- Binance Coin’s weekly chart outlined two important levels that haven’t yet been breached.

- The short-term bias was bearish, but traders need to look out for a short squeeze.

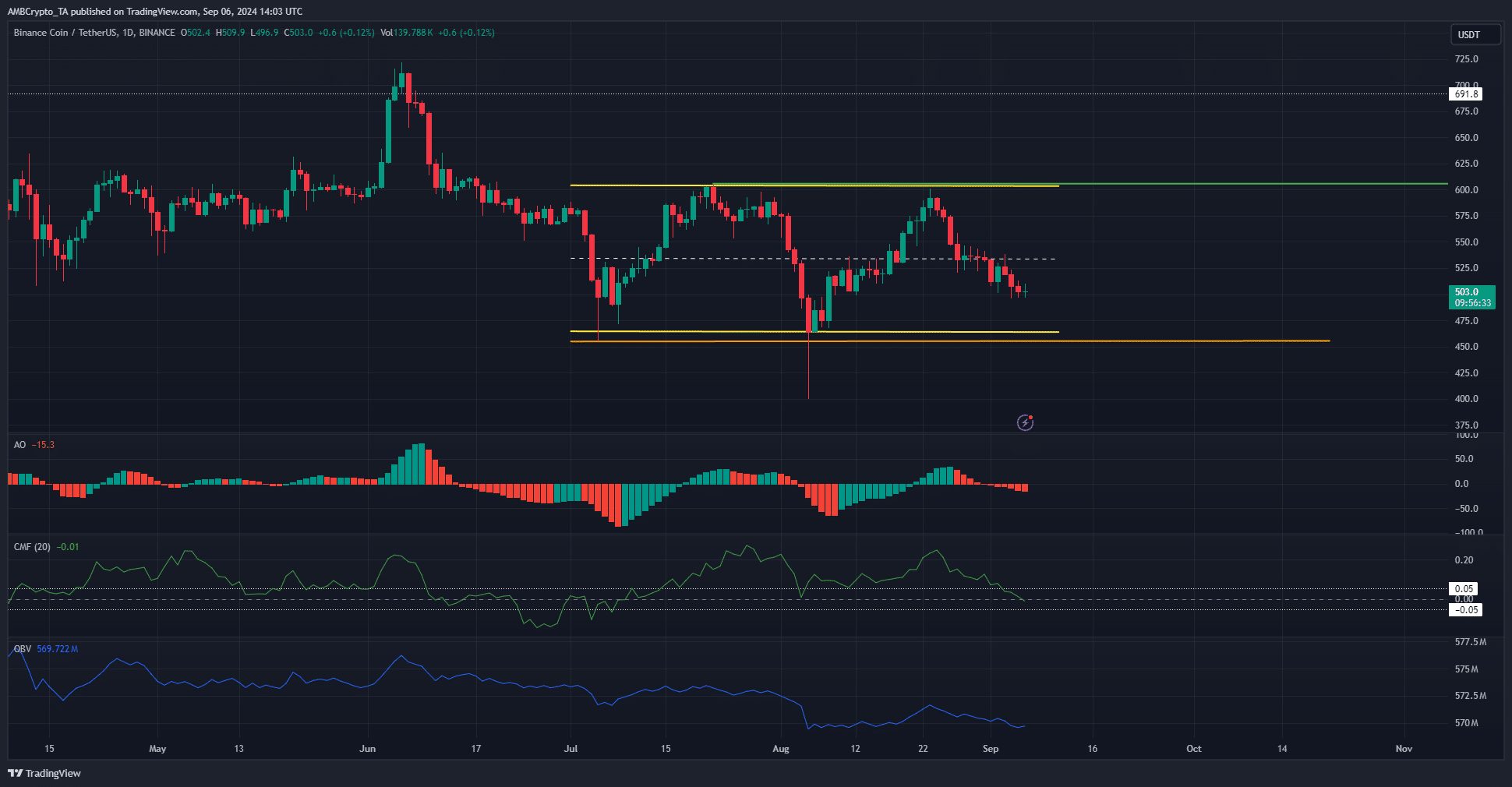

As an experienced analyst with over a decade in the crypto market, I see the current Binance Coin [BNB] situation as a tug-of-war between bulls and bears within a defined range. The recent bearish divergence and rejection at $600 are clear signs of seller dominance, but the uptick in OBV suggests that the bulls aren’t ready to throw in the towel just yet.

Over the past few days, Binance Coin (BNB) has shown a bearish trend, which has led to a 2% decrease in its price. This downward movement follows a bearish divergence that occurred a couple of days ago. Additionally, the resistance at the psychological $600 level, which was established towards the end of August, continues to impact the price of BNB.

In the upcoming weeks, significant battleground levels for both bulls and bears might emerge on long-term charts; however, within this period, we’re looking at price ranges dominating the market.

