- The asset is currently trading within a bullish framework that could propel it beyond its previous ATH if the trend materializes.

- On-chain metrics reveal strong buying interest among market participants, further reinforcing the asset’s bullish outlook.

As an analyst with years of experience navigating the cryptocurrency market, I must admit that the current bullish structure of Binance Coin (BNB) has piqued my interest. The robust on-chain metrics and strong buying interest among market participants suggest a promising outlook for this asset.

Over the last 24 hours, the price of Binance Coin (BNB) has increased by 5.21%, thanks to bullish energy. This recent rise comes after a dip of 3.46% earlier in the week, which temporarily affected its overall performance.

According to AMBCrypto’s analysis, there remains strong possibility for this asset to increase more, backed by a positive overall market mood.

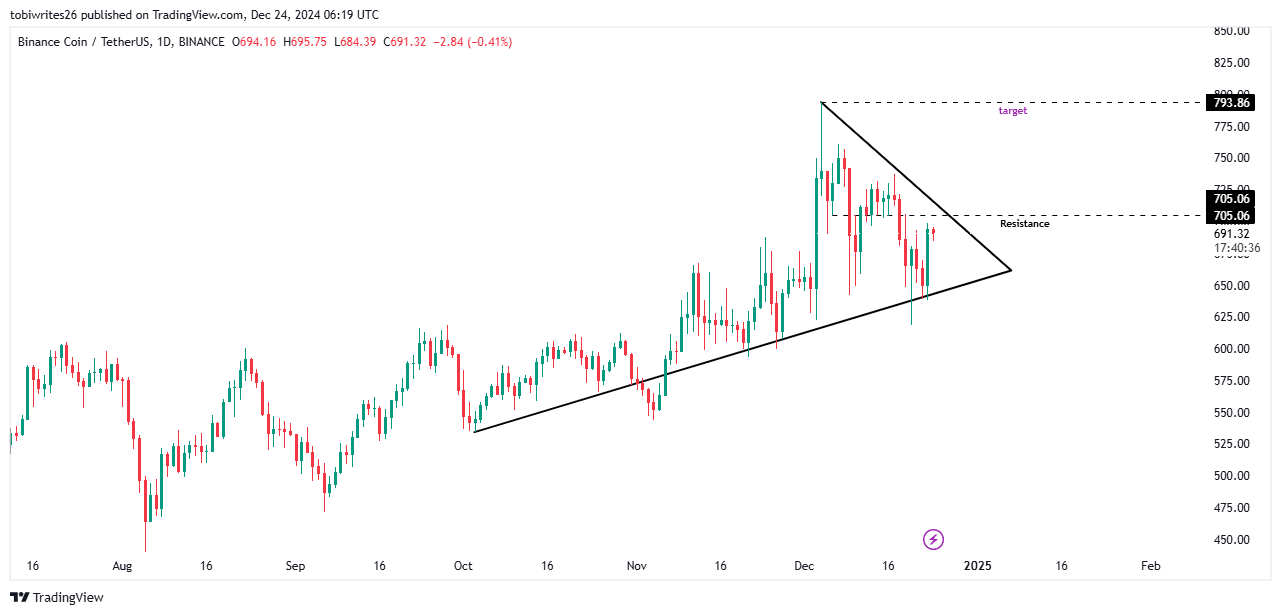

Bullish structure targets a new high

At the moment, BNB’s price movement is occurring within a bullish symmetrical triangle formation. This particular pattern suggests a build-up stage driven primarily by buyers, where the price oscillates between rising support and declining resistance lines.

Should this trend continue, BNB may return to its previous record high of around $793.86 and potentially push towards $800. Yet, it’s important to note that a notable resistance level exists at approximately $705.06, which could momentarily slow its progress upward.

Over the past day, I’ve witnessed a significant price surge that’s brought BNB to the brink of breaking free from its established pattern, boosting its market capitalization by 5.25% to an impressive $99.59 billion. Moreover, this surge has sparked a 29.39% increase in trading volume, pushing it up to a robust $1.6 billion.

