-

BNB chain led the way with one of the highest transactions in H1.

The BNB price is almost double its value from what it was at the start of the year.

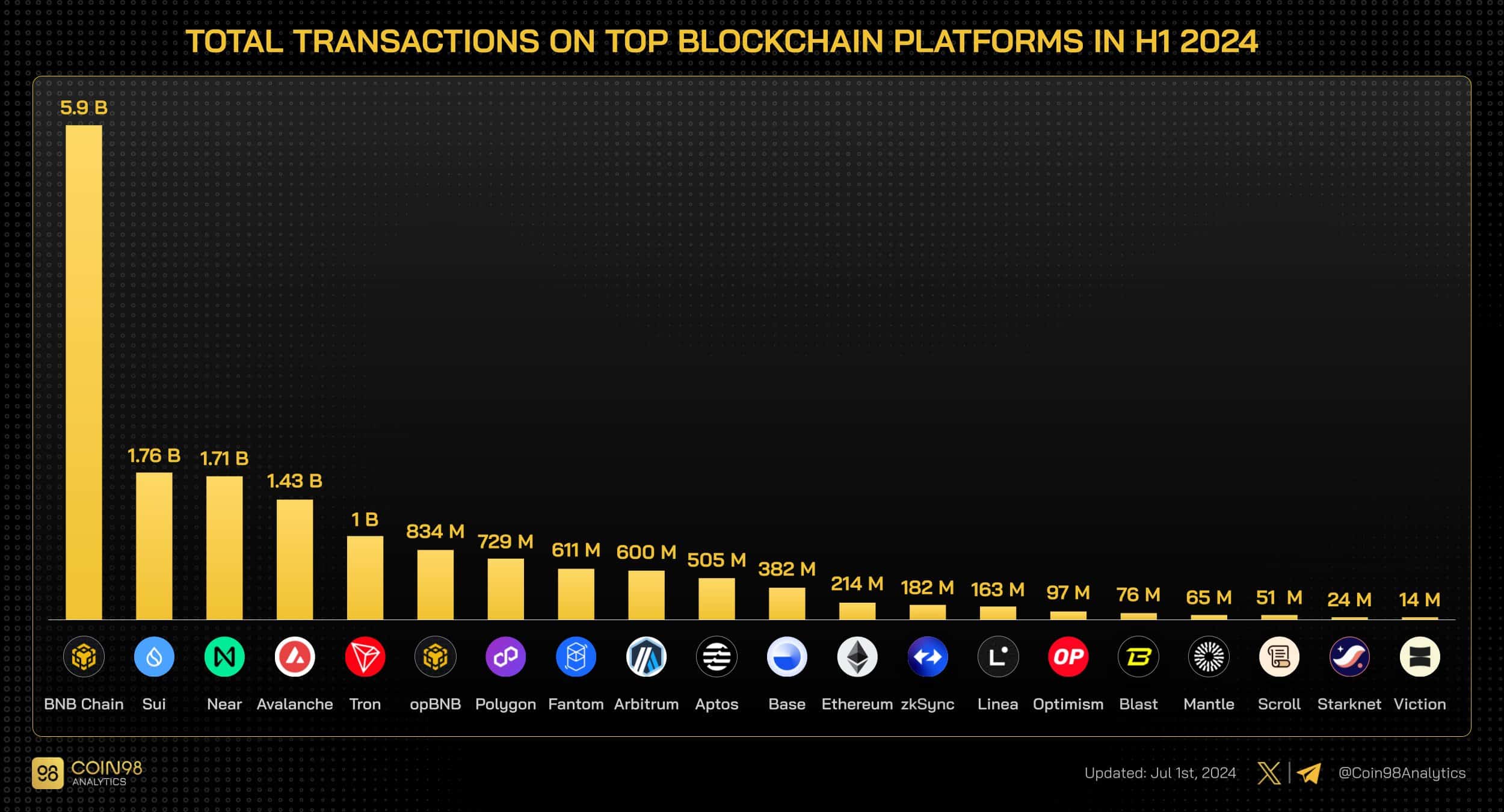

As an experienced analyst, I find the Binance chain’s performance in the first half of the year quite remarkable. Based on recent data, it led the way with one of the highest transaction volumes among blockchain networks. The impressive number of transactions, approximately 6 billion, puts Binance in a strong position within the blockchain space.