Binance Coin’s two-month range formation

As a crypto investor, I’ve noticed that the price has recently fluctuated between two significant levels: $454.8 (the recent low) and $605.6 (the high). These crucial points have shaped the range in which the market has moved over the past eight weeks on the weekly chart.

Last week’s market trend leaned bullish, yet the significant dip below $450 in August revealed a clear advantage of sellers over buyers. Furthermore, the Chaikin Money Flow (CMF) dipped beneath 0.05 on the daily chart, emphasizing the diminishing strength of the bulls.

Over the past month, the OBV has experienced a slight uptick, offering investors a glimmer of optimism for an upward trend. Currently, both $600 and $450 serve as significant resistance and support points, but it seems that $450 might be the less robust of the two.

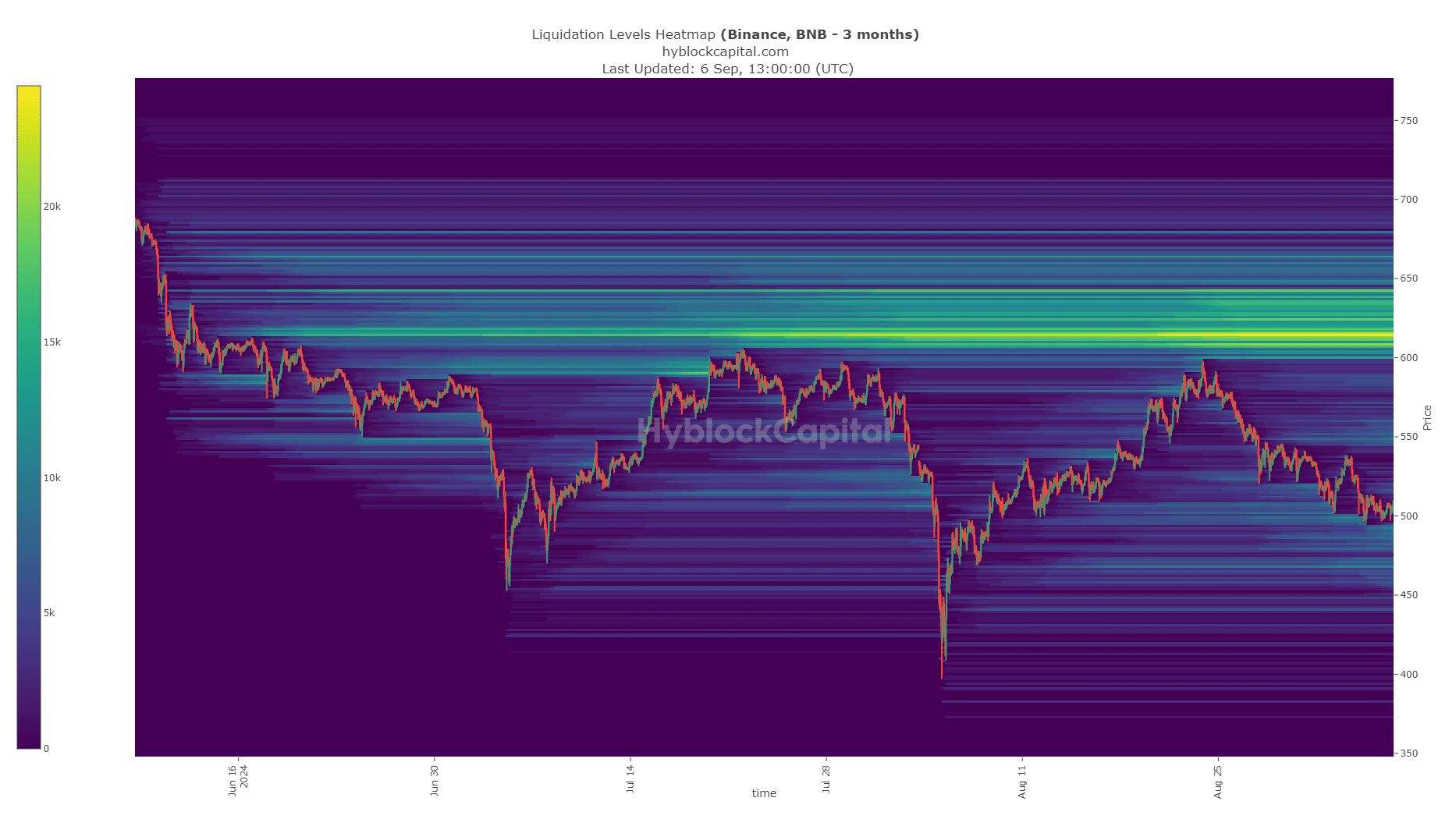

Liquidation levels show a short squeeze for BNB

Each week, a strong resistance area accumulated around Binance Coin’s price point of approximately $615, creating a concentration of significant liquidity. Consequently, it’s predicted that the token’s prices will trend upward toward this level, but may encounter rejection shortly after surpassing the $600 mark.

