-

opBNB testnet launch aims to boost scalability and reduce costs.

Recent price action suggests the potential for a bullish breakout.

As a dedicated researcher with a background in blockchain technology and cryptocurrencies, I have closely monitored the recent developments within the Binance ecosystem. The upcoming opBNB testnet launch on Binance Smart Chain (BSC) has piqued my interest due to its potential to address scalability issues and reduce costs.

As a researcher exploring the latest developments in the blockchain industry, I’m excited to share that Binance Chain is making waves with its newest innovation: the opBNB Layer 2 testnet. This groundbreaking project, which utilizes Optimism’s OP Stack, aims to directly address scalability challenges through a robust and effective solution.

OpBNB has the potential to revolutionize the network by drastically increasing transaction speeds and reducing costs.

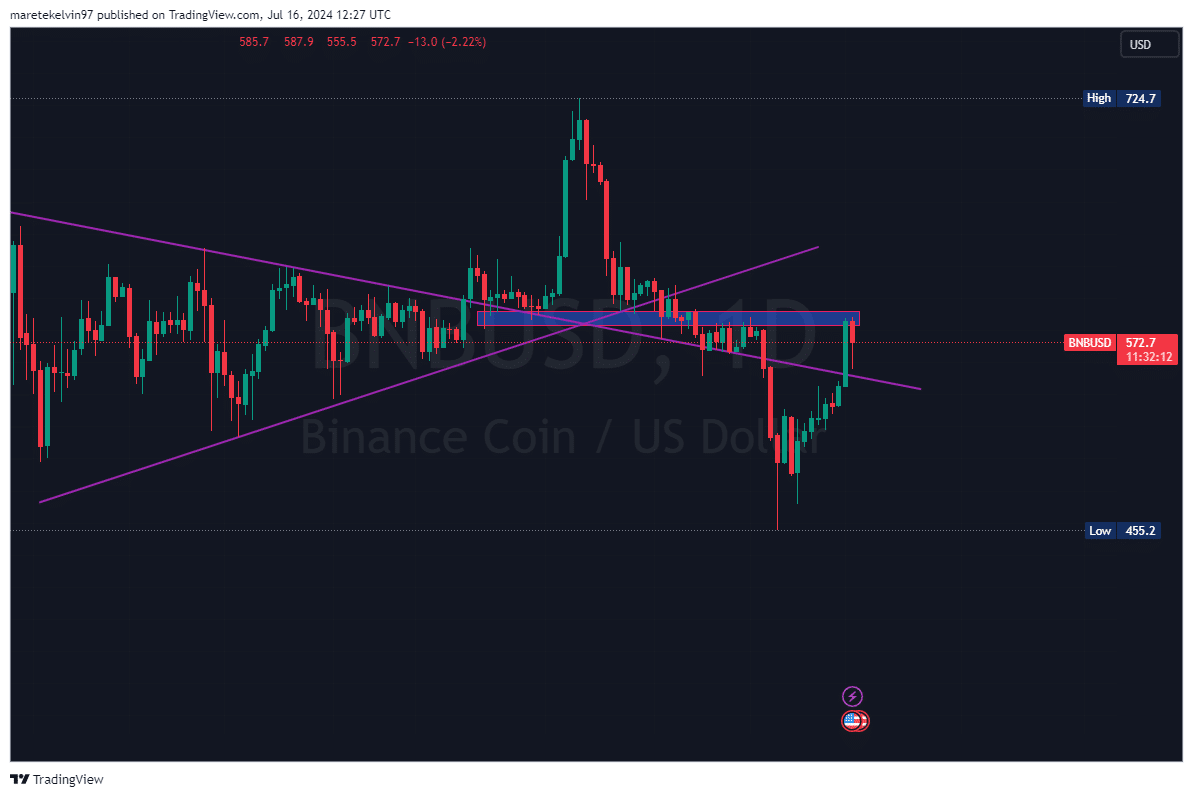

Recently, Binance Coin (BNB) has experienced significant volatility, recording a robust increase of approximately 29.4% since touching its support level at $455.2.

Following its escape from a triangular pattern’s downward trend, BNB accumulated sufficient force to surpass the previous $572.7 support, which had transformed into robust resistance, signaling a shift in market dynamics.

As a researcher studying financial markets, I’ve observed that recently, the price has been driven up by the bulls, pushing it to challenge previous resistance levels. However, a brief correction ensued, which could potentially pave the way for another bullish rally and subsequent price increases.

BNB metrics paint a bullish picture

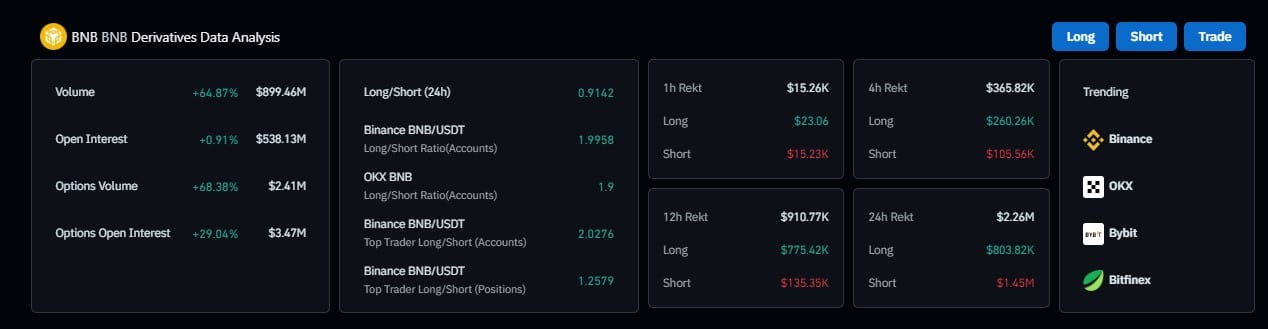

Based on AMBCrypto’s assessment, the trading activity indicated by Coinglass has noticeably increased, as evidenced by the data.

As an analyst, I’ve noticed an intriguing development in the Binance Coin (BNB) market: the trading volume has witnessed a significant surge, reaching a remarkable $899.46 million. This represents a substantial 64.87% increase compared to previous levels. The magnitude of this spike implies heightened interest and engagement from traders in the potential opportunities offered by BNB.

The surge in open interest for derivatives wasn’t only about quantity, as it grew by 0.91% to reach $538.13 million, implying a greater number of participants in the market.

The options market is experiencing a significant surge. The trading volume has increased by 68.38%, amounting to $2.41 million, while open interest has risen by 29.04% to reach $3.47 million.

As an analyst, I’ve observed a notable increase in trader confidence based on recent data. Specifically, the long to short ratio for the Binance BNB/USDT pair reached 1.9958 at the time of my analysis, indicating a stronger bullish sentiment in this market.

The potential catalyst for BNB

With the introduction of BNB Chain’s opBNB Layer 2 solution, there is growing excitement about its possible influence on BNB’s price. This new development offers the prospect of enhanced scalability and reduced transaction costs, which may lead to heightened network activity and potentially trigger a significant price surge.

With the merging of favorable conditions—the successful launch of the Omnibus BNB update, a bullish market environment, and advantageous price trends—Binance Coin (BNB) appears primed for a possible price surge.

Should the current trend persist, there is a strong possibility that BNB will break through its previous resistance points, leading to a notable price shift for the token.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-07-17 12:07