- BNB retraced towards $700 amid increased profit-taking.

- Will weak sentiment and muted whale interest push it lower?

As a seasoned crypto investor with a knack for deciphering market trends and whale activity, I find myself standing at the precipice of uncertainty regarding Binance [BNB]. The recent retracement towards $700 is concerning, especially after BNB’s soaring nearly above $800 in December.

Binance [BNB] has cooled off after soaring nearly above $800 in December.

As I analyze the current market situation, I noticed that at this moment, the value of the altcoin has dipped down to approximately $700. This decline could be attributed to a surge in profit-taking following its all-time high of $793.

But can the altcoin defend $700 ahead of this week’s Fed rate decision?

BNB price prediction: Will $700 hold?

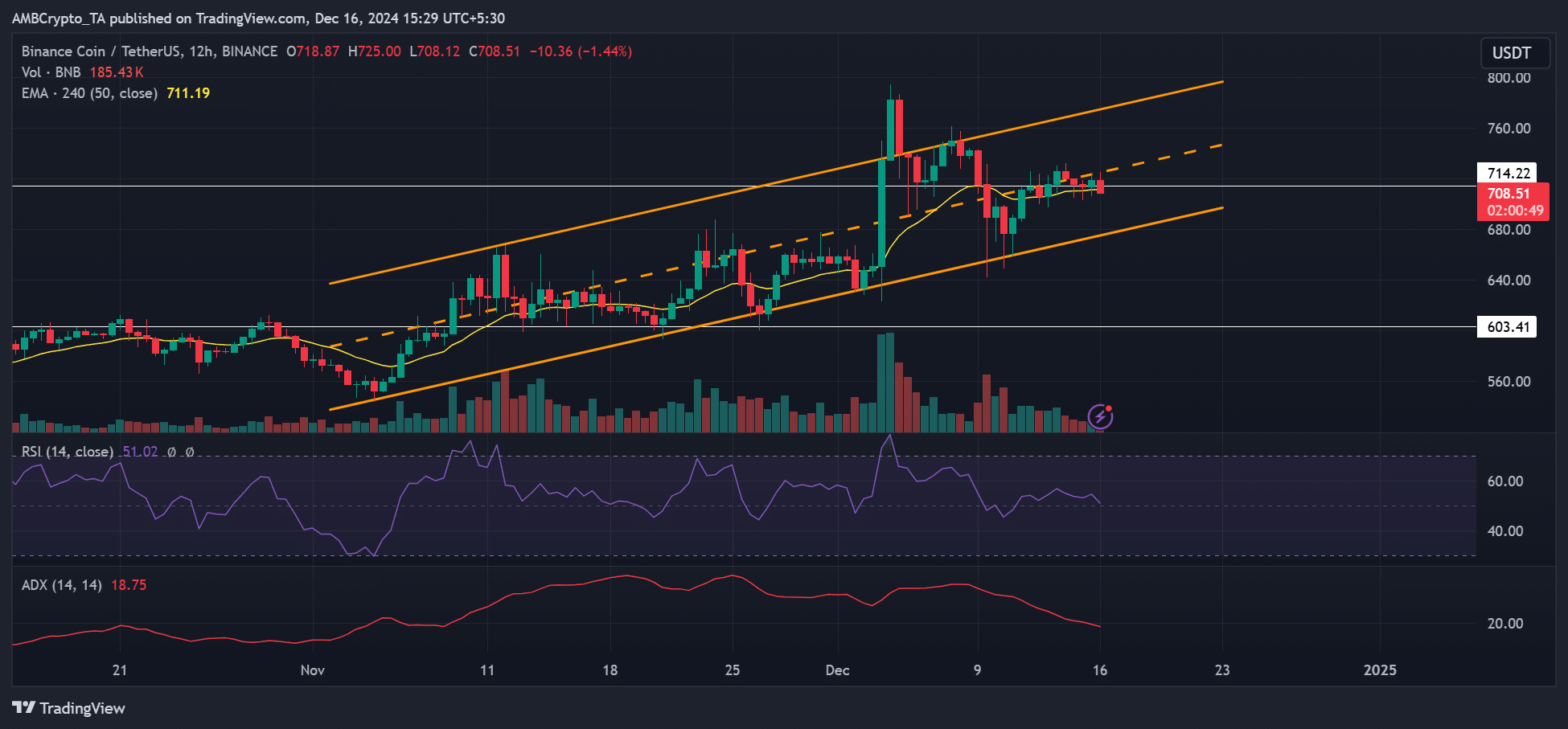

For approximately two months now, the price of BNB has been trending within an upwardly sloping channel. Recently, there have been two periods where the price stabilized near the 4-hour 50EMA (represented in yellow), but these periods saw a subsequent drop towards the lower boundary of the channel.

