-

BNB’s price retracted by 4% after rallying to an all-time high on 6 June

Altcoin’s market bulls, however, seemed ready to defend support level at $635

As a researcher with a background in crypto markets and experience observing the trends of various digital assets, I find it intriguing to see Binance Coin’s (BNB) recent price action and market sentiment.

The price of Binance Coin (BNB) encountered resistance near $712 during trading, triggering profit-taking after a recent surge in its market value.

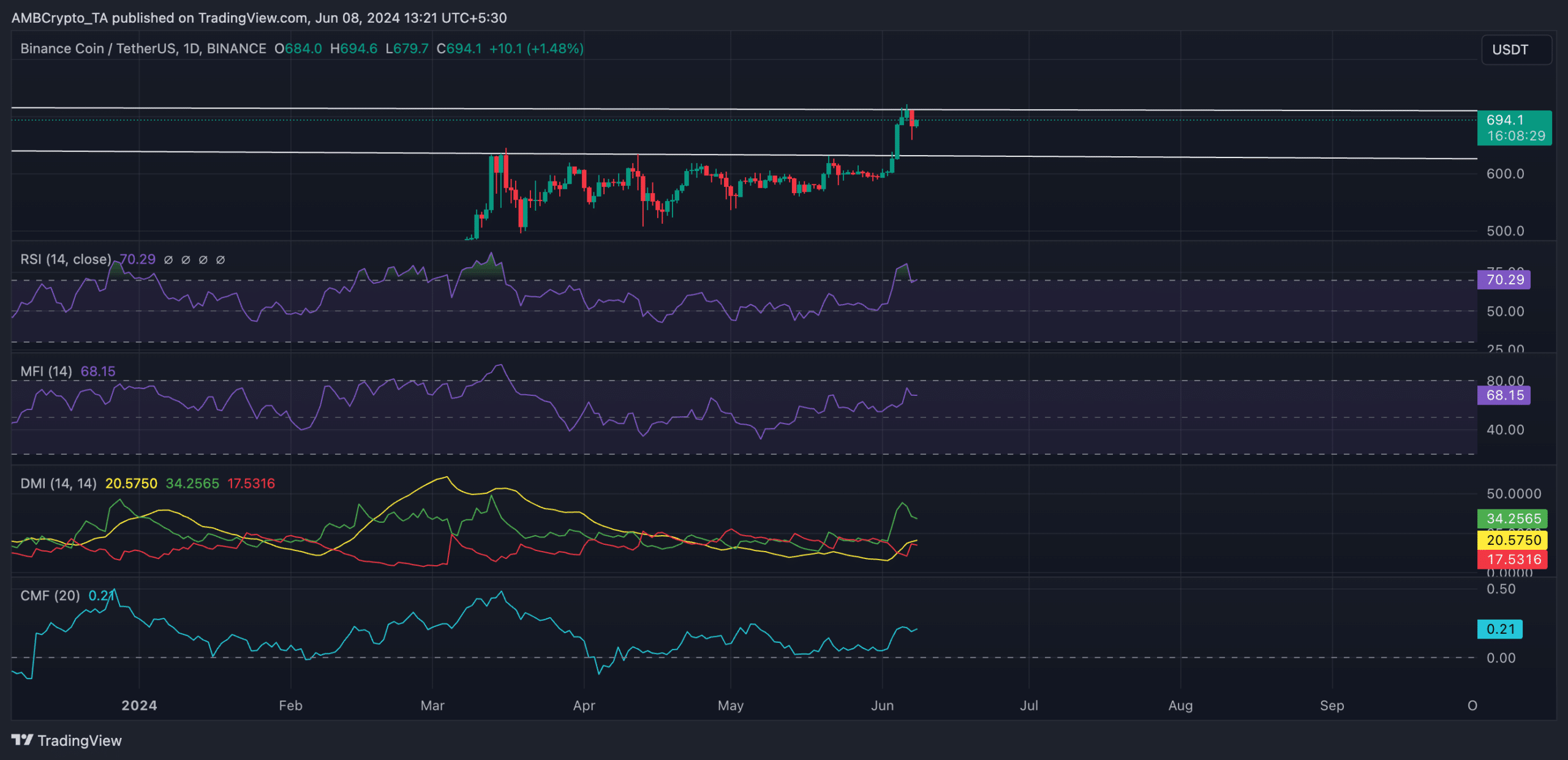

I analyzed the price chart of the altcoin provided by AMBCrypto and noticed that on the 4th of June, it managed to surge above the upper boundary of its horizontal channel. This breakout propelled the altcoin to reach a new peak price of $720 on the 6th of June, marking a significant milestone in its price history.

