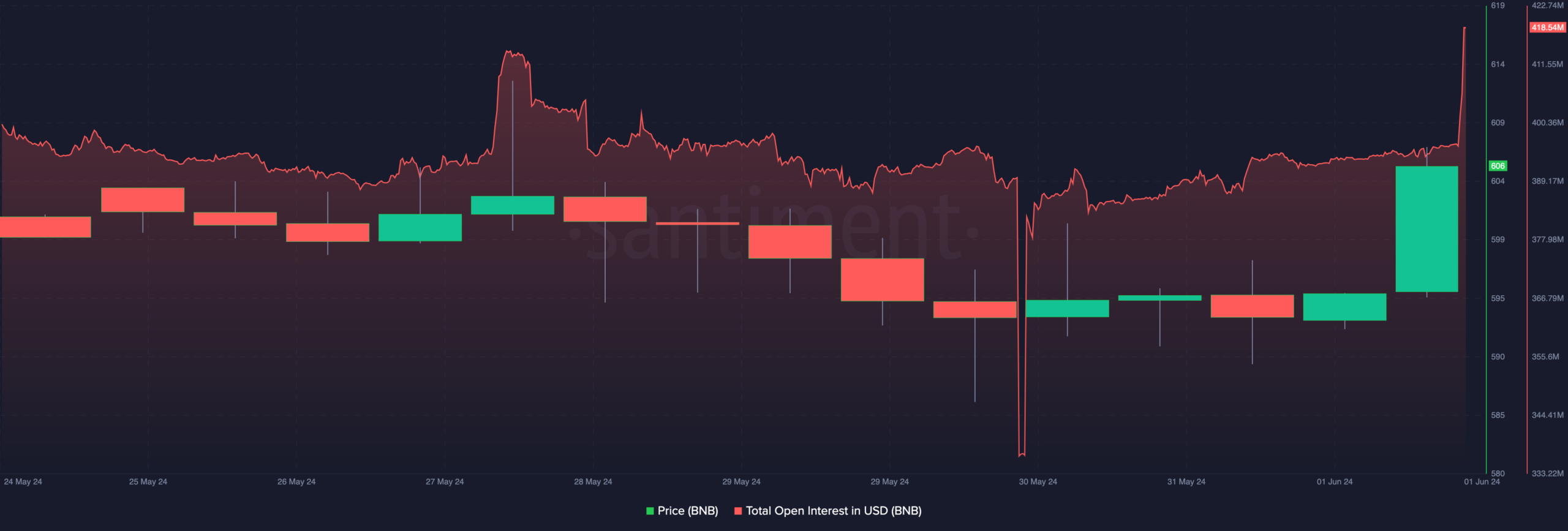

- Altcoin’s price moved from $593 to $607 after the Open Interest added almost $100 million

- Momentum seemed bullish, indicating that the price could climb close to $700

As a seasoned crypto investor with a keen interest in Binance Coin [BNB], I find the recent surge in Open Interest (OI) intriguing. The metric, which indicates the amount of money flowing into contracts related to BNB, has risen significantly from $335 million to $418.54 million in just a few days.

As an analyst, I have observed that Binance Coin’s [BNB] Open Interest (OI) has rebounded after experiencing a dip a few days ago. Specifically, on May 30th, the OI figure was recorded at $335 million according to the charts.

At the point when we checked, the open interest data from Santiment indicated that this figure had risen to $418.54 million for the given contracts associated with the cryptocurrency. Open interest signifies the amount of money being invested in these contracts, showing whether there is an influx or outflow of funds.

The “god candle” appears

When the Open Interest (OI) goes up, it indicates that traders are introducing new positions into the market. On the other hand, a decrease in OI signifies that traders are closing their existing positions and withdrawing their liquidity from the market.

In the case of Binance Coin (BNB), an increasing open interest (OI) might bolster the market’s momentum. Currently, the BNB price hovers around $607.57.

It’s important to mention that, based on AMBCrypto’s evaluation, the particular candlestick that drove the price up was referred to as a “powerful candlestick” or “strong candlestick.” The term “god candle” is an expressive way of describing it.

As a crypto investor, I’ve come across the term “god candle” which refers to an astonishing price increase happening in a very short timeframe on a chart. For instance, just by looking at the attached BNB chart, it’s evident that its price was $593 before this unexpected and seemingly too-good-to-be-true surge occurred.

The recent spike in demand for this coin is a clear indication that it’s driving the current upward trend. Previously, when BNB exhibited similar behavior, its price reached an impressive peak of $641.