Read Binance Coin’s [BNB] Price Prediction 2024-25

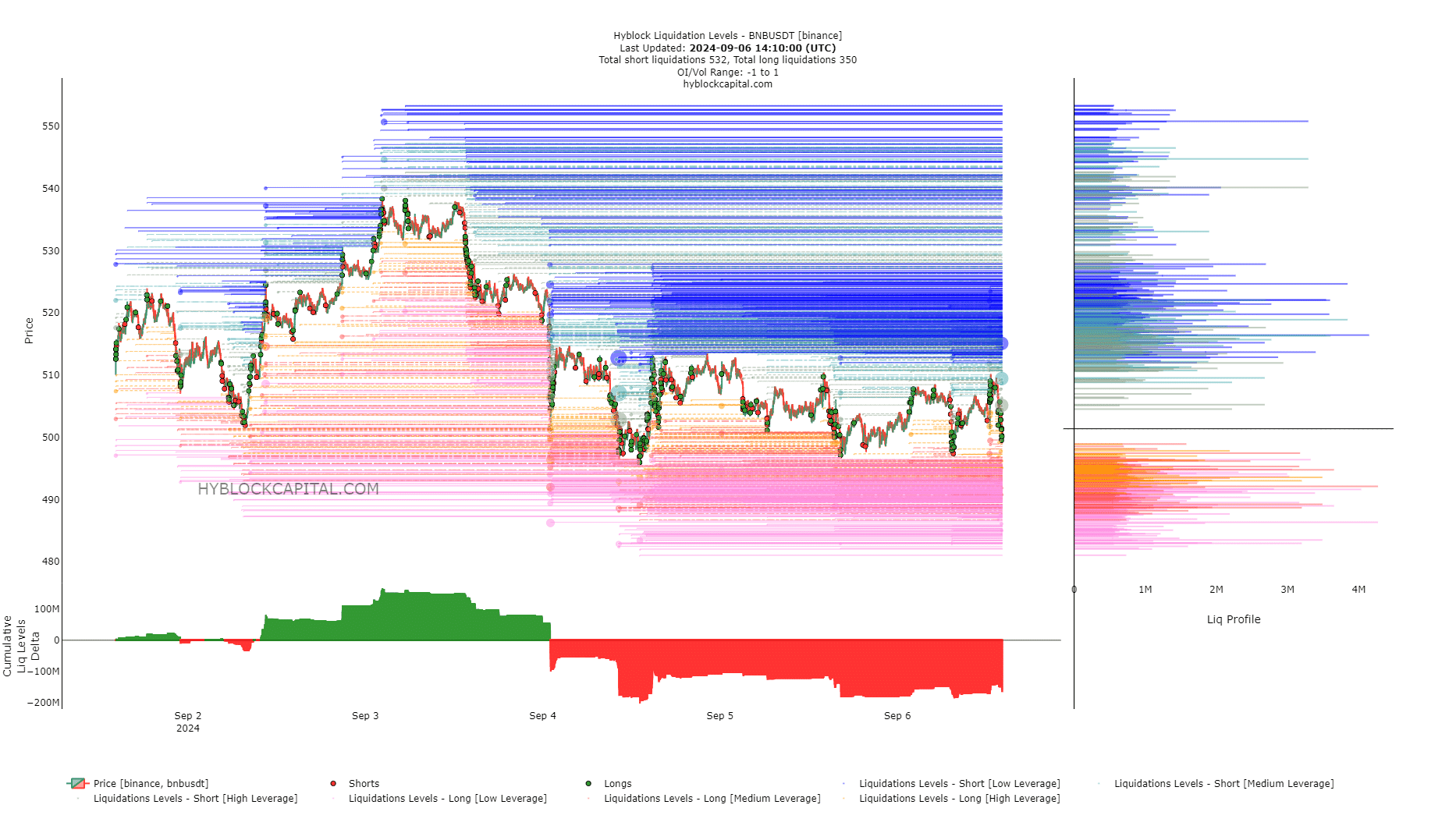

As a crypto investor, I noticed a significant imbalance in the lower timeframe liquidation levels, with short liquidations becoming more frequent than long ones. This indicated the potential for a short squeeze – a situation where the price rises due to investors being forced to buy to cover their short positions, thus further driving up the price.

Based on the analysis of AMBCrypto, it’s predicted that the price might fluctuate around $507 and $512. Upon examining the 1-hour price chart, they noticed a narrow range between approximately $498 and $513. Notably, $506 has been acting as a recent resistance level.

Read More

2024-09-07 11:03