- Binance Smart Chain experienced a surge in active addresses, indicating increased activity.

- Additionally, the supply of BNB on exchanges has been gradually decreasing, which could lead to a supply squeeze.

As a seasoned crypto investor with over a decade of experience in this dynamic and ever-evolving market, I find myself intrigued by the recent developments within Binance Smart Chain (BSC). The surge in active addresses is indeed an encouraging sign, hinting at increased network activity and potentially stronger fundamentals. However, it’s essential to remember that history often doesn’t repeat itself but rhymes – so while BNB may be poised for further growth based on these trends, it’s crucial not to jump to conclusions too hastily.

Even though there have been significant advancements in network activity lately, Binance Coin’s [BNB] growth has been more gradual compared to other major market-cap tokens. Over the last month, it managed a 29.65% increase, however, this is overshadowed by the impressive gains seen in other prominent assets.

On a daily scale, BNB has dropped by 4.85%, pointing to potential weakness.

According to AMBCrypto’s analysis, there seems to be potential for BNB to keep rising as it currently shows signs of continued price increase.

Gap in network activity despite growth

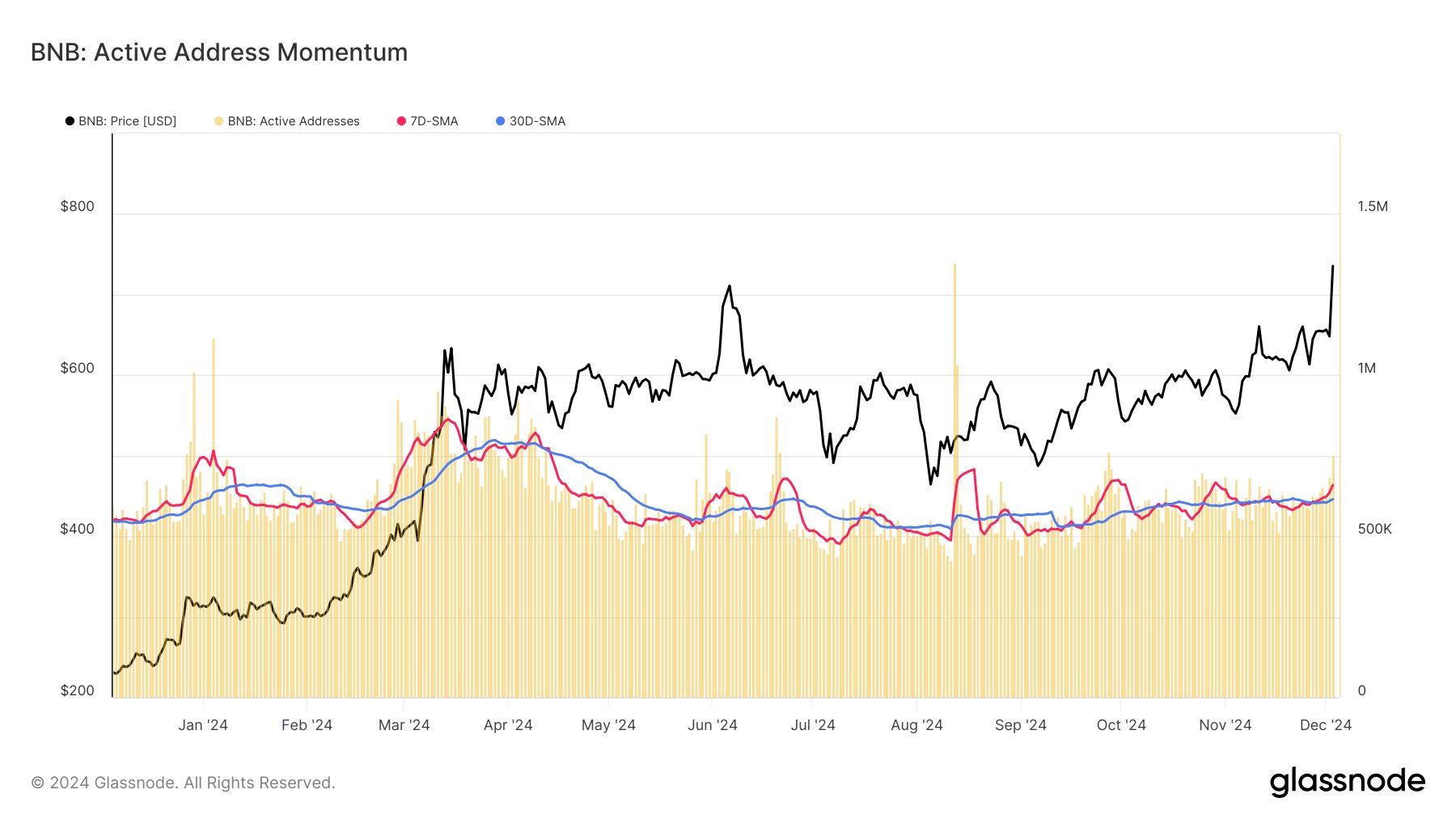

New information from Glassnode indicates an increase in the number of active accounts on the Binance Smart Chain (BSC), now at approximately 751,000. This surge suggests a possible continuation of price fluctuations for assets associated with this network.

