-

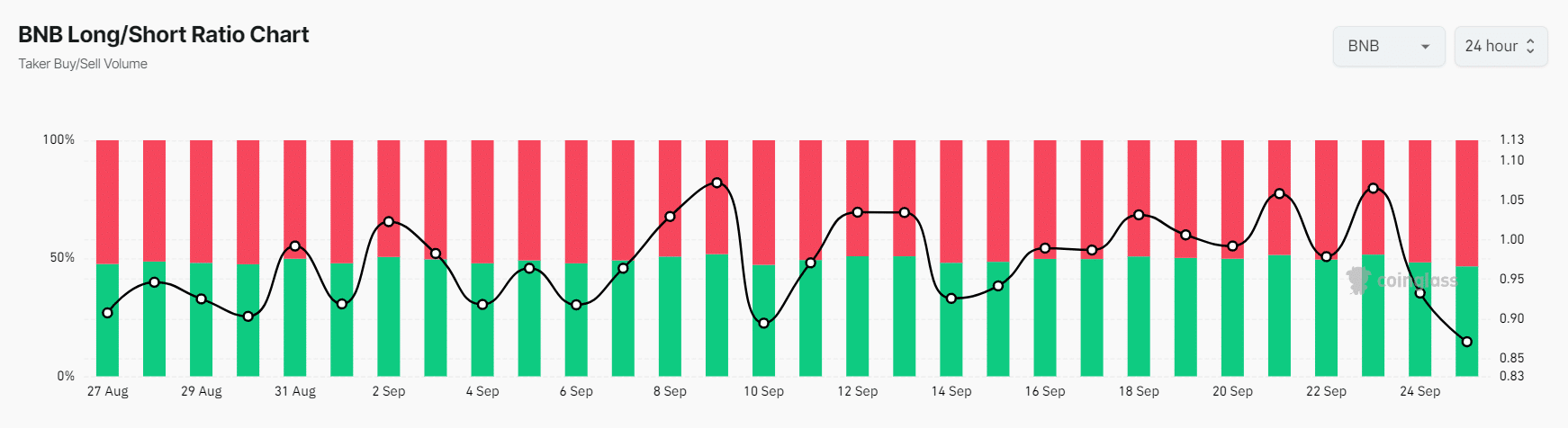

BNB’s Long/Short Ratio was 0.871 at press time, indicating bearish market sentiment.

53.44% of traders held short positions, while 46.56% held long positions.

As a seasoned researcher with years of experience in the cryptocurrency market, I have seen enough bull and bear runs to know that every coin has its cycle. The current state of Binance Coin [BNB] seems bearish, at least from the technical perspective.

As a researcher studying the crypto market, I’ve observed a potential downward trend in Binance Coin (BNB), the globe’s fourth-largest digital currency by market capitalization. On a daily basis, it seems to have formed a bearish pattern in its price action, hinting at a possible decline.

Over the past few weeks, I’ve witnessed BNB skyrocket by more than 25%. However, this significant growth has led us to a point where selling pressure is intense, not just for BNB but across major digital currencies as well.

