-

BNB bulls demonstrate dominance by pushing higher as most top coins face sell pressure.

Binance smart chain yield farming demand could be one of the key reasons behind BNB’s upside.

As a seasoned analyst with years of experience in the crypto market, I find myself intrigued by BNB‘s recent performance. While many top coins are grappling with sell pressure, BNB continues to surge, and it seems that Binance Smart Chain’s yield farming demand could be the driving force behind this upside.

As an analyst, I’m observing a notable surge in Binance Smart Chain’s native coin, BNB, while the broader market seems to be grappling with maintaining its bullish momentum. The coin has been steadily climbing on the upward trajectory it established over the weekend. However, there’s one significant factor propelling this extended bullish run.

This week, the surge in interest for yield farming on the Binance Smart Chain (BSC) has significantly contributed to the ongoing rally of BNB. Notably, this increase was spurred by Binance’s recent announcement about the addition of Scroll’s SCR token to their launchpool, which appears to have drawn large investors (whales) towards purchasing BNB for yield farming with Scroll.

On October 8th, there were outflows for Bitcoin and Ether, causing a drop in their prices over the past 48 hours. In contrast, Binance Coin (BNB) saw an upward trend due to continuous demand, reaching $580 at the time of reporting, marking a nearly 3% increase on Tuesday.

In the past week, the positive trend boosted BNB by more than 6%, making it the leading percentage gain among the top ten cryptocurrencies ranked by market capitalization.

As a researcher, I’ve observed that at the current moment, Binance Coin (BNB) stands just 3.44% shy of its targeted price of $200. The significance lies in the fact that over the past three months, BNB has found it challenging to surpass the $200 price range. This could indicate a potential resistance level or a ceiling for the token’s price action at this stage.

On several instances, it was able to achieve that, but every time, a fresh wave of selling pressure emerged. Is there a possibility that BNB will experience another dip, or can it maintain its upward trajectory beyond the $600 mark this time around?

Can BNB sustain the bullish momentum?

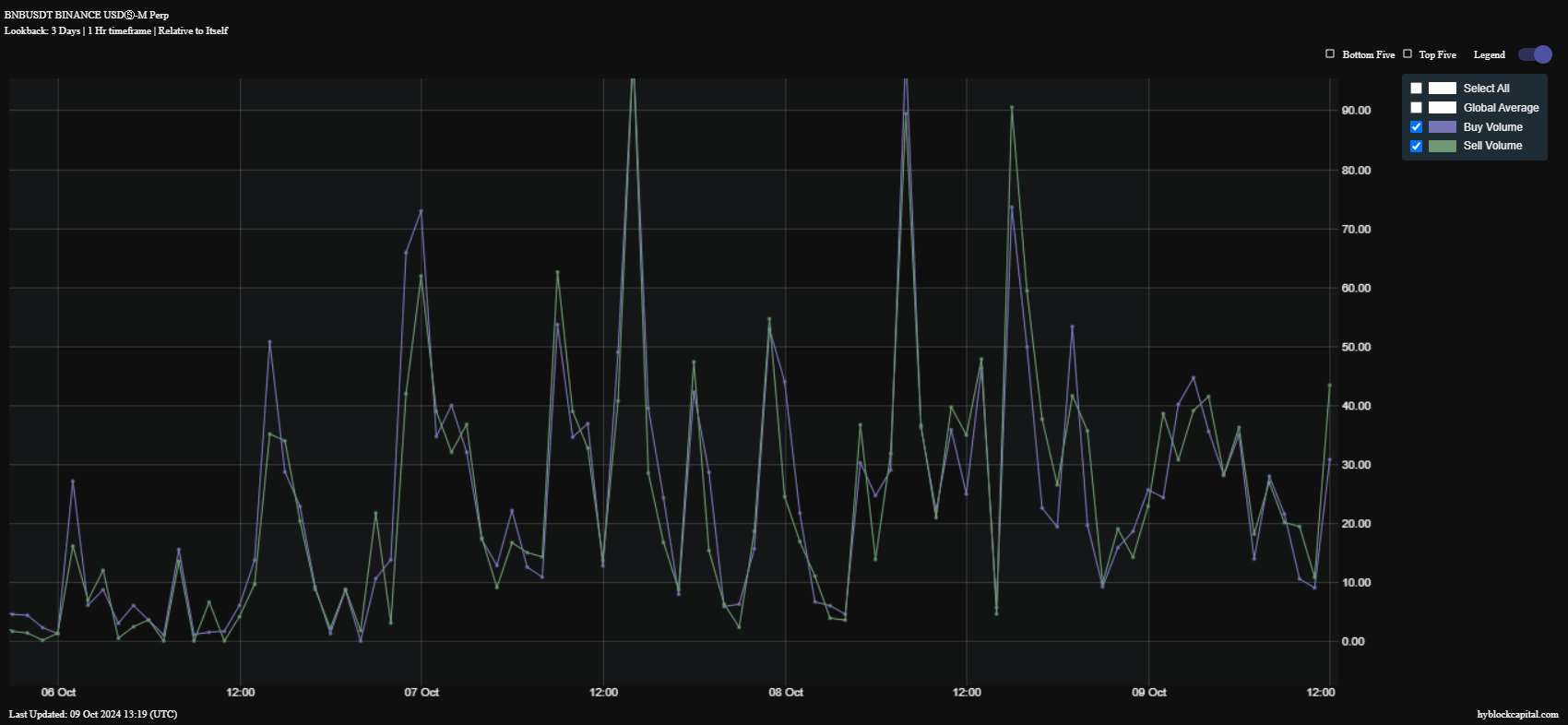

If the driving force behind the cryptocurrency weakens, it’s likely to face increased selling activity. Recent analysis of buy and sell volumes suggests that selling pressure has noticeably increased over the past two days.

A stronger selling force than buying force indicates that Binance Coin (BNB) might encounter increased resistance as it tries to reach $200. Whether this happens depends on whether the demand weakens, which could then open the door for bearish trends to dominate.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

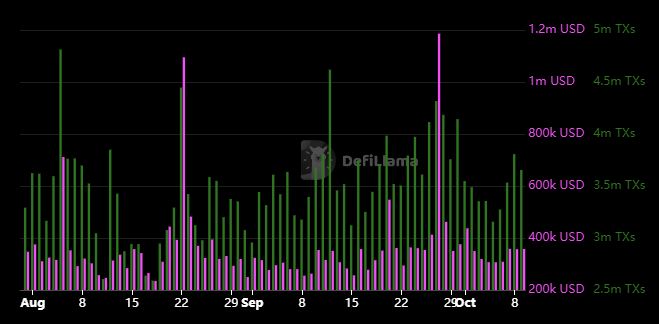

The performance of BNB showed signs of network activity improvement within its chain. Weekly transaction numbers climbed from a low of 3.16 million on October 5th, up to 3.65 million by October 9th.

Over the past three days, fees on the network have experienced a shift from their previous decline which began at the end of September. Specifically, daily fees dropped to approximately $306,000 during the weekend, but have now surged above $350,000, indicating an increase in network activity.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-10 10:15