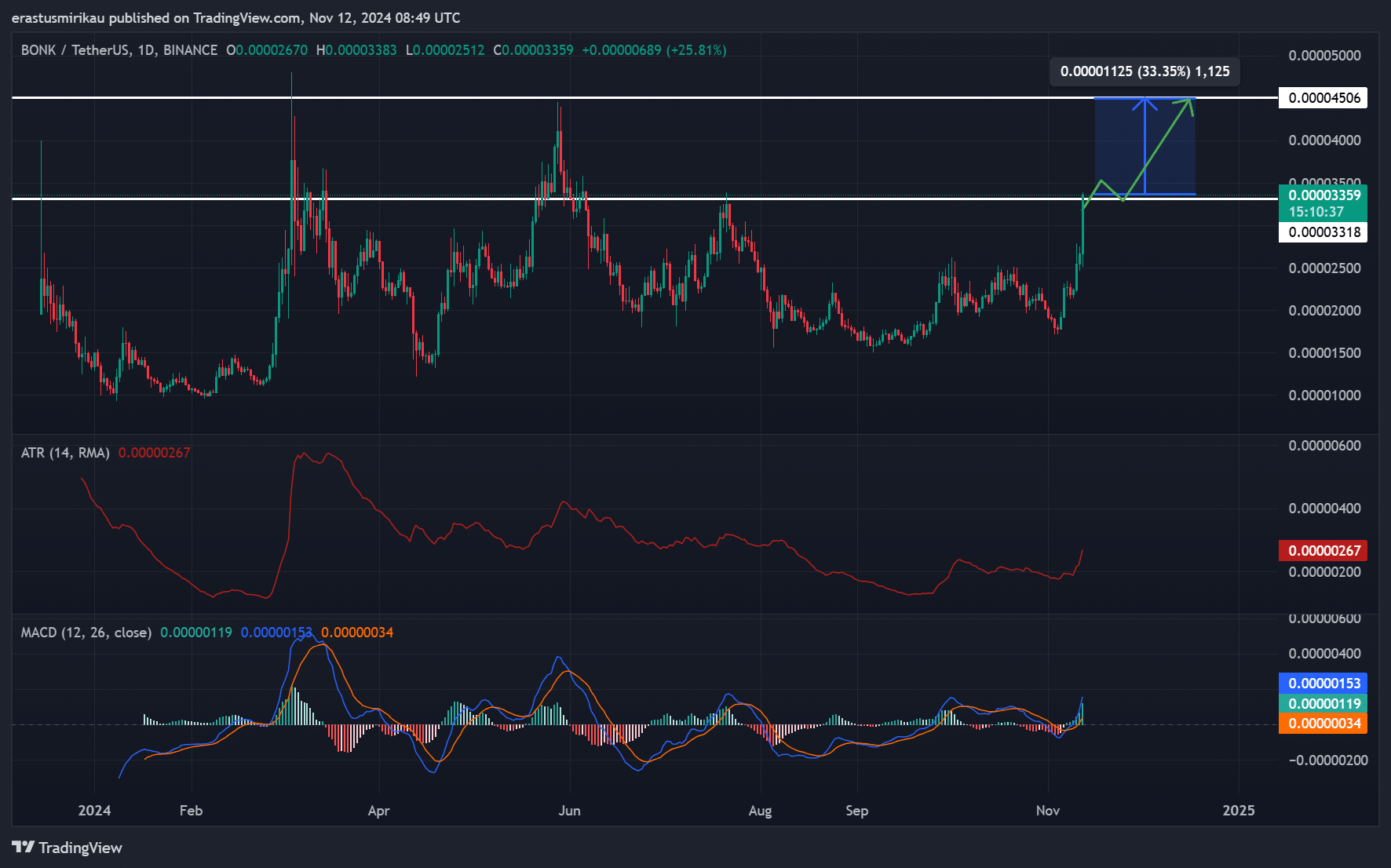

- BONK’s breakout past $0.000025, combined with strong MACD momentum, signaled a bullish trend.

- Mixed long/short ratios and a slight dip in social dominance introduced cautious optimism.