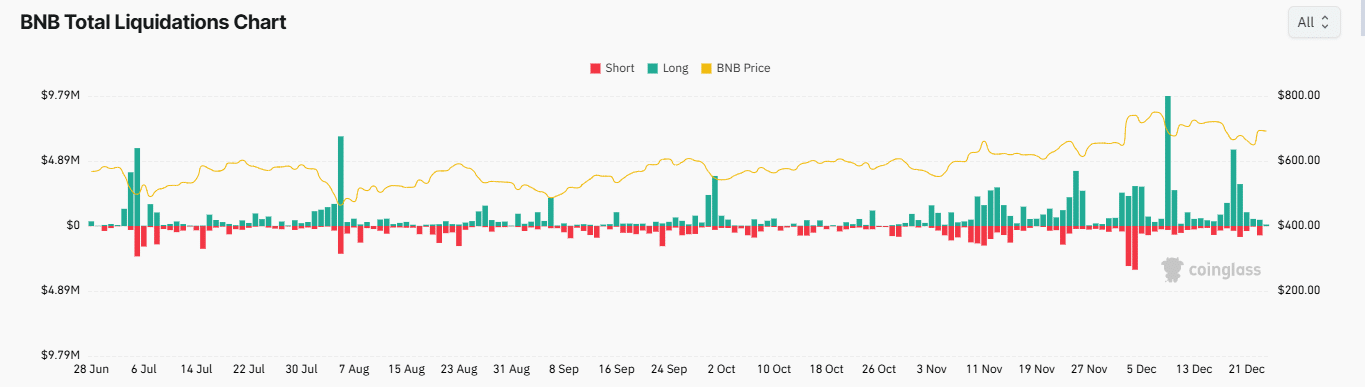

Shorts record losses as long contracts surge

The data from Coinglass shows that the market is leaning towards increasing prices as there are more instances where short contracts are being terminated compared to long positions.

Of the total $1,030,000 in liquidations that occurred over the last 24 hours, a greater amount – $578,680 – came from short contracts being closed, while slightly less – $447,480 – involved long contracts.

Furthermore, there’s been a notable rise in extended agreements within the market. At present, the long-to-short ratio – a measure comparing the quantity of long positions to short ones – exceeds 1.

Currently, based on the most recent figures, the ratio shows a value of 1.0202, signifying that more traders are placing wagers on BNB’s price increase. This trend is evident in the asset’s rising price trajectory and the expanding losses for short positions, as demonstrated by the liquidation data.

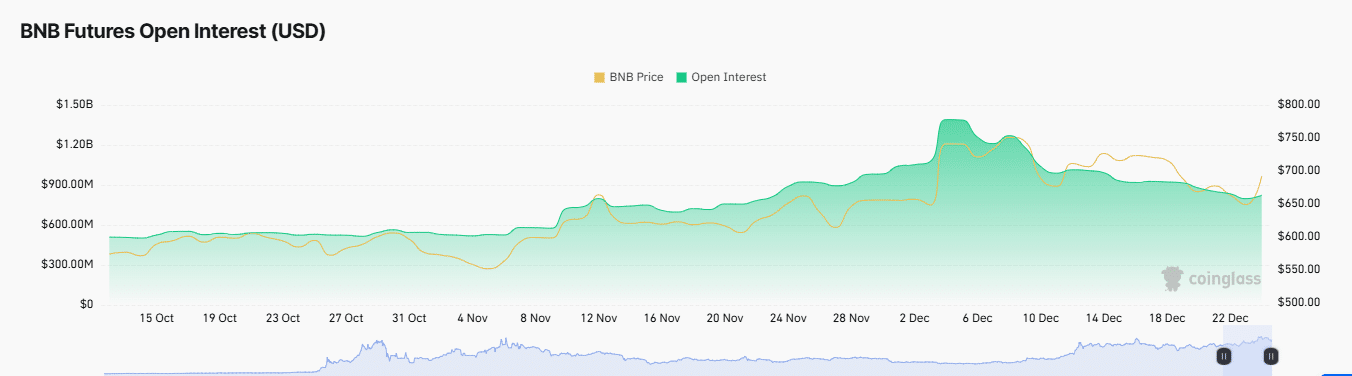

BNB open interest surges higher

Following a prolonged drop, the Open Interest (representing outstanding derivative agreements in the market) is now on an upward trend, with a growth of about 0.57%, reaching around $817.75 million.

This change indicates an increase in the number of deals being made in the market. When you consider the recent spike in trading activity and prices, it seems to suggest that there’s a greater chance of bullish attitudes influencing these new transactions.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

To sum up, there’s been a shift in the way Binance Coin (BNB) owners are acting. An increasing number of them are choosing to keep their investments rather than sell, and a large chunk is being moved into personal wallets for safekeeping. In all, approximately 2.15 million dollars’ worth of BNB has been transferred in this manner.

Based on the general market mood, Binance Coin (BNB) appears optimistic and could possibly hit new price peaks during the forthcoming trading periods.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-12-24 22:16