- BONK pumped 100% in the past week; will the uptrend continue?

- BonkDAO planned to burn 1T BONK by Christmas – A bullish cue?

As a seasoned analyst with years of experience navigating the volatile cryptocurrency market, I find myself intrigued by the recent surge of BONK. The 100% pump in just a week has caught my attention and left me wondering if the uptrend will continue. The planned burn of 1T BONK by Christmas is indeed a bullish cue, but it remains to be seen how this will play out in the coming days.

In the last week, the memecoin BONK, which operates on the Solana [SOL] platform, experienced a significant surge of 100%, primarily due to a general market uptrend and an ambitious strategy to destroy 1 trillion of its own tokens through deflation.

On 15th November, Bonk DAO announced the deflationary plans with the 2024 Christmas deadline.

“The BONK DAO BURNmas SUPER thread. The Mission: Burn 1 Trillion $BONK by Christmas. The campaign features BONK burns based on specific engagement criteria.”

After the recent announcement, I noticed a significant surge in BONK’s price – approximately 27%. This upward trend has not only maintained but also surpassed the weekly growth target, reaching an impressive 100% increase. To put this into perspective, this surge was further accentuated by an additional pump over the weekend. The reason behind this price hike is the reduction in the number of tokens being burned, which in turn increases the value of the remaining assets due to a decrease in supply.

What’s next for BONK?

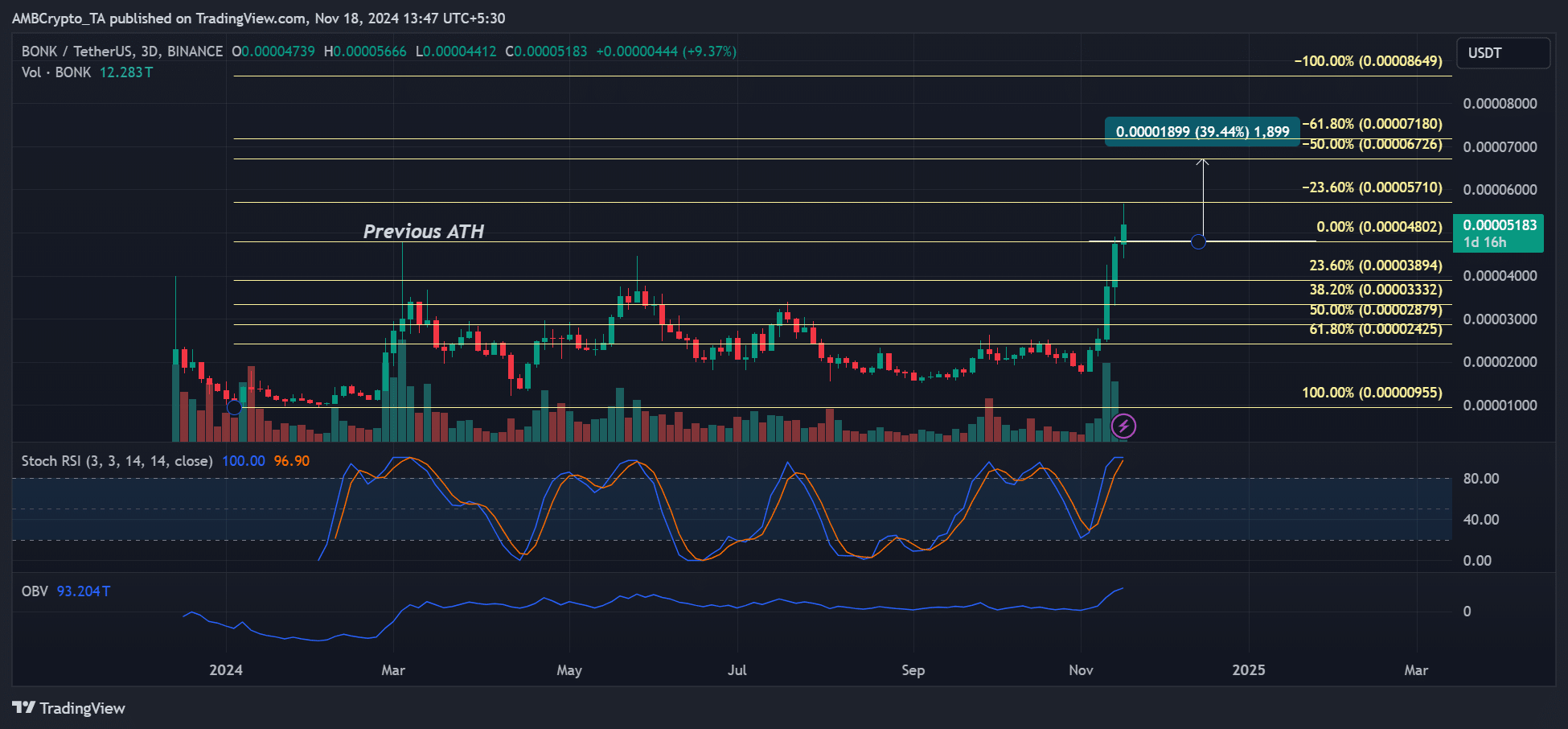

Over the past week, the impressive surge of BONK’s price has propelled us into a period of price discovery. In order to predict potential future milestones, I’ve employed a Fibonacci retracement tool by drawing it between our previous all-time high and the yearly low (marked in yellow).

