-

The BNB market has not trended in the past two months, but traders still have opportunities.

Investors can take heart from the similarities between the early 2024 consolidation and the current one.

As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market consolidations. The current stagnant phase of Binance Coin (BNB) in the past two months may not be trending, but it presents opportunities for those willing to dig deeper.

As a crypto investor, I’ve noticed that Binance Coin (BNB) has been trading between specific price levels over the last two months. Among these levels, two have piqued my interest as potential opportunities for swing trading.

Previously, AMBCrypto identified these price points in their analysis, indicating that the BNB market was experiencing a period of price stabilization.

As a crypto investor, I’ve noticed that the sentiment towards the exchange token’s weighted value was on the negative side. This observation implies that potential buyers in the market may not be eager to make purchases due to their perceived unfavorable outlook on the token.

Based on my analysis of the technical indicators and price movements, it seemed that an uptrend rather than a downtrend was a stronger possibility for the upcoming weeks.

A look at the January consolidation shows where BNB could head next

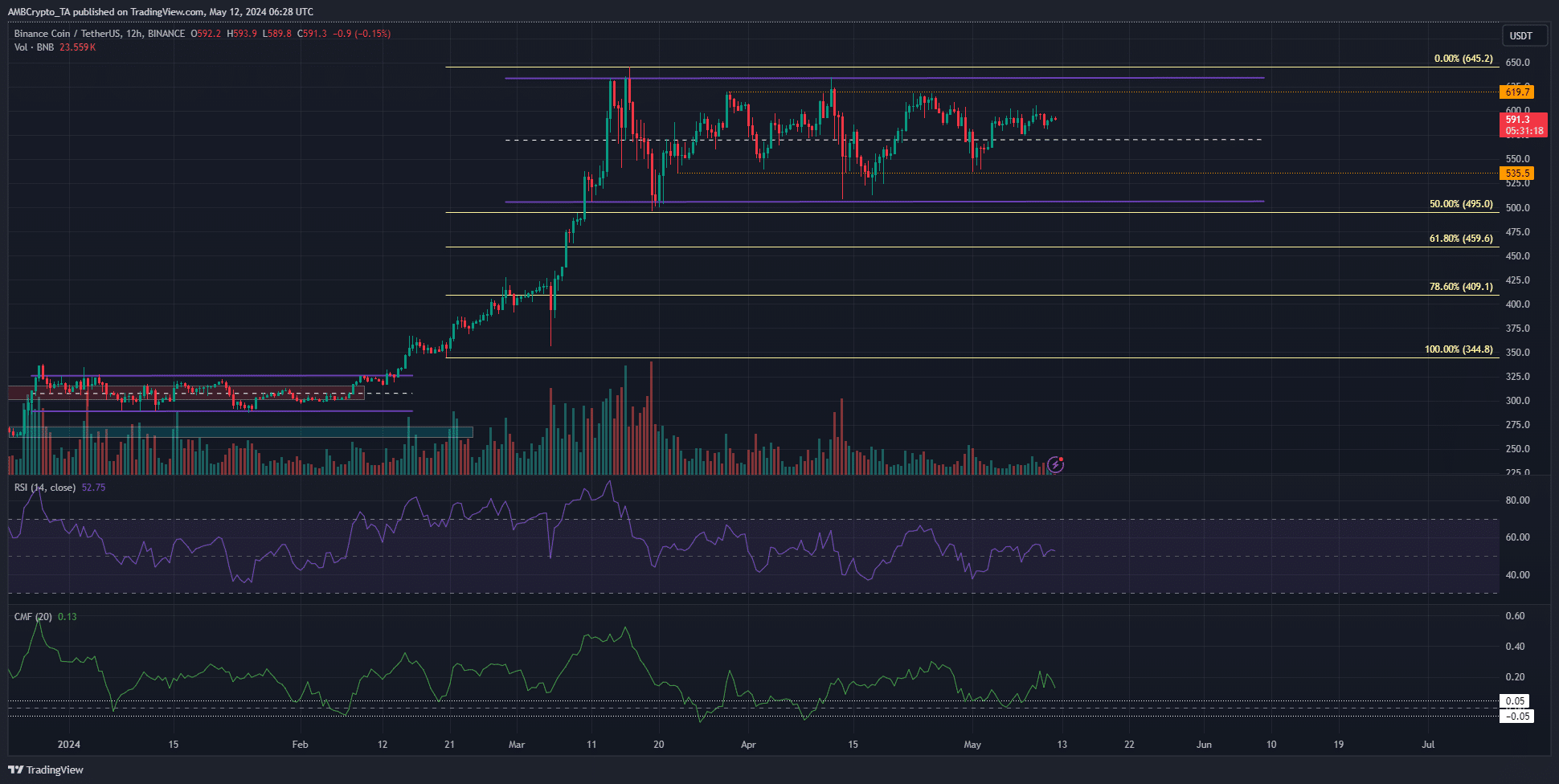

As a crypto investor, I’ve noticed that the price action of BNB over the past two months has formed a range between $506 and $633, which I’ve marked in purple on my chart for reference. More recently, over the last six weeks, BNB has been trading within a narrower range of $619 to $535. These levels have become particularly significant as they represent the upper and lower bounds of this more recent price action.