BNB technical analysis and key levels

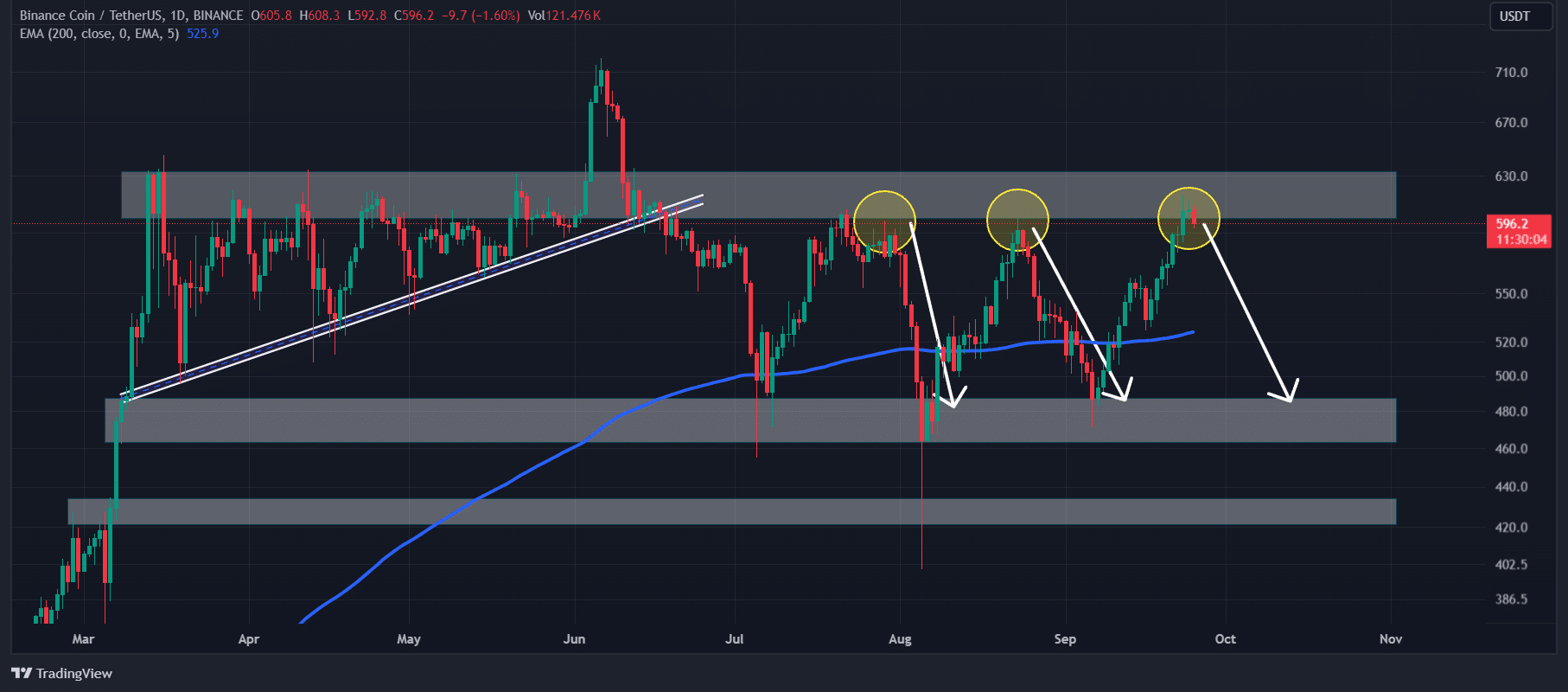

Based on the technical assessment by AMBCrypto, Binance Coin (BNB) appears to have developed a bearish triple top chart formation over its daily chart.

Beyond what we’ve already discussed, the asset has additionally developed an “evening star” candlestick formation near the resistance level of approximately $605. This pattern strengthens the pessimistic viewpoint.

According to past price trends, it’s quite likely that the price of BNB might drop about 20%, potentially reaching around $480 within the near future.

As long as BNB‘s price remains below $625, a pessimistic view is justified; however, if it surpasses this level, there’s a possibility that the outlook might not hold up.

Despite this, the stock continues to trade higher than its 200-day Exponential Moving Average (EMA), suggesting that the overall trend remains bullish.

Many traders and investors frequently rely on the 200 Exponential Moving Average (EMA) as a tool for identifying if a particular asset is experiencing an upward trend or a downward trend.

