-

BNB faces key resistance at $560, with a potential breakout targeting $725 for a 19% price increase.

RSI suggests neutral momentum, while a break above $545 could trigger a bullish rally toward $600.

As a seasoned crypto investor with battle-scarred fingers and a heart full of stories from the volatile world of digital assets, I’ve seen my fair share of bull runs and bear markets. The latest development with Binance Coin [BNB] has piqued my interest, as it seems to be forming an inverse head and shoulders pattern on its chart – a classic bullish reversal signal.

It appears that Binance Coin [BNB] is exhibiting indications of a possible bullish breakout, as an inverted head and shoulders pattern seems to be taking shape on its chart. This well-known bullish reversal signal implies that BNB may experience a significant surge if it manages to breach crucial resistance levels.

The three points – the left shoulder, head, and right shoulder – have a curved base, and the neckline is approximately located at $560. Investors are closely monitoring this price point, as a surge beyond it could validate the bullish prediction.

Should BNB successfully breach its current neckline, this pattern suggests a potential price rise toward approximately $725, representing an increase of about 19.45% from its current value around $545. This projected level is derived from the distance between the pattern’s head and neckline, which serves as the estimated breakout range.

Key support and resistance levels

Right now, BNB is hovering around $545, encountering potential obstruction at approximately $560 – a significant line that could decide if the reversed head and shoulders pattern has been officially validated.

As a researcher, I hypothesize that surpassing the $560 mark in the closing price might initiate a prolonged bullish trend. If this occurs, the subsequent hurdle for the price increase could be the $725 level, acting as a significant resistance point.

On the negative side, the nearest strong resistance is approximately $530, a level that has historically been robust during recent price fluctuations. If BNB falls below $530, the next major support can be found around $383. This potential drop could weaken the bullish argument.

RSI and market sentiment

In simple terms, the Relative Strength Index (RSI) stands at approximately 54, which means there’s no clear trend or pressure in the market. This number doesn’t signal either buying excess (overbought) or selling excess (oversold), allowing for potential price fluctuations up or down.

Conversely, given that the Relative Strength Index (RSI) currently exceeds 50, it could foster a rise in bullish feelings if purchasing momentum intensifies.

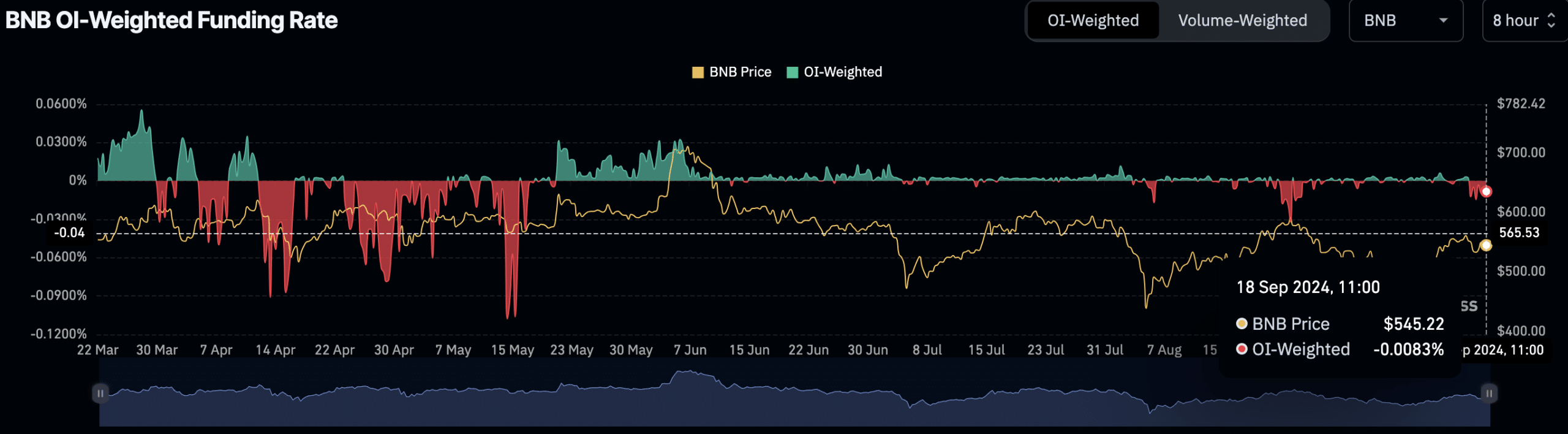

According to data from Coinglass, as of September 18, 2024, the BNB OI-Weighted Funding Rate stands at -0.0083%. This rate hints at a slight tilt towards bearish sentiments in the market. However, if bulls manage to seize control, the trend could flip very quickly, favoring long positions instead.

At the moment of publication, BNB was being traded at approximately $545.22. The oscillations around this value hint at a sense of market indecision.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Based on findings from AMBCrypto’s latest study, traders might anticipate a potentially profitable setup offering a 1:3 risk-to-reward ratio. The suggested entry point lies above $545, with the goal of reaching $600. If the market doesn’t go as planned, a stop-loss should be set around $525 to limit potential losses.

But the trading setup will only become active if Binance Coin (BNB) finishes its daily chart with a close above $545, which indicates an increase in bullish power.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-09-19 12:07