-

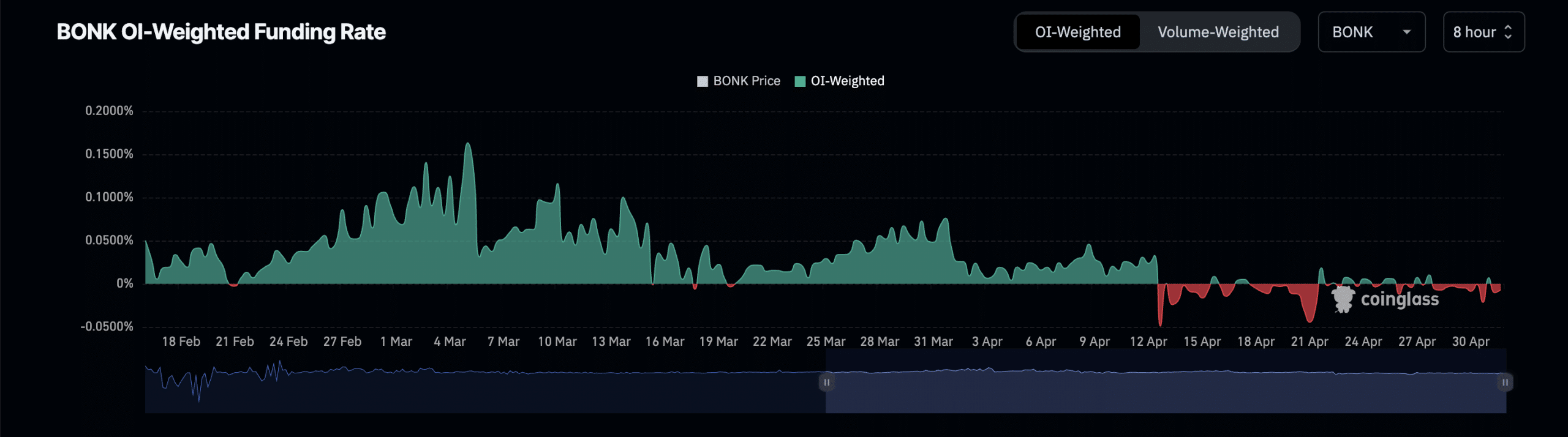

BONK’s funding rates have been mostly negative since the 13th of April.

Its price may decline further if bearish momentum climbs.

As a crypto investor with some experience under my belt, I’m keeping a close eye on Bonk (BONK) due to its recent negative funding rates and declining open interest in the futures market. The persistent negative funding rates suggest a strong demand for short positions, which is a bearish signal. Moreover, the decline in open interest indicates an increase in market participants exiting their positions without opening new ones, another bearish sign.

Data from Coinglass indicates that there’s been a drop in BONK‘s value lately, and this trend has been reflected in the meme coin’s futures market with unfavorable funding rates.

As a researcher studying perpetual futures contracts, I would describe funding rates as a built-in feature that helps maintain the price difference between the contract and the underlying asset (the spot price) at an optimal level. These rates are periodically adjusted based on market conditions to incentivize long or short positions, ensuring the contract remains closely aligned with the real-time value of the asset.

As a crypto investor, when I observe that the futures funding rates of a particular asset have turned negative, I interpret this as a sign of significant demand for investors to open short positions. This bearish indicator often precedes a decline in the asset’s price.

Based on data from Coinglass, the funding rate for BONK cryptocurrency has mainly been in the red, or negative, on various exchanges since the 13th of April.

From my perspective as a crypto investor, the current figure represents a decrease of 0.0068% at present. This indicator signifies that there are more traders in BONK‘s futures market who anticipate the memecoin’s price to decline than those planning to buy it and sell it at a profit later on.

Examining the futures open interest of this memecoin as of the present moment revealed a comparable downward trend since the 26th of April. The current open interest for its futures contracts stands at approximately $6 million, representing a decrease of around 33% in the past week.

The open interest for a financial asset’s future contracts signifies the current outstanding number of agreements between traders that have not been settled. A decrease in open interest implies more traders are closing their positions without establishing new ones.

It is also regarded as a bearish signal.

What BONK might do next?