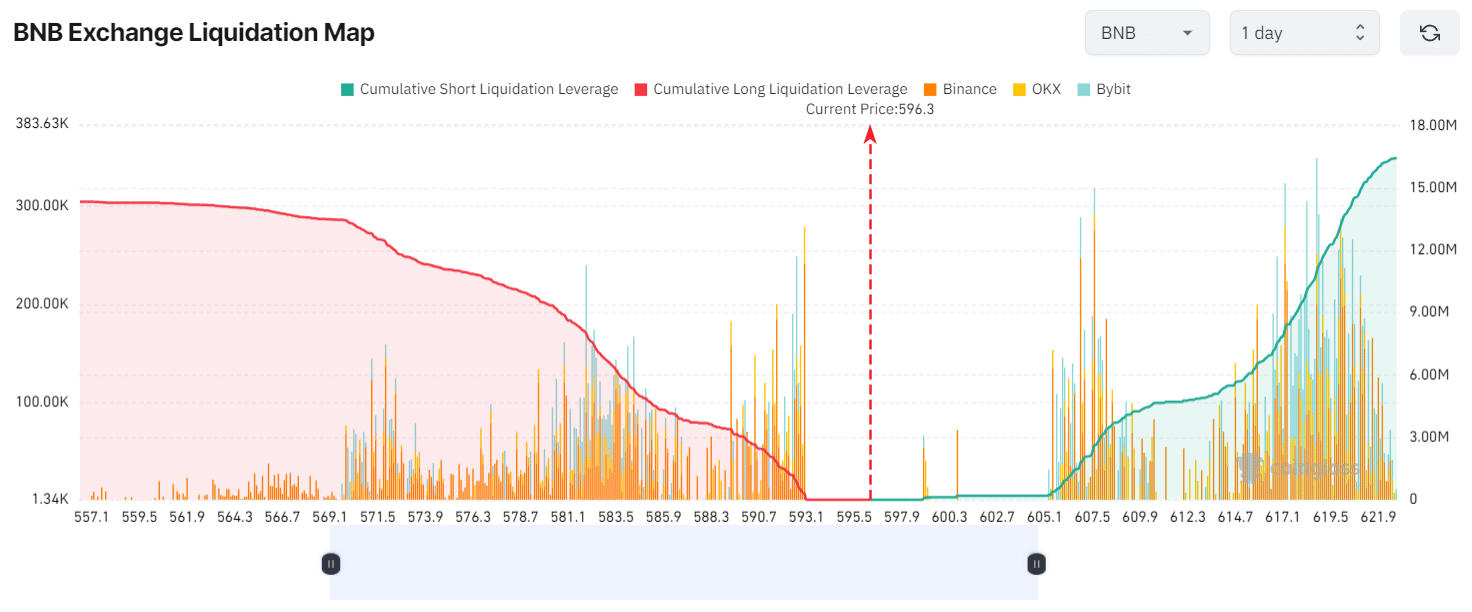

Major liquidation levels

At present, significant selling and buying points can be found around $593 (on the lower end) and $607.5 (on the higher end), based on data from the analytics firm Coinglass, who suggest that traders are heavily leveraged at these price ranges.

Should the market outlook become pessimistic and BNB drops down to the $593 price point, approximately $280,000 in long positions could face liquidation.

Should the market’s mood flip and the price surge to around $607.5, it would mean a tidy sum of about $2.3 million worth of my short positions would need to be closed out.

This data shows bulls are currently exhausted, while bears are highly active at the moment.

BNB’s bearish on-chain metrics

Additionally, other indicators based on blockchain activity also reinforce the bearish perspective. At the current moment, the BNB Long/Short Ratio provided by Coinglass stands at 0.871, suggesting that most traders are currently adopting a bearish stance.

Furthermore, there’s been a 3.5% decrease in its Futures Open Interest within the last day, indicating that traders are cautious about establishing new positions.

Approximately 53% of leading traders are currently taking a bet that prices will fall (short positions), compared to around 47% who believe prices will rise (long positions) as we speak.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Current price momentum

At press time, BNB was trading near $596 after a price decline of over 1.4% in the past 24 hours.

For the same duration, the trading volume declined by 13%, suggesting a decrease in trader involvement due to the pessimistic market sentiment.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-25 22:48