- BONK shed nearly 30% after hitting a new all-time.

- Whales led the profit-taking and cleared their long positions; will recovery be delayed?

As a seasoned researcher with years of experience in the cryptocurrency market, I’ve seen my fair share of bull and bear runs. The recent pullback of Bonk [BONK] has left me slightly concerned but not entirely surprised given the rapid rise it experienced. The profit-taking wave led by whales seems to have cleared their long positions, which could potentially delay recovery.

During the previous week, meme coins experienced significant losses, with larger and mid-sized altcoins gaining prominence due to renewed discussions about an ‘altcoin season.’ Bonk [BONK] emerged as the biggest loser, with profits being cashed out following its new peak at $0.000062, which triggered more selling.

At the moment, BONK has dropped by 29% from its latest record peak. However, this decrease might be part of a broader pattern of funds shifting, or capital rotation. Here are some significant points that bullish investors may want to keep an eye on.

Evaluating BONK’s pullback

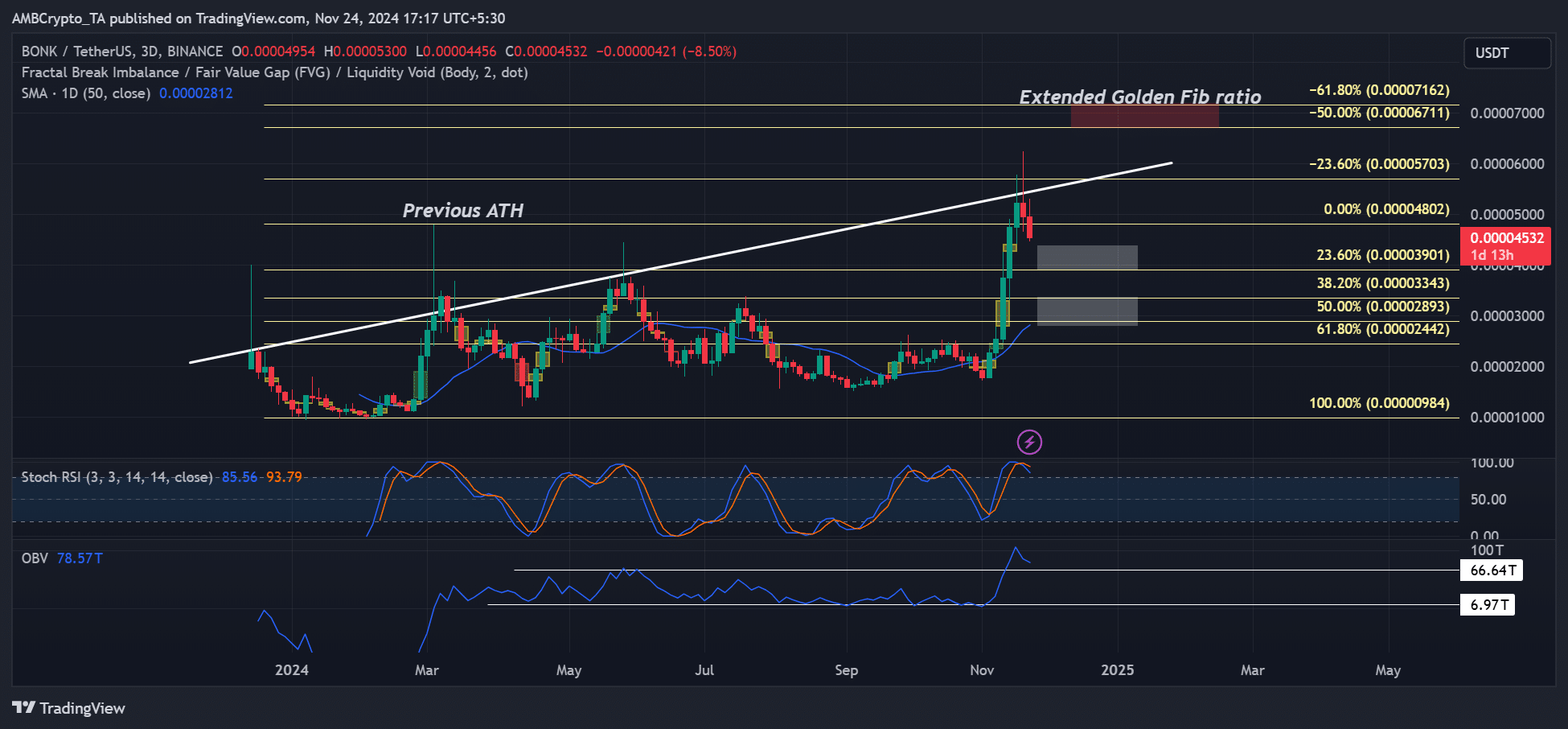

Even though the recent All-Time High (ATH) fell just a bit shy of aligning with the extended Golden Fibonacci ratio (-61.8%), this level could still serve as a potential bullish goal if there’s a rebound following the dip.