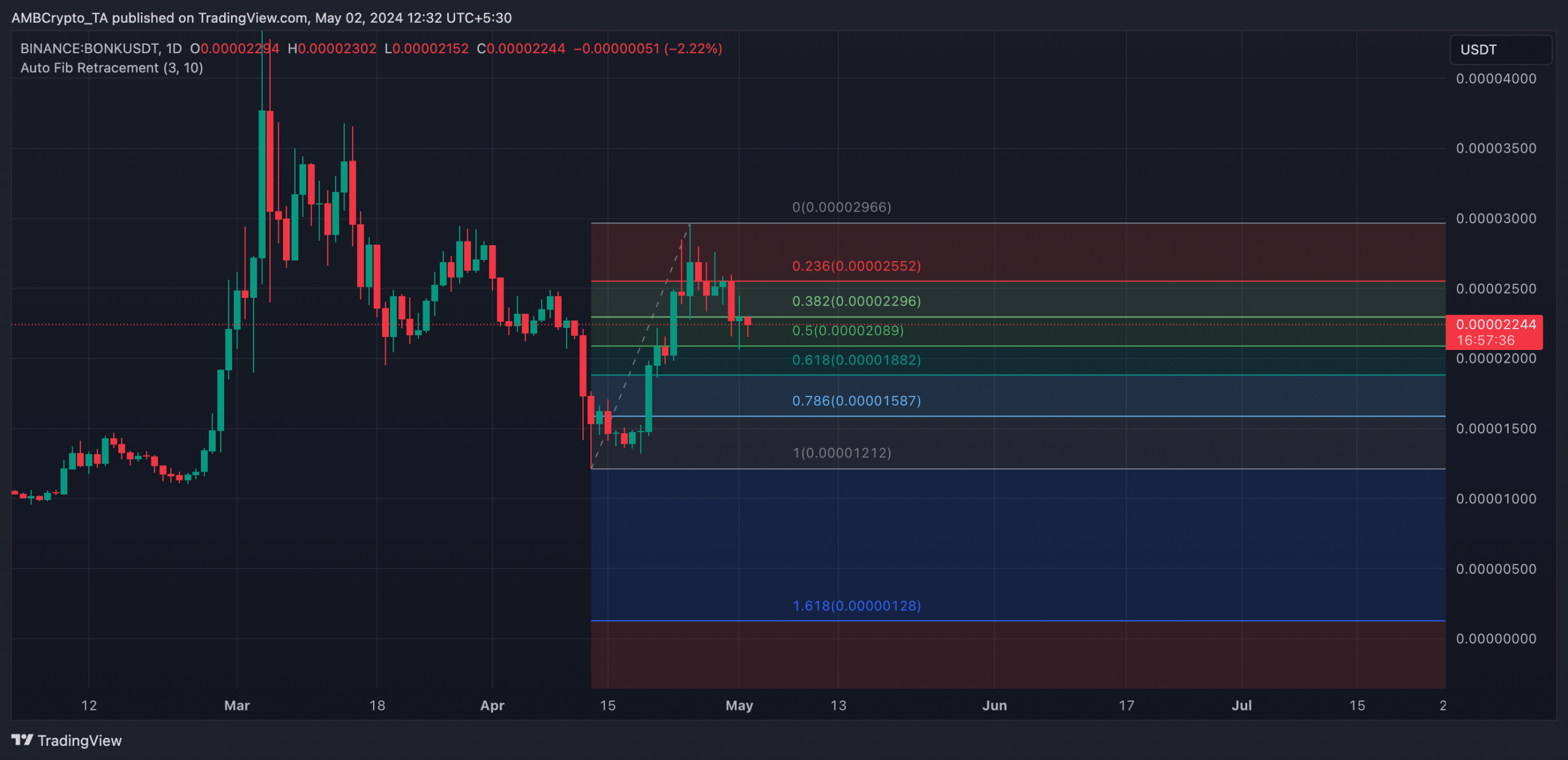

As an analyst, I observed that BONK experienced a short-term price surge between the 20th and 25th of April, pushing its value above previously established support levels.

Starting from the 25th of April, the memecoin’s surge encountered a setback as it failed to surpass the resistance level at $0.000029. Consequently, it began to decline and revisited its support level.

Due to the surge in negative market sentiment, the price of BONK dipped below its support level and ended at $0.000018 on May 1st.

If the bearish trend persists and gains strength for the meme coin, it could potentially drop to a trading price of $0.000015. If the bulls are unable to reverse this trend at that point, the price of BONK might continue to fall, reaching a possible trading value of $0.000012.

If there is a strong surge in buying pressure, the coin could potentially revisit its support level before attempting to regain its resistance at $0.000029 again.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-05-02 22:16