-

BOME witnessed a surge in price over the last 24 hours.

Sentiment and social volume around the token fell.

Despite the significant expansion of the memecoin market in the past, tokens like BOOK OF MEME (BOME) were often overshadowed by coins such as DOgeCoin (DOGE) and Boden (BODEN), which received more spotlight and interest.

What’s next for BOME?

In the past day, BOME underwent considerable expansion. Yet, it faced challenges in breaking out of its downtrend, even with this recent progress.

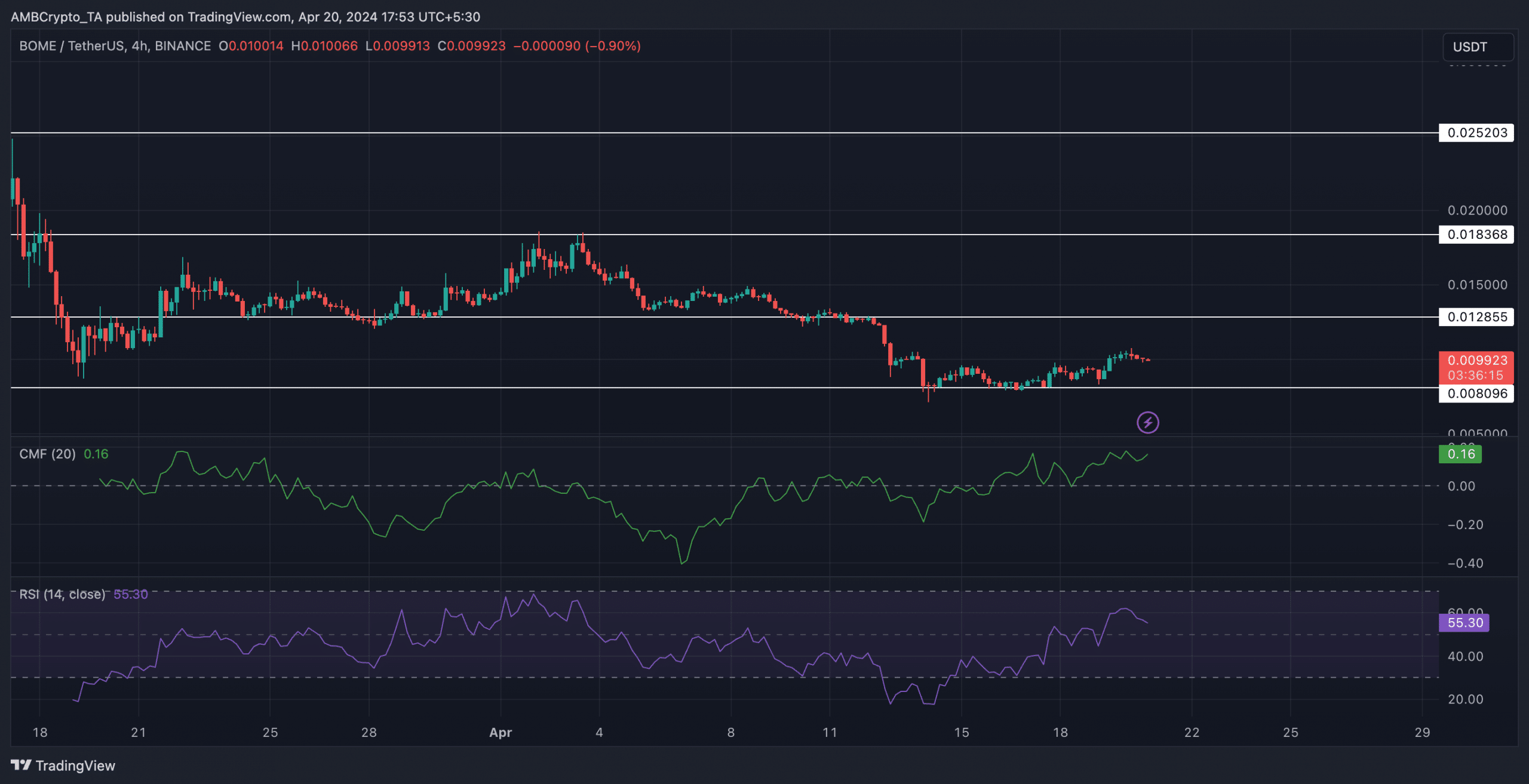

Over the past few days, BOME has been facing a tough market situation as it kept touching new lows after each attempt to rise above the $0.0252 mark, which it reached on March 17th.