In the past few days, BNB’s price has fluctuated above the moving average and mid-range.

If the moving average breaks and serves as a support level instead, there’s a good chance the price might fall below $700. Furthermore, the Relative Strength Index (RSI) suggests that demand may be waning, showing less enthusiasm in its readings.

Currently, the trend’s strength is decreasing, as indicated by the falling Average Directional Index (ADX), implying that the price of BNB might drop to around $700 or lower.

Whales trim BNB exposure

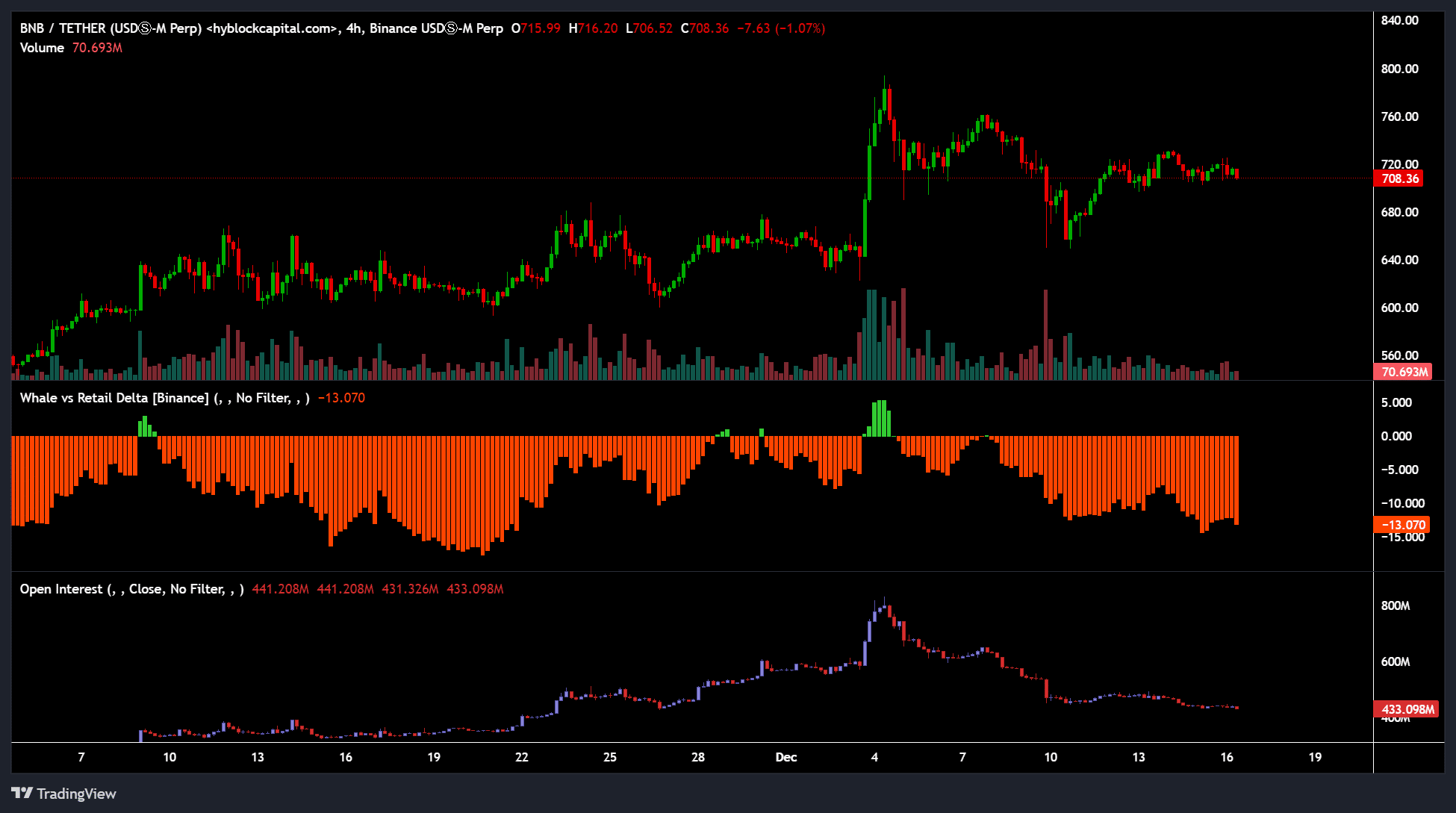

During the price surge at the all-time highs in early December, whale investors incrementally increased their holdings as suggested by the small upward spikes (green bars) on the chart comparing Whales vs. Retail positions.

However, they reduced their holdings recently, a move that aligned with the market’s correction towards $700.

Beyond whales, there was a noticeable lack of interest in the futures market, with Open Interest (OI) falling roughly 50% from $800 million down to $433 million. This decrease suggests a temporary negative outlook or “bearish” trend.

