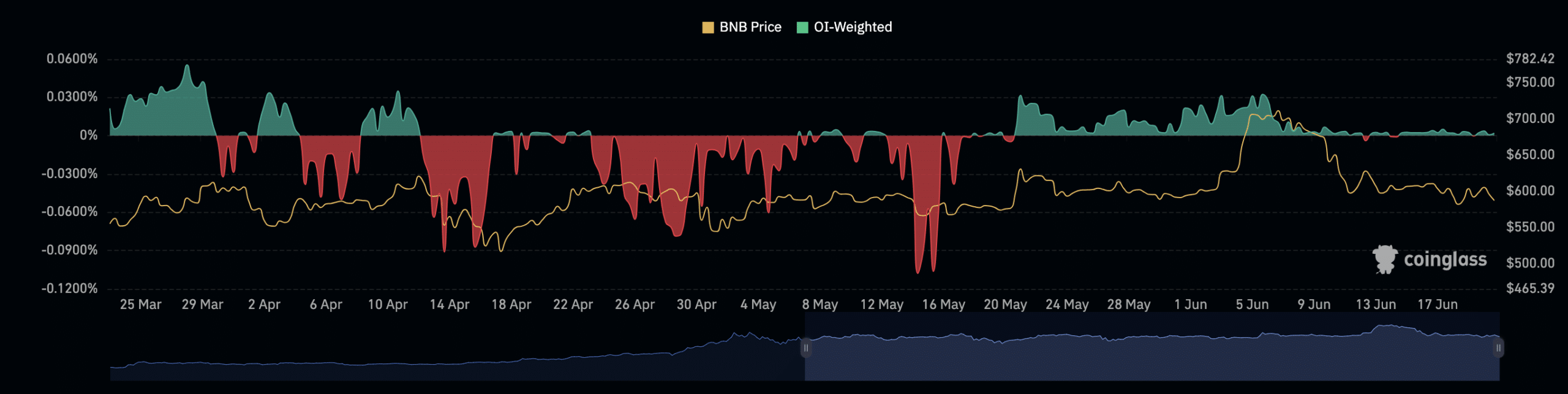

The purpose of examining this metric is to determine whether traders consider the upgrade to be a significant factor propelling a price rise.

Based on Coinglass data, the BNB Funding Rate stood at a low figure of 0.0020%. A positive value for this indicator signifies that the contract price is above the spot price. This suggests a bullish attitude among traders.

From a different perspective, a pessimistic interpretation suggests that the continuous price stands at a discount. Consequently, the prevailing trader attitude reflects bearishness.

As a market analyst, I can interpret the current Funding Rate in this way: At the present moment, long traders are required to pay a fee to short traders for holding their positions open. This implies that the average trader anticipates the price of BNB to rise.

Read Binance Coin [BNB] Price Prediction 2024-2025

But for the price to increase, buying pressure in the spot market has to be increase.

As a researcher studying Binance Coin (BNB), I have identified a potential scenario where its price could exceed $600 in the short term. However, it’s essential to acknowledge that this prediction is contingent upon certain conditions being met. Conversely, if these conditions are invalidated, the coin’s price might dip down to around $570 instead.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-21 16:08