-

Bearish sentiment around BNB increased as its price fell.

Market indicators and metrics hinted at a trend reversal.

As an experienced crypto analyst, I have seen my fair share of market fluctuations and price movements in the digital currency space. With BNB‘s recent price drop and the bearish sentiment surrounding it, I believe that a trend reversal could be on the horizon. While it’s true that the coin’s price declined by more than 1.7% in the last 24 hours, and its trading volume sank by 14%, the chart patterns suggest otherwise.

In the past few hours, the value of most cryptocurrencies, including Binance Coin (BNB), experienced significant declines, resulting in a notable drop in the crypto market.

“BNB‘s price has been confined to a particular pattern. If this pattern is broken, there could be a significant surge in the price.”

BNB’s chart turns red

In recent developments, cryptocurrencies including Bitcoin (BTC) and Ethereum (ETH) experienced price decreases. Consequently, Binance Coin (BNB) mirrored this trend, recording a decline of over 1.7% in value during the past 24 hours.

Based on the data from CoinMarketCap at this moment, I see that the coin’s current price is hovering around $583.63. Its market value, which represents the total worth of all existing coins in circulation, exceeds an impressive $86.1 billion.

Although the price of BNB had dropped, an intriguing development emerged as it formed a bullish pennant pattern during consolidation.

A well-known cryptocurrency analyst, World Of Charts, recently shared on Twitter their observation of this particular chart pattern. According to their post, should the coin manage to surmount this pattern in an upward direction, it could potentially trigger a significant bull market for investors.

In fact, the rally might as well clear BNB’s path towards $1000 in the coming weeks.

What to expect in the short term?

To determine if reaching $1000 for BNB was a feasible near-term prospect, AMBCrypto analyzed its key performance indicators.

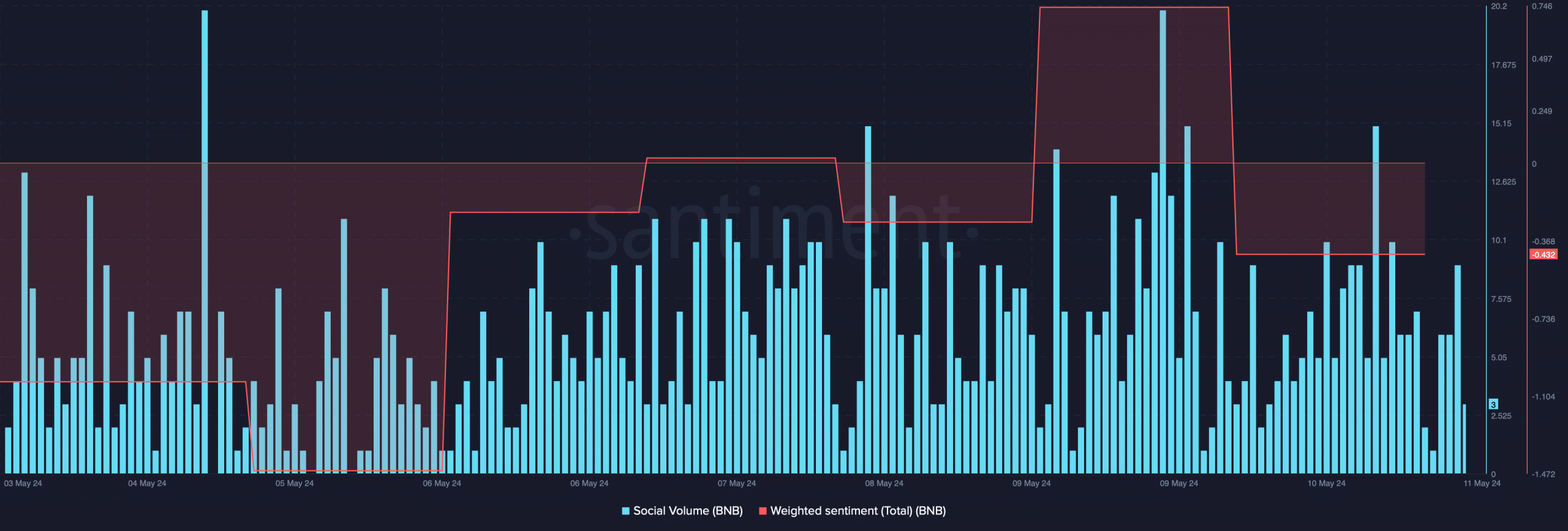

Based on our examination of Santiment’s statistics, there was a rise in the coin’s social activity, but its value decreased. Simultaneously, the pessimistic sentiment surrounding BNB grew more prominent, as indicated by a decline in its weighted sentiment.

