-

BNB’s price currently trends within a descending triangle.

The demand for the altcoin must increase for it to break above the upper line of this triangle.

As a seasoned crypto investor with a few years of experience under my belt, I’ve seen my fair share of market trends and price patterns. Currently, Binance Coin (BNB) finds itself at a critical juncture, as it trades within the confines of a descending triangle on the chart.

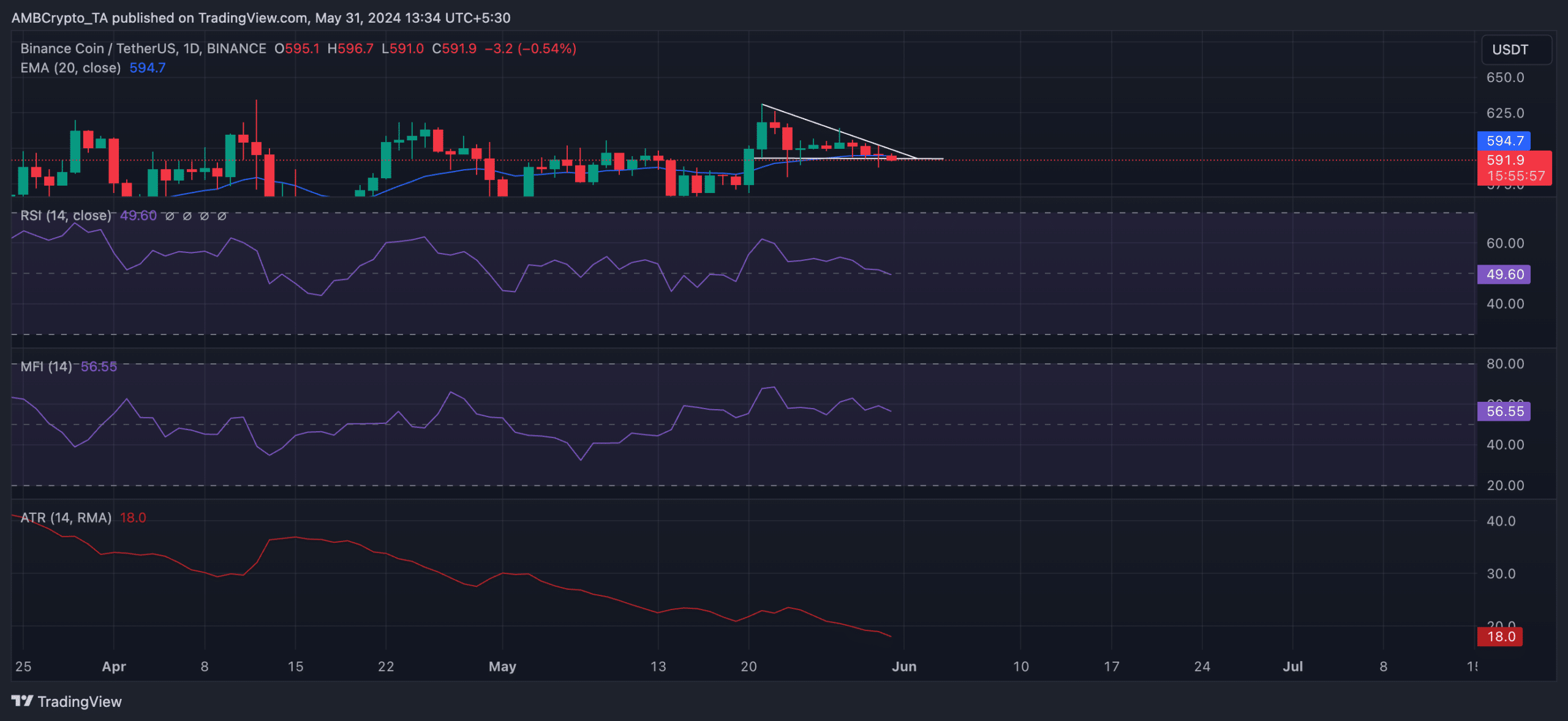

The price of Binance Coin (BNB) has been decreasing since it reached a high of $612 on May 27th, forming a triangle pattern indicative of a potential downtrend. At present, BNB is priced at $593.11, representing a 3% decrease over the previous three days.

BNB at a crossroads

In its present pricing, Binance Coin hovered just beneath the lower boundary of the descending triangle, acting as a base of support.

To reach the peak of this triangle (resistance level), a significant increase in demand or buying activity is necessary for the rally to become a reality.

As a crypto investor observing the current market trends, I noticed that BNB‘s key momentum indicators didn’t show any clear signs of buyer or seller dominance. Neither group seemed strong enough to significantly influence the price direction.

The RSI and MFI readings for BNB were 49.50 and 56.60, respectively. These figures indicate a relatively neutral price trend, as neither the selling pressure (bears) nor buying pressure (bulls) is significantly stronger than the other.

As a financial analyst, I’ve observed that BNB‘s Average True Range (ATR) value has decreased by approximately 23% relative to its level on May 23rd.