If BOME reaches the $0.0128 mark during its testing, there’s a possibility that the token may experience a price change and head towards the $0.0183 price range in the future.

In this timeframe, the RSI value climbed up to 57.08, suggesting growing purchasing activity without yet reaching the point of being overbought.

Additionally, the Chaikin Money Flow (CMF) reached 0.17, implying a greater inflow of funds for the memecoin.

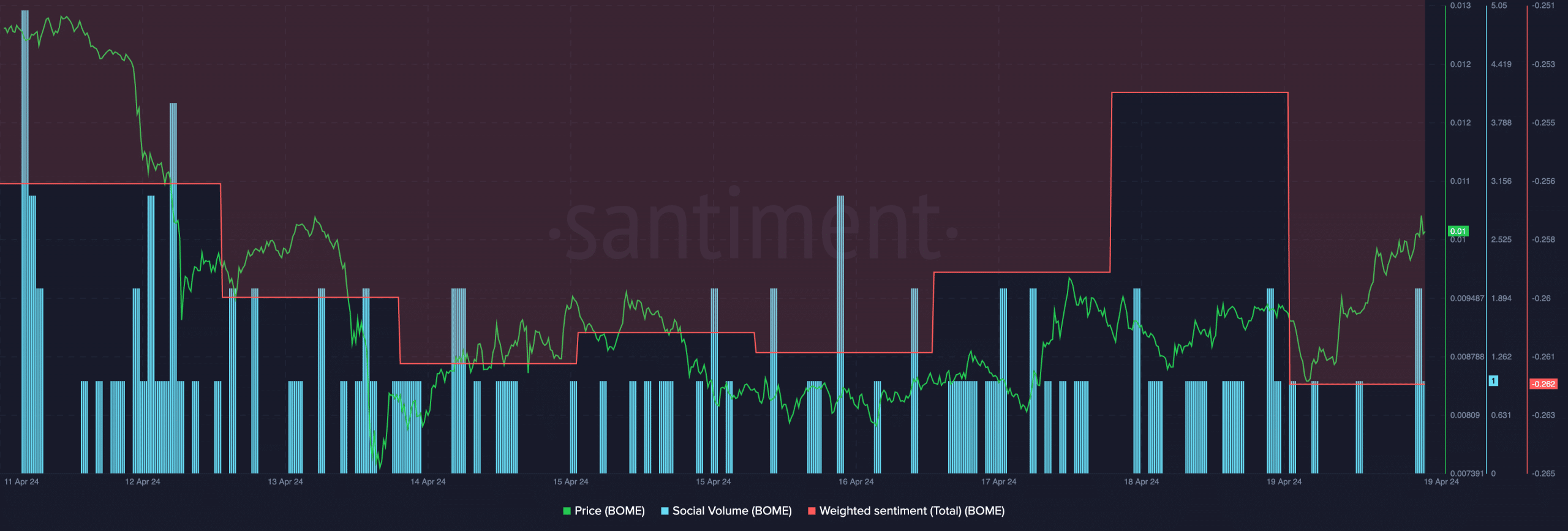

In simpler terms, there’s been a significant increase in activity on the Social platform lately, showing that people are becoming more invested and engaged in BOME. This surge in interest highlights BOME’s potential for even more expansion.

Despite the heightened level of engagement, there were more negative remarks than positive ones, resulting in a decrease in Weighted Sentiment during this timeframe.

A change in public opinion could have the consequence of affecting investor trust and market behavior, making it a challenge for BOME‘s stock price to advance in the upcoming period.

Traders bleed

Over the last day, BOME experienced a total of $575,000 worth of long position liquidations, indicating increased market instability and potential danger for investors.

Read Book of MEME’s [BOME] Price Prediction 2024-25

It’s worth noting that there was a noticeable change in trading patterns: the number of long positions increased markedly, while the number of short positions decreased.

Despite experiencing losses, or “liquidations,” investors maintained optimism towards the memecoin, reflecting a change in both market and investor attitudes towards a more positive viewpoint.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-04-21 09:11