- A confirmed bullish pennant breakout may position BNB for more gains

- Technical indicators and rising derivatives activity supported the likelihood of sustained bullish momentum

As a seasoned crypto investor with over a decade of experience navigating the cryptosphere, I can confidently say that the current bullish pennant breakout for Binance Coin [BNB] has my attention. The technical indicators and rising derivatives activity suggest that BNB is poised to achieve its midterm target of $725 – a level not far from its all-time high.

Investors are finding Binance Coin [BNB] intriguing due to its confirmed bullish pennant breakout, indicating the possibility of a substantial price surge. At this moment, each BNB is being traded at $624.51, marking a slight decrease of 0.98% over the past day.

Currently, BNB is sitting at a point that’s only 12.19% lower than its all-time high of $720.67, which it reached in June 2024. This recent surge raises an intriguing question: Will BNB continue to gather steam and reach its midterm goal of $725?

Further upside potential?

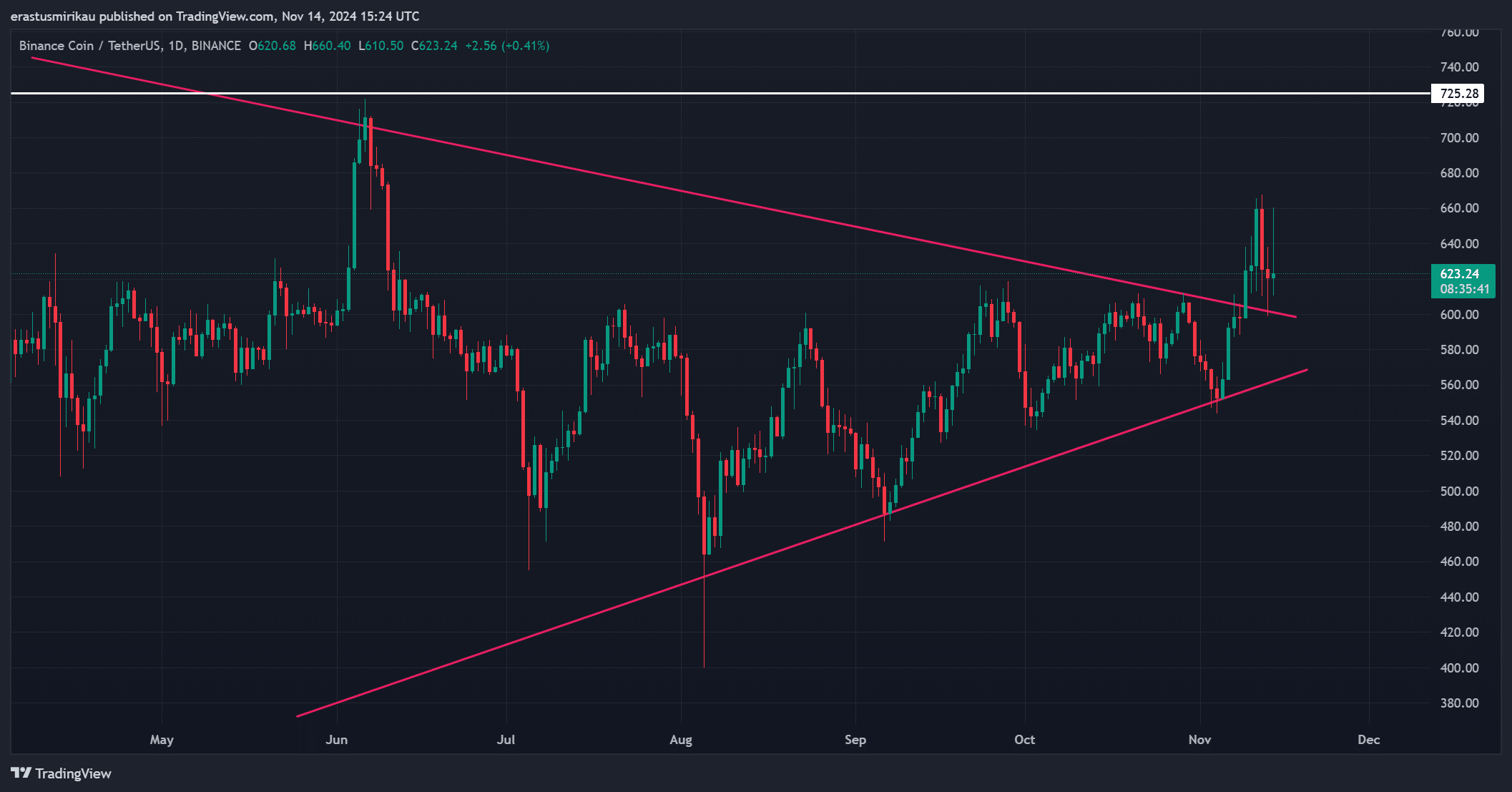

Analyzing the graph of the altcoin showed a strong bullish pennant breakout, suggesting a possible increase in its value. This breakout appeared to push BNB over a crucial downward trendline, implying a high aim for its price, which could reach $725 within the short term.