As a seasoned crypto investor with battle-scarred fingers from past market rollercoasters, I can confidently say that BONK’s meteoric rise has caught my attention like a neon sign in a dark alley. The breakout above $0.000025 and the subsequent GOD candle are reminiscent of those golden moments when you stumble upon a hidden gem amidst a pile of worthless junk.

As a researcher immersed in the dynamic world of cryptocurrencies, I’ve been captivated by the extraordinary surge of BONK. In just a short span, it has soared an astounding 23%, a growth that has analysts labeling its performance as a “GOD candle” – a term used to describe an extremely large and bullish candle on a price chart. This meteoric rise is certainly turning heads in the crypto market!

At the $0.000025 resistance point, the cryptocurrency BONK surged to around $0.00003359, representing a 25.81% increase when last checked.

This breakout, combined with surging MACD momentum, signaled substantial buying interest.

Bullish momentum ahead?

Lately, the price chart for BONK has surged past a significant barrier at $0.000033. Such a breach typically indicates a potential bullish market movement, especially given the high trading volume accompanying this surge.

Consequently, having passed this hurdle, BONK now sets its sights on the next potential resistance at $0.000045. Yet, whether it maintains this forward thrust is largely contingent upon the forthcoming trading actions and overall market mood.

Furthermore, the MACD (Moving Average Convergence Divergence) indicator signaled a strong bullish trend since the MACD line consistently stayed well over the signal line, suggesting a notable increase in price.

This arrangement generally indicates a strong upward trend, suggesting that the market’s momentum is being driven by buyers. If this positive movement persists, it’s possible that the price of BONK may increase and reach its next potential price range.

Keep an eye out for abrupt changes in the MACD (Moving Average Convergence Divergence), as these could potentially signal an impending shift or reversal in the trend.

Additionally, the Average True Range (ATR) indicator from BONK showed a significant rise, suggesting that the market has experienced higher volatility during the latest trading periods.

An increase in market volatility could provide thrilling possibilities for traders, but it simultaneously brings about higher risks that need careful consideration.

Therefore, traders should devise a plan when dealing with meme coins, taking into account possible fluctuations in prices.

Experiencing this level of market turbulence underscores the intense engagement, but it also acts as a gentle nudge to remember the erratic fluctuations that characterize my BONK investments.

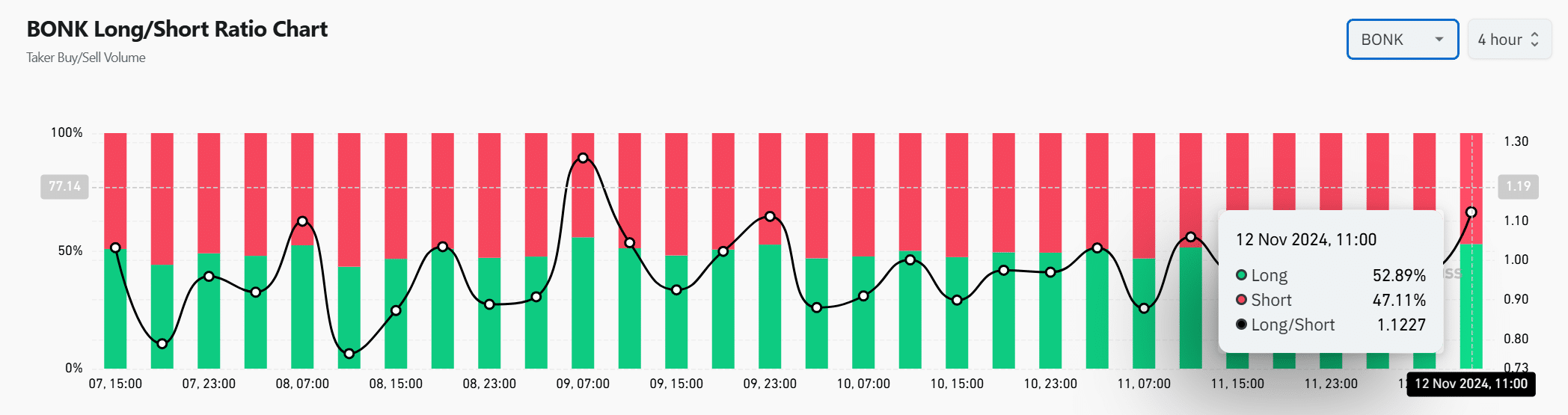

Balanced Long/Short Ratio

At the current moment, the Long/Short Ratio indicates a slightly bullish trend, as approximately 52.89% of traders are taking long positions, compared to 47.11% who are shorting. This implies that there is a predominant sense of optimism among traders, but the high number of traders who are short suggests they may be exercising caution.