To put it simply, the upward trend created significant disparities in price, or “gaps,” at two distinct areas, which we call Fair Value Gaps (FVG). The first imbalance occurred above approximately 23.60%, and the second was right at the 50% level of the Fibonacci Retracement.

Additionally, this point in time aligned with the 50-day Simple Moving Average, hinting that it might provide robust support should the decline fall below $0.000039. In other words, if the bullish trend persists, these levels could serve as significant opportunities for buyers to rejoin the market.

If the Stochastic RSI of BONK is high and overbought, there might be a possibility for further price decline as traders who have been short-selling may decide to cash in their profits.

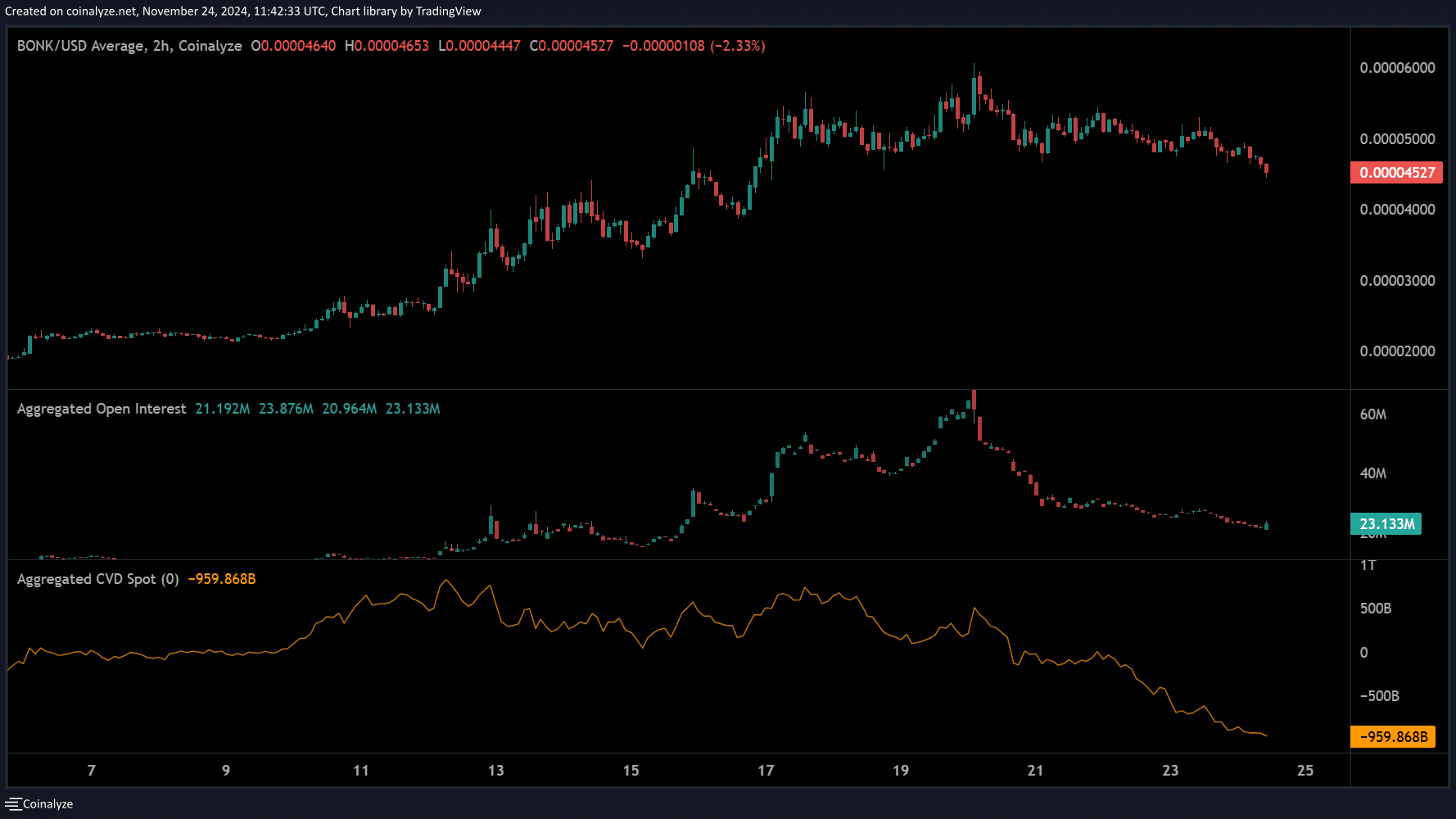

Demand tanked

During the early part of November, an increase in spot market demand (as indicated by a rising Cumulative Volume Delta – CVD) fueled the upward trend. Subsequently, this surge was mirrored and sustained by the Futures market as evidenced by a growth in Open Interest.

