-

BNB recently dipped below $500, which resulted in a resurgence of buy pressure.

Assessing the potential implications for price in case it maintains momentum.

As a seasoned crypto investor with a knack for recognizing patterns and trends, I find myself intrigued by Binance Coin’s [BNB] recent performance. After dipping below $500, the resurgence of buy pressure is a testament to the coin’s robust utility and resilience above this price level since March.

As a researcher, I’ve noticed an intriguing trend with Binance Smart Chain’s Binance Coin [BNB]. Despite the general downward pressure on most top cryptocurrencies, which are currently trading significantly lower than their March highs, BNB has managed to hold its ground above the $500 price level since then. This resilience is certainly worth further exploration and analysis.

BNB reached a fresh peak in June, suggesting strong practical value. Occasionally, its price has dropped below $500, but it quickly bounced back.

This encompasses its downward trend over the past couple of weeks, dipping to a low of $471 on the 6th of September.

At the moment of reporting, BNB was traded at approximately $509.6, indicating robust demand levels under $500. Upon closer inspection, it appears that BNB has been moving in a horizontal pattern, experiencing noticeable fluctuations both upward and downward since March.

From the graph presented, it’s evident that there’s been consistent support and resistance at the recent lows (dips) and highs (peaks). Given this pattern, it seems like the price is gathering strength for a potential rise to another peak.

Given these circumstances, there’s a possibility that BNB might surge by an additional 15% or more, reaching towards the next significant resistance point. This potential development could potentially drive the price beyond $190.

Assessing BNB chain’s prospects

At the current moment, BNB had climbed more than 7% above its most recent weekly low price. This rise aligns with a surge in anticipation for an “altcoin season,” which has occurred after a decrease in Bitcoin‘s influence.

The continuation of BNB‘s current pace hinges on the demand for the token and the level of activity within the Binance Smart Chain.

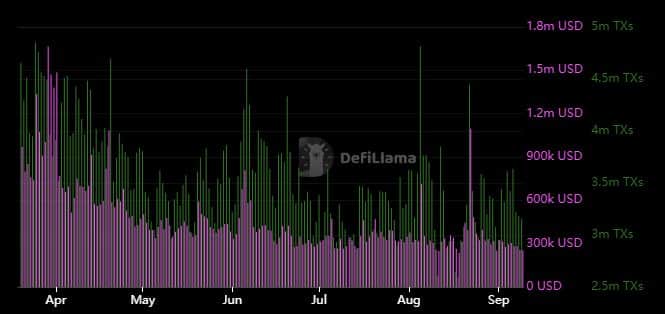

At this moment, we’re seeing an increase of 6.19% in the number of weekly active addresses on the Dune network. Yet, the overall network activity seems to be still building up, as there was a slight decrease of 1.1% in weekly transactions.

This was also evident in network fees, which also slid over the weekend.

The significance of these results lies in their illumination of the current level of organic interest in the Binance Coin market (BSC). Intense interaction within the network tends to increase the desire for BNB, thereby influencing its value.

This can be observed during instances of more market confidence, especially in altcoins.

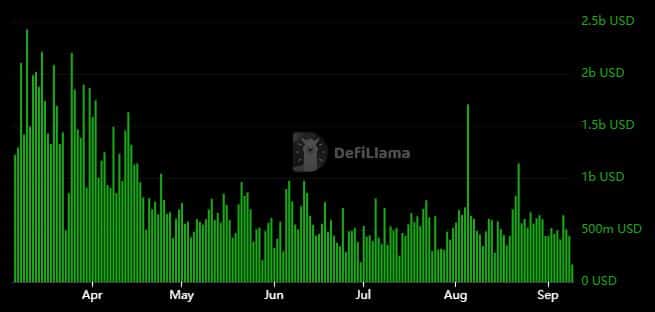

Regarding the amount of data being processed on-chain, there’s been a noticeable decrease for the past five months. This trend has also continued over the last fortnight, with the market experiencing an increase in unpredictability.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

It’s quite possible that the reappearance of “altseason” will cause an increase in on-chain activity, approaching the levels experienced as recently as March.

In this situation, it’s uncertain whether BNB will indeed benefit, but it could strongly profit if there is a significant increase in demand. Conversely, if the price continues to fall from its current point, it might lead to a chain reaction of sellers rushing to offload their holdings.

Read More

2024-09-09 21:11