As a crypto investor, I believe that if the bears manage to reject the uptrend, we may see a retracement in price down to around $585. However, if the bulls are strong enough to break through the resistance level, then the value of the coin could potentially rally and head towards $686, as AMBCrypto forecasted.

Negative sentiment can’t stop the move

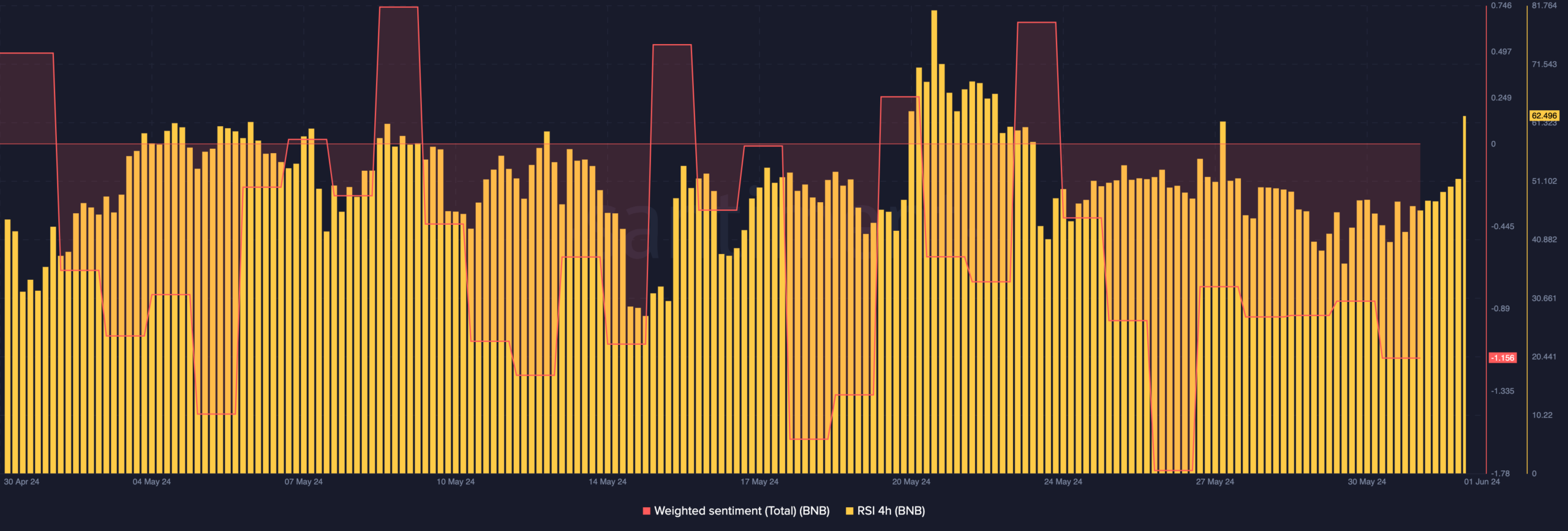

Consider examining the Weighted Sentiment towards BNB as well. Currently, the sentiment score stands at a relatively low point of -1.156. This figure suggests that a large proportion of remarks regarding BNB have been negative in nature.

As a crypto investor, if BNB‘s price continues to rise, it may shift the coin’s narrative and spark optimistic feelings among investors. Consequently, demand for BNB could surge, potentially validating the bullish price forecast.

Another indicator AMBCrypto examined was the Relative Strength Index (RSI).

The Relative Strength Index (RSI) measures the cryptocurrency’s momentum. When the RSI value is 30 or less, it signifies that the crypto is being bought less than usual and could be underpriced. Conversely, a reading of 70 or more suggests that the crypto is experiencing heavy buying and might be overvalued.

As of the current news update, the Relative Strength Index (RSI) for BNB on the 4-hour chart stood at 62.49. Such a figure suggested an uptick in purchasing power within the market.

As an analyst, I would interpret the current trend as suggesting that BNB‘s price may continue to rise if the momentum remains strong. However, should the momentum weaken, there is a possibility that the coin’s value might not reach $700 and could instead dip below $600.

Realistic or not, here’s BNB’s market cap in BTC terms

As a researcher observing the market trends, it appears that traders may be inclined to increase their BNB contract holdings based on current price patterns. The majority of open positions seem to lean towards buying, suggesting potential gains if the price upward trend continues. Should this occur, long-term investors could potentially reap rewards in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-06-02 11:03