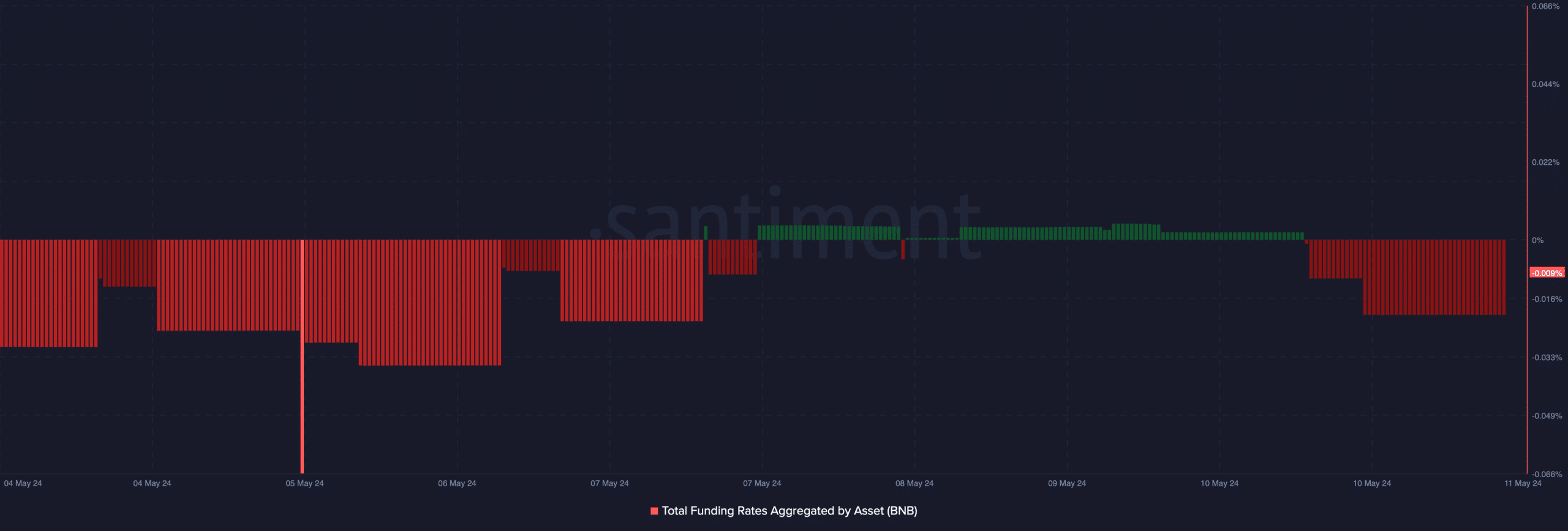

Despite the decrease in the coin’s price, its trading volume dwindled by 14%. Normally, a diminishing trading volume is an indication that the current price trend may be coming to an end. Furthermore, BNB‘s funding rate has now shifted to negative.

From my perspective as a researcher observing market trends, it appears that price movements and funding rates have been diverging lately. Given this observation, I believe there’s a strong possibility of an imminent trend reversal in either prices or funding rates.