This balanced sentiment might contribute to continued volatility, as shifting positions could either support further gains or trigger a pullback.

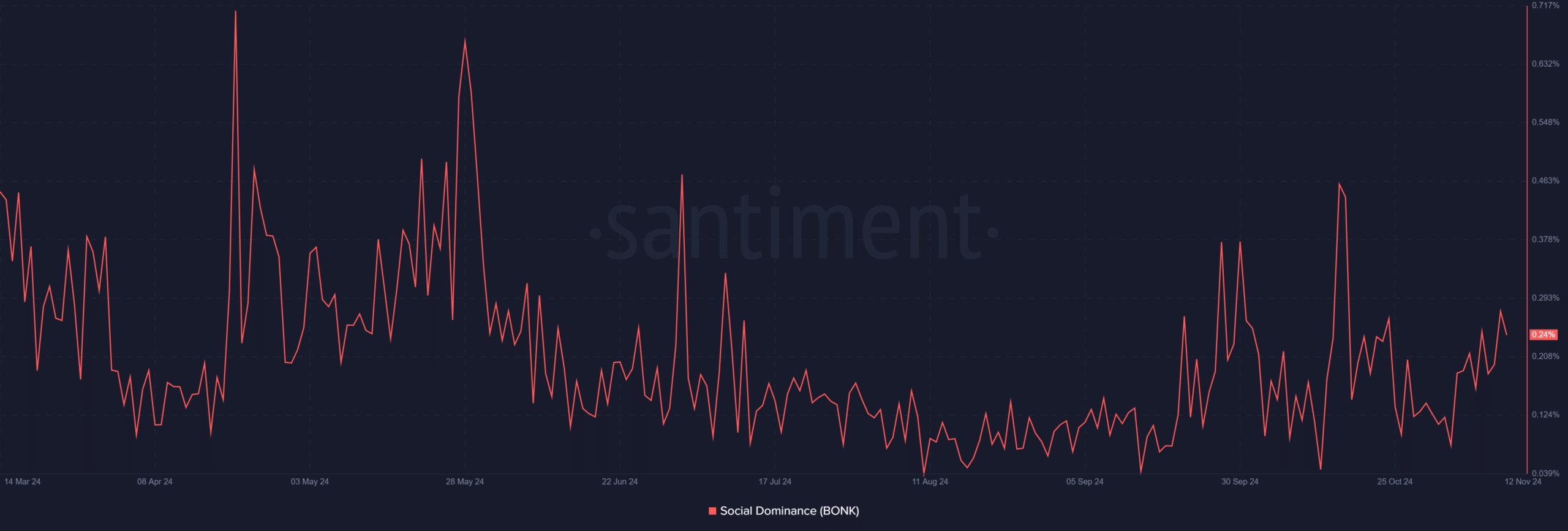

BONK social dominance dip raises questions

Currently, there’s been a slight decrease in social dominance, which could signal a reduction in retail enthusiasm towards these investments. Given that social buzz frequently sets off the initial excitement for meme-based cryptocurrencies like BONK, this downward trend might impact its pace of growth.

As a crypto investor, I believe that should the social buzz around cryptocurrencies pick up again, it might spark another buying frenzy. Consequently, keeping a strong online presence and active engagement on social media channels could be pivotal in sustaining this bull run.

Will BONK maintain its momentum?

With a robust push beyond its resistance levels and solid technical signals, it seems that BONK is poised to maintain its upward trend.

In simpler terms, when we see a strong match between Moving Average Convergence Divergence (MACD) lines and a slightly positive bias in the ratio of buying to selling, it’s a sign that the current uptrend might persist for a while in the near future.

Read Bonk’s [BONK] Price Prediction 2024–2025

However, traders should remain cautious due to the elevated volatility and mixed social signals.

In summary, BONK’s upward trend appears promising and likely to persist, however, keeping a close eye on crucial markers is vital to successfully maneuver through this energetic climb.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-11-13 05:44