- Increasing Open Interest and negative Funding Rate placed BNB in place to hit $630.

BNB might continue to outperform SOL despite the negative sentiment around it.

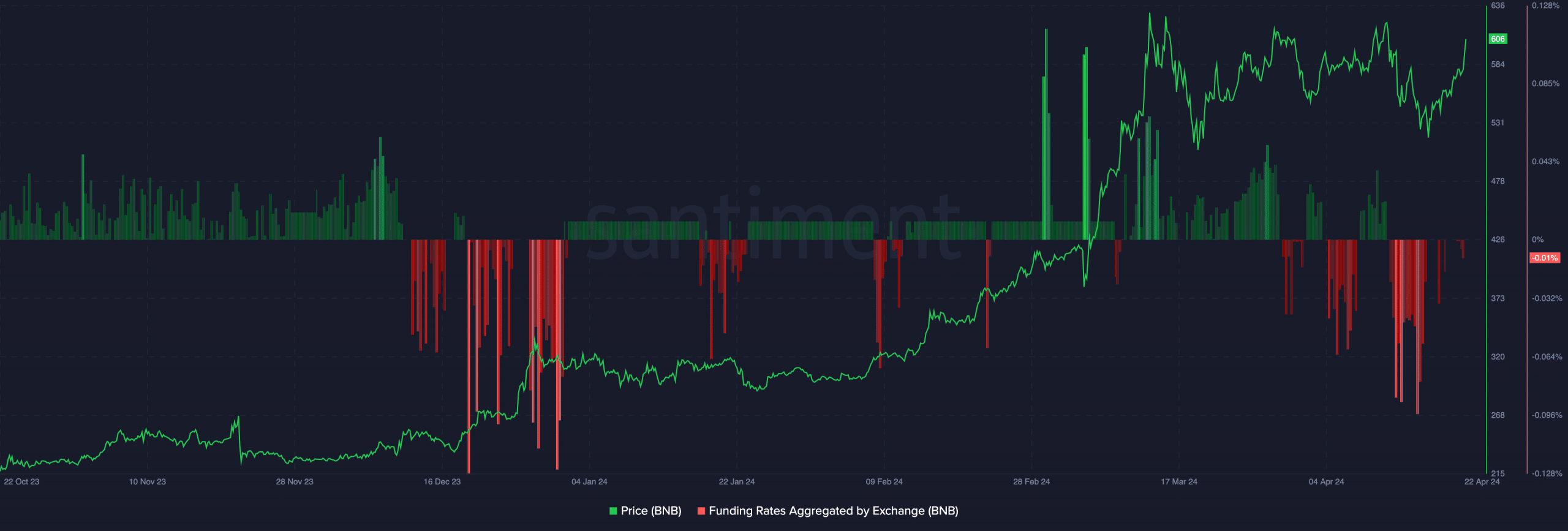

Based on AMBCrypto’s assessment, the funding rate for Binance Coin (BNB) on Binance derivatives exchange became negative on the 22nd of April, suggesting that more traders held short positions than long ones in the market.

A short position is when a trader wagers that a price will drop in order to earn profits. In contrast, the funding rate refers to the ongoing expense of maintaining an open perpetual contract position.

If the market situation is favorable, long position holders pay a premium to short position holders to maintain their positions. However, when the situation was unfavorable for BNB, it meant the opposite: shorts were profiting from their positions instead of paying a premium. Despite their significant market presence, shorts were currently benefitting from their positions.

BNB is king, sets eyes on another rally

The price surge of BNB over the past day caused this situation. In the previous 24 hours, BNB’s value rose by 4.33%, surpassing the widely discussed threshold of $600.

Normally, when the price is increasing while funding is negative, it indicates that short sellers aren’t earning a profit on their positions. Consequently, the price trend might suggest a bullish outlook for them.

If the current trend continues for the next several days, the value of the coin could reach up to $630. Notably, Binance Coin (BNB) has been leading the pack among the top 10 cryptocurrencies recently.

This year so far, the coin’s value has grown by an impressive 92.12%. It outperforms Solana [SOL] in this regard. However, is there more growth in store for the coin’s price in the near future?