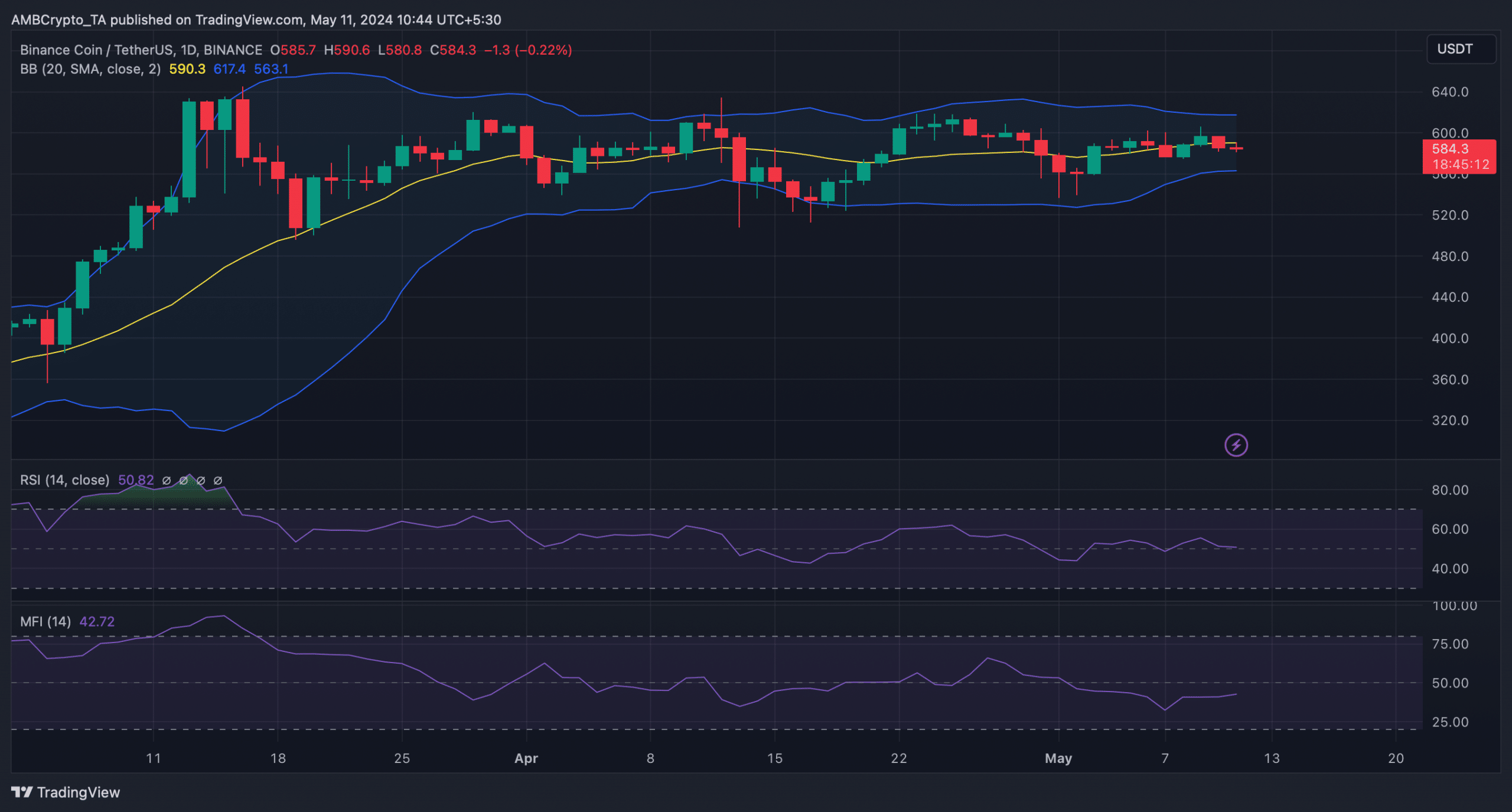

After examining BNB‘s daily chart, we noted the following indicator readings. According to our assessment, the Money Flow Index (MFI) for the coin had remained relatively stable over the past few days.

The RSI pattern mirrored the trend, implying potential for a brief respite with slower market movements for investors.

According to the Bollinger Bands analysis, the coin’s price was located in a less volatile region, implying that the risk of a significant unexpected price drop was relatively low.

As a crypto investor, I examined the coin’s liquidation heatmap and discovered that a significant increase in liquidations was imminent around the $573 price level.

If bears continue to hold their ground in the next few days, the price of BNB could potentially drop down to that level before rising again.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- SOL PREDICTION. SOL cryptocurrency

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- LINK’s $18 Showdown: Will It Break or Make?

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-05-11 14:15