- BONK has dropped by around 21% in the last seven days amid a bearish trend across the memecoin market.

- The lack of speculative activity amid selling activity could trigger further declines.

The value of meme coins has been decreasing significantly, with their combined market worth falling by about 15% to $97 billion over the past seven days. Bonk [BONK], which is currently one of the top four meme coins, has also experienced a drop of around 21% in just one week due to this downward trend.

The potential for the memecoin’s decline may persist, as investors in the open market appear disinterested, leading to less buying activity, and there are fewer derivatives traders who foresee a positive outcome for its future value.

BONK’s price analysis

Each day, BONK’s price graph demonstrates that the memecoin is moving along a falling trendline channel. This suggests a continuous decline in price, as there appears to be more selling happening compared to buying.

Currently, the memecoin is attempting to hold its ground at the middle line of the current price channel. A fall below this point may intensify the downward trend. For a potential bullish turnaround, BONK needs to surge above the upper trendline with substantial buying activity.

In simpler terms, the Chaikin Money Flow (CMF) and Money Flow Index (MFI) are suggesting that BONK might be in a period where more people are selling than buying, which is often referred to as a distribution phase. The CMF is currently in a negative area, signaling selling pressure, while the MFI has dropped to 47, hinting that the bears (those who believe prices will fall) may have control at the moment.

Reduced speculative bets could fuel the downtrend

An increase in transactions within the derivatives market frequently indicates strong confidence among traders regarding upcoming price fluctuations. Nevertheless, when it comes to BONK, it seems that traders are opting to wrap up their positions instead.

In just a week, the value representing commitments between buyers and sellers for this memecoin’s future contracts (Open Interest) has decreased by about 28%, now sitting at approximately $14.12 million as reported by Coinglass. Meanwhile, the volume of derivative trading over the past 24 hours reached $36 million, marking a low not seen since the beginning of the year.

This decrease may result in more consistent pricing because of lower market fluctuations, but a decrease in interest rates could foster negative feelings and sluggish price trends.

Decrease might bring about steady prices thanks to diminished volatility, however, lower interest rates could induce pessimistic attitudes and slow price shifts.

Key levels to watch

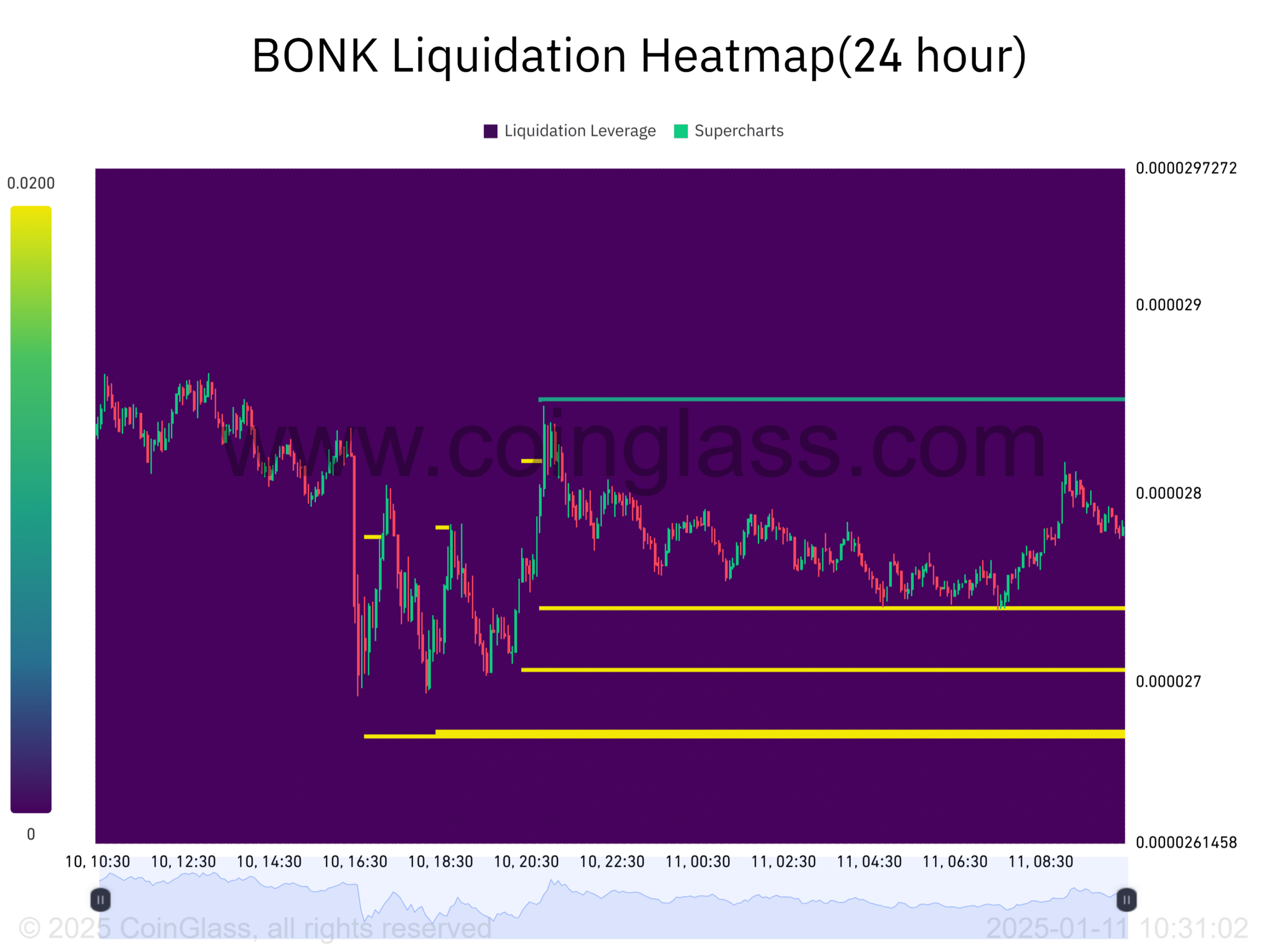

Over the past four days, positions for BONK that were betting on an increase in its value (long positions) amounting to more than $1 million have been closed, intensifying the demand to sell. Yet, even with these closures, there are several potential groups of traders below the current price who might push the prices down further.

Read Bonk’s [BONK] Price Prediction 2024-25

At a price of $0.0000273, you’ll find the nearest group of potential liquidations. There are also clusters at slightly lower prices: $0.0000270 and $0.0000267. If BONK falls to these levels, the ensuing liquidations could contribute to a continuing decline in its price.

Instead, if there are no groups of assets being sold off above the current price, this could potentially halt the upward trend and lead to a period of stability or sideways movement within the existing levels.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-01-12 02:15