- The U.S Supreme Court has turned down an appeal by Binance to overturn a class action lawsuit against the exchange

- Court’s decision fueled a price decline for BNB, which led to $1.9M in long liquidations

In simpler terms, the U.S Supreme Court refused an appeal submitted by cryptocurrency exchange Binance. Binance claims that it isn’t bound by U.S securities regulations because it doesn’t have a traditional office within the United States.

The rejected appeal significantly weakened Binance Coin (BNB), causing it to reach a low not seen for several weeks at $660, but it later recovered slightly to trade at $687 as of the latest update.

Details of the case

The petition originated from a legal case filed against Binance back in 2020, which was categorized as a class action lawsuit. In this lawsuit, investors alleged that the platform was providing unregistered securities services, violating the requirements of being recognized as a brokerage platform under U.S regulations.

In response to these allegations, Binance countered by stating that it does not fall under the jurisdiction of American laws as it is not an American company. In a court decision made in March 2022, U.S District Judge Andrew Carter sided with Binance and dismissed the lawsuit filed against them.

In March of last year, the Manhattan Appeals Court brought back this lawsuit. They decided that even though Binance doesn’t have a base in the United States, it must adhere to securities laws because American investors purchased tokens from the platform using U.S servers.

Binance seeks an appeal

In December 2024, Binance challenged the court’s ruling at the U.S. Supreme Court. They argued that their platform allows investors a simpler and more streamlined way to engage with international financial markets due to advancements in technology.

Previously, only those who could journey overseas, collaborate with foreign investment companies, or set up offshore businesses had access to certain investment opportunities. However, thanks to the internet, similar possibilities are now within reach for investors with more limited financial means.

Consequently, the U.S Supreme Court declined to intervene in this matter, thereby validating the Manhattan Court’s decision that U.S legislation applies to the transaction. This validation means the case will now move forward.

Impact on BNB

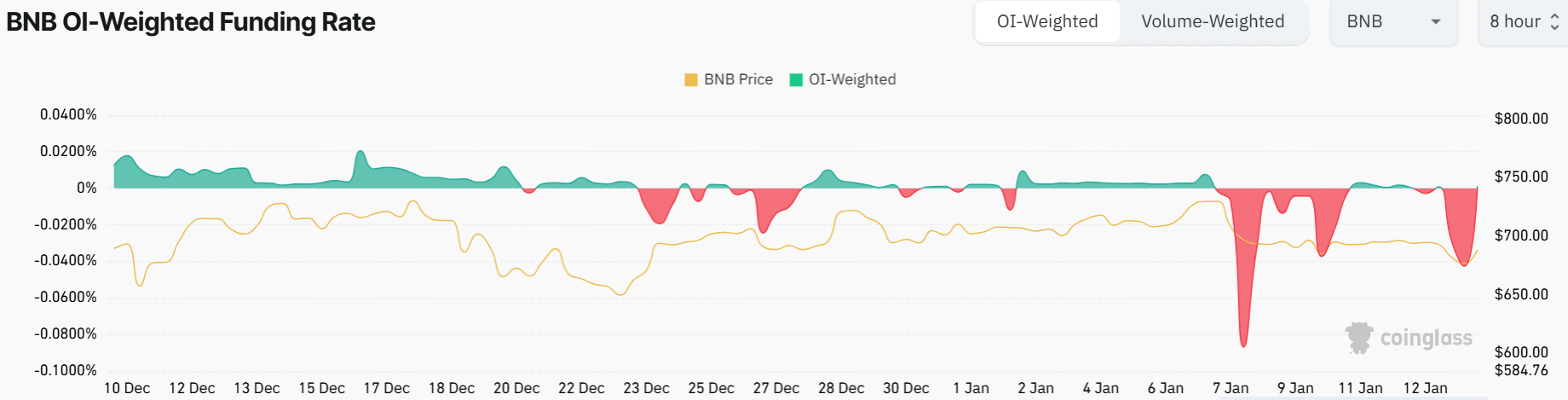

The rejection of the appeal caused fluctuations in Binance Coin’s price, leading to the liquidation of approximately $2 million worth of open positions within a 24-hour period. Interestingly, it was found that about $1.94 million of these liquidated positions were long positions. (Coinglass data)

For as long as traders must offload BNB to settle their trades, there is continuous pressure pushing the price down. Additionally, due to decreasing funding rates, long-term traders tend to abandon their positions.

As we speak, the funding rates for BNB have reversed, becoming negative. This suggests that short traders are prepared to pay a fee to keep their trades active.

Is BNB ready for a recovery?