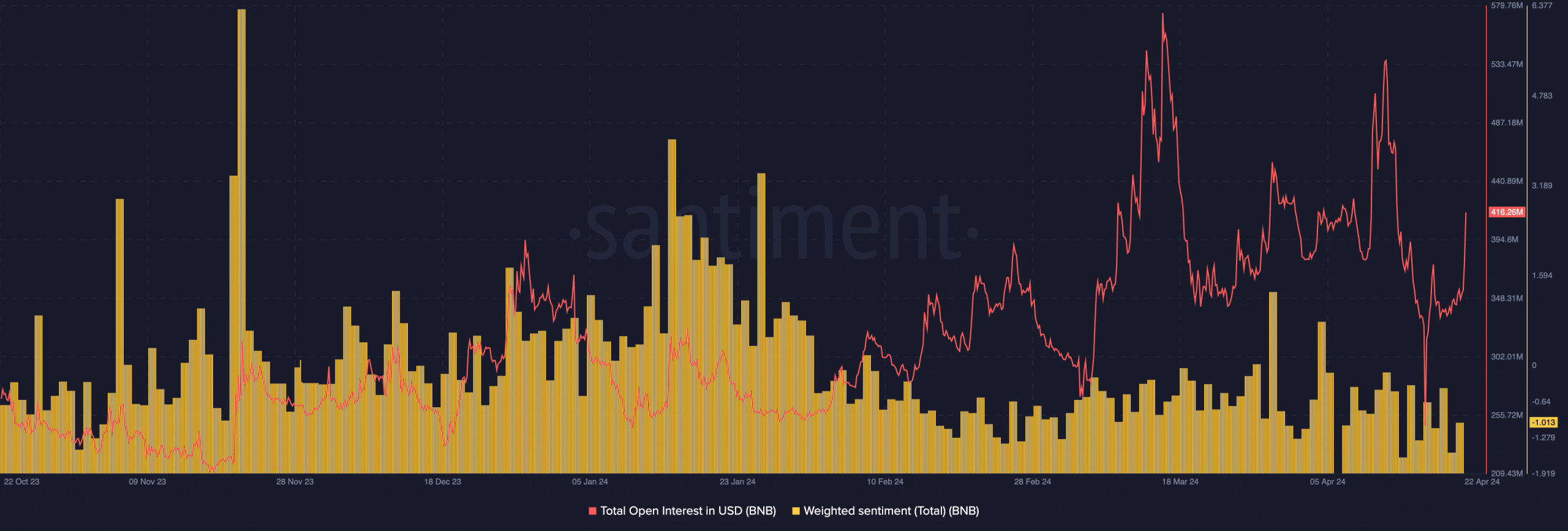

AMBCrypto examined BNB‘s potential by analyzing its Open Interest (OI) figure. According to on-chain information from Santiment, there was a rise of 17.89% in OI within the past 24 hours.

The metric was set at $416.26 million here, implying that a significant number of traders were initiating new crypto-related contracts. Furthermore, open interest significantly impacts price movements.

Despite the coin at your peril

If the OI (Open Interest) keeps rising along with prices, it’s possible that the uptrend will persist, giving long positions an advantage over short ones.

If the on-balance volume (OIV) decreases while the price increases, the uptrend may weaken, and a downturn could be forthcoming. However, it’s important to note that this might not occur right away.

In addition, the Weighted Sentiment towards the BNB coin showed a predominantly negative slant despite the overall bullish market sentiment. This unfavorable sentiment indication implies that the majority of discussions regarding BNB were pessimistic in nature.

Typically, when this indicator shows a pessimistic outlook, it’s expected to dampen the interest in the coin. However, an intriguing observation made by AMBCrypto is that despite these unfavorable conditions, BNB often experiences unexpected rallies, which some might call “hated rallies.”

Realistic or not, here’s BNB’s market cap in SOL’s terms

Traders should be cautious of BNB‘s price momentum in the near future. If the coin becomes overbought, there’s a risk that its price may correct and potentially drop below $600.

But as it stands, bears might not be able to halt the coin’s northward move.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- How Potential Biden Replacements Feel About Crypto Regulation

- Why Shiba Inu’s 482% burn rate surge wasn’t enough for SHIB’s price

2024-04-22 14:15