As some investors hurriedly cashed in their gains, the value of BNB dropped by 4% around that point in time. Currently, one BNB token is worth approximately $688.

Bulls attempt to defend key support level

As a crypto investor, I’ve noticed an increase in selling activity for BNB over the past few days, which has dragged its price closer to the important resistance level of $632. However, at the moment, bulls appear determined to protect this level as support based on ongoing accumulation by traders.

At present, BNB‘s uptrend is marked by a RSI of 70.25 and an MFI of 68.15. These indices indicate that while there is significant selling activity, the buying force remains more prominent based on the chart analysis.

As an analyst, I’ve examined BNB‘s Directional Movement Index (DMI) and observed that its positive directional index (represented by the green line) is currently superior to its negative index (red line). This observation signifies a bullish trend. Typically, this configuration implies that the buying power of the market is more robust than the selling pressure, indicating an ongoing uptrend in the price action.

At the current moment, Binance Coin (BNB) was experiencing an upward trend and its Chaikin Money Flow (CMF) stood at 0.21. This indicator signifies the pace of money flowing into or out of an asset. A CMF value greater than zero, as in this case, indicates a strong market – a continuous influx of capital towards the asset, which is a bullish indication.

Open interest climbed to a multi-year high

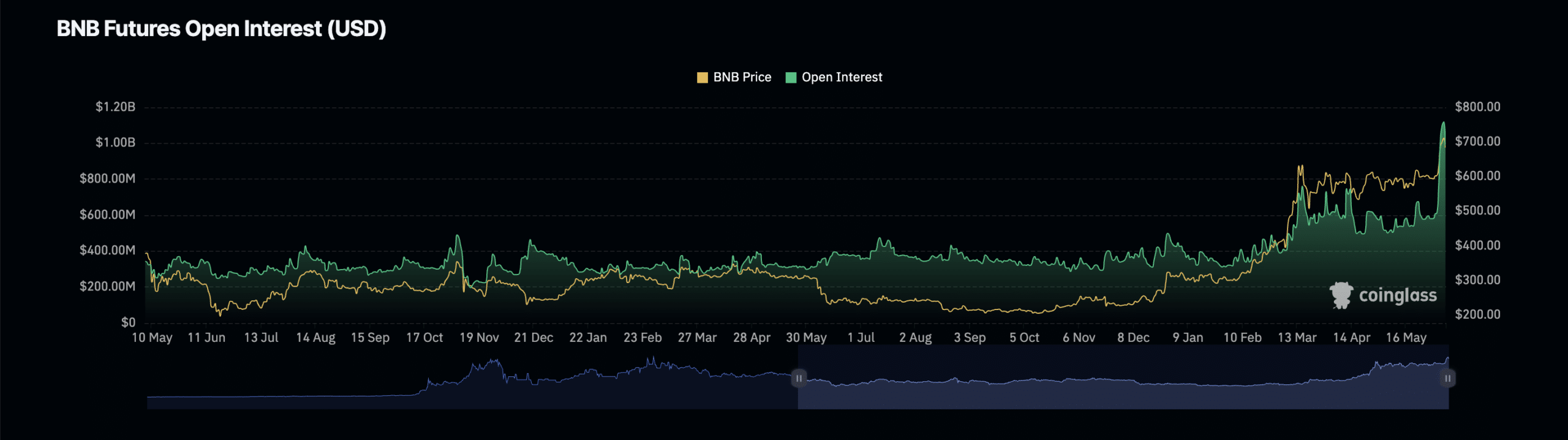

As a researcher studying the cryptocurrency market trends, I’ve noticed an intriguing development regarding Binance Coin (BNB) and Ripple (XRP) futures open interests. On the 7th of this month, BNB’s futures open interest reached a three-year peak of $1.12 billion on Coinglass, a figure last seen in May 2021. In contrast, XRP’s futures open interest has experienced a substantial increase by approximately 70% since the beginning of this month.

Realistic or not, here’s BNB’s market cap in BTC terms

The quantity of open Futures contracts on Binance, representing positions yet to be liquidated or finalized.

When it increases, it indicates a surge in market action with more traders and investors making fresh moves in the market.

Since May 21st, the coin’s positive funding rate indicates that recent market entrants have preferred to buy rather than sell, implying long positions. Conversely, during a prolonged phase prior to this, BNB experienced negative funding rates in cryptocurrency markets due to traders taking shorts or betting on its price decrease.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-09 02:15