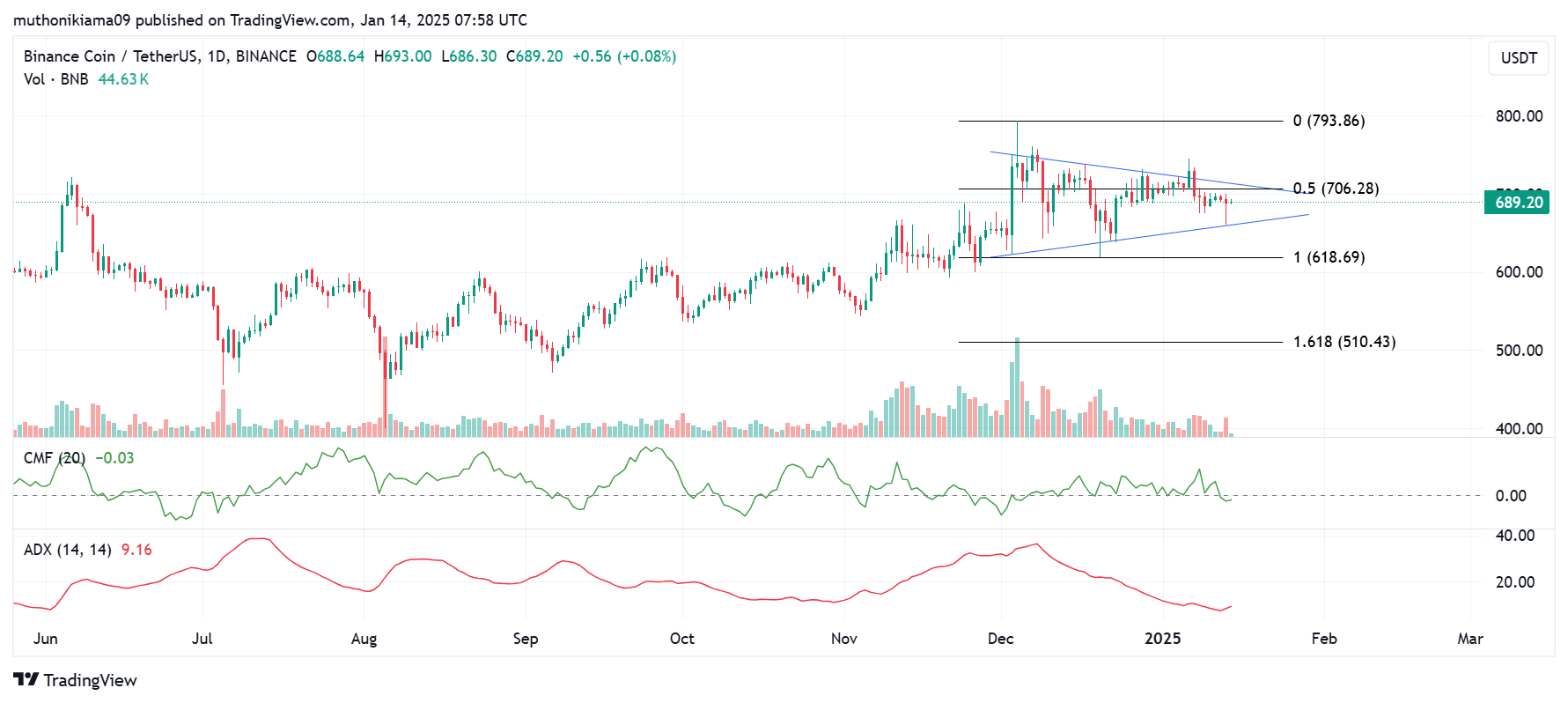

Currently, BNB appears to be experiencing significant selling activity. Notably, the Chaikin Money Flow (CMF) indicator has fallen into the negative region, a development not seen in more than three weeks.

The Average Directional Index (ADX) signal pointed upward as well, suggesting that the ongoing downward trend is growing more robust.

Even with ongoing transactions, Binance Coin has been moving within a symmetrical triangle structure. If it manages to surge past this pattern and overcome resistance at the 0.5 Fibonacci level (approximately 706), it might challenge the bearish sentiment. On the other hand, a fall below the lower trendline could trigger a descent towards $510.

One potential factor that might contribute to a bull market is the impending change in leadership at the U.S. Securities and Exchange Commission (SEC). The departure of Gary Gensler as SEC Chairman could be beneficial for cryptocurrency tokens that have faced scrutiny from the commission in the past, potentially leading to more favorable regulations or less enforcement action against these assets.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-14 23:06