- BNB surged to a five-month high of $652 on the back of rising buying activity

- Open interest also jumped by more than 27% in 24 hours, with the long/short ratio showing demand for long positions

As a seasoned crypto investor with battle scars from multiple market cycles, I can confidently say that the recent surge of Binance Coin (BNB) to a five-month high of $633 is nothing short of intriguing. The rising buying activity and open interest suggest a strong bullish sentiment, which has me keeping a keen eye on this coin.

🔥 Trump Tariffs Shock Incoming! EUR/USD in the Crosshairs!

Massive forex shifts expected — don't miss the crucial insights now unfolding!

View Urgent ForecastAt the current reporting, Binance Coin (BNB) led the pack among the top ten digital currencies with the largest market capitalization. Within a day’s span, BNB experienced an increase of approximately 6%, reaching a trading value of $633 – marking its highest price point in five months.

After these profits, Binance Coin’s (BNB) market capitalization climbed over $5 billion, reaching $91 billion. Nevertheless, BNB has not regained its position as the third-largest cryptocurrency (non-stablecoin) following a recent shift by Solana (SOL).

Could it be that the general optimism in the wider market is fueling BNB’s upward trend, but are there additional factors driving this surge?

Buyers rally behind BNB

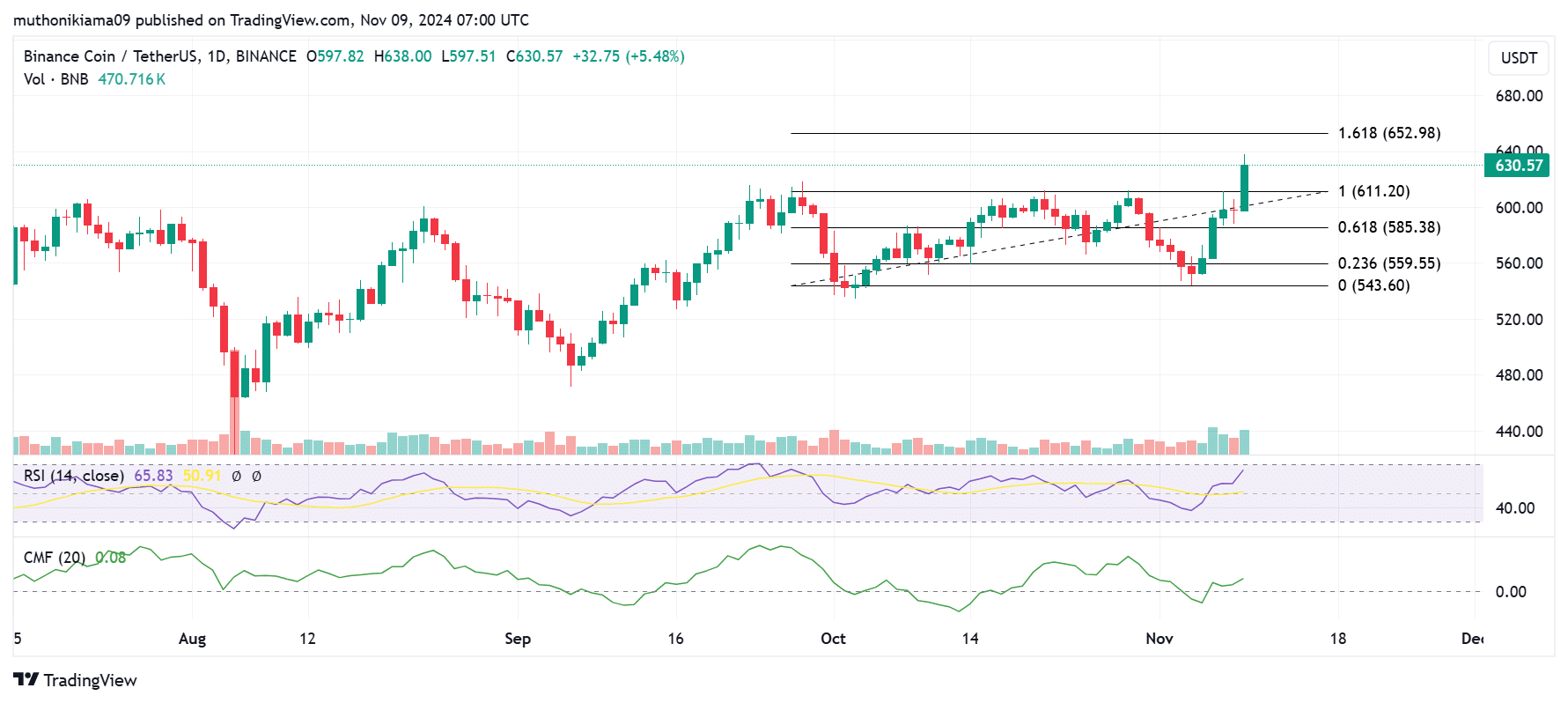

Taking a peek at BNB’s daily trading activity, it appears that the demand for buying has noticeably increased. To illustrate, the volume histogram bars seem to be turning green, indicating that the market is currently being driven by buyers rather than sellers.