But can weak sentiment and demand push BNB below $700?

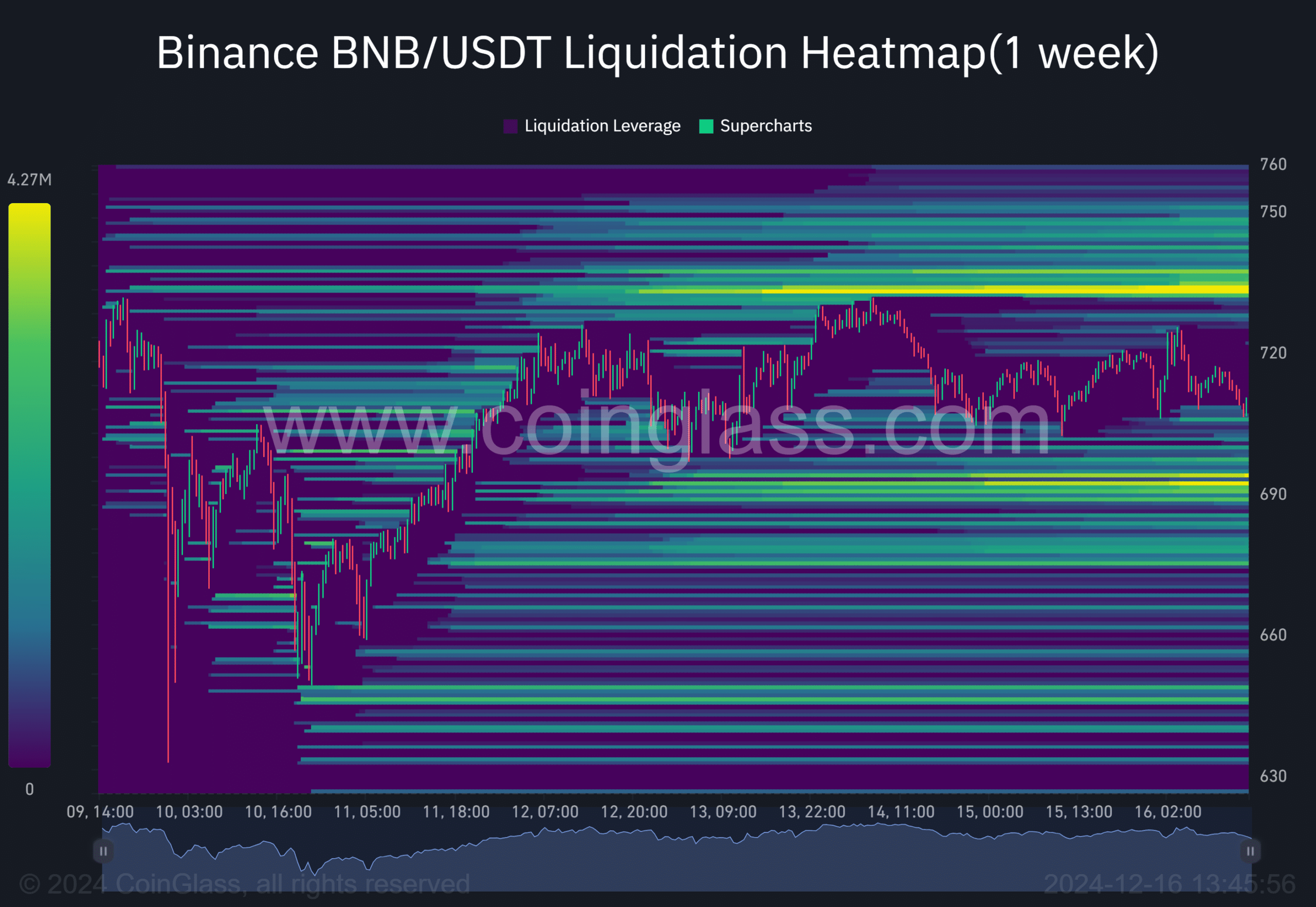

Based on Coinglass’s weekly liquidation chart, positions taken by those who shorted (betting the price would go down) were found at approximately $734 and $750, suggesting potential gains if the price rose beyond these levels.

Read Binance [BNB] Price Prediction 2024-2025

Instead, it’s important to note that a significant number of leveraged long positions were found at $690. Market makers searching for these leveraged longs might successfully drive BNB prices down towards $700. However, once they’ve exhausted the downside liquidity, they may then target the upward liquidity level at $734.

To sum up, a moderate decrease in BNB demand by large investors (whales) and a generally negative market feeling might cause it to fall beneath $700. However, should market sentiment change for the better, the liquidity points at $734 and $750 could prove alluring.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-17 04:07