Should Binance Coin sustain its current pace and meet its objectives, it might build a robust base for potential growth, potentially aiming towards the $1,000 mark in the long run.

In the near future, prices approaching approximately $640 might encounter difficulties, whereas $600’s support could offer protection during temporary declines.

Technical indicators strengthen BNB’s outlook

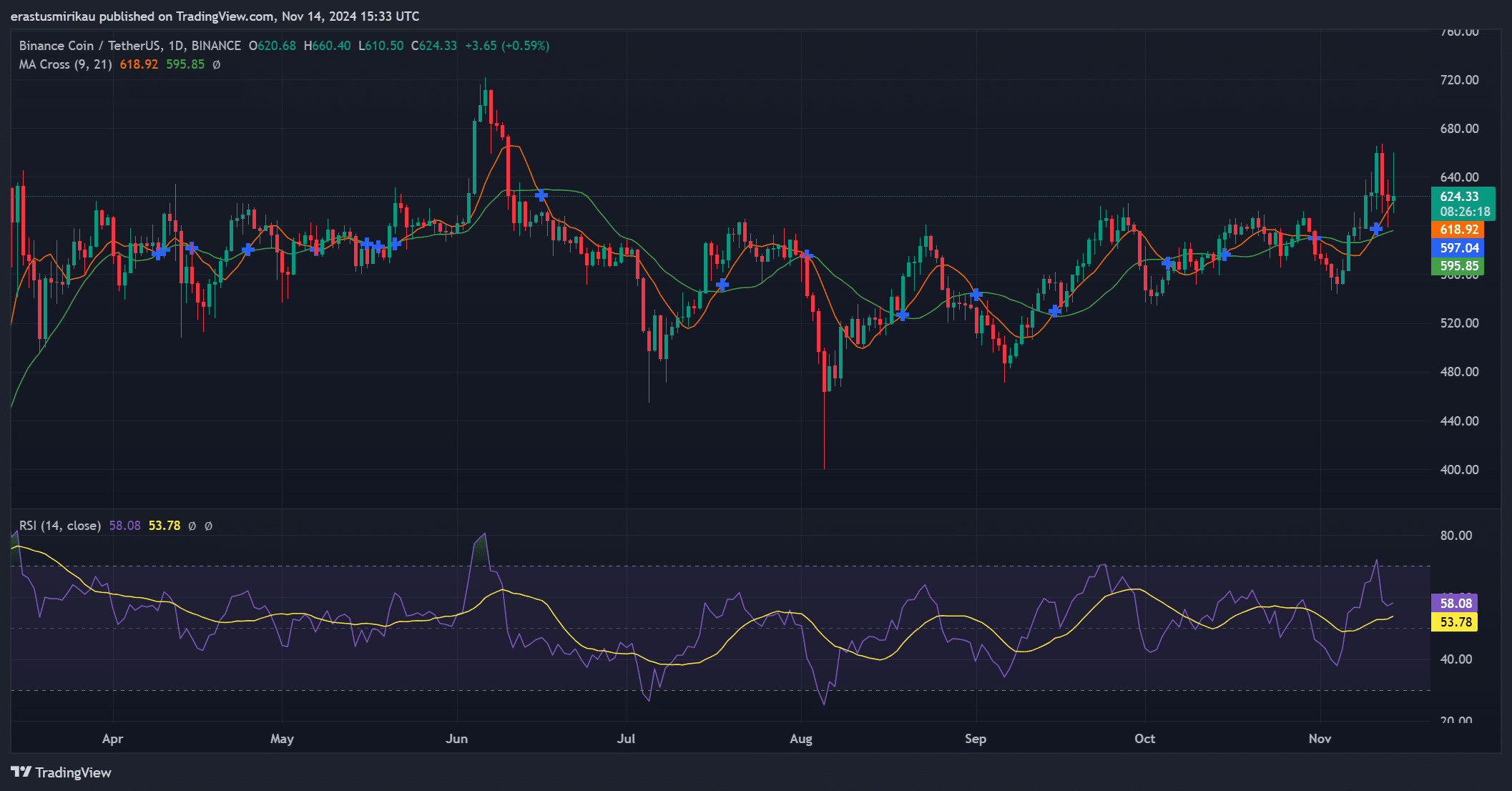

Multiple technical signs supported a positive outlook for BNB. Specifically, the Relative Strength Index (RSI) was roughly at 58.08, suggesting a balanced environment for expansion that didn’t hint at the risk of excessive buying.

Moreover, the recent crossover of the Moving Averages (MA), specifically between the 9-day and 21-day averages near $618, serves as another robust bullish indicator – A clear demonstration of persistent price growth. Consequently, the harmony of a positive RSI and MA crossover complemented the pennant breakout, boosting the chance that BNB will achieve its goal.