As a researcher observing market trends, I’ve noticed that during the present consolidation period in 2024, trading volumes bear resemblance to those experienced earlier in the same year. Towards the terminal stage of this consolidation, the trading activity has dwindled significantly.

A breakout past the $310 resistance zone and the $327 range high boosted the volume.

As of the current reporting, the trading volume was relatively low in comparison to March’s figures. Yet, the market price had surpassed the midpoint at $571. The Relative Strength Index (RSI) for the past 12 hours indicated a neutral momentum with a score of 52.75. Meanwhile, the Chaikin Money Flow (CMF) displayed a positive trend.

The influx of capital into the market was substantial, signaling robust buying demand. Should Bitcoin [BTC] regain its upward trend, there’s potential for Binance Coin [BNB] to surge further as well.

Marking the liquidity pockets

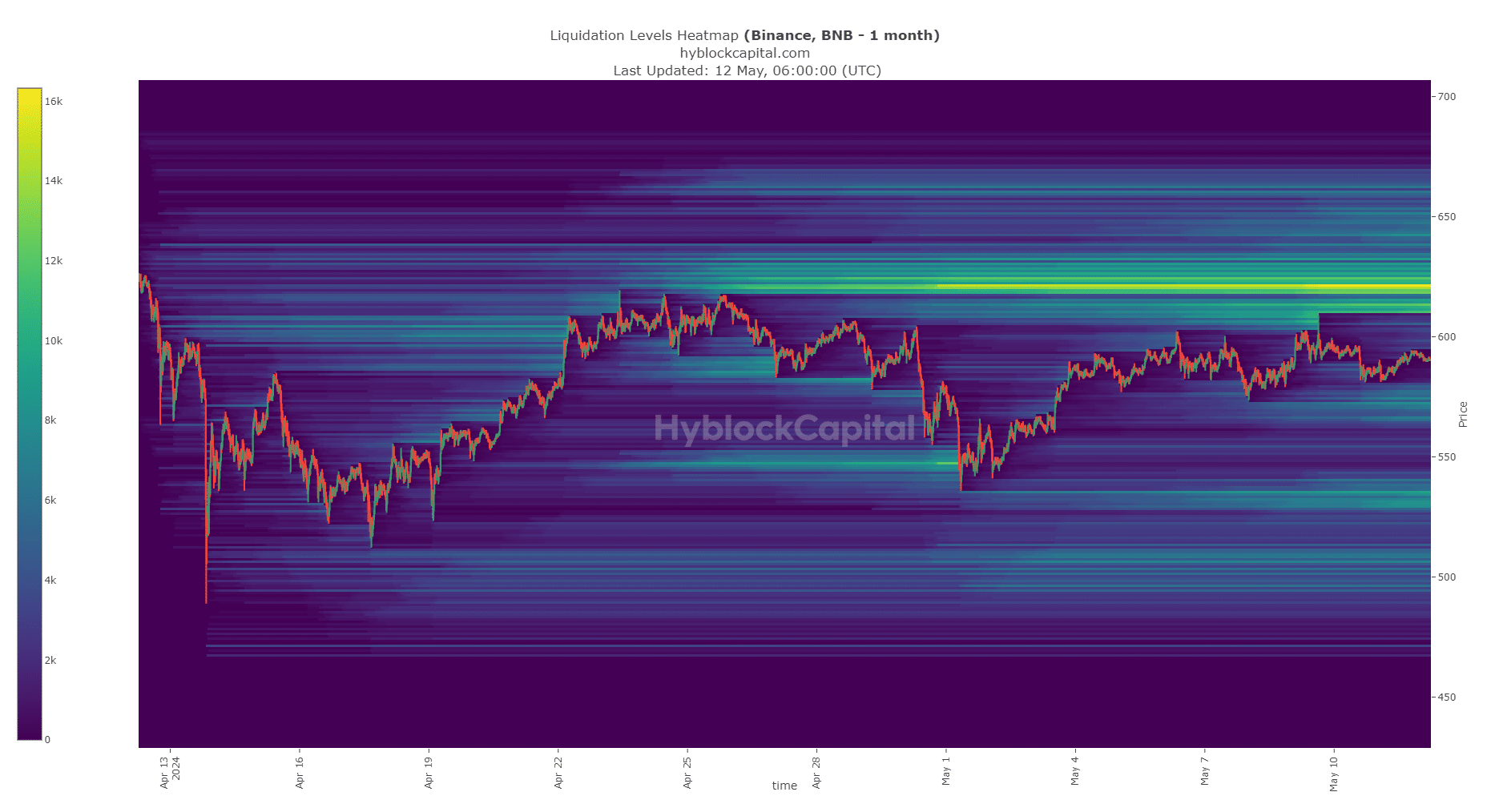

As a market analyst, I’ve identified two significant price levels based on my technical analysis: $619 and $535. From a price action standpoint, these levels held importance. Furthermore, the liquidation heatmap of the previous month revealed that the $615-$625 range exerted a strong magnetic pull on the price.

Hence, BNB could visit this region and fall lower.

In the southern region, keep an eye on the smaller pools of liquidity located at $570 and $535. A potential drop in the price of BNB may occur before a bullish turnaround at these points.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- SOL PREDICTION. SOL cryptocurrency

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- LINK’s $18 Showdown: Will It Break or Make?

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-05-13 00:07