During the first half of the year, the Binance chain recorded remarkable activity with a large volume of transactions, placing it among the busiest blockchain networks. Furthermore, the Total Value Locked (TVL) on the Binance Chain underwent a significant shift over this timeframe.

Binance leads transaction trend

Based on recent figures from Coin 98 Analytics, the Binance chain has seen a substantial volume of transactions during the first half of the year.

During this timeframe, Binance Chain ranked second in terms of transaction volume amongst all blockchain networks, with approximately 6 billion transactions taking place. While Solana headed the list, Binance Chain came very close with a substantial number of transactions.

The heavy traffic on this chain clearly demonstrates its significant role and popularity in the blockchain industry. Notably, the number of transactions processed on Binance Chain outstrips that of the four leading competitors in the marketplace.

The high level of user activity in this network is a clear sign of robust connectivity and continued increase in user interaction, which are favorable symptoms indicating the network’s strength and expansion.

Binance sees remarkable TVL growth

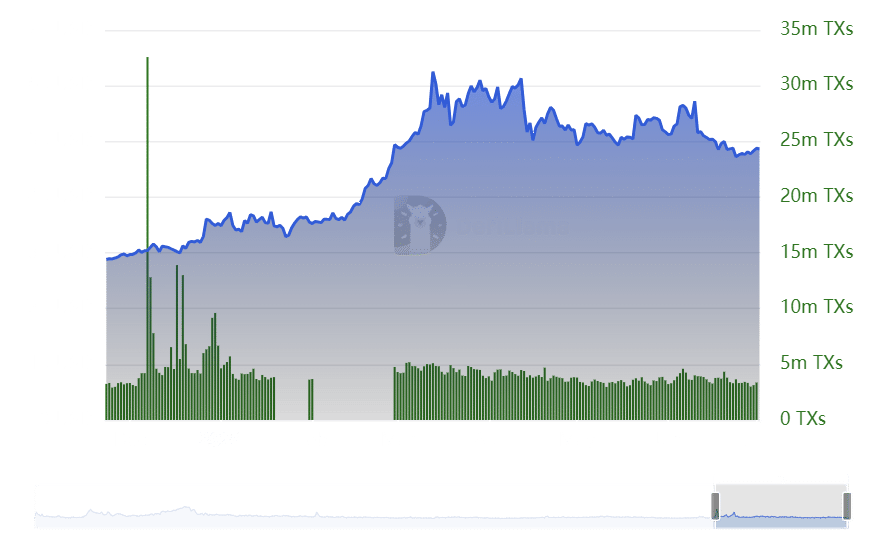

Based on the data from DeFiLlama’s assessment of the Binance Smart Chain, there has been significant expansion in the Total Value Locked (TVL) during the previous several months.

With a total value locked at approximately $3.5 billion to begin the year, the chain has consistently seen an uptick in this metric. Currently, its TVL exceeds $4.8 billion.

Despite not yet reaching its record-breaking peak, this growth represents a substantial advancement from the start of the year. Furthermore, it underscores a strong increase in assets amassed within its Decentralized Finance (DeFi) system.

Furthermore, Binance Chain has continued to see substantial transaction volume on a daily basis. According to the data, there were typically over 3 million transactions per day in most months.

As of this writing, the figures reached over 3.3 million transactions.

The patterns in total value locked and transaction activity indicate that the chain is successfully drawing and retaining substantial financial investment and user interaction.