Increasing interest in BNB

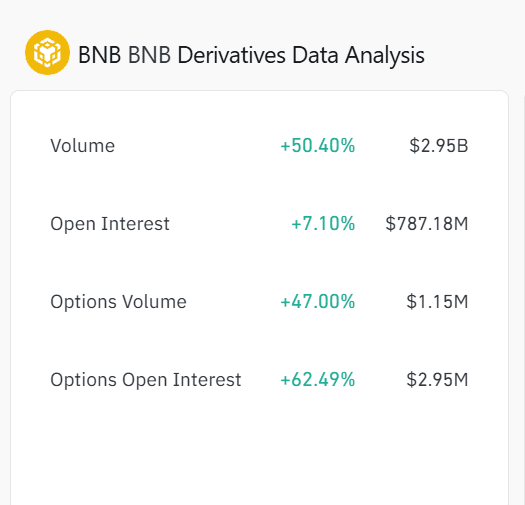

The derivatives data reinforced its optimistic outlook as volume increased by approximately 50.40%, reaching $2.95 billion, and the Open Interest climbed up by around 7.10% to a total of $787.18 million.

As a researcher, I’ve observed a significant surge in my findings: The Options volume has escalated by an impressive 47.00%, while Open Interest in Options has experienced a notable increase of 62.49%. These upward trends suggest heightened confidence among traders, who appear to be strategically positioning themselves in anticipation of a potential market upswing. This projected rally seems to be fueled by the recent technical breakout.

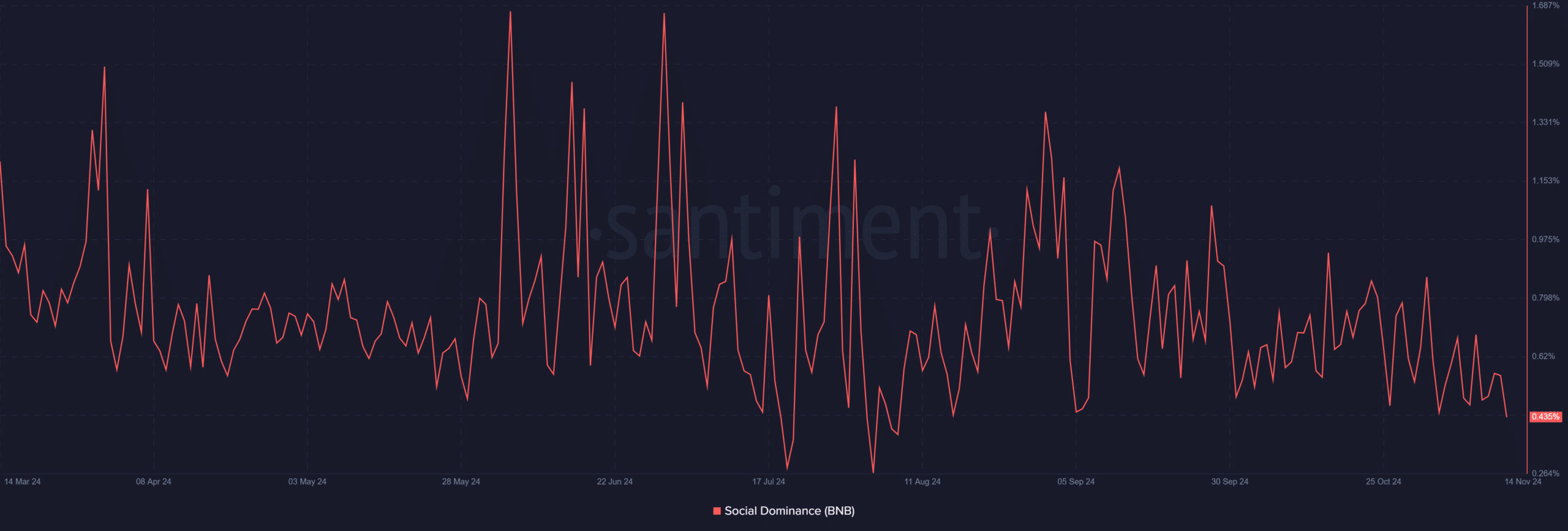

BNB’s social dominance declines despite positive outlook

It’s worth noting that the social dominance decreased from 0.562% to 0.435%. This decrease indicates a possible reduction in social media focus. This reduction might be due to lessened enthusiasm among retail traders, despite the fact that technical indicators and derivatives data remain robust.

On the other hand, such a transition might stimulate fresh attention towards BNB. Particularly if it manages to reach its goal of $725 and maintain positive momentum.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

BNB poised to reach $725 target and beyond

At the current moment, BNB seems poised for a bullish run towards its projected mid-term goal of $725, given its successful breakout, optimistic technical signs, and growing derivatives market activity.

Reaching this point might strengthen its optimistic perspective even more, potentially leading to a prolonged upward trend. In simpler terms, Binance Coin (BNB) could be poised for additional growth if it maintains its current momentum and manages to draw in increased attention from individual investors.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-15 11:36