In simpler terms, active address metrics count the number of individuals involved in various transactions like trading or other actions within the Binance Smart Chain (BSC).

Glassnode noted that this growth is promising, stating:

This suggests a growth in transactions happening on the blockchain, which points towards stronger foundations and higher usage of the network.

It seems that the increase in BNB’s usage indicates growing interest in its blockchain’s native token, potentially leading to a rise in price. However, according to past trends, this upward trend may not have reached its full potential yet.

In the 2021 bull run, BNB Chain recorded a peak of around 1.5 million active wallets, marking a new record high.

If the market continues in a similar pattern, it’s possible that the price of BNB might double (increase by 100%) from its current point, given the difference in active address milestones.

Is a supply squeeze on BNB imminent?

A possible decrease in the availability of BNB could soon occur – when the desire for this asset increases while its circulation decreases, leading to a rise in its value due to high demand and low supply.

Currently, there’s been a substantial outflow of BNB, with a net flow of approximately -$729,340 over the last 24 hours. Over the past week, this negative net flow has amounted to around -$1,850,000. In simpler terms, more BNB has been leaving than entering these networks during these timeframes.

This indicates that more BNB is leaving exchanges than entering, reducing the available supply.

Should this pattern persist, the ongoing reduction of BNB available on trading platforms, along with rising interest, might lead to a significant increase in its market value.

Supporting indicators for a bullish trend

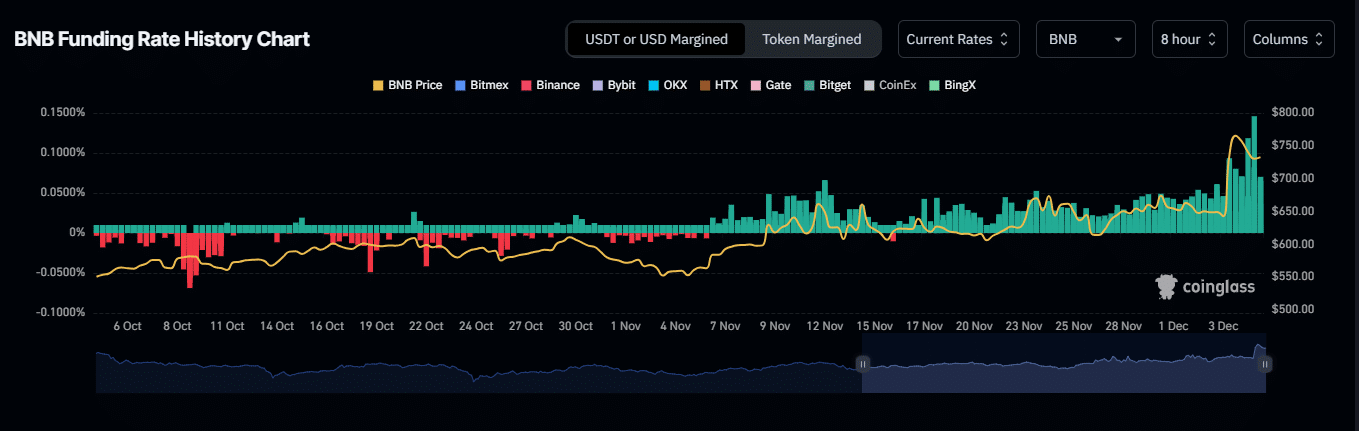

In recent times, the funding rate for Binance Coin (BNB) has experienced a substantial increase, hinting at a possible forthcoming bullish trend in the market.

Currently, the funding rate is set at 0.0650%, which means that long-term traders are currently providing financial support for the market. They do this by regularly contributing funds to help keep the market’s prices steady. This positive rate suggests an active role of these traders in the market.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Furthermore, the funding rate, calculated by combining funding rates with open interest to gauge market sentiment and leverage, continues to stay above zero and is increasing. This trend indicates a high probability of a rise in BNB’s price.

With several key indicators pointing in the same direction—an increase in active addresses, recurring trends, and associated performance measures—it appears that BNB could be primed for a possible price spike.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Rick and Morty Season 8: Release Date SHOCK!

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-12-05 21:12