Improved price but declining trend

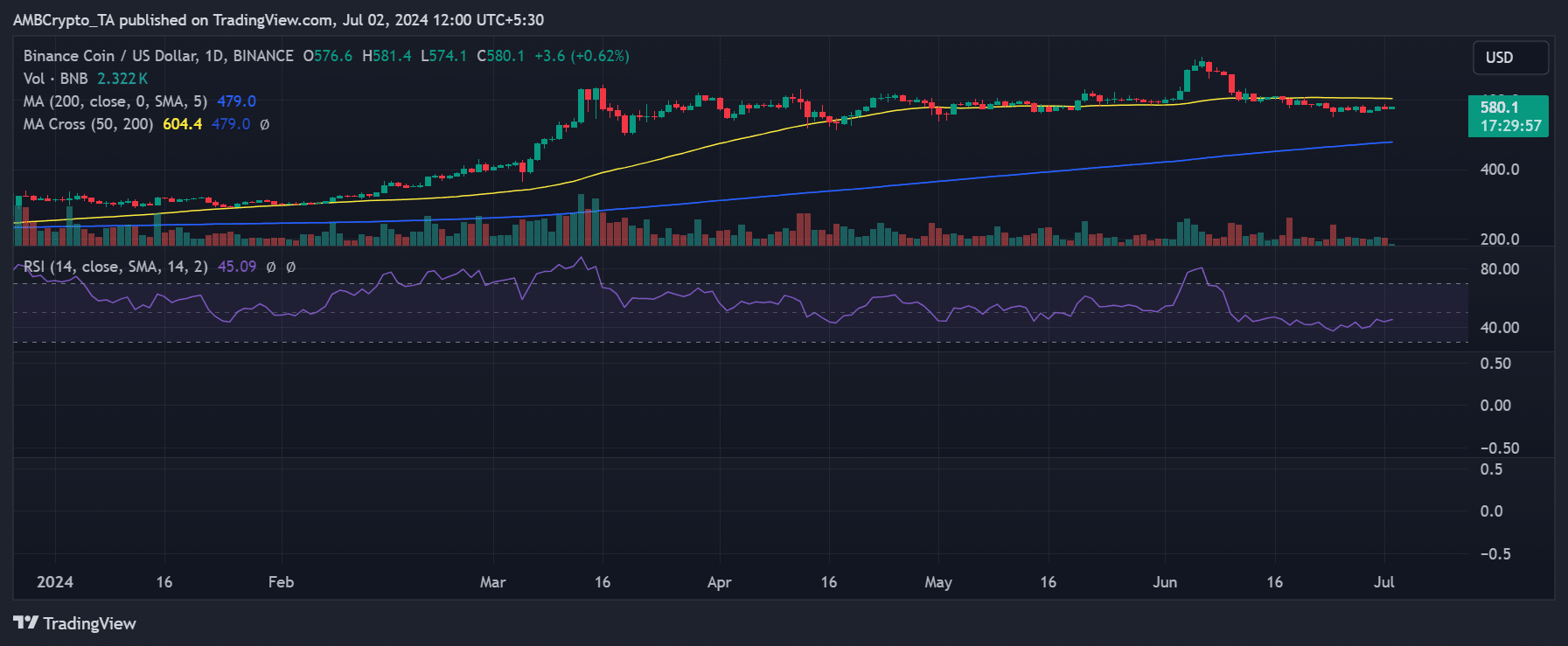

As a researcher examining Binance Coin’s (BNB) price behavior on a daily time frame chart, I discovered an impressive rise in value since the beginning of the year.

At present, the BNB token is priced approximately at $580 with a minimal rise of under 1%. This represents nearly double its initial value of around $300 that was set at the year’s outset.

As a crypto investor, I’ve been thrilled to see the significant price increase of Binance Coin (BNB) recently. However, based on current market analysis, it seems that BNB may be heading for a bear trend. The Relative Strength Index (RSI), a popular indicator used to assess the strength of a security’s recent price action, is pointing towards this trend. Keeping an eye on these developments and considering adjusting my investment strategy accordingly.

As a researcher observing the market trends, I’ve noticed that the Relative Strength Index (RSI) currently falls below the neutral threshold of 50. This indicator implies a bearish trend. The reason behind this could be investors taking profits following a substantial price increase or external factors influencing investor sentiment.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-07-02 16:08