This metric evaluates the market’s price instability by determining the typical difference between the highest and lowest prices over a given time frame.

As a researcher observing market trends, I would interpret a decline in asset volatility as an indication that the price of the asset is stabilizing. This could be a sign that the market is entering a period of consolidation, where prices may fluctuate less dramatically for an extended period.

BNB bulls stand a chance

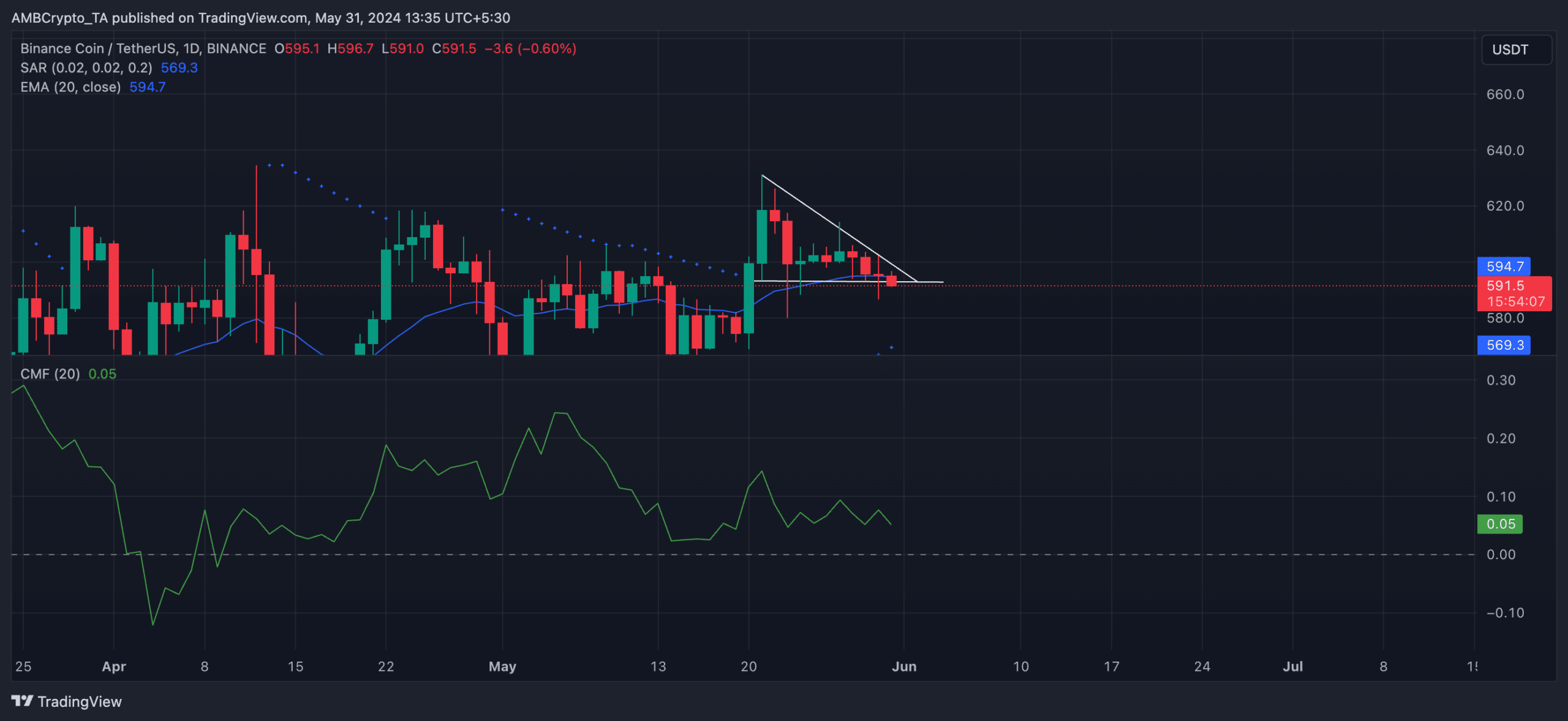

Despite an apparent equilibrium between BNB‘s supply and demand, AMBCrypto’s analysis uncovered several signs supporting a bullish outlook for the altcoin.

As an analyst, I would interpret BNB‘s Chaikin Money Flow (CMF) being above its zero line at present as a sign of persistent buying pressure in the BNB market. The CMF, which measures the net flow of money into and out of the BNB market, was recorded at 0.05. This figure implies that more money has been flowing into the market than out of it, indicating a bullish sentiment among investors.

From my perspective as an analyst, the Parabolic SAR readings for BNB have reinforced the current trend. At present, the indicator’s dots are situated below BNB’s price level, suggesting a potential short-term price increase.

Read Binance [BNB] Price Prediction 2023-2024

In simpler terms, the current price of BNB is slightly more than its average price over the last 20 days as indicated by its Exponential Moving Average.

This bullish signal suggests that traders might be slowly accumulating the altcoin.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-06-01 06:15