At a reading of 66, the Relative Strength Index (RSI) underscored robust upward momentum. Following a bullish signal upon crossing above the Signal Line, the RSI was exhibiting higher peaks – a sign that the current upward trend was growing more powerful as we speak.

In simpler terms, the Chaikin Money Flow indicated a value of 0.08, which suggests that there has been an influx or flow of money into BNB recently.

Should purchasers maintain their current upward momentum, it’s possible that the value of BNB may reach a new resistance level around $652. Overcoming this barrier could pave the way for potential additional growth.

Instead, considering the current surge aligns with usual weekend market fluctuations, there’s a good chance the altcoin might fall to retest its support level at $585 as traders may choose to sell and secure their profits.

Open interest shows bullish sentiment

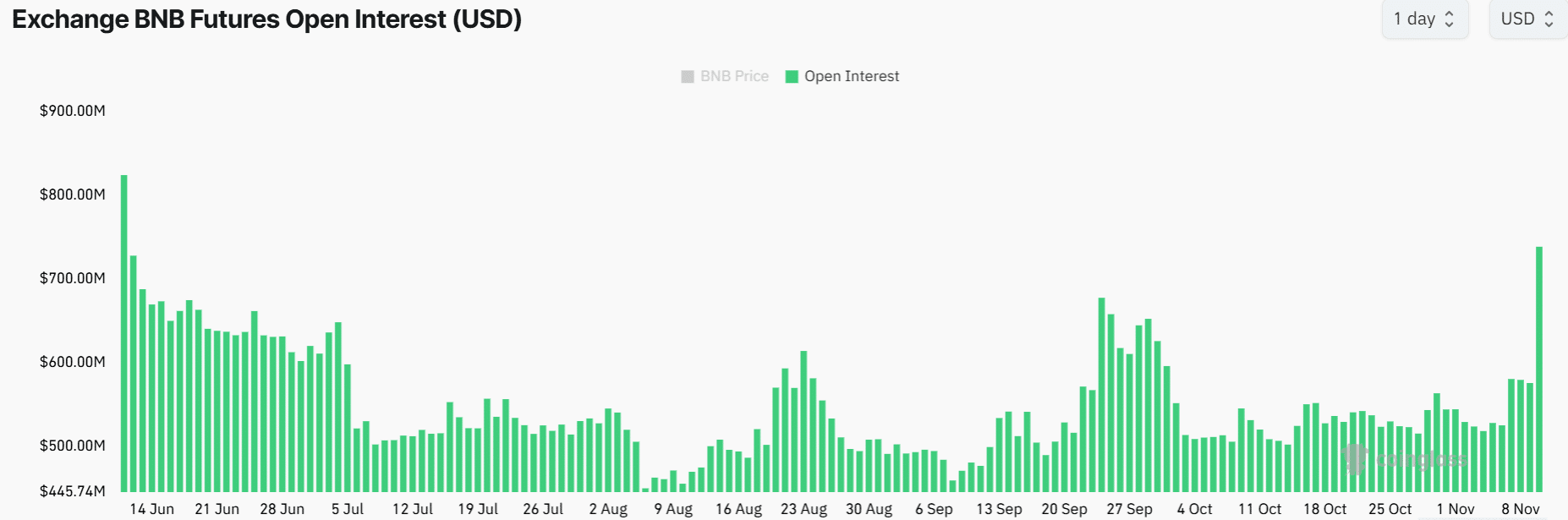

Not only are large amounts of trading activity being observed in the spot market, but also in the derivatives market. Intriguingly, information from Coinglass shows that within a single day, Open Interest (OI) for BNB increased by 27%, reaching $738 million at the time of reporting.

Currently, the Open Interest (OI) for BNB has reached its peak since June, indicating a surge in derivative traders taking up positions on this particular altcoin. As the Open Interest climbs concurrently with the price, it suggests that optimism among bullish traders is growing stronger.

It seems that many of the newly created positions are coming from long-term investors. This is due to a change in the long/short ratio, which increased from 0.90 to 1.11. Moreover, funding rates have been favorable for the past week or so.

BNB Chain’s DeFi TVL is fuelling the rally

According to DeFiLlama’s data, the value locked in Decentralized Finance (DeFi) on the BNB Chain has been gradually increasing and currently stands at approximately $4.90 billion. At this moment, this figure is at its peak since late July.

According to earlier reports from AMBCrypto, there’s been a substantial increase in Decentralized Finance (DeFi) activities within the past week. Since BNB Chain ranks fourth among blockchains by Total Value Locked (TVL) in DeFi, this surge in activity is likely to boost the price of the associated altcoin.

Despite the solid on-chain data, however, Market Prophit revealed that smart money sentiment is yet to flip bullish on BNB. These traders could be waiting for a confirmation of the uptrend’s strength, if the altcoin flips resistance at $652.

Read More

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-10 00:07