On Sundays, the price surge had its sights set on a swift bullish peak at approximately $0.000057, as indicated by our Fibonacci tool. If the upward momentum persisted, an additional target of $0.000067 would come into play, potentially rewarding investors with an extra 40% return.

However, cashing in on those additional profits would only be practical if the meme-coin managed to surpass its old All-Time High (ATH).

It’s worth noting that the technical indicators suggest a strong buying trend, yet the market appears to be excessively heated. The Stochastic RSI indicates an oversold state, but the On Balance Volume (OBV) has hit record highs.

BONK whales trim exposure

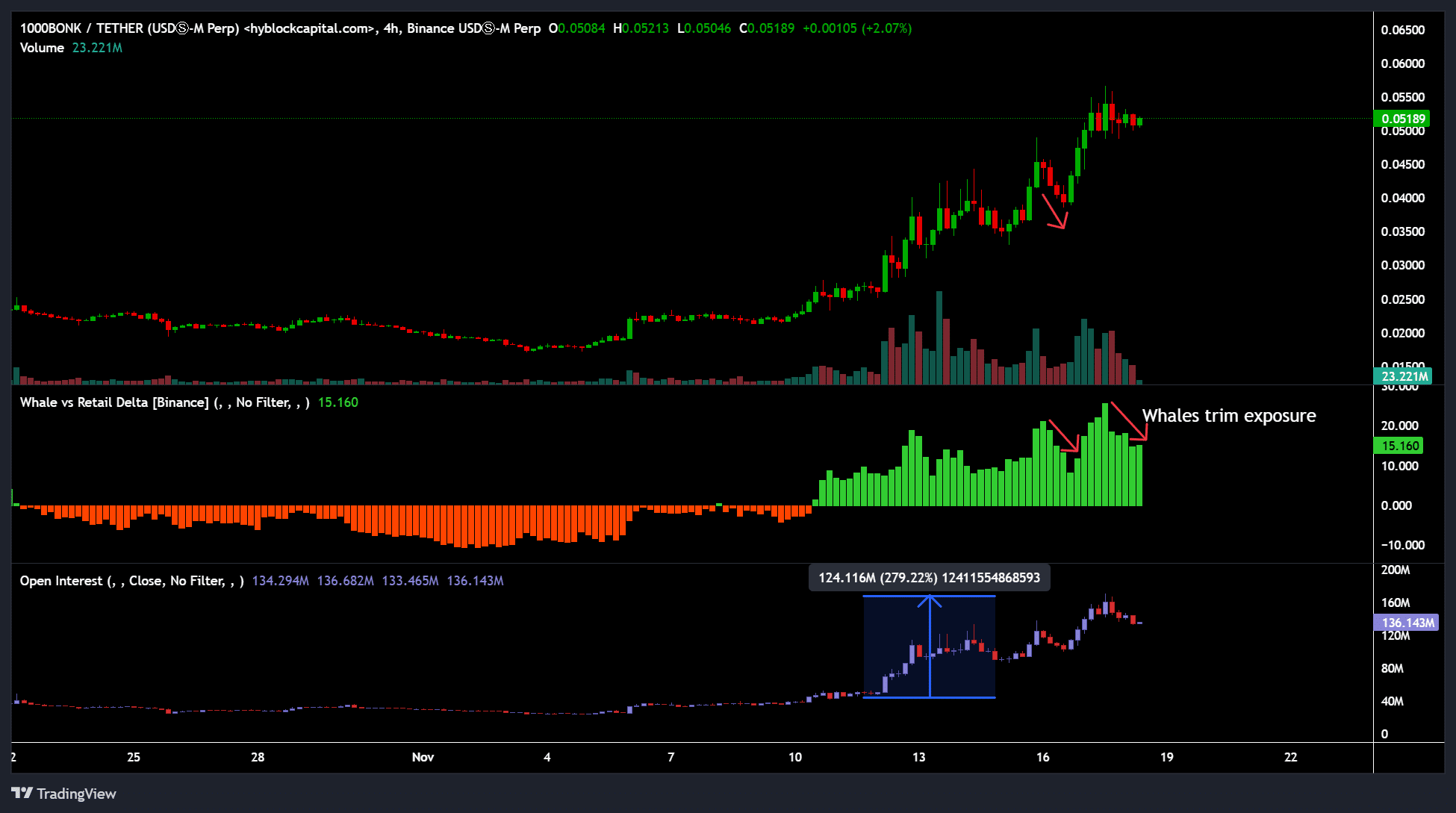

Regarding our market placement strategy, some large investors (often referred to as ‘whales’) reduced their investment levels following the recent market rally. This reduction is suggested by the decrease in the Whale-Retail Ratio indicator.

Decreased involvement with whales (large investors) often leads to either consolidation or a drop in prices. If BONK persists in reducing their holdings, there might be a cooling off period or a price decrease.

On the contrary, increased whale exposure always signals a potential price rally.

Read Bonk [BONK] Price Prediction 2024-2025

It’s worth noting that even those using leverage jumped on the bandwagon of BONK’s rise. The Open Interest rates skyrocketed by a factor of three, rising from around $50 million to over $150 million in a short span of time. This indicates that players employing leverage borrowed heavily to make bullish bets on BONK.

Experts predict that the BONK surge will continue, largely because of the anticipated 1T token destruction. Yet, the overall mood of the cryptocurrency market may influence where the meme coin’s price heads next.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-18 22:02