On the other hand, there was a decline in demand for both the Futures and spot markets, which can be seen by the decrease in Open Interest (OI) and Contango Volume Daily (CVD).

If the trend of meme coins doesn’t regain its previous influence, it might make a swift recovery more difficult.

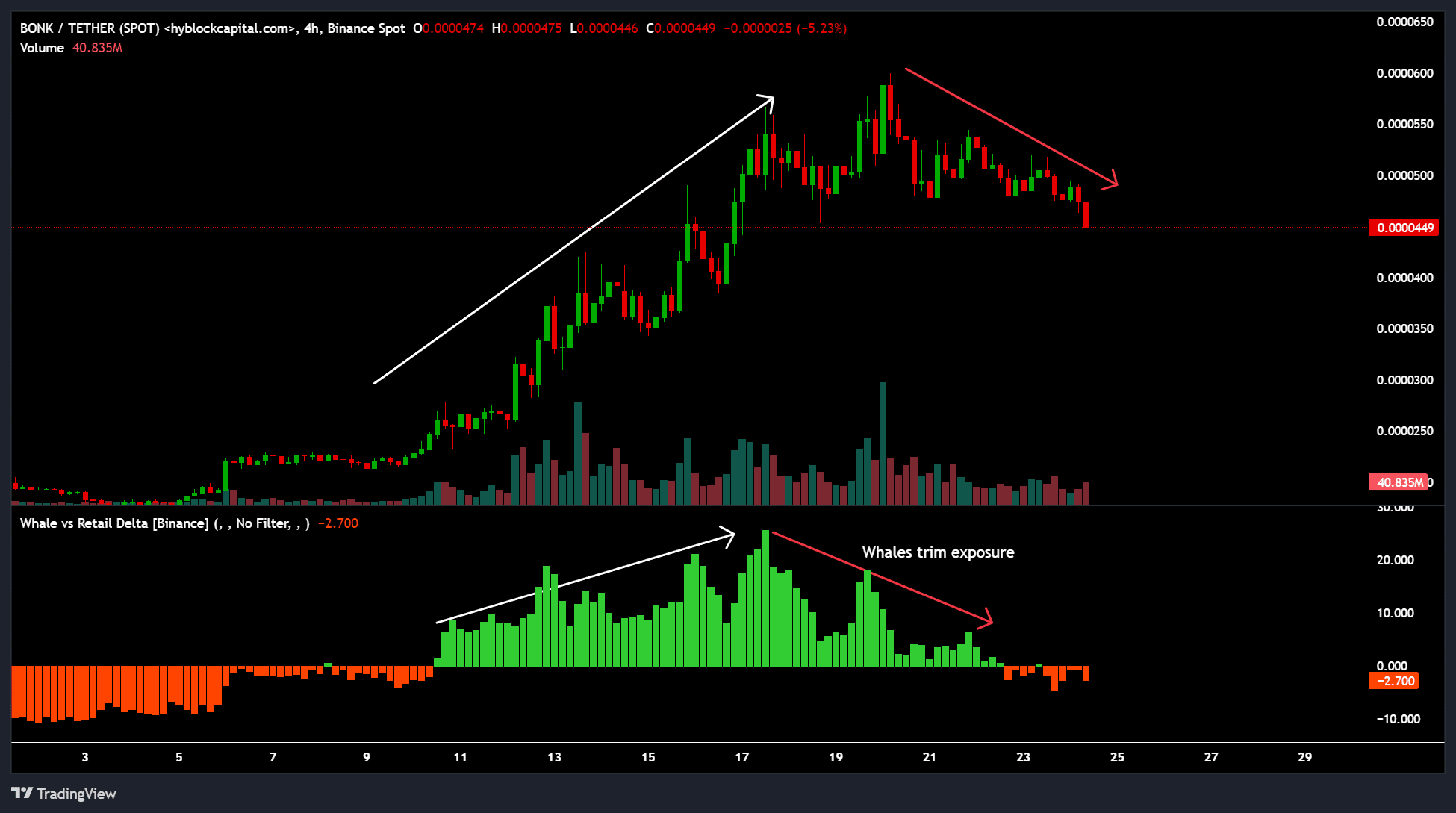

A significant bearish signal emerged from the practice of whales reducing their exposure or “de-risking” on the Binance exchange. This trend has been evident since mid-November, as evidenced by the Whale vs. Retail Delta showing a negative value, indicating that more whales are closing long positions compared to retail investors.

Read Bonk [BONK] Price Prediction 2024-2025

As a crypto investor, I’ve learned from past experiences that when large players exit or reduce their positions, it often leads to temporary price stability or consolidation. Given this historical trend, I find myself cautiously considering the potential impact on BONK in the near future.

To predict a possible price flip, traders might monitor significant levels while keeping an eye out for potential whale participation. This could indicate a probable bounce back